It is the responsibility of employers to notify employees of the amount of accrued wages and deductions made from it. This requirement is specified in Art. 136 Labor Code of the Russian Federation. Therefore, before receiving their salaries, all employees must be given pay slips containing this information in detail. The law does not approve a special form of this document, so employers have the right to develop it independently.

While employees can still sort out the accrued and withheld amounts on their own, the codes on the payslip raise a lot of questions for them. What are such codes for and how to decipher them? The answers to these and other questions are in our material.

Payroll sheet

Two friends meet:

“What are you working for?”

- Get a big salary!

People work, first of all, to provide for their personal material needs and the well-being of their family. In Russia, the law stipulates that entrepreneurs and the state must pay wages to employees twice a month in the form of an advance and wages.

An employee can check the accuracy of salary calculations by looking at his payroll sheet. The employer is required to present this document with each payment of money earned by the employee. As a rule, such a sheet is prepared by the accounting department once a month. It must be generated in paper form, regardless of whether the company pays wages in non-cash form (by transfer to card accounts) or workers receive money at the cash desk. The procedure for issuing pay slips is determined by the organization independently, but failure to issue them can lead to penalties in the amount of one to five thousand rubles (the fine is imposed on the manager) or from thirty to fifty thousand rubles (for a legal entity). There is no standard form of pay slip. Each business entity develops it independently. However, there are certain requirements that must be met. The main thing is that the information on the sheet should be understandable.

- The pay slip must contain the full name of the enterprise and division (department) where the employee works. The sheet must be personalized, that is, contain information about the employee (last name, first name, patronymic, position and personnel number).

- It must have two large columns “Accrued” and “Retained”. In the “Accrued” column, all types of earnings should be listed: basic salary, all types of bonuses, overtime pay, bonuses, sick leave payments, vacation pay, and so on. In this case, it is necessary to indicate the number of days and hours worked. Allowances must be indicated separately for each type. For example, for length of service, qualifications, special working conditions, etc. The column “Withheld” shows the amount of personal income tax (13%), deductions on writs of execution (alimony, etc.), fines. Amounts may also be withheld for damage caused to the enterprise or compensation for shortfalls. At the request of the employee, union dues may also be withheld from him, for example. Sometimes these accruals and deductions are not written down in words, but are given as codes on the payroll sheet. These are accounting codes. The accounting department must provide the employee with a breakdown of payroll codes upon request.

- The slip must indicate the amounts payable or transferred to the bank (indicating dates).

What to do if the employer does not issue a payslip

As already mentioned, the payslip is confirmation of the regularity and timeliness of payment of earnings.

If an employer ignores the obligation to provide information about wages, an employee of the organization can file a complaint with the labor inspectorate.

Inspectors will conduct an inspection based on the complaint filed.

If an employee decides to contact the labor inspectorate due to violations by the employer, he must file a complaint in writing

If a violation is revealed during the inspection, labor inspectors will issue an order to eliminate it. In addition, the employee can file a claim in court.

If the employer refuses to issue a payslip, he may face penalties.

The fines will be as follows:

- for officials - up to 5 thousand rubles;

- for individual entrepreneurs - up to 5 thousand rubles, with the possibility of suspending activities for a period of three months;

- for legal entities - from 30 thousand to 50 thousand rubles. followed by suspension of activities for a period of three months.

For repeated violation, the employer faces a ban on conducting business for three years.

For the disclosure of personal information about an employee, the employer is also subject to administrative liability.

In this case, liability is expressed by a fine in the following amount:

- for an official - from 5 thousand to 10 thousand rubles;

- for a legal entity - from 30 thousand to 50 thousand rubles.

Pay slips - how to issue them correctly

The purpose of the payslip (can be lower) is to explain information about the composition of wages and other accruals. The document is generated separately for each employee. The frequency of preparation is once a month for final payment; when issuing advances/vacation pay, there is no need to issue pay slips. The form is developed by the employer independently, taking into account the regulatory requirements of Art. 372 TK. The following data must be reflected:

- About the components of wages for the billing period, including salaries, bonuses, coefficients, bonuses, etc.

- About other accruals, including vacation pay, sick leave benefits, monetary compensation for delays in payment of earnings, payments upon dismissal, etc.

- About the deductions made - alimony, personal income tax, loan payments, advances, excessively withheld amounts, etc.

- About the total amounts to be issued “in hand”.

The responsible person of the employer must not only correctly reflect the transcript of the payroll slip, but also correctly issue the document to the employee, with mandatory confirmation of the fact of delivery. Experienced personnel officers advise keeping records in a special journal of pay slips or providing a tear-off part with a line for the individual to sign directly on the form itself.

Maintaining confidentiality of information

Before issuing funds, each employee must sign the document.

