In accordance with the law, the invoice number is a mandatory detail. However, there are no specific legal rules for numbering. There are only two requirements - the numbers must be formed in ascending order, and there must not be identical numbers. The numbering is in order for both paper and electronic invoices.

In practice, the organization independently determines how to number invoices. The following rules apply:

- The numbering is in ascending order for all types of invoices, including advance invoices.

- Numbering begins again after a certain period (day, month, quarter, year, etc.).

- The number may include not only numbers, but also letters and other characters.

These rules are enshrined in the accounting policies of the organization.

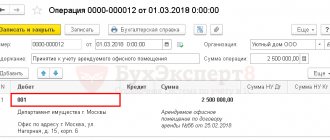

In the instructions we will look at the numbering of invoices in 1C 8.3, their configuration and correction.

What to consider when numbering invoices

The list of mandatory details of shipping, advance and adjustment invoices is contained in paragraphs.

5, 5.1 and 5.2 art. 169 of the Tax Code of the Russian Federation, respectively. One of these details is the serial number. At the same time, the Tax Code itself does not establish the order of numbering of invoices and refers us to the by-law - the resolution of the Government of the Russian Federation (clause 8 of Article 169 of the Tax Code of the Russian Federation). For 2021, a similar document is the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. However, regarding the issues of numbering invoices, nothing has changed. Thus, since the entry into force of Resolution No. 1137, there have been no fundamental innovations in numbering in its text. Some clarifications took place in the summer of 2014 (Resolution of the Government of the Russian Federation dated July 30, 2014 No. 735), when the type of dividing mark used in invoices of separate divisions, participants in partnerships and trustees was determined. This sign became the slash (fraction, slash) - “/” (previously it was simply a dividing line, but it was not specified whether a slash was meant or a dash).

The main points about the numbering of invoices were given by ConsultantPlus experts. Get trial access to the system and move on to the Ready-made solution.

Read about the latest changes that significantly changed the form and rules for filling out an invoice here .

PAYERS SUPPORTED YOU RF

Fortunately, FAS judges do not share this approach of controllers (see, for example, decisions of the FAS Moscow district dated 08/30/06 No. KA-A40/7949-06, Ural district dated 07/05/07 No. Ф09-5097/07-С2).

Now the Presidium of the Supreme Arbitration Court of the Russian Federation is on the side of taxpayers. In the published decision, the judges indicated: if the payment was received in the same tax period in which the goods were shipped (work performed, services provided), such payment cannot be considered an advance payment for the purposes of Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation. And if so, then it is not necessary to fill out line 5 of the invoice in this situation.

Note that the Presidium of the Supreme Arbitration Court of the Russian Federation has already noted that the payment that the supplier received in the same tax period when it sold goods for export is not an advance payment (Resolution No. 10927/05 dated February 27, 2006). But in the published ruling, the judges of the highest arbitration court for the first time directly allowed not to fill out line 5 of the invoice if payment and shipment took place in the same period.

What are the rules for numbering invoices?

The main (and only) rule is that numbers are assigned in chronological order as invoices are compiled/issued (subparagraph “a” of paragraph 1 of the rules for filling out an invoice, subparagraph “a” of paragraph 1 of the rules for filling out an adjustment invoice) .

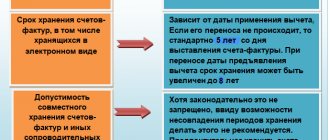

An organization can set the numbering renewal period independently in its accounting policies, depending on the number of documents it prepares. For example, you can resume numbering from the beginning of the next year, quarter, month. The only thing that officials spoke out against was the daily numbering of invoices from the first number (letter of the Ministry of Finance of Russia dated October 11, 2013 No. 03-07-09/42466).

Invoice numbers may not only consist of numbers: the use of letter prefixes and digital indices is allowed. The latter must be included in invoices:

- separate divisions (the document number separated by a slash is supplemented by the digital index of the OP, fixed in the accounting policy);

- participants of partnerships or trustees (the company’s transaction index for a specific agreement is also indicated through a slash).

Read more about invoice details and their significance for this document in this article .

Can advance or adjustment invoices be numbered separately?

A direct indication of a unified chronology of all invoices drawn up by the taxpayer appeared in 2012 with the release of Resolution No. 1137. In the previous Decree of the Government of the Russian Federation of December 2, 2000 No. 914, there were no such norms, therefore accountants often numbered invoices for shipment and prepayment separately - it was so convenient. Now you shouldn’t do this so as not to cause criticism from the inspectors.

The Ministry of Finance of Russia is clearly against separate numbering of advance invoices (letters dated October 16, 2012 No. 03-07-11/427 and August 10, 2012 No. 03-07-11/284). If there is a desire or need to somehow distinguish invoices for an advance payment, it is permissible to use a letter prefix (for example, A or AB) to a number that fits into a single chronology.

Read more about issuing invoices for advance payments in the article “Rules for issuing invoices for advance payments in 2021 - 2021” .

As for adjustment invoices, the filling rules clearly state that serial numbers are assigned to them in general chronological order. This order must be followed.

