Most companies use non-cash payments in their work. This is a convenient method of payment both for the company itself and for regulatory authorities. Allows you to easily track cash flows. However, some payments are still made in cash. They are stored in the cash register. The cash proceeds received by the company must be spent in accordance with the rules. If they are not followed, the company may be held liable.

How can individual entrepreneurs spend cash proceeds ?

In what order are the funds issued?

As a rule, the issuance or payment of cash from the cash desk is carried out by the organization in the following typical situations:

- payments to personnel (salaries, other payments);

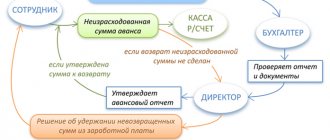

- providing certain employees with accountable money for specific needs (when the authorized employee spends these funds, he will have to prepare and submit the appropriate advance report with the necessary supporting documents attached);

- cash is handed over (collected) by the organization to the servicing financial institution and credited to a bank account;

- repayment of obligations to suppliers to pay for goods, services, works (no more than 100,000 rubles under one agreement);

- dividend payments to the founders of a business entity.

When cash is issued to the recipient according to cash settlement or payroll, the cashier of the payer’s organization performs the following actions:

- Checks whether the cash document has a real signature of the chief accountant, accountant, or manager. This signature must correspond to the approved sample.

- Checks the compliance (correctness) of monetary amounts indicated both in numbers and in words.

- If cash is provided under a cash settlement, the cashier checks that the recipient has supporting documents directly mentioned in this cash settlement.

- The recipient must document his or her identity (for example, by presenting a passport). If necessary, the recipient presents to the cashier not only his passport, but also the corresponding power of attorney.

- Cash is issued directly only to the subject (recipient) specified in the cash settlement and other documents. The cashier must make sure that all available documents indicate the same full name of the recipient or authorized person. If cash is received by an entity under a power of attorney, this power of attorney becomes an annex to the cash document (CDR).

- The cashier prepares the required amount of funds and hands over the cash settlement form to the recipient of the funds for signature. If an electronic cash settlement is issued, the recipient can sign it with an electronic signature.

- Cash is carefully counted by the cashier. The recipient watches the cashier's work. The correct amount of cash is transferred directly to the recipient using the sheet-to-sheet method. The recipient immediately checks it and recalculates it.

- When the recipient has accepted the money, the cash settlement form is signed by the cashier himself.

Register of entrepreneur's expenses

Let's make it more difficult. This is all clear and beautiful if there are not many entries in the Income and Expense Book. But what if the turnover is large, and you constantly have to buy and buy something? At different times, in different places and for each product, you need to write a line in the Book of Income and Expenses.

If there are a lot of expenses, you can first take into account these expenses separately in a separate table, which I call a register. You can call it a savings sheet or something else.

Let's call it a register of an entrepreneur's expenses for such and such a period. This is a regular table, you can make it in Excel.

Date, contents of expense, supporting document, amount

They collected, for example, per day, or per week, or per month, and the final figure was transferred to the Income and Expense Accounting Book. After all, the other side of the expense report is the same thing.

The main thing is that there are no words “advance report”. As a last resort, these words can be crossed out and written “expense register”. But this is, rather, out of despair, when the program does not allow you to create any other document other than the “advance report”. But I’ll say more about this later.

Let's return to the cash transactions of the entrepreneur. It would seem that everything was simple and logical and there was no point in starting such a detailed conversation. But the fact of the matter is that in practice there are other difficulties. The reason for this is the established habits of accountants and the most popular accounting program in Russia, 1C.

conclusions

The issuance (expenditure) of cash is carried out by the business entity in the manner prescribed by the norms of the current legislation.

In this case, it is necessary to follow a certain algorithm, which involves the commission of specific actions by the cashier and the recipient of funds.

The availability of the necessary papers, as well as their correct preparation and completion by all participants in the procedure, is of great importance. The recipient of the money must document both his identity and his authority.

The responsible cashier and the recipient of the cash must promptly verify the adequacy and correctness of all parameters of the procedure being performed (amounts, documents, reasons). Accounting for relevant transactions is also carried out properly.

Individual entrepreneur and cash desk: accounting

Unfortunately, for many accountants in Russia, all accounting comes down to standard transactions from 1C. It seems like nothing else is needed!

