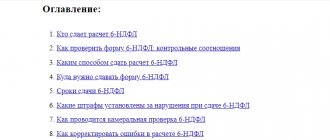

A tax return is a report submitted by payers of a certain taxation system. For each tax regime, the Federal Tax Service develops special forms and approves its deadlines for submission.

The simplified tax system declaration is submitted by all individual entrepreneurs who have switched to a simplified regime, reporting this on form 26.2-1. The absence of income or activity within the framework of the simplified procedure does not exempt the entrepreneur from submitting reports, in this case, zero.

No one has canceled the obligation to submit a zero declaration

In Russia, a huge number of limited liability companies and entrepreneurs operate under a simplified special tax regime. But sometimes it happens that there was no activity for a long time and/or there was no income at all in 2021. Let us immediately note that the absence of simplified activities for LLCs and individual entrepreneurs in 2021 does not exempt them in 2021 from the obligation to submit reports to the Federal Tax Service according to the results of the specified tax period.

An important nuance: if funds did pass through the simplified person’s accounts in banks or through a cash register, then it will not be possible to get away with a zero declaration of the simplified tax system. You need to submit a regular report with calculated indicators.

What is zero reporting for individual entrepreneurs?

Many novice entrepreneurs mistakenly believe that tax reporting is necessary only for those individual entrepreneurs who make a profit from their activities. That is, if an entrepreneur has registered an individual entrepreneur, but has not yet launched his own business in the new status, then there is nothing to report to the regulatory authorities for, because the cash flow has not been registered. However, this misconception can lead a businessman to fines and blocking of accounts. In the absence of profit, all registered individual entrepreneurs are required to submit zero reports.

At its core, zero reporting is no different from regular tax reporting - the law establishes the same forms and deadlines for submission. However, an entrepreneur submitting this type of report to the tax office must be sure that no funds have been transferred to his account. This is necessary so that the tax service does not doubt the veracity of your reporting. If, for example, personal funds were nevertheless transferred to the entrepreneur’s account, the tax service may request an explanation of what kind of money it was and why it was not indicated in the declaration.

What to choose: simplified taxation system or EUD declaration?

Based on clause 2 of Art. 80 of the Tax Code of the Russian Federation, every simplifier who did not conduct business formally has a choice:

1. Submit a zero declaration of the simplified tax system in 2021.

2. Submit a single simplified declaration (approved by order of the Ministry of Finance dated July 10, 2007 No. 62n):

However, in the second case, you need to do it before January 20 of the year that follows the reporting year. Therefore, in terms of deadlines for the simplified tax system, it is more profitable to submit a zero declaration on the “native” form, which was approved by order of the Federal Tax Service of Russia dated February 26, 2021 No. ММВ-7-3/99:

Also see "".

Let us remind you of the deadlines for submitting a zero report under the simplified tax system. They are exactly the same as a regular declaration with calculated indicators for 2021. Namely:

- for individual entrepreneurs - no later than May 3, 2021 inclusive (postponement from April 30);

- for LLC – no later than April 2, 2021 inclusive (postponement from March 31).

Also see “Declaration on the simplified tax system for 2021: deadlines for submission by organizations and individual entrepreneurs in 2018.”

Deadlines and procedure for submitting a simplified declaration without charges

Zero reporting under the simplified tax system is submitted by entrepreneurs to the Federal Tax Service within the same time frame as the usual one. Namely, no later than April 30 of the year following the reporting year.

Note: If this day falls on a public holiday or weekend, it will be moved to the first working day.

The procedure and methods for submitting zero reporting under the simplified tax system to the tax authority also do not change. A simplified tax return can be submitted both on paper and electronically. It is also possible to send it by registered mail with a list of attachments.

Having considered what zero reporting is under the simplified tax system, let’s say a few words about the Unified Simplified Declaration (USD).

Composition of a zero declaration

In 2021, filling out a zero declaration of the simplified tax system for 2021 implies the inclusion of the following parts (depending on the initially selected tax object):

| Object "Revenue" | Object “Revenue minus Expenses” |

| Title page Section 1.1 (tax/advance on it to be paid or reduced) Section 2.1.1 (tax calculation) | Title page Section 1.2 – tax (advance payment) payable and minimum tax payable/reduced Section 2.2 – calculation of tax, including the minimum payment for it |

Single simplified declaration

A single simplified declaration (SUD) is submitted by the taxpayer upon complete suspension of activities under one or more taxes, instead of zero declarations under the applicable taxation regime.

Currently, there is an ambiguous position of the Federal Tax Service of the Russian Federation on the issue of submitting this document.

1st position - submitting the EUD is the responsibility of the taxpayer, and for failure to submit it the individual entrepreneur faces a fine in accordance with the Tax Code of the Russian Federation, 2nd position - replacing zero declarations with a single simplified one is the right, not the obligation of the taxpayer.

