Changed criteria for classifying funds as basic

The new standard established the basic rules for accounting for fixed assets (FP). In particular, the very concept of fixed assets has changed. Now these include not only material objects, but also material values (assets). That is, all the previous criteria for classification as OS remain the same. However, a new criterion has appeared - the object must have useful potential, that is, the OS is characterized by these properties:

- The object is needed to perform functions or provide relevant services.

- The object is required to pay off obligations.

- The item can be exchanged for other assets.

- The initial cost of the property can be assessed with the participation of a professional.

If an item does not meet the standards in question, it is placed in an off-balance sheet account. It should also be taken into account that the condition of mandatory state registration of rights to real estate with the Federal Bureau of Investigation has now been canceled.

The new standard has expanded the conditions for classifying OS. Now budgetary institutions can include these objects in the operating system:

- Rented.

- Receipt on the basis of a gratuitous transfer agreement.

The requirements for these items are established by the FSBU “Rent”. It is now necessary to include a number of government property as OS.

The following items will not be included in the OS:

- Biological substances intended for the manufacture of bioproducts.

- Property for further sale.

Perennial plantings, from which bioproducts will not be made, continue to remain in the structure of funds. However, it makes sense to allocate a separate account for them.

Cultural heritage objects will be included in the OS structure only if these conditions are met:

- If potential benefits can be obtained from the object.

- The item has not only cultural value, but also other useful potential.

If a cultural heritage item does not meet these criteria, it must be placed in an off-balance sheet account. If an item cannot be valued, its conditional value will be 1 ruble.

New in low-valuation accounting

To determine which objects can be classified as low-value fixed assets, from what amount 2021 should be calculated and how to take them into account, we will determine the maximum limits.

Cost limits have been adjusted. Now, fixed assets subject to immediate write-off on the balance sheet should include objects that cost 10,000 rubles or less. Let us recall that until 2021, fixed assets with a value of up to 3,000.00 rubles were recognized as such property.

How much should I charge 100% depreciation on fixed assets this year? The cost limits have also been adjusted: from 10,000 to 100,000 rubles.

For fixed assets costing more than 100,000 rubles, depreciation should be calculated in accordance with the chosen method. Let us remind you that in 2020 there are three methods for calculating depreciation:

- linear is the only method available until this year;

- reducing balance method;

- method of writing off the cost in proportion to the products produced.

Consequently, all property of an institution worth up to 100,000 rubles can be classified as “low value”.

IMPORTANT!

The organization is obliged to consolidate the key points of accounting for fixed assets, including low-value property, in its accounting policies. Otherwise, problems with the Federal Tax Service cannot be avoided.

OS evaluation requirements

The new standard also changed the OS rating. Now there are two new operations for interacting with objects:

- Exchange actions. OS are exchanged for cash and other valuables. The cost of the item may include the cost of work performed or services provided. Exchange transactions are carried out based on market value. The OS item will be assessed based on actual costs.

- Non-exchange actions. In this case, the objects are transferred either for a nominal fee or on the basis of a gratuitous transfer agreement. The initial cost will be calculated based on the adequate value of the object.

The manager himself must determine the methods for assessing various categories. The chosen policy is reflected in the accounting policy of the entity.

Mice - what is it, material or OS?

In tax accounting, fixed assets are understood as part of the property used as means of labor for the production and sale of goods or for managing an organization (Article 257 of the Tax Code of the Russian Federation). In this case, fixed assets classified as depreciable property must meet the conditions of Article 256 of the Tax Code, which are similar to the requirements of paragraphs 4 and 18 of PBU 6/01. Note that in the classifier of fixed assets (OKOF), which is the basis for the classification of operating systems in tax accounting, devices for information processing (processors, operating devices - codes 1420263), information display devices (code 14 3020350) and input-output devices are separately identified information (code 14 3020360). Thus, in accordance with OKOF, such devices can be taken into account separately. Consequently, in tax accounting, devices (keyboard, system unit, monitor) must be taken into account as separate objects, taking into account the cost limit (clause 1 of Article 256 of the Tax Code of the Russian Federation). If the cost of the purchased item is less than 10 thousand rubles, then the costs of its acquisition in tax accounting are written off in full as part of material expenses (clause 1.3 of Article 254 of the Tax Code of the Russian Federation).