The data of private organizations regarding the earnings of citizens is not subject to protection. Workers see exactly what amount their colleague signed for. In government agencies, the rules may be different. This must be specified in internal documentation.

Information is provided to third parties only upon request. These are interested individuals (applicants for alimony) or government bodies (Federal Tax Service, Federal Bailiff Service and others).

All information entered into the database on a PC must be accessible to employees and also protected from unauthorized hacking. For these purposes, various antivirus programs are used.

Salary slip - decoding of indicators

When compiling payslips, it is necessary to separately reflect all amounts of accruals and deductions, and, if desired, encode the data. Combining payments for different purposes is not permitted. The legislation of the Russian Federation does not establish regulatory requirements for income codes. The company has the right to independently approve the coding. Then, instead of specific payments (salary, vacation pay, alimony, etc.), the pay slip form will contain only code numbers.

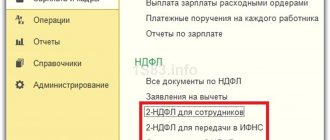

Note! If coding is used, all values must be notified to plant personnel. At the same time, for convenience, you are allowed to develop your own data or use codes from 2-NDFL certificates according to Order No. ММВ-7-11 / [email protected] dated 09/10/15. For example, individual income indicators are presented below.

Salary codes in the payslip:

- 2000 – salary for performing work duties.

- 1010 – income in the form of dividends.

- 2001 – remuneration paid to directors, members of the management body, board of directors, etc.

- 2012 – vacation payments.

- 2300 – amount of hospital benefits.

- 2010 – amounts paid for work under GPC contracts. except royalties.

- 2530 – earnings in kind.

- 2201-2209 – amounts of royalties.

- 2610 – the amount of material benefits from the use of loans received from the employer.

- 2720 – monetary value of gifts received.

>Salary slip - sample

Document role

The value of a payslip cannot be overestimated - it allows an enterprise employee to understand exactly what his salary is formed from, and also, in some cases, to see in a timely manner the inconsistencies between the calculation of wages and the terms of a specific employment contract or legal requirements. If such facts are identified, an employee can turn to the company’s accounting department for clarification of controversial or unclear issues, and if it comes to a conflict, then go to the labor inspectorate or court to restore justice.

How to decipher and understand a salary sheet?

The labor law states that the form of the payslip is approved by the employer, taking into account the opinion of the representative body of employees, for example, using an order. May be issued in paper or electronic form - .

To keep track of issued documents, you can keep a register of pay slips or an accounting sheet.

Therefore, each organization may have its own form.

However, the salary sheet must contain the following sections:

- Accrued. All amounts accrued for the month are indicated here: salary, bonus, allowances, night time pay, additional payment for length of service, benefits, vacation pay, etc.

- Held. Information about deductions is reflected: personal income tax, writs of execution, orders for damages, etc.

- Paid or intersettlement payments. Typically, the advance payment is displayed here. But there may be other payments. For example, the payment of sick leave benefits was made before the payday, or the employer paid vacation pay.

- To be paid or in debt. The amount in this column is added up according to the formula: accrued - withheld - paid. If it turns out with a minus, then debt is indicated. This can happen if, for example, the advance payment for some reason turns out to be more than the accrued salary.

What it looks like:

Pay slip for June 2018

Personnel number 30672

Division Sales Department

Position Manager

| Total taxable income: 174,000 | |||||||

| Accrued | Held | ||||||

| view | period | days | watch | sum | view | period | sum |

| Salary by day | June 1 – 30 | 19 | 151 | 25000 | Personal income tax (13%) | June 1-30 | 3770 |

| Prize | June 1 – 30 | 4000 | Total withheld | 3770 | |||

| Total accrued: | 29000 | Paid: | |||||

| Prepaid expense | 10000 | ||||||

| Transferred to card | 15000 | ||||||

| Total paid: | 25000 | ||||||

| Debt owed by the company at the beginning of the month: | 15000 | Due for June: | 15230 | ||||

Salaries are paid to staff in the period from the 1st to the 15th of the month following the reporting period. The item “debt owed by the enterprise at the beginning of the month” remains from the previous billing period (in the example, May).

In this example, wages for May are paid in June, which is reflected in the “transferred to the card” item.

The June salary will be paid in July; accordingly, this operation will be displayed on the payslip for July.

The amount from the column “payable for June” - 15230 will be reflected in the July payslip as “debt owed by the enterprise at the beginning of the month” and after its actual payment will appear in the paid column.

According to Art. 236 of the Labor Code of the Russian Federation, the employer is obliged, in case of untimely payment of wages, to immediately pay compensation for the delay. Then another item “compensation for delayed wages” will appear in the accrued column.