The numbers are out of order: will the seller be punished?

Mistakes happen to everyone, and violation of invoice numbering, alas, is not uncommon. The most common occurrences are missing numbers or non-compliance with chronology (an invoice that is later in date has a lower number than the previous ones, or vice versa). Duplication is a rarer case, because basically everyone works with accounting programs and the software simply does not allow you to assign the same number to different documents.

It is extremely difficult to bring the broken numbering into chronological order, since as a result of shuffling invoices, the numbers of later documents that have already been transferred to buyers will “creep”. Therefore, the question arises: is it necessary to do this?

We answer: not necessarily, since tax legislation does not provide for liability for violation of the rules for numbering invoices for the seller. In Art. 120 of the Tax Code of the Russian Federation talks about a fine for the lack of invoices, but it cannot be applied to the situation with “dropped out” numbers. We can talk about the absence of invoices only when there is an obligation to issue them, but it has not been fulfilled - missing a number does not apply here. However, all this does not mean that the rule of a single chronology can be ignored.

Design rules

With prefixes

The legislation does not provide for the indication of any prefixes in the document serial number. However, regulations do not prohibit their use.

Thus, if an enterprise issues invoices, it is permissible to use separate codes when numbering them , indicating the essence of the document being drawn up. For example, a separate numbering for an advance payment with the prefix “A” with a fraction – No. 1001/A, where “1001” is a serial number, and “A” will indicate that the invoice was issued under an agreement with an advance payment. The same applies to No. 100/K, where K indicates an adjustment invoice)

You can find out more about preparing an invoice for an advance payment here, and you can learn more about the codes in the invoice here.

For separate units

Separate divisions of an organization that enter into separate contracts and make their own payments are one of the few cases when regulations directly allow the use of additional indices and other designations.

Important! In this case, the serial number can be separately assigned, through a slash, the number of the department that issued the document. The division number itself is assigned based on the company’s internal regulations.

Through the end-to-end method

The legislation concerning primary accounting documents in accounting (Federal Law “On Accounting” and by-laws) does not provide a definition of continuous numbering. However, using the analogy of the law, based on the Federal Law “On Communications”, we can conclude: continuous numbering is the assignment of numbers to each of the primary documents (including invoices) subject to two main conditions:

- Each number during the accounting period (determined in accordance with the Tax Code of the Russian Federation and other regulations) must be unique.

- During the accounting period, each number for the subsequent document must increase. It is unacceptable for a later document to have an accounting number lower than the one that was issued and presented earlier.

In all other respects, companies have the right to determine their own accounting policies . For example, it is permissible to make the number composite, indicating in it not only the serial number, but also the accounting period (for example, it is allowed to number invoices according to the principle: 1/01 - the first for January, 223/08 - 223 for August, etc. .).

However, official documents as of the beginning of 2018 do not contain requirements for continuous numbering. It is only the observance of the chronology that is important, and not the numbering sequence - especially since it is determined on the basis of the internal acts of the organization, and it is difficult to verify it from the outside.

In addition, since 2014, it has been clearly defined that only a slash (slash, /) is used as a separator character, and not a hyphen, dash or any other character.

The rules on numbering provide only one thing: numbers must increase. Later documents must have a higher number than earlier ones. There are no mandatory requirements by law that the first invoice of the year or reporting period must have the first number.

Therefore, it is quite acceptable that in the reporting period, invoices would be numbered not from the first, but from a different number. This is especially true if continuous numbering is valid for several periods.

Attention! It should be remembered that the features of bank information systems in most cases are designed for three-digit numbers. Therefore, it is recommended not to prepare more than 999 similar documents per year - otherwise technical failures may occur.

Will jumping numbering affect the buyer?

Most likely it will not be affected. An error in the invoice number does not prevent the identification of the seller, the buyer, the name of the goods (work, services) and their cost, the rate and amount of VAT, and therefore does not provide grounds for refusing the buyer a deduction (clause 2 of clause 169 of the Tax Code of the Russian Federation) . In any case, such claims by controllers have long been easily disputed. According to some courts, even the absence of a number in the invoice should not deprive the VAT deduction (resolutions of the Federal Antimonopoly Service of the Central District dated 04/08/2013 in case No. A14-7612/2011, FAS Moscow District dated 08/10/2011 in case No. A41-41420/ 09).

For other non-fatal errors in the invoice, read the material “What errors in filling out the invoice are not critical for VAT deduction?” .

In what cases is a document issued?

In what cases is a corrective (corrected) invoice issued? Edits to the invoice are quite acceptable and necessary if an error is found in it :

- typo;

- incorrect tax rate;

- error in details.

When is the correction document issued? Editing of an erroneous document is carried out in a new invoice - ISF (corrected invoice), which refers to the period when the original invoice was issued, regardless of the date of the corrections.

Results

One of the required details for each type of invoice is its serial number. The word “ordinal” implies numbering in order as documents are drawn up. However, it is not always possible to comply with it, and the attempt at ordering is reflected in the numbering of documents issued later than those whose numbers failed. There is no liability for jumping or missing numbers. The deduction of errors in the number is not prevented.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.