What an exporter of goods to Belarus needs to know: legal acts and VAT rate

Belarus is a member of the Customs Union (CU) and is subject to the rules in force on the territory of the CU member countries. When exporting goods by Russian suppliers to the territory of this republic, it is necessary to comply with the norms of the relevant legal regulations:

- Clause 1 Art. 72 of the Treaty on the Eurasian Economic Union (signed on May 29, 2014) - this clause determines that in mutual trade between the member countries of the Customs Union, indirect taxes are collected according to the principle of the country of destination, which provides for the application of a zero VAT rate and (or) exemption from excise taxes when exporting goods .

- Appendix No. 18 to the Treaty on the Eurasian Economic Union (EAEU) - it describes the procedure for collecting indirect taxes when exporting goods and the mechanism for monitoring their payment.

The following figure will help you become more familiar with this procedure in relation to the export of goods from Russia to Belarus:

Zero rate

Clause 7 of Art. 164 of the Tax Code of the Russian Federation was introduced recently and allows in some situations to refuse the 0% rate:

It is logical to ask, for what purpose or for what reasons can one refuse a preferential rate? One of the reasons is this: you cannot simply take and apply a 0 VAT rate when exporting; you need to confirm it. And confirmation of the 0 VAT rate for export requires the collection of a large amount of documentation, that is, labor and time costs.

We will tell you further what is needed to confirm the zero VAT rate for export.

Features of reflecting deductions in the VAT return depending on the type of goods exported

The procedure for filling out a VAT return depends on which group the exported goods belong to.

Note! The VAT declaration was updated by order of the Federal Tax Service dated August 19, 2020 No. ED-7-3/ [email protected] The form is used from the reporting campaign for the 4th quarter of 2021.

You will find a line-by-line algorithm with examples of filling out all twelve sections of the report in ConsultantPlus. Trial full access to the system can be obtained for free.

We are talking about dividing exported goods into raw materials and non-raw materials. The main criterion for such classification is the degree of human participation in the formation of the main characteristics of the product.

Enlarged groups of raw materials are listed in clause 10 of Art. 165 Tax Code of the Russian Federation:

Commodity codes were approved by Decree of the Government of the Russian Federation dated April 18, 2018 No. 466.

Goods not listed in clause 10 of Art. 165 of the Tax Code of the Russian Federation, relate to non-raw materials (letter of the Federal Tax Service of Russia dated August 3, 2016 No. 1-4-05/0021).

For these groups of goods, the following procedure for applying VAT tax deductions is established:

- Input VAT on the value of non-commodity goods intended for export is accepted for deduction in the quarter when the goods are registered and the other mandatory conditions for deduction are met.

Find out about the conditions for applying deductions from the material “What is the procedure for applying (accepting) tax deductions for VAT: conditions”.

- Input VAT on the cost of raw materials purchased for export is accepted for deduction in the quarter when the zero tax rate is justified (clause 1, clause 10 of Article 165, clause 3 of Article 172 of the Tax Code of the Russian Federation).

How to apply a VAT deduction if the product is a raw material, but it is not on the government list, find out in this publication.

Confirmation of eligibility for a 0 percent rate

To prove the legality of applying the zero VAT rate for exports, it is necessary to generate the following package of documents:

Instead of copies of the specified documents, paragraph 15 of Art. 165 of the Tax Code of the Russian Federation allows the submission of electronic registers indicating the registration numbers of the relevant declarations.

Electronic registers must be compiled in approved formats and sent to the tax authority via TKS through an EDI operator duly registered in the Russian Federation.

It must be borne in mind that during the audit, tax authorities may require the submission of documents from the electronic register.

If the taxpayer nevertheless collects the entire package of documents after 180 days and pays VAT under Art. 164 of the Tax Code of the Russian Federation, the right to submit documents to the tax office is retained. If the tax authorities come to the conclusion that the 0% rate has become confirmed, the previously paid VAT on exports will be returned to the taxpayer.

Clause 10 of Art. 165 of the Tax Code of the Russian Federation states that the VAT declaration and confirmation documents must be submitted to the tax office at the same time.

VAT declaration for export to Belarus

Sales of goods to Belarus are reflected in the VAT return according to the following scheme:

What to do if documents confirming the zero rate are not collected in a timely manner? The answer to this question is in the ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Find out which transaction codes to use to fill out a VAT return from the diagram below:

If goods are sold to a related party or a resident of an offshore zone, special codes from the specified application are applied.

The procedure for filling out individual lines of Section 4 depends on the type of product (commodity or non-commodity):

For a sample of filling out the updated VAT declaration form when exporting goods to Belarus, see ConsultantPlus, having received trial demo access to the K+ system. It's free:

The remaining sections of the declaration are completed in the usual manner.