Interesting read: How to check the status of documents submitted to the Internal Revenue Service

The company can purchase components for the system unit and then assemble it (third option). In this case, surprises await her. In practice, tax authorities claim that assembling a computer is equivalent to installation work performed in-house. Accordingly, for these works it will be necessary to charge and pay VAT (clause 3, clause 1, article 146 of the Tax Code of the Russian Federation). To do this, the company will need to generate costs and confirm them with documents (timesheets, production sheets, acts for writing off materials, etc.). Grigory K., chief accountant: “I heard that tax authorities classify the assembly of computers as installation work. We buy components and then assemble them ourselves. We reflect the costs on account 08 “Investments in non-current assets”, then put them into operation as fixed assets and write them off to account 01 “Fixed assets”. We charge depreciation every month. There are no problems if you buy the whole thing according to the documents (with assembly). But since it’s more profitable for us to buy spare parts (for price reasons), we have to do it this way.”

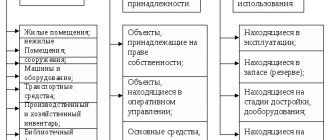

Features of grouping OS objects

The standard established new principles for grouping operating systems. Previously, there were only two groups: “Non-residential objects” and “Structures”. From 2021, there will be only one group - “Non-Residential Properties”. There are no separate groups for the library collection and jewelry. They will be placed in the “Other OS” category.

A separate group has appeared for investment real estate. This includes movable objects and real estate that are intended to be rented out.

For correct accounting, already accounted objects must be moved. If objects no longer correspond to the previously selected category, you need to move them to another group. The cost of the items remains the same.

Operating assets are moved between accounts once through the “Financial total of previous periods” account. The movement is carried out on the basis of a certificate drawn up in form 0504833.

Do you accept fixed assets on your balance sheet? The computer is a single object

What does the term “extended shift” mean?

According to officials, in the Classification of Fixed Assets, the useful life is determined based on the mode of two-shift continuous operation, and an increasing factor can be applied when equipment operates three shifts and around the clock (letter of the Ministry of Finance of Russia dated February 13, 2021 No. 03-03-06/1/78 , dated 05/30/2021 No. 03-03-06/1/341). Clause 1 of Article 259.3 of the Tax Code of the Russian Federation provides for such a possibility. Organizations are allowed to apply an increasing factor to depreciation rates, which should not be higher than 2. This clause also applies to fixed assets used to work in conditions of extended shifts or aggressive environments.

Selection of depreciation method

The innovation increases the number of methods for determining depreciation. Previously, only the linear method could be used. Currently, an accountant can use these depreciation methods:

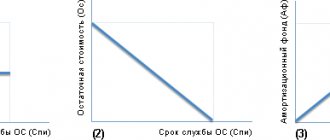

- Linear method. Depreciation is accrued in equal installments every month. Accrual is made throughout the entire life of the facility. To determine the payment amount, you need to divide the original cost of the item by the SPI.

- Reducing balance method. Suitable for assets whose useful life is very short. Also relevant for objects used in aggressive conditions. This method is necessary for accelerated depreciation.

- A method for determining depreciation in proportion to the volume of goods. The method is relevant for items that have a certain potential. That is, the accountant knows how much goods can be produced over a certain period using the asset. To make calculations, you need to multiply the actual volume of production by the depreciation rate.

The depreciation method is chosen by the organization independently. When choosing, you need to take into account the specifics of the subject’s activities. The chosen method must be recorded in the accounting policy.

If the purpose of using an asset has changed, the method for determining depreciation can also be changed. The change is made at the beginning of the reporting period. The new standard requires determining depreciation for the following items:

- Idle.

- Temporarily not in use.

- Items intended for write-off.

The exception is items that have a residual value of zero.

The new standard has changed the initial cost for low-value items. Let's look at all the features:

- Items with an original price of up to 10 thousand rubles are placed in an off-balance account. They do not require depreciation.

- For items worth 10 thousand-100 thousand rubles, depreciation is 100% of the price on the date the object was put into use.

- If the cost of the item is more than 100 thousand rubles, depreciation is determined based on the chosen method.

The standard introduced quite a lot of new principles. All of them must be taken into account in 2021. Otherwise, a violation of the instructions will be recorded.

Results

Thus, in the current conditions in the Russian Federation, an extensive regulatory framework has been formed for accounting for fixed assets at an enterprise, which consists of both federal laws and PBUs, as well as methodological recommendations that explain the rules and regulations of mandatory documents.

However, some issues in these documents are not sufficiently resolved. Eliminating the shortcomings of the regulatory framework, as well as bringing it as close as possible to IFRS standards is a primary task in the current conditions in the Russian Federation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to account for a computer

When we talk about a computer, we imagine an assembled PC - turned it on and sat down to work. In order for a PC to work, you need to purchase not only a system unit, but also a monitor (sometimes 2 monitors), a keyboard and a mouse. A printer, webcam, speakers, flatbed scanner, etc. can also be connected to the computer.