It should be noted that the first point of view is biased in the sense that the application of penalties and other sanctions for failure to submit the tax return on timely submission of zero declarations to the tax authorities under the chosen taxation regime, to individual entrepreneurs, is unlawful, since the taxpayer has fulfilled the obligation to submit reports on established taxation system:

Who has the right to take the EUD

An individual entrepreneur who meets the following conditions can submit the EUD:

- Absence of any (including erroneous) transactions on the current account.

This condition assumes that no transactions took place on the current account during the reporting period, be it write-off of rent, payment of wages to staff, or payment for housing and communal services. Even the return of funds to the current account or their erroneous transfer will deprive the individual entrepreneur of the right to submit these reports;

- Absence of taxation objects and tax transactions (taxes) for which the EUD is submitted

For what taxes can an individual entrepreneur submit a EUD?

- VAT;

- simplified tax system;

- Unified agricultural tax

Please note that for personal income tax, the presentation of EUD is not provided.

Deadline for submitting the EUD

The EUD must be submitted no later than 20 days from the end of the reporting period.

Thus, an individual entrepreneur can submit a EUD:

- according to the simplified tax system for 2021 - until January 20, 2017;

- for VAT for the 4th quarter - until 01/20/2017.

Methods for passing the EUD

Unlike the VAT return, which must be submitted only in electronic form, the EUND can be submitted both electronically and in paper form.

Individual entrepreneurs fill out only one, the first sheet, of the declaration.

An example of filling out the EUND for VAT for the 4th quarter of 2021

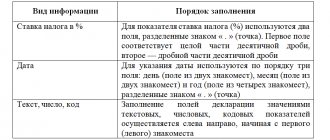

On a single sheet of the declaration you must indicate:

- Document type – 1/-;

- Reporting year – 2021 or 2017;

- Code (OKATO)

Please note that this field indicates the code OKTMO, not OKATO. If the code consists of 8 characters, the remaining cells are filled with zeros;

- OKVED;

- Tax or taxes for which the return is being submitted (column 1)

Column 2 indicates the number of the chapter of the Tax Code of the Russian Federation, containing information about the tax (taxation system.

Column 3 indicates the tax or reporting period for which the EUD is being submitted. If the reporting (tax) period for the tax is a quarter, then “3” is indicated. For VAT the specified value is always “3”

Column 4 indicates the quarter number: 01, 02, 03, 04.

Sample of filling out the EUD according to the simplified tax system for 2021

When filling out the EUD according to the simplified tax system, in column 3 you must indicate the value “0” (reporting period - year), and leave the fourth column blank.

How to fill out a zero report according to the simplified tax system

There are no special provisions for filling out a zero declaration under the simplified tax system. But some features are:

- put dashes in all cells with cost indicators;

- do not forget to indicate the tax rate for the simplified tax system: it is 6 percent (for the object “Income”) and 15 percent “Income minus Expenses”;

- Provide OKTMO inspection of the Federal Tax Service of Russia at the location of the LLC (place of residence of the individual entrepreneur).

When filling out a zero declaration according to the simplified tax system using software when printing it on a printer, it is permissible to have no frames for familiar signs and dashes for unfilled cells (clause 2.4 of the General requirements for the procedure for filling out a simplified tax declaration).

Also note that all text data is written in CAPITAL letters and symbols.

Failure to conduct business does not exempt merchants on the simplified tax system from transferring fixed insurance premiums for themselves from the minimum wage (letter of the Ministry of Labor dated December 18, 2014 No. 17-4/OOG-1131). But in Section 2.1.1 of the zero declaration for individual entrepreneurs on the simplified tax system in 2021, they are not listed without employees. The fact is that it is incorrect to reflect contributions that exceed the calculated (and it is zero) tax (clause 6.9 of the Procedure for filling out a declaration under the simplified tax system, approved by order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3/99).

In general, filling out a zero declaration under the simplified tax system for individual entrepreneurs in 2021 coincides with how LLCs do it.

If at least 1 person worked for an individual entrepreneur in 2021, then the declaration must be filled out according to the same rules as for organizations. If the simplified individual entrepreneur did not hire anyone in 2021, then in line 102 “Taxpayer Sign” of Section 2.1.1, code “2” is needed, which symbolizes the tax inspectorate about an individual entrepreneur without staff;

Features of reflecting zero reporting

You can reflect zero reporting in various ways - it depends on the tax regime used. In this case, zero indicators are indicated for all types of activities of the entrepreneur, including expenses and income. Such a document will indicate that the individual entrepreneur did not receive any income and did not incur expenses, which means that the amount of tax in this case will be zero.

In this case, a standard form enshrined in legislation is filled out, however, where numbers should be indicated, it is necessary to put a dash.

IP for OSNO in 2021: what and how to take

Individual entrepreneurs operating under the OSN must report on two types of taxes:

- VAT. Reports are submitted every quarter, no later than the twenty-fifth day from the end of the quarter.

- Personal income tax. The declaration is completed annually for the previous period. The document must be submitted no later than April thirtieth.

Value added tax declaration forms, if the results of activity are zero, must be partially filled out. The entrepreneur only needs to make entries on the title page. The following data must be indicated in it:

- Individual tax number issued upon registration.