Let me explain in more detail. Individual entrepreneurs become accountants who are specialists who have worked with the accounting of organizations for many years. Or novice accountants who learn from their more experienced colleagues. And experience has been gained in organizations. And accountants apply this experience to accounting for individual entrepreneurs.

What is most typical for organizational accounting? First of all, the double entry method. This is when each Debit must have its own Credit. And one more thing - the mandatory use of the Chart of Accounts. But the Chart of Accounts is approved only for organizations and is applicable only for organizations.

These rules do not apply to individual entrepreneur registration. He can keep records using the barn book method. Only this book is called the Book of Income and Expenses. And that's it. All income and all expenses are recorded there line by line. Then the total is summed up and a profit or loss is obtained.

Of course, no one prohibits keeping records for an individual entrepreneur using the double entry method and chart of accounts. Moreover, the program is at hand, all that remains is to enter the data. That's what they do. And they fall into a trap. Especially if you use 1C.

The problem is that 1C does not provide the ability for organizations to classify cash payments as expenses if they have not first gone through an expense report. So accountants first give the entrepreneur money against the report, and then draw up an advance report for it.

Or an even more interesting situation. The entrepreneur's expenses from his own pocket are documented through an advance report. And the debt of IP Petrov to the same IP Petrov is growing. It’s absurd, of course, but the accountant asks in all seriousness, almost in tears, on our forum: what should I do with this 71st account?

The first thought is to give him an “overspend” on the expense report. But there is no money in the cash register. And in principle, there is no cash desk - all income comes to the current account. Then, how much is needed is transferred to the individual entrepreneur’s personal card, from which he withdraws money for personal needs. And at the same time spends it on entrepreneurial purposes.

Do you know what, among other things, they advised the author of the question about the 71st account? Let the individual entrepreneur give himself a cash loan and deposit it in the cash register. And then pay him from the cash register for the overexpenditure according to the advance report. But this, in my opinion, is absolutely thoughtless adherence to the whims of an accounting program. True, when I expressed my opinion in that topic, one of the authors of the “scheme” said that the whole country is doing it through an advance report, and I am telling some fairy tales of my own composition.

I note that not the whole country does this. The whole question is in choosing a program wisely. There are programs that do not blindly copy accounting in an organization, but approach accounting for individual entrepreneurs from a common sense perspective. I can give you “Accounting.Contour” as an example. There, in my opinion, quite decent accounting for an entrepreneur is implemented.

But I digressed from the main question. Let's say an accountant for an individual entrepreneur wants to keep records with a chart of accounts. It’s more familiar and understandable to him this way. I have nothing against it. I only advise you to approach your working chart of accounts creatively.

If the program allows, you do not need to keep records of settlements with an individual entrepreneur on account 71 or 75 or use even more exotic options - 80, 84, 91 and 99...

There are many “empty” unused accounts in the standard chart of accounts. For example, 72, 74 or 78 - this is if we take “settlements” that are close to settlements with accountable persons or with personnel. Or 85, 87, 88 and 89 - if we take it from the “capital” section. And in the “financial results” section there are free 92, 93 and 95. Personally, I like the 72nd best. But this is purely a personal attachment - you can choose any account of their empty ones.

Why do I not recommend using accounts that have a target designation and require certain paperwork?

For example, an uninitiated person will see that the individual entrepreneur has balances on account 80 and will be surprised: where does the individual entrepreneur get the authorized capital? Maybe it’s not a good idea to think about an accountant. What if he sees 75? The first thought is that they consider the individual entrepreneur to be the founder of himself? Maybe they also pay dividends? Look, the balance is in credit. Funny.

But with a score of 71 it might not be funny. A corrosive inspector will come and see the 71st invoice, submit advance reports here, where is the application for reporting? And you will spend a long time explaining to him everything that I said at the beginning.

So one assumption - they took a standard account, will entail the need to draw up a bunch of papers - both advance reports and an application for the issuance of money.

And yet the question still remains: where should we put what the individual entrepreneur took for personal needs? This is where options like “this is his salary” are born. But then other questions arise: “Is it necessary to charge personal income tax on payments to individual entrepreneurs for personal needs? What about insurance premiums? As a result, we logically come to the question: “Can these payments be classified as expenses? After all, they’re in my 70s, how’s the salary?”

By the way, another argument against the 71st account. An entrepreneur may have employees who, in turn, can take money on account. For them, the 71st score couldn’t be better. And in this case, when the entrepreneur’s expenses are also there, you can get confused.