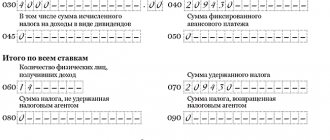

What is total taxable income?

The total taxable income on the payslip is the amount accrued to the employee from the beginning of the year, which is subject to personal income tax - 13%.

Not all employee income is subject to income tax.

Art. 217 of the Tax Code of the Russian Federation establishes restrictions in this regard.

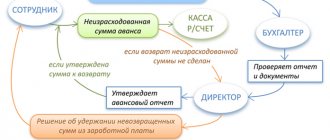

Intersettlement payments

The concept of interpayments is not always used in payslips. These are advances or accruals that are issued in the period between the completion of main payments.

For example, this could be an advance or vacation payments. They are issued precisely during the inter-payment period.

Such payments can be made in one of the following ways:

- through the bank, transfer register;

- through the cash register, cash order or payroll.

How to deal with deductions for children?

Citizens with minor children or full-time students have the right to count on standard tax deductions for children.

They reduce the tax base.

To understand this benefit, you need to know what types of deductions are provided for by the Tax Code of the Russian Federation.

Deductions for children are provided in the following amounts:

- for one child – 1400 rubles;

- for the second offspring – 1400 rubles;

- for the third and subsequent children 3,000 rubles;

- for disabled children, parents - 12,000 rubles;

- foster parents for disabled children – 6,000 rubles.

Deductions for children are provided monthly until the total income exceeds 350 thousand rubles.

With the new year, the countdown begins anew. The required benefit amounts are reflected in the line “deduction for children” on the sheet.

For example, if an employee has 1 child and wrote an application to the accounting department for a benefit, the amount of 1400 will appear in this column on his payslip. This should be understood as the amount by which taxable income will be reduced.

Employees may also have the right to other types of deductions: social or property. Then a separate position on the payslip will indicate the amount of the benefit and its name.

Codes and ciphers

Organizations quite often use income codes on payslips; to decipher them, you need to know which ones are provided.

Basic codes to be reflected in the salary slip:

- 2000 – salary;

- 2012 – vacation pay;

- 2013 – compensation for unused vacation;

- 2014 – severance pay;

- 2300 – payment of sick leave;

- 2762 – payments in the form of financial assistance at birth, adoption, etc.

The list of codes is quite wide, it is approved by order of the Federal Tax Service No. ММВ-7-11/ [email protected]

How should vacation pay be reported?

If the employee went on vacation, then a separate position in the accruals “vacation pay by calendar days” will appear on the payslip; it is reflected with the code “2012”.

No later than three days before going on vacation, the employer must pay vacation pay (Article 136 of the Labor Code).

When paid, the amount of accrued vacation pay minus personal income tax will appear in the “paid” column.

If there is a writ of execution, then the employee will receive even less money.

Example

Condition:

The employee was accrued vacation pay for 28 days of 45,000 rubles.

According to the writ of execution, 20% is withheld from him monthly.

Calculation:

The amount will appear in the “paid” column: 45,000 - (45,000 - 45,000 * 13%) * 20% = 31,320 rubles.

In other words, from the accrued vacation pay, the accountant will first deduct personal income tax, then 20% according to the writ of execution, and give the difference to the employee.

How to read the line “total withheld”?

This section reflects all deductions from the employee's salary by law.

These could be the following positions:

- Tax on personal income. It is calculated as 13% of the accrued amount, minus the deduction (if any).

- Deductions according to executive documents. The maximum amount of such deductions cannot be more than 50%. In exceptional cases 70%.

- Deductions at the request of the employee. For example, voluntary transfers to a pension fund.

- Deductions based on orders for the enterprise: compensation for damage, accountable amounts, membership fees, etc.

All listed items, if they are present on the payslip, are deducted from the accrued salary and are reflected in total in the “total withheld” line.

Let's sum it up

- When making payments to individuals, payment orders must indicate the income code. You can choose it based on the nature of the payment and the classification of the Central Bank.

- The payment format has not been changed. The code is indicated in field 20. If the organization withheld amounts from the employee under writs of execution, this must be indicated in the purpose of payment.

- The company is obliged to ensure that payment documents are filled out correctly. The bank has the right to skip a payment with an incorrect code or without it. If, due to an error, inflated amounts are written off from an employee, the organization may be fined.

If you find an error, please select a piece of text and press Ctrl+Enter.

Rules for issuing pay slips

At the federal level, the basis for providing pay slips has been approved. They are specified by local regulations of the employer.

The main principle is strict formality, timeliness, and reliability of information.

The employee must have an idea of the accrued wages, including contributions and deductions that the employer makes for him.