- Correction number. “0—” is entered because the primary document is being filled out.

- Tax period, submission of declaration.

- Reporting period.

- Tax authority code.

- Code for the location of the account.

- Taxpayer details.

If the declaration is filled out by an entrepreneur, in the section confirming the accuracy of the data, you must indicate the unit. If the reporting is completed by a trusted person, a two is given. At the same time, the personal data of the representative and details of the notarized power of attorney must also be indicated. You can fill out the declaration with the help of an accountant hired from outside.

It is also possible to use samples presented on the tax website or in the branches of the Federal Tax Service.

In fact, an entrepreneur can easily cope with this task on his own, especially if there are zero performance indicators. In the first section, the entrepreneur must indicate the OKTMO and KBK code. The remaining sections of the document are marked with dashes.

Important!!! VAT reporting is submitted electronically through the TKS operator. Paper forms will not be accepted. Providing a paper copy will be equivalent to the absence of a declaration as a whole. This will raise the risk of fines being imposed by tax officials.

In the zero personal income tax declaration, the title page and partially the first and second sections are filled out. The title page indicates:

- TIN.

- Correction code "0—".

- The tax period is calendar year “34”.

- Reporting period. The year for which the reports are submitted is indicated.

- Tax authority code.

- Taxpayer category code. Individual entrepreneurs indicate “720”.

- Personal data of the taxpayer.

At the very end of the title page, “1” is inserted in the case of a personal completion of the declaration by the taxpayer, “2” - by his representative. The number of sheets is also indicated. The first section indicates the code OKTMO and KBK. In subsequent sections there are dashes. Their affixing is mandatory. Dashes indicate the absence of income and expenses for the period under review. The personal income tax declaration can be submitted in any convenient form: electronic or paper. At the legislative level, there is no clear form for its provision, so the decision is made only by the entrepreneur.

Deadlines for submitting reports to the Pension Fund: table

| Reporting type | Until what date is it provided, taking into account postponements due to holidays and weekends | |||

| For the 1st quarter of 2021 | For the 2nd quarter of 2021 | For the 3rd quarter of 2021 | For the 4th quarter of 2021 or for the year | |

| SZV-M | Jan. 2021 – 02/15/18 Feb. 2021 – 03/15/18 March 2021 -04/16/18 | Apr. 2021 – 05/15/18 May 2021 – 06/15/18 June 2021 – 07/15/18 | July 2021 – 08/15/18 Aug. 2021 – 09.17.18 Sep. 2021 – 10/15/18 | Oct. 2021 – 11/15/18 Nov. 2021 – 12/17/18 Year 2021 – 01/15/19 |

| Information about the insurance experience SZV-STAZH | – | – | – | 01.03.19 |

| Information for individual accounting EFA-1 | – | – | – | 01.03.19 |

When should you seek professional help?

With zero reporting, no less (and sometimes more) problems can arise than with other types of accounting and tax reporting. Not all entrepreneurs learn about the need to prepare it in time, which is why they end up in a whole range of troubles, from fines to frozen accounts.

A professional accounting team will not only prepare and compile all the necessary reports, but will also help you navigate the documentation in your future activities. One-time assistance, consultations or outsourcing on an ongoing basis - choose the type of cooperation that will be optimal for you.

Choose the service you need and call us at the phone number listed on the website. The company’s employees will conduct an initial consultation, after which they will advise on the cost and timing of the start of cooperation. Waiting for you!

What is the liability for violating filing deadlines or failing to submit a declaration?

Let us note once again that any of the types of zero declarations can be applied only when the individual entrepreneur did not work and did not receive income. Failure to comply with these strict requirements may result in penalties being imposed on the entrepreneur.

Blocking an individual entrepreneur's account - immediate reaction of the Federal Tax Service to the absence of a declaration (including zero)

You need to know that fiscal authorities quickly identify violators who are trying to evade taxes. As soon as regulators see that during the period when an individual entrepreneur who has declared a business freeze begins to receive money into his current account, the business may be declared illegal, and this threatens the entrepreneur:

- the obligation to pay all tax and insurance fees in full for the entire reporting period, the Federal Tax Service has the right to do this retroactively (they have all the resources for this);

- blocking the current account;

- fines and penalties for this entire time.

Classic penalties for individual entrepreneurs who delay tax reporting (including zero) are 5-30% of the tax payment amount for each full and partial month (minimum fine - 1,000 rubles). But since with zero profit the tax will be zero, the maximum fine for violations of reporting discipline per month will be 1,000 rubles.

But you need to take into account that the Tax Code of the Russian Federation does not establish a single fine rate of one thousand rubles. The first thing the legislation indicates is the minimum fiscal penalty. And secondly - there is a comment here - this fine can be collected monthly.

Another important point that should be taken into account: in recent years, the practice of tax authorities has increasingly included blocking the bank account and personal cards of an entrepreneur. If the Federal Tax Service does not receive the declaration within ten working days, this sanction may be applied to the violating individual entrepreneur.