Hello members and readers of the Debtors Community! I welcome you again to the pages of this blog.

Repaying a debt with a bill of exchange is a very interesting topic. Many anti-collectors and simply lawyers have now begun to actively offer such a service as repaying a debt with a bill of exchange at the stage of enforcement proceedings.

Many began to offer this service, others began to study what the catch was, began to publish materials both “for” such a service and materials “against” such a service.

In general, a very strong discussion ensued on the Internet. Do you think I take part in these disputes? I don’t know your answer - I’m just interested in knowing about it, I ask you - leave your answer below in the comments.

And I’ll answer myself - of course, how can such a relevant and simply interesting debate take place without me? Moreover, the dispute is on a topic that worries every debtor.

So here's the discussion.

It all started when the famous loan lawyer Yu. Nikitin published his next post - Repaying a debt with a bill of exchange. In this post, Yu. Nikitin expressed his positive attitude towards such a new phenomenon and asked those involved in this issue to provide practical examples.

Immediately there were advertisements for this post - that, they say, everything is fine, everything is legal, the bailiffs accept bills and everything will be fine with you, dear debtors.

Yura again asked these “representatives” to talk in more detail about the service and give practical examples of positive outcomes. And again silence.

And on this note I enter into the debate. I expressed an opinion on this issue, plus, for my part, I published a survey on VKontakte on the topic - is it possible to repay a debt with a bill of exchange or not. Here are the results - see for yourself.

Now these same representatives began to write to me, what is called “personal”, and say that the scheme really works. I will not cite their letters so as not to divulge the secret of the correspondence; whoever wrote to me will understand who I am talking about.

They probably hoped for the fact that they could somehow lure me to their side, that I wouldn’t figure it out or trust their promises. They are wrong! I know legal work very well, I know very well what a bill of exchange is and what these comrades are talking about all over the Russian Internet. More on this a little later, so stay until the end - it will be interesting!

In response, I wrote to them my thoughts, gave my evidence why I believe that such practices will never have a place in our state. With all this, I respectfully asked to present specific facts, decisions of the bailiff service to seize such bills, and then, as a result of this, the end of enforcement proceedings.

As a result, I received very “good” comments that I was a bad lawyer, that I couldn’t figure it out and was drawing conclusions indiscriminately, and so on. With all this, these representatives did not provide materials confirming their words!

But we will somehow talk about my knowledge in other topics, and now I give you, my readers, my arguments regarding this whole issue.

Repaying a debt with a bill of exchange: what is the essence and content of the service?

Let's start with the fact that it is possible to cover the debt itself with a bill of exchange. Why not. Those. if you have a bill of exchange in your hands, and a bill of exchange is a security with all the details that this security called a bill of exchange should contain, you have the right to present it to the bailiff service and invite the bailiff to arrest it.

The bailiff seizes the security and then transfers the security to the creditor. If everything is fine with the security (it has been paid in full, there are no payments on it (not a loan!), all details comply with the law, and so on), the creditor can cash it and receive satisfaction of his claims in this way.

Everything is clear here. If you are interested, I advise you to purchase a book that describes in detail:

- actions of bailiffs when seizing securities;

- how creditors satisfy their claims by cashing out securities;

- judicial practice of repaying debt by bill of exchange and other securities;

- and much more.

In general, the book is very useful on the issue of paying off debt with a bill of exchange. I give it as an example because I read this book quite a long time ago. It really tells the practice: the practice that exists at the present time. It was this book that gave me knowledge, thanks to which it is now difficult for me to be fooled by all sorts of incomprehensible schemes.

This is the essence and content of repaying a debt with a bill of exchange. You have a paid bill in your hands and present it to the bailiff service to resolve the issue of closing the proceedings.

The creditor accepts such a bill and the proceedings are closed. It must be said that everything is clear here and any action to the side can lead to the most unfavorable consequences, including criminal prosecution.

Where are bills used?

Essentially, a promissory note is a written confirmation of a debt. It is not affected in any way by the circumstances under which it is issued and the characteristics of the transaction. If you need to specify additional conditions - for example, the sale of goods, the provision of a loan, and so on, then an additional agreement is concluded between the parties.