When another person receives a salary for an employee under a power of attorney, you should ask whether the power of attorney provides for the opportunity to receive pay slips. If the content of the power of attorney is universal, then the employer must hand over the document to the employee’s principal.

Based on the contents of the document, the employee sees:

- what components make up his salary;

- the amount of net income;

- the amount of additional payments and bonuses;

- deductions and deductions.

The amount of payment according to payslips includes: salary, overtime, payment for work on holidays, sick leave, etc.

Most organizations still do not issue such documents to employees on a monthly basis, which is formally considered an offense.

The payslip is provided not only by the main employer, but by the head of the enterprise where the employee works part-time.

The document can also be obtained by home-based employees or employees collaborating with the company remotely.

When should you create a document?

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

The payslip must be made several days before salary payments, but it can also be issued in advance or on the day the salary is paid. At the same time, it should be remembered that usually the payment of salaries is divided into two stages, two weeks apart - so the pay slip should be provided to employees on the day they receive their “graduation”, when all the necessary amounts have already been calculated. It must be said that the payslip concerns only wages, so there is no need to create it for issuing, for example, vacation pay. When resigning, it is mandatory to provide a payslip (it is given to the resigning person on his last working day along with his salary).

Employee pay slip

The salary slip must be developed by the employer and issued by his written order. There is no single form of document provided. But the form is available in accounting programs, for example, in 1C Salary.

The finished form is easy to fill out. Entries are made in it based on statements and primary documents. The form is printed on a printer.

The rules for issuing pay slips can be agreed upon in a collective agreement and are adopted taking into account the position of the trade union body.

Dates of issue

Labor legislation provides for the obligation to pay an employee a salary twice a month.

The payslip can be presented each time after the employee transfers the amount earned.

Experts recommend issuing it after the final payment for the month or other agreed period.

There is no specific deadline for transmitting the payslip to the employee in paper or electronic form.

The document is required when terminating an employment contract with an employee. When issuing vacation pay, the payslip is not given to the employee.

What is the percentage of income tax on salary? See here.

Salary on card

Transferring money to the card does not relieve the employer of the obligation to transfer the payslip. It is signed by the employees.

It is common to use a journal to record pay slips, although the obligation to prepare such a document at the all-Russian level is not provided.

We recommend reading: Is it possible to transfer other money to a salary card?

On a sick leave

Accrued and paid sick leave amounts are also taken into account. An accountant does the calculations. If necessary, he is obliged to explain to the employee the contents of the received document.

The payslip does not have direct legal force, but it can serve as evidence in a trial.

What is it and what is it for?

A payslip is a document in which the employer informs the employee about the wages received, as well as about the deductions made . It also indicates the amount of income tax and other information, for example, bonuses for length of service, etc.

It is a statement that must be issued to the employee when he receives his salary.

Their issuance is primarily aimed at protecting the rights of the employee. He must receive documented evidence that wages are paid on time and in full. If, without specifying the reasons, the salary does not correspond to what was indicated when concluding the employment contract, the employee can use this document to challenge this in court.

Didn't find the answer to your question?

Find out how to solve exactly your problem - call right now: (Moscow) (St. Petersburg) (Other regions) It's fast and free!

How to read?

To find out how to understand the contents of the payslip, you need to pay attention to the table and the amounts indicated in it.

The information in the calculation sheet is placed in special columns and presented in digital form.

Each column indicates the name of the payment (withholding, deduction) and its amount.

Decoding

Below the table of the payslip form are the formulas for calculating payments in each column (column):

- gr. 1 – total payment;

- gr. 2 – amounts of social and property deductions;

- gr. 3 – personal income tax salary amounts;

- Gr.4 – monthly additional payment (bonus);

- Gr.5 – additional payment for managing a structural unit;

- gr.6 – total amount of accruals;

- gr. 7 – personal income tax;

- gr. 8 – voluntary insurance amounts;

- gr.9 – total amount of withholding;

- gr. 10 – the first amount transferred through the cash desk to the bank (advance);

- gr. 11 – subsequent amount accrued to the employee (pay);

- gr. 12 – total amount of payments.

Sample

The payslip indicates the name of the organization, full name of the employee, and his worksheet number. The structural unit, department, or branch of the organization where the employee works may be indicated.

There is no single sample pay slip. The employer must develop its own payslip form or approve by order the template form provided in the accounting programs.

How to give a payslip to an employee

The payslip can be handed over to the employee personally from hand to hand in the accounting department or cash desk of the organization directly upon receipt of money or through electronic means or a trusted person. Art. 136 of the Labor Code of the Russian Federation obliges the employer to notify staff about accrued wages and withheld amounts. For this purpose, employees receive payslips every month before payment of wages. Not everyone can understand it and understand the numbers, codes, and ciphers contained in this document. Therefore, we will look at each position of this document in detail. The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 938-43-28 – Moscow – CALL +7 – St. Petersburg – CALL +7 – Other regions – CALL It’s fast and free!

