Changed criteria for classifying assets as fixed assets The new standard established the basic rules for accounting for fixed assets

Chapter 28 of the Tax Code of the Russian Federation is devoted to transport tax. Transport tax in 2017-2016

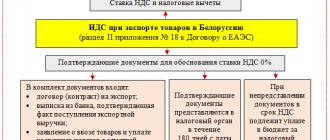

What an exporter of goods to Belarus needs to know: legal acts and VAT rate Belarus is included in

We are all accustomed to card transfers. No need to withdraw cash or run to the ATM. We

Taxes and contributions Denis Pokshan Expert in taxes, accounting and personnel records Current on

Seminars and webinars Ayudar Info The state is regulating volunteer activities in more and more detail, intending to make it

Introductory information First, let us remind you that the property tax for individuals still exists.

List of documents for payment According to the law, a dividend is any income of a shareholder (participant)

A tax return is a report submitted by payers of a certain taxation system. For every tax

Consequences of a low tax burden According to tax specialists, a low tax burden for VAT is a reason