An entrepreneur can top up his current account at any time to support his business. We’ll tell you how to deposit cash into your account—revenue and personal funds—so as not to overpay taxes and bank commissions.

Depositing cash proceeds and personal funds into an account - what is the difference?

How to top up your account with personal money so as not to pay tax

- Specify the purpose of payment

- Collect documents confirming the origin of the money

- Prepare a business case

How to deposit cash into an individual entrepreneur's current account

- Method 1. Through an ATM

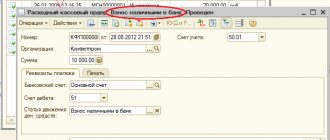

- Method 2. Through a bank cash desk

- Method 3. Through a bank partner

- Method 4. Ask another person to top up your account

How many days does the money go?

Why deposit personal money into a current account?

Ivan registers as an individual entrepreneur and opens a coffee shop.

Nobody knows about the coffee shop - so far only random passers-by and friends drop by. It’s good that Ivan brews delicious coffee - people are starting to recommend it. But in the first month of work, expenses are still higher than income. It's time to pay the rent: Ivan replenishes his current account with personal money.

In six months, Ivan recoups half of his investment and even hires a barista. The barista convinces the entrepreneur that buying a new coffee machine is a smart move because the coffee will taste even better. And if you launch an advertising campaign, there will be a line in the coffee shop. Ivan agrees and again deposits cash into the checking account.

The barista was right: business is looking up. A year later, Ivan is already opening a second coffee shop and preparing documents to launch a franchise. But the renovation of a new premises and the services of a lawyer are expensive. There is not enough money in the current account, and the entrepreneur replenishes it again.

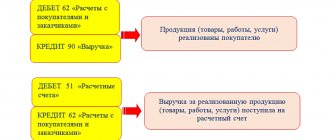

Ivan could have other reasons for replenishing: paying off debts to partners, settling accounts with employees, paying taxes and insurance premiums. It is important that Ivan makes all business-related expenses from his current account. If you purchase equipment, pay suppliers and pay salaries using a personal card, there will be no expenses on your current account. This is bad if you pay tax on profits: expenses from a personal card cannot be taken into account as business expenses - the tax will be higher. To avoid this, pay business expenses from the individual entrepreneur’s account.

Why do they do this?

Replenishing a current account is important when an entrepreneur is just starting to run his own business. While the business does not generate enough income, you have to invest personal savings. In the process of doing business, situations often arise when there is not enough money for some purpose, for example:

- Making payments for mandatory payments, that is, taxes, contributions for pension and health insurance. They must be paid within a strictly established period of time by law, so it is not always possible to meet the budget when it arrives.

- Payment of wages to employees. You should not be late with payment, otherwise you risk losing subordinates and earning a bad reputation. Therefore, if there is not the necessary amount to pay off loans, purchase equipment, commercial real estate, and so on. r/s, it is better to top it up with personal money.

- Repayment of loans. Nowadays, entrepreneurs actively use the services of banks to develop their own businesses. If you don't pay off your debt on time, problems will arise. Therefore, depositing personal funds is the best solution in this situation.

- Making payments to suppliers. For the services of these workers, it is necessary to pay strictly within the agreed period, otherwise the deal may fall through. If there is not enough money in your current account, you should quickly replenish it with your own savings.

Also, an individual entrepreneur may simply want to contribute his own funds to develop his business, without having a specific goal.

Purpose of payment when replenishing an individual entrepreneur's current account

To prevent the tax authorities from considering the transfer as income, the purpose of the payment must explain that this is the entrepreneur’s personal money. You can indicate the purpose in free form. For example, “depositing your own funds” or “replenishing with personal money.”

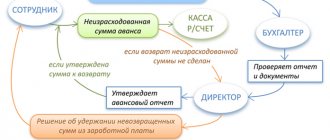

If you don't do this, the tax office will think that you are evading taxes. The inspector will see that you received the transfer, but did not indicate it in the declaration. Even if you have paid regularly for several years before, the inspector is obliged to issue a fine. After the transfer, it is difficult to prove that it was personal money.

The money must be transferred on behalf of the owner of the current account - that is, the entrepreneur. The tax authorities will regard a transfer from a relative as income from business activities - you will have to pay tax on it.

How to put your individual entrepreneur’s reporting in order?

Accounting and tax accounting specialists know all the intricacies of accounting and will help you not only get your reporting in order, but also, if possible, reduce costs. You shouldn’t wait until your business grows and you can no longer cope with the documentation on your own; it’s better to turn to professionals in advance.

We invite you to apply for consulting services, as well as accounting services in !

Why choose us?

- Teamwork. You collaborate not with one specialist, but with a whole team, which means you no longer depend on one person and receive multi-level quality control of the work.

- Specialists in various fields. Our company employs not only professional accountants, but also lawyers. We have access to up-to-date information about all innovations in legislation.

- Extensive work experience. More than 9 years of working with the taxation system in construction allows us to anticipate possible errors and problems in advance.

- Possibility to reduce payments. We are looking for opportunities to reduce tax payments.

Call the number listed on the website or fill out the feedback form so that we can guide you on the cost of accounting and tell you how to start cooperation!

How to deposit money into a current account

Transfers cost money, and you will have to pay twice: to the bank through which you send, and to the bank where the current account is opened. To find out how much a transfer will cost, check the rates on the bank's website or ask the cashier. There are four ways to top up your account:

- Transfer from card. You can transfer money to an individual entrepreneur's account from a card of any bank. This can be done in your personal account on the bank’s website or in the mobile application - just know the account number or card that is attached to it. The method works wherever there is Internet.