The concept of a pay slip and its function

A payslip is a document that helps the employer inform the employee about various deductions and the salary received. In addition, the amount of mandatory tax and additional information, for example, bonuses for any length of service, are indicated here.

The document resembles a certain statement issued to an employee at the time of receiving his salary.

According to the Labor Code of the Russian Federation, all companies undertake to accompany the payment of wages with a document. This is a duty, not a right of the entrepreneur.

Responsibility of the entrepreneur and the procedure for issuing the document form

According to Art. 136 of the Labor Code, the employer undertakes to issue a document on the day the salary is transferred. There are no exceptions to this rule.

Rules for calculating wages in the payslip.

The employer is required to notify both main employees and temporary workers and part-time workers.

It is prohibited to issue a payslip on the day of receipt of an advance payment, as well as when issuing vacation pay. When receiving the salary itself, the sheet usually indicates the accruals made earlier.

If you are interested in raising chickens on an industrial scale, all the necessary information can be found here.

We recommend reading: How many current accounts can an individual entrepreneur have?

Earned funds are transferred to the employee’s card (which is usually indicated in advance in the employment contract) or issued at the place of work. The issuance of a document accompanying the salary cannot depend on the option of its transfer (to an account in a financial organization or in person).

If wages are paid to an account, the employer has the right to establish the procedure for issuing the document personally. For example, an employer can issue a document in both paper and electronic form.

A sample order for approval of a payslip can be downloaded here.

Due to the fact that issuing a document is considered the responsibility of any employer, failure to comply with this law is subject to liability in the form of the following fines:

- for officials - from 1,000 to 5,000 rubles;

- for legal entities - from 30,000 to 50,000 rubles. with a probable suspension of the company’s activities for up to 3 months;

- for individual entrepreneurs - from 1,000 to 5,000 rubles. with a probable suspension of the company's activities for up to 3 months.

In case of repeated violation of this law, the employer is subject to a fine, which prohibits him from conducting individual activities for the next 3 years.

The obligatory observance of confidentiality is an additional clause of the law.

The document must indicate the salary amount and full name. employee. The employer needs to make sure that the payslips reach the required employee. Salaries and accompanying documents are issued to the employee personally.

Positions that must be reflected without fail

The employer has the right to accept the form independently or with the permission of the trade union (if any). Required details:

- Name of company.

- The period for which payments are made (day, month, year).

- Employee's full name.

- Position, qualifications of the employee.

- Personnel number (registration number in the enterprise system).

- Mandatory columns indicating hours of production (days, shifts).

- Signatures of authorized persons and company seal.

The representative body may wish to make corrections to the document. The manager cannot refuse in this case. Changes must be made within 3 working days.

Sample and procedure for approving the document form

It is impossible to find a general approved type of calculation sheet. Any employer has the right to develop a document form and then approve it in his company.

A sample pay slip and its form can be downloaded here and here.

Typically, in companies where accountants carry out accounting using automated software, the form is chosen in accordance with it.

Penalty for missing pay slip.

What is better: individual entrepreneur or LLC? This article will help you decide.

It is very important not to forget to approve the future form in the manner established for the adoption of local regulations. The use of an unapproved document form is also grounds for imposing a fine. To approve the document form, entrepreneurs must issue an order.

Contents of the calculation sheet

There are some components that are certainly included in the payslip:

- the amount of time worked by the employee;

- total amount without withholdings and taxes;

- FULL NAME. employee;

- components of salary;

- calculation made upon dismissal.

Penalties cannot exceed 20% of the salary (in other cases - 50%).

Possible deductions include:

- contributions to the trade union committee;

- an advance, which is given out of salary, provided that the employee has not worked for it;

- alimony;

- Personal income tax and other contributions to various insurance companies;

- amounts that are accrued erroneously due to errors in the system.

You need a USRIP - get it via the Internet. Detailed instructions are here.

Since the document is issued at the time of receipt of the salary itself, it indicates all amounts earned during the month. In addition, fines are indicated, as well as bonuses, overtime, work on weekends, and an additional amount for working in unfavorable health conditions.

Example of a payslip.

Questions and answers

I was sure that the total taxable income on the payslip was the entire amount of income that was taxed.

And now I have my doubts... On the sheet for January (the year has just begun!) an amount is calculated (consisting of three terms), and 13% is taken from it. Everything is mathematically correct.

But why does the “accrued” value not coincide with the “total taxable” amount? The difference is the size of one term (premium).

But 13% is withheld from this term (premium).