In fact, it is unlikely to be possible to use these components separately without a system engineer. Therefore, in this case we can say that the main means of control when working on a computer is “ a complex of structurally articulated objects .” And this complex can be taken into account as one inventory object.

A complex is usually called one or several objects that have a common control system, are mounted on the same foundation (location) and perform their functions only as part of the complex, and not separately.

Let us explain with an example what we mean here.

The so-called video wall consists of several monitors, one system unit and one keyboard and mouse. Special software is installed on the PC for broadcasting picture in picture. In this case, this complex is one inventory object, since monitors can only be used as part of this complex. And vice versa: the system unit cannot be used without monitors without special modification and/or modernization or dismantling.

POSTINGS

- Dt 08 – Kt 60: the cost of components is included in the initial cost of the object;

- Dt 01 – Kt 08: the computer is put into operation;

- Dt 20 (25, 26, 44) – Kt 02: depreciation has been accrued on PC.

Hard disk is the main tool or materials

Explanations from regulatory authorities. Based on the early clarifications of the Ministry of Finance, the depreciation bonus on capital investments during modernization (reconstruction, etc.) of a fixed asset must be written off in the month following the month the property was put into operation after the modernization (letter dated July 26, 2021 N 03-03-06 /1/529, dated 07/16/2021 N 03-03-06/1/486, dated 04/16/2021 N 03-03-06/1/236).

It would seem that everything comes down to two independent and sequential stages. At the first stage, you need to repair the hard drive, and at the second, extract information from it. But it only seems so. In fact, each specific case requires a different approach. Different tasks have their own characteristic differences:

What computer programs should I include on my resume?

Advanced user. Ability to work with basic MS Office programs (Access, Excel, Power Point, Word, WordPad), graphic editors (Picture Manager, CorelDRAW), programs for sending and receiving electronic correspondence (Outlook Express). I can quickly search for the necessary information on the Internet, I can work with various browsers (Opera, Firefox, Chrome, Amigo, Internet Explorer). Good knowledge of the features of the Windows operating system.

In the professional skills or additional information section, many indicate computer knowledge. But not everyone can make a list of computer programs for a resume. Of course, it’s best to only indicate software that you really know how to work with. After all, the recruiter may ask you to show your skills right at the interview.

How to calculate movable property tax in 2021

Having determined the cost of fixed assets related to movable property, the accountant:

- checks whether the enterprise has benefits confirmed by regional laws, finds out tax rates;

- establishes the tax base for calculation;

- calculates the amount of tax payable.

As a rule, property taxes are paid in quarterly advances (if they are established in the region), and at the end of the year - in a final payment. The advance payment is determined as ¼ of the product of the average cost of fixed assets for the reporting period and the tax rate. Branches and separate divisions located not at the location of the parent enterprise, but in other regions, pay movable property tax at the rates established in the regions where they are located.

Which depreciation group does the Laptop belong to?

OKOF code (version until 01/01/2021) 14 3020210 - Electronic computing equipment, including personal computers and printing devices for them; servers of various performance; network equipment of local computer networks; data storage systems; modems for local networks; modems for backbone networks.

Code OKOF (version from 01/01/2021) 330.28.23.23 - Other office machines (including personal computers and printing devices for them; servers of various capacities; network equipment for local computer networks; data storage systems; modems for local networks; modems for backbone networks)

Useful life of a computer

Many educational institutions are opening robotics courses or including training in this subject in existing educational programs. To teach robotics, you need to purchase teaching aids - robotic kits. Also, depending on the level of complexity of the course, you may need specialized software, control single-board computers, 3D printers and other equipment.

Answer: In accordance with the Classification of fixed assets (Resolution of the Government of the Russian Federation No. 1 of 01/01/2021), servers of various capacities belong to the second depreciation group with a useful life of over 2 to 3 years inclusive (OKOF code 14 3020210). Within the specified period, the useful life of the server in tax accounting can be established by the taxpayer himself.

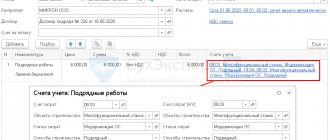

Accounting for fixed assets in the program - 1C: Simplified 8

And this means that that computer, the initial cost of which is 15,000 rubles. will not be considered a fixed asset in tax accounting. It must be taken into account as part of material costs. But the second computer for 25,000 rubles. - This is definitely the main tool.

Recognition of expenses for the acquisition of fixed assets in the program is done with the document Closing the month, but only when closing the last month of the quarter, i.e. for March, for June, for September and for December. For tax accounting, you must check the Recognition of expenses for the acquisition of fixed assets (Fig. 3).