- Top up via ATM. The first option is to insert the card attached to your current account and top it up in the usual way. The second option is to find the “replenishment of current account” item in the ATM menu, indicate the login and password issued by the bank, then deposit money. Not all banks have this feature. Information about the commission for replenishing your account is displayed on the ATM screen.

- Replenishment at the bank cash desk. To top up through the bank's cash desk, you need to come to the branch with your passport. The sending bank charges a commission for the transfer. The cashier will give accurate information about the commission and help you correctly fill out your account.

- Translation through the translation system. These are companies that transfer money for interest - Contact, Unistream and others. The commission is usually around 2%. The translation can be made at the company's office or through the website. Tariffs are on the website, but you can also find out from the cashier. To make a transfer you will need a passport and current account number.

Cash deposits can take up to 5 business days, while card transfers usually arrive within 1 day. If the card and current account are serviced by the same bank, there will be no commission for the transfer.

How many days does the money go?

If you top up a corporate card through an ATM, the money usually arrives within 10 minutes. And if you deposit money into an account using a number through a partner’s office, then crediting can take from 1 to 5 days. For example, a payment sent at the end of the business day will only be processed the next morning. And sending on Friday evening will cover the weekend.

If you make a mistake in the details, the payment will fall into the “unclarified” category. In this case, bank employees will call you and clarify the details for the transfer; this will also take time.

Where can you spend personal money from your current account?

Once personal money is deposited into a current account, it ceases to be personal. Now it's business money. You can spend them on business expenses: pay rent and supplies, transfer salaries, purchase equipment.

If your bank allows, you can spend the money you earn on personal needs directly from your current account. For this purpose, banks offer corporate cards linked to a current account. Such a card can be given to employees so that they can purchase office supplies or pay for lunch with a client.

If an individual entrepreneur has several accounts

The law does not prohibit an entrepreneur from opening several accounts. If you want to make a transfer between your accounts, you need to come to the bank with a prepared payment order.

In it, indicate the purpose of your payment, and also make a note that personal funds are being transferred, with or without VAT. Then your payment will be 100% processed and will not fall into the category of “doubtful”. And during a counter-inspection by tax authorities, there will be no unnecessary questions for both you and the individual entrepreneur.

What you need to remember about depositing personal money into an individual entrepreneur’s account

- An individual entrepreneur can freely deposit personal money into a current account. Transfer of personal funds is not income. There is no need to pay tax on it.

- To prevent the inspector from collecting tax, you must indicate the correct purpose. If you are transferring your own money, write “depositing your own funds” in the destination.

- For replenishment through a bank, you pay a commission twice - when sending and when depositing. The exception is replenishment within the same bank.

- Money can be spent on all business-related transactions: salary transfers, settlements with partners, purchase of goods.

- There are four ways to replenish an individual entrepreneur’s account: by card, at an ATM, at a bank cash desk and through a transfer system.

Can third parties transfer funds?

Third parties have the right to transfer funds to the entrepreneur’s current account. But in this case, the transfer is considered the businessman’s profit, and therefore must be reflected in the posting and taxed. Even the transfer of funds from family members of a citizen is considered income and is subject to fees.

At the same time, money from other individuals must come through the cash register as from buyers for goods, and not just by transfer.

Note! It will be possible to avoid doubts on the part of the tax authority if, when drawing up an agreement with the bank, you indicate the name of the third party who is granted the right to manage the current account, or make a power of attorney for a specific citizen. Then no questions will arise.

Replenishment methods

A number of ways to deposit money into a PC are available to individual entrepreneurs.

Important! Conditions regarding ways to replenish using proceeds or your own money, interest charged for the transaction and the time it takes to receive funds should be clarified in advance with the bank whose client you are.

Below we will consider what options exist for crediting money to a current account:

- Non-cash transfer from a personal account or from your bank card.

It’s worth remembering that you can transfer money between your accounts with virtually no restrictions. - Operation at bank tellers.

Transfers through a third-party financial institution are always subject to a commission. But a transfer within the system of the native bank that services your DC will cost significantly less or without payment at all. The main thing is to find a branch. - Cash transactions through a self-service device.

It can be implemented through native ATMs, third-party and partner ones. Of course, it all depends on what conditions the banking company provides in this regard. For example, institutions such as Tinkoff, Tochka and ModulBank do not maintain their own branches, and therefore neither do cash desks. To compensate for this point, the client is provided with a plastic card attached to the current account - for manipulations with the ATM (payment machine). Other companies with a developed network of offices and ATMs do not always provide this opportunity. - Transaction through payment services, money transfer systems or electronic wallets.

For this purpose, the services of Unistream, Elexnet, Qiwi, etc. are used. - Transaction through MTS and Euroset.

In this way, you can top up your accounts, for example, at the Ural Bank for Reconstruction and Development or at Tinkoff Bank.

Note 1.

Online banking stands apart. In fact, this tool is also intended for non-cash transfers. However, it is specific due to the fact that it relates to remote services. The owner of the current account can carry out all operations remotely – even while at home.

Important! Regardless of the chosen method, it is worth paying special attention to identifying the correct payment purposes. Without specifying the purpose of the operation, it will not be performed - or problems may arise with the bank itself.

There is one more point that deserves close attention. We are talking about how to deposit funds into the account so that the tax service does not perceive the receipt as income (revenue). Read about it below.