An entrepreneur can top up his current account at any time to support his business. We'll tell you how to deposit

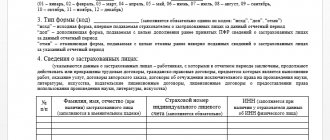

Deadlines for submitting SZV-M in 2020 SZV-M is submitted no later than the 15th day of the month following

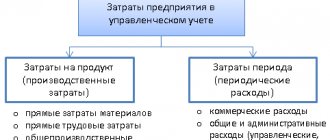

Basic and overhead costs Based on the economic role in the production process, costs are divided into

It is the responsibility of employers to notify employees of the amount of accrued wages and deductions made.

Skip to content Kontur.Partner PRACTICAL ACCOUNTING, TAXES, HR 8-800-551-36-30 Free call within Russia 01/20/2019

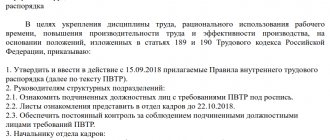

A document called “Internal Labor Regulations” regulates the general procedure for working at a given or

Every year, no later than April 1, employers - companies and individual entrepreneurs submit to the tax office

Reporting Employers are required to inform the Social Insurance Fund about the special assessment carried out (clause 18, clause 2, article 17

Any work must be safe, no matter where and who you work with and,

Long-term and short-term financial investments Placement of free funds of an organization for the purpose of subsequent extraction