It turns out to be some kind of nonsense

Expert:

The total taxable income on the payslip is the amount accrued to the employee from the beginning of the year, which is subject to personal income tax - 13%. Not all employee income is subject to income tax. Art. 217 of the Tax Code of the Russian Federation establishes restrictions in this regard.

the salary slip is issued personally to the employee or in another way if I work as a watchman at night during non-working hours of the main staff

Expert:

In accordance with the requirements of Article 136 of the Labor Code of the Russian Federation, when paying wages, the employer is obliged to notify each employee in writing, including: about the components of the wages due to him for the corresponding period; on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee; about the amounts and grounds for deductions made; about the total amount of money to be paid. The Letter of Rostrud dated March 18, 2010 No. 739-6-1 clarifies the procedure for issuing pay slips, namely: the issuance of pay slips must be made no later than the day of final payment to the employee for the month; transferring salary to a bank card does not eliminate the need to issue a payslip;

You can come during business hours and receive a payslip.

Expert:

According to Article 136 of the Labor Code of the Russian Federation:

When paying wages, the employer is obliged to notify each employee in writing: 1) about the components of the wages due to him for the corresponding period; 2) on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee; 3) about the amount and grounds for deductions made; 4) about the total amount of money to be paid. The form of the pay slip is approved by the employer, taking into account the opinion of the representative body of employees in the manner established by Article 372 of this Code for the adoption of local regulations.

You can’t agree that they leave you a pay slip or give it to you during your shift?

Good luck!

Please explain to me what I mean by amounts with a negative sign in the “Accrued” section, in the “Amount” column, on my payslip and whether the wages are accrued correctly!?

Expert:

Dear Sergey. It is impossible for an outsider to understand your payslip, at least by seeing only the payslip itself. Why?

In accordance with Parts 1 and 2 of Art. 136 of the Labor Code of the Russian Federation, when paying wages, the employer is obliged to notify in writing each employee: 1) about the components of the wages due to him for the corresponding period;

2) on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee;

3) about the amount and grounds for deductions made;

4) about the total amount of money to be paid.

The form of the payslip is approved by the employer, taking into account the opinion of the representative body of employees in the manner established by Article 372 of the Code for the adoption of local regulations.

Consequently, each organization, including yours, has its own form of pay slip, and has its own payment symbols.

Therefore, advice: if you wish, ask the employer for an order to approve the form of the pay slip, or write a statement asking for clarification of the accruals made (see Article 62 of the Labor Code of the Russian Federation).

Naturally, it is even more impossible to answer the question of whether the salary was calculated correctly without knowing the data about your work in November 2014.

Saint Petersburg. In the Payslip for the month 58,000t rubles, in fact 33,000t rubles were transferred to the card. The supervisor remains silent to my questions. Doesn't give a clear answer. Mumbling, you need to call Omsk, ch. The office is there. Time is dragging until the weekly meeting. How can I quit and get paid on the same day from this organization?

Sincerely.

Expert:

In the payslip that you attached, for the month of August you were credited with 29,486.96 rubles. We subtract personal income tax and get the amount that is transferred to your card, namely 25,653.96 (this amount is indicated on the payslip in the column Debt due to the enterprise at the end of the month).

The amount of 58,552.67 in the Total taxable income column shows all accruals in total from the date of your employment (as far as I understand, this is two months - July and August).

Thus, I do not see any violations by the employer (unless, of course, the salary for the previous month in the amount of 25,286.71 was actually paid to you). In this connection, when terminating an employment contract, you must be guided by Art. 80 Labor Code of the Russian Federation:

An employee has the right to terminate an employment contract by notifying the employer in writing no later than two weeks in advance, unless a different period is established by this Code or other federal law. The specified period begins the next day after the employer receives the employee’s notice of dismissal. By agreement between the employee and the employer, the employment contract can be terminated before the expiration of the notice period for dismissal.

Good luck!

I’ve been working at the housing office for two years now and I just can’t understand what they write on the pay slip, my salary is always constant, the advance is 15,000 and the salary is 25,000 plus or minus a thousand. Various incomprehensible numbers constantly appear on the payslip, and in the Payments column. I have never received this kind of money in my life; no one can find out from the accounting department what these amounts are. Sometimes 100,000 and so on every month. I know that taxable income is added, but the rest is an unknown amount. In the attached photo, the Total accrual and minus tax are highlighted in green, and there are always different incomprehensible numbers in red.

Expert:

Anton.

In general, it’s an ordinary payslip from the 1 C program.

It is impossible to draw an unambiguous conclusion based on one pay slip. You also need to see what amounts you signed for in the statements (if payments were made through a cash register) or what amounts you transferred to the bank.

In addition, you need to know when your payment days are - when they pay for the first half of the month (advance payment), when for the second half (final payment).