Frequently asked questions about cash limit

What cash on hand limit can small businesses set?

For small businesses in 2021, there is no need to set a cash limit. Confirmation - instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U. If the company decides to determine the cash limit, the formula will depend on the volume of revenue or money issued. Read more >>

How often should a company recalculate its cash limit?

This is decided by the head of the organization. The Central Bank of the Russian Federation does not specify a period, but the letter of the Central Bank dated February 15, 2012 No. 36-3/25 states that the cash limit should be reviewed if the volume of cash receipts or withdrawals has changed significantly.

When can you exceed the cash limit?

Exceeding the cash register limit is allowed in the following cases:

- issuance of salaries, scholarships and other payments,

- Company work on weekends and holidays.

Who sets the cash limit?

The head of the company determines the procedure for calculating the cash limit based on the economic characteristics of the enterprise.

Is it necessary to set a cash limit for an LLC in 2021?

Yes. All organizations are required to determine the cash limit for 2021. Sample order with calculation attached here >>

Is cash discipline required for individual entrepreneurs?

Yes. But for individual entrepreneurs, cash discipline is simplified: they may not maintain PKO, RKO, cash book and not set a cash limit.

How to calculate the cash limit for 2021

The company independently establishes the procedure for calculating the cash limit. There are two options: based on the organization’s revenue or cash disbursement volume

Cash limit calculation: based on revenue

The first method is based on the organization’s actual or planned revenue. It is more suitable for those who sell goods or provide services for cash. In this case, the cash limit formula will be:

Limit = Revenue / Billing period x Days

The billing period is no more than 92 business days of the company. You can choose it arbitrarily, taking into account, for example, seasonality or “peak” revenues of previous years.

Days are the number of working days between the dates of depositing money into the bank; the duration of this period should be no more than 7 days, and in areas where there is no bank - no more than 14.

Example. In the 4th quarter, the cash desk of Solnyshko LLC received:

- in October - 130,500 rubles,

- in November - 345,000 rubles,

- in December - 146,900 rubles.

Money is deposited in the bank every day. How to calculate the cash limit for 2019?

We calculate using the formula above:

(RUB 130,500 + RUB 345,000 + RUB 146,900) / (22 days + 20 days + 21 days) x 1 = 9879.4

The resulting figure must be rounded to whole rubles. Thus, the cash register limit is 9879 rubles.

Calculation of the cash register limit: based on the volume of cash dispensed

The second method is suitable for those who mainly use cash to pay for purchases or services. The cash limit formula will be based on the volume of cash dispensed:

Limit = Issue / Billing period x Days

Example. Tiger LLC in the 4th quarter of 2021 issued employees a report for payment for household goods:

- in October - 30,000 rubles,

- in November - 45,000 rubles,

- in December - 60,000 rubles.

Money was withdrawn from the current account every 5 working days. The cash limit calculation will be as follows:

(30,000 rub. + 45,000 rub. + 60,000 rub.) / (22 days + 20 days + 21 days) x 5 = 10714.3

Rounding up to whole rubles, we get 10,714 rubles.

Cash transactions without cashiers

Cash transactions can now be carried out using automatic devices without the participation of an employee. Money withdrawn from the device is accepted according to a receipt order, and an outgoing order is issued to load money into the device.

Such machines must have the function of recognizing at least four of the following machine-readable security features of Bank of Russia banknotes over the entire area of the banknote:

- dimensions, location and visual image in the visible range of the spectrum of artistic image elements, inscriptions, numerical designations, banknote numbers, security thread;

- absorption of infrared radiation by banknote design elements;

- magnetic properties of banknote design elements;

- luminescence of banknote design elements in the visible range of the spectrum under the influence of ultraviolet radiation;

- absence of background luminescence of banknote paper in the visible range of the spectrum under the influence of ultraviolet radiation;

- luminescence of banknote design elements in the visible range of the spectrum under the influence of infrared radiation.

Who is prohibited from paying wages in cash and how to pay foreigners?

In some cases, the state prohibits the payment of wages in cash. Violation of it may result in penalties being imposed on the employer.

It is established at the legislative level that all settlements with citizens of foreign countries relate to foreign exchange transactions. At the same time, payment of wages to foreigners is not included in the list of transactions that can be carried out in cash (Part 2 of Article 14 of the Law “On Currency Regulation...” dated December 10, 2003 No. 173-FZ). Therefore, payment for non-residents should be made only by non-cash method.