Deduction for export transactions

Those involved in the distribution of VAT on exports need to pay special attention to the process of VAT deduction.

The procedure for applying deductions when calculating export tax is described in paragraph 3 of Art. 172 of the Tax Code of the Russian Federation. It states that exporters of non-commodity goods can deduct input VAT in the general manner, that is, in the same way as for ordinary non-export sales. These rules were introduced on July 1, 2016. Those exporters who refused to use the preferential rate do the same.

For commodity exporters, the process of applying deductions depends on whether a package of documents confirming the zero rate has been collected or not. In addition, if VAT was accepted for deduction earlier, VAT restoration will be required when exporting this product.

Documents were not collected on time: what to do with VAT reporting

Exports that are not confirmed on time require the submission of an updated declaration. Such a declaration has three important nuances:

- it is rented out per quarter of export shipment;

- must contain completed section 6;

- The composition of the information in section 6 depends on the type of goods exported (raw materials, non-raw materials).

What can prevent you from confirming your export on time?

Even if the exporter conscientiously approaches the procedure for collecting documents, there is no complete confidence that he will meet the deadline allotted by the Tax Code of the Russian Federation to confirm the validity of applying the zero VAT rate. This is due to the fact that the set of supporting documents includes an application for the import of goods, which the buyer must hand over to the supplier. And it is difficult to influence the actions of a buyer (especially one located abroad). At the same time, the absence of an application for the import of goods deprives the seller of a tax preference in the form of a zero VAT rate (if the buyer has not paid the tax).

The main difficulty in obtaining such a document is that the Belarusian buyer must pay the tax, put a stamp on the application with his tax authorities about payment and, with such a mark, transfer the application to the supplier.

It happens that the export seller was unable to receive an application because the buyer:

- for some reason I did not send the application, although I paid the tax;

- did not pay the tax and did not send anything to the seller;

- I sent the application, but without a tax payment mark.

There are two possible scenarios here:

- If the Belarusian buyer has paid the tax, the situation is not hopeless - Russian tax authorities can check the fact of tax payment in their database (within the framework of electronic information exchange), and the supplier himself can check in a special electronic service on the Federal Tax Service website.

- If the tax is still not paid, the Russian export seller will not be able to confirm the zero rate.

We will tell you in the next section what a supplier can do to protect itself from possible material losses due to unscrupulous buyers.

Import from EAEU countries

The main feature is that when importing from Kazakhstan to Russia, VAT will have to be paid in any case, unlike paying VAT when exporting to Kazakhstan. Even simplified people and those who are exempt from paying VAT.

An import VAT return is different from a regular import VAT return. It is submitted to the tax authority at the place of registration of the organization before the 20th day of the month following the month in which imported goods were accepted for registration. The same deadlines are established for payment of this tax. Subsequently, it can be taken for deduction.

Accounting for VAT on exports is a rather labor-intensive process. Exports can be taxed at a preferential zero rate, but for this it is necessary to submit a package of documents to the tax authorities within a certain period. If this is not done, the regular rate of VAT will need to be applied to export transactions.

Contractual insurance against unscrupulous buyers

In order to somehow protect yourself from careless buyers from the EAEU, provide special conditions in your contracts with them. For example:

- The buyer's obligation to pay a fine (compensating for the seller's losses from paying VAT and penalties on it) if the import application is not received from him within the agreed period (for example, no later than 160 days from the date of shipment).

- An indication of the judicial authority (Russian or Belarusian) in which the dispute will be heard if the buyer refuses to pay penalties. It is no secret that it is better to protect your interests on your own territory with the participation of competent lawyers.

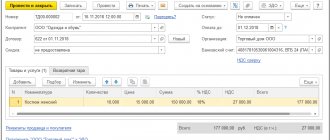

The “penalty” element of the contract may look like this:

Results

Exports of goods from Russia to Belarusian buyers are taxed at a rate of 0% if the supplier submits a set of supporting documents to the tax authorities along with the VAT return. If the documents cannot be collected on time, the supplier must submit an updated VAT return for the period in which the export shipment occurred.

Sources:

- Tax Code of the Russian Federation

- Treaty on the Eurasian Economic Union (signed on May 29, 2014)

- Decree of the Government of the Russian Federation dated April 18, 2018 No. 466

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Services and works: differences, examples

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting of foreign trade activities and ruble transactions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

The agreement provides language for services and works.

Services are activities without a tangible result that is consumed in the process of the activity itself. Services also include the transfer of patents, trademarks, licenses, and copyrights. Examples of services: rental of premises, machinery and equipment, consulting, accounting and legal services.

Work is an activity with a tangible result that can be used to meet the needs of an organization or individuals. Examples of work: installation, construction, software development.