The amount “debt owed by the enterprise at the beginning of the month” is usually present when the final payment for the reporting month is made after the beginning of the next month.

Judging by the fact that three payment documents are indicated in the “paid” column, you must sign for three amounts. It is quite possible that the third statement is the “left one”, from which you are not the one receiving the money (the signatures are forged).

If you need to discuss your problem in more detail, providing additional documents and information, you can contact me via chat as part of a paid service (the cost is agreed upon in the chat).

How to decipher the leaflet?

In all companies, accounting is carried out based on special codes representing the organization's accounts. To ensure accurate documentation when drawing up a payslip, you should definitely decipher these codes.

This will greatly help in making accurate salary calculations. An employee's salary is calculated based on the following factors:

- category and its level of training;

- the level of complexity of the work he performs;

- quality of operations performed;

- employee experience;

- the result of the actions taken;

- conditions in which the employee works.

Each organization differs in its digital indicators and personal codes. Each has a different number of digits and even their set. Decoding the sheets allows employees to determine the correctness of salary calculations, and digitization makes it easier for the accounting department to make payments.

Some employers are trying to introduce other forms of notifying employees about salary components. For example, they create an electronic catalog placed on the company’s computer network and containing a list of employees with the data that must be indicated on the pay slip.

This will help protect the organization from unwanted fines.

If you want to know more about the payslip, watch this video:

What does it represent?

A payslip is an official document issued for each specific employee and containing information about the parts from which wages are collected.

This list includes:

- Basic salary.

- Additional accruals, which may include vacation pay, compensation, bonuses and other additional payments.

- In some cases, the amount of deductions is included, such as contributions to the Russian pension fund and tax authorities or fines.

- At the end of the payslip, the total total amount of the salary issued is indicated.

This sheet must be issued monthly without mandatory requirements from the employee.

If a pay slip is not issued, we can speak of a violation of Article 136 of the Labor Code of the Russian Federation.

Pay slip form

The salary sheet form is issued to each employee individually by the responsible person, usually an accountant. Transfer through another person is not allowed, since the level of your salary is a trade secret and is not subject to disclosure. The payslip we receive will look something like this:

Rice. 1. Salary slip transcript (sample)

The form may take different forms, since it is not established by law, but it will contain the following sections:

- Accrued;

- Held;

- Paid;

- To be paid (or employer/employee debt).

Some companies, this is especially true for large companies, indicate payment and deduction codes on the form. Having received such a coded pay slip, deciphering the codes in it confuses the employee. It is important to know that the use of such codes is not established by law and the employer must either provide the name of accrual or deduction along with the codes on the sheet, or familiarize the employee with the decoding of the codes used in the organization.

conclusions

To understand a payslip, you need to know what components it consists of.

The employer is required to notify staff of accrued wages and amounts deducted from them. For this purpose, payslips are issued. The law does not approve a special form of pay slip; the employer has the right to do this independently.

The main blocks of the payslip are: accrued, withheld, total paid, payable, debt of the enterprise at the beginning of the month. All types of employee income have their own individual code or code.

Purpose of the sand and oil catcher KPN

The installation is designed to capture sand, suspended and floating substances from surface and industrial wastewater.

It is used as a structure for treating wastewater before discharging it into the city sewerage network after preliminary rough mechanical cleaning on grates and sand traps, and as a structure for mechanical treatment before sorption filters.

The structure combines in one building the stages of purification from suspended solids, oil products and post-treatment; they are installed both in schemes with primary accumulation and in schemes with flow separation.

Deadline for issuing salary slips

As already mentioned, this sheet is issued to company employees on a monthly basis. It can be issued through the cash register if the salary is transferred in cash.

If wages are credited to employees’ bank cards, then on the day the wages are transferred. Or, the transfer of documents can be carried out by an authorized person on a certain set day of the month.

The following persons can prepare a payslip:

- Trade union worker.

- Accounting employee, if the organization is small enough to create a trade union.

- The entrepreneur himself, if the employee is an individual entrepreneur.

This document relates to personal data and is therefore passed exclusively into the hands of the employee. Transfer through a third party is unacceptable in this case.

Many modern entrepreneurs strive to save time, money and paper. And they try to issue payslips via the Internet to personal email. However, this method is only possible in addition. It cannot be used as the main one.

The only exception in this case is remote workers. All other full-time employees should be provided payroll information on paper.

To check the correctness of the accruals and deductions, you will need to pay attention to several key points.

First of all, on the number of hours worked and the amount of the tariff rate. If necessary, an employee can independently calculate the approximate amount of his salary, especially if he knows what bonuses he should have received and in what amount.