At the same time, the Supreme Arbitration Court of the Russian Federation, in its ruling No. VAS-19914/13 dated January 27, 2014, indicated that relations with a foreign employee fall within the scope of labor legislation. The Labor Code of the Russian Federation obliges the employer to pay the employee wages regardless of whether the employee has a bank account. Opening a bank account to receive a salary is a right, not an obligation, of a foreign worker. In this regard, imposing a fine for paying wages in cash to a non-resident is illegal. There are also court decisions canceling fines due to the insignificance of the violation.

Nevertheless, the Federal Tax Service continues to insist on violations of currency laws (letter of the Federal Tax Service dated August 29, 2016 No. ZN-4-17/15799) and impose fines for cash payments to foreigners. Therefore, if you do not want to sue, indicate in the employment contract with the foreigner that the payment of wages will be carried out by bank transfer to an account that the employee is required to open.

In 2021, payment of wages in cash to employees of state and municipal institutions is not prohibited. The Law “On Amendments to the Federal Law “On the National Payment System”” dated 05/01/2017 No. 88-FZ obliges banks from 07/01/2018 to credit wages of employees of the specified budget organizations only to the cards of the national payment system “Mir”. If an employee refuses to receive wages on the Mir card, it can be paid from the institution’s cash desk.

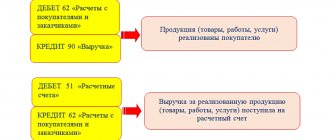

Reflection in accounting

When making payroll settlements with employees through the cash register, accounting records must show the reduction of the company's available cash and repayment of obligations to personnel. This is done using standard correspondence D70 - K50. If the salary will be issued by transfer to card accounts, then the posting is made between the debit of account 70 and the credit of account 51. The deposit of funds is reflected by entry D76 - K70.

Read also

25.07.2018

How to start receiving your salary in cash

To begin with, the employee writes a free-form application addressed to the director of the enterprise with reference to Art. 136 Labor Code of the Russian Federation. An employee can ask for approval of his application, but not demand payment in cash - the law does not give such a right.

| General Director of LLC “First Workshop” I.I. Ivanov from mechanic Glushkov D.D. STATEMENT I ask that starting from July 2021, you pay me wages at my place of work in cash in accordance with Article 136 of the Labor Code of the Russian Federation. 30.06.2020. (signature) Glushkov D.D. |

Date of issue of earnings through the cash register

The terms for paying wages through the cash register do not differ from the terms for non-cash transfers to employees’ bank cards. The law does not establish the exact date for the issuance of funds, but the deadline is fixed - no later than 15 calendar days from the date on which the salary accrual period ended.

Thus, no later than the 30th day of the current month, employees must be given an advance payment, and the remainder must be issued in the month following the billing period, no later than the 15th day.

These rules apply equally to all employers. Even if employees of their own free will want to shift deadlines or receive earnings in the form of one monthly amount, it is illegal to do so.

If the salary payment date falls on a weekend or holiday, it should be issued on the previous day.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Receiving and issuing money

According to the new rules, the cashier is obliged to check the money for solvency in accordance with the Directive of the Bank of Russia dated December 26, 2006 N 1778-U “On the signs of solvency and the rules for the exchange of banknotes and coins of the Bank of Russia.”

The cashier must accept solvent money. These are banknotes and coins without signs of counterfeiting and without damage, or with acceptable damage:

- dirty, worn, torn banknotes;

- with abrasions, punctures or holes, extraneous inscriptions, stains, stamp impressions, without corners and edges;

- coins with minor mechanical damage.

But you can only give out money from the cash register that does not contain:

- surface contamination leading to a decrease in image brightness by 8 percent or more;

- extraneous inscriptions consisting of two or more symbols, drawings and stamps;

- contrasting spots with a diameter of 5 mm or more;

- edge breaks of 7 mm or more;

- through holes, punctures with a diameter of 4 mm or more;

- tears sealed with adhesive tape;

- lost corners with an area of 32 mm or more;

- lost edges, if the dimensions of the banknote in length or width have decreased by 5 mm or more;

- partially lost paint layer as a result of abrasion or discoloration.

If the cash register has such bills with at least one of the listed damages, they need to be handed over to the bank. It is not yet clear how they will punish for issuing “substandard” money from the cash register.