Since the results may be approximate, it is worth contacting the accounting department if there are large discrepancies. In the case of minimum wages, it may turn out that one or another point of salary adjustment was overlooked. For example, the most commonly missed tax is income tax.

According to the Labor Code of the Russian Federation, wages are paid at least twice a month. However, a payslip should be issued upon final payment (letter of Rostrud dated December 24, 2007 No. 5277-6-1). That is, when an advance is paid, a receipt is not issued. This can also be explained by the fact that at the time of salary payment, many indicators are not yet known, for example, personal income tax.

There is no need to issue a receipt ahead of schedule when paying vacation pay.

But if a person quits, he needs to make a final settlement and issue a receipt with all accruals and deductions.

First of all, you must always remember that the pay slip contains the employee’s personal data, which cannot be disclosed (Article 88 of the Labor Code of the Russian Federation, Article 7 of the Federal Law of July 27, 2006 No. 152-FZ “On Personal Data”). This means that the receipt must fall into the hands of a specific employee so that there is no leakage of information.

Most often, receipts are issued by an accountant who, by virtue of his work, knows about all the accruals of employees. The employer must, against signature, familiarize all authorized persons with access to the personal data of employees with the provisions on the confidentiality of personal data (Article 86, Article 88 of the Labor Code of the Russian Federation).

For many, the paper form of a payslip is more familiar. But in the age of modern technology, some employers send salary receipts to the employee’s personal or corporate email. Whether such actions are legal - there is no clear answer to this question. On the one hand, the Labor Code requires the employer to issue pay slips exclusively in written form (Article 136 of the Labor Code of the Russian Federation). On the other hand, there are court decisions according to which sending payslips by e-mail is not prohibited by law.

The possibility of receiving receipts in electronic form is clearly defined only for remote workers (Article 312.1 of the Labor Code of the Russian Federation).

We suggest that you familiarize yourself with Calculation of wages when working on a rotational basis || How to achieve payment of wages My husband worked on a rotation basis for 15 months

If the employer decides to issue payslips to all employees by sending them by email, this provision must be enshrined in a local act and the employee must be familiarized with it. If you do not want unnecessary disputes with the labor inspectorate, it is better to issue sheets on paper.

It would also be a good idea to keep a journal for issuing pay slips, where employees will sign their receipt. Such a journal will protect the company in case of litigation with employees. In addition to the journal, in the form of a receipt, you can provide a detachable part where a signature on receipt will be placed (similar to a power of attorney). The employer has the right to choose the method of confirming the fact of issuing pay slips independently.

If the employer does not issue pay slips, he will violate labor laws. For such violations, he will face a fine of 30,000 to 50,000 rubles. Officials can pay a fine in the amount of 1,000 to 5,000 rubles (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). For repeated violations, the fines will be higher.

Service Expert Standard

E.A. Rogacheva

At the time of payment of the first part of the salary (advance), as a rule, all accruals and deductions due for the month (including the first half), such as bonus payments, accruals for sick leave, the amount of calculated personal income tax, deductions for writs of execution, etc.

Advantages of the NVK-KPN sand and oil catcher

- High degree of wastewater purification - the output reaches 95%.

- The body is made of heavy-duty reinforced fiberglass in accordance with SanPiN 2.1.2.729-99 “Building materials, products and structures. Hygienic safety requirements."

- Resins from the best imported manufacturers are used in production.

- Unpretentious operation of the equipment, inexpensive maintenance.

- Thermal stability of the installation and resistance to aggressive environments.

- Delivery is available throughout Russia and Kazakhstan.

Operating principle of the sand-oil catcher KPN

Surface runoff is directed to the first compartment of the settling part of the structure, where a baffle wall is installed. In the sand collection compartment there is the 1st filtering modular loading block (with a transverse-cross structure (3)). This module is used for primary sedimentation from coarse impurities and petroleum products. The block is made of reliable impact-resistant material (polypropylene).

After the settling zone, wastewater is directed to a block with filter elements (4). The block is a fiberglass box with polyurethane foam loading. The properties of the loading material allow for continuous filtration of wastewater for a long time (from 100 to 150 hours). Both washing and replacement of the filter media is possible.

Each block is equipped with pumping risers:

1 — sediment pumping riser;

2 - oil products pumping riser.

Next, the purified wastewater is discharged to the post-treatment unit (5), which is made in the form of a vertical box equipped with a lower distribution system and an upper drainage pipeline. Filter loading: carbon powder. Filtration is carried out from bottom to top through a calculated layer of sorbent. The material ensures effective extraction of petroleum products from purified water up to the maximum permissible concentrations in fishery water bodies.

According to the technical specifications, NVK-KPN with an additional sorption block can be made of metal or HDPE. It is also possible to install a sand level sensor, an oil product level sensor.