Basically, bills of exchange are used in:

- In lending. Any person can act as a lender or borrower. This could be a private owner, a credit organization, any legal entity - everything except the state! As we said at the beginning of the article, authorities do not have the right to issue such papers. Moreover, as before, a loan on a bill of exchange will be regarded as more reliable for the one who issues it. In fact, they pay off their own debts using bills of exchange and sell the debts to others.

- Entrepreneurship. Basically, sellers thus give the client the opportunity to defer payment. Typically, such transactions are carried out without interest.

- Raising capital. This is mainly done by banking organizations. But, unlike the first option, we are not talking about lending. Because in this case, bill obligations are similar to bank deposits. In addition to banks, large companies and investors can also increase turnover in this way.

- Monetary sphere. In other words, sometimes bills act as a substitute for money. These papers are used to pay off the debt. And this can be done in front of almost anyone. First of all, we are talking about business niches. You are unlikely to see bills of exchange in everyday life of ordinary citizens.

What is the meaning of the service about which I have a dispute?

The service is as follows.

There is a certain Consumer Society (hereinafter referred to as PO) - a non-profit organization that unites members and all the activities of this organization boil down to simplifying or improving the lives of its members in one issue or another.

You pay an entrance and membership fee to this consumer society, pay 20% or 30% of the amount of your debt (different rates vary in different software). Next, the software issues you a bill of exchange.

You have the right to present this bill (most often it meets all the requirements of the law - I am not considering an illegal bill in this article) to the bailiff service.

Everything was fine, if not for one small BUT!!! Which? Where is the money? The money that the lender will receive as a result of cashing the bill?

And here two situations are possible:

- The bill has not yet been paid

- The PO issues to its member an already paid promissory note for the entire amount of his debt.

The bill has not yet been paid

In this case, we are talking about a kind of refinancing. Those. the debtor, paying entrance and membership fees to the software, plus 20 or 30 percent of the amount of the debt, receives a bill as if on credit. Those. for this, the PA member will in the future make permanent and regular payments to the PA.

Those. in fact, one obligation is closed, another obligation arises. The question arises here: what exactly is the legal service in this case?

This turns out to be not a legal service, but a financial service, which has a number of negative circumstances. Which ones? Well, the first thing that comes to mind is a new obligation, where the creditor is the software that issues the bill to you. A new obligation carries with it new interest, a new term, new risks, new litigation, and so on.

In general, remember how they harassed you, how they called you, how they scared you, and so on under the old loan agreement. Remember? The same thing awaits you in the future, because if you did not pay for the old agreement, why are you sure that you will pay for the new one, which is essentially the same - a loan, only issued through a security - a bill of exchange?

However, I will not talk about the negative consequences of this action in this article. This is a completely different story. And on topic I’ll tell you what happens next.

Then the bailiff seizes the security. But the lender does not accept it, because there is no money on the security.

As a result, the following situation arises: Enforcement proceedings are not closed because the bill of exchange was not accepted by the creditor due to lack of money. Those. the old contract has not been closed, the debt has not been paid.

And the debtor has a new obligation - an obligation to the consumer society to provide a bill of exchange on credit. If you receive it for 20%, in any case you will have to return the money for which it was issued.

Bill of exchange for the entire amount of debt

Yes, it is also possible for a situation where a consumer society (consumer society) issues its member a paid bill for the entire amount of the debtor’s debt. What happens in this case?

This case is especially dangerous. And it reminds me of the scenario of such a Society as MMM. Remember this happened? It opened twice, failed twice, and nothing teaches our Russian people...

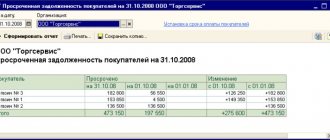

See for yourself. Let us analyze this example using the example of three participants. For a Consumer Society, let’s say the authorized capital is 100,000 rubles. Its participants, say, Ivanov, have a debt of 50,000 rubles, Petrov has 50,000 rubles, and Sidorov has 50,000 rubles.

Here are two of them - they will taxi out, and the Bank will cash out its money. Let's say, let there be Ivanov and Petrov. But Sidorov, having contacted the bailiff service, the software will no longer be able to pay his obligations. Why? Because the software doesn’t have an extra 50,000 rubles. Where will the software get the money to pay for its members, and practically for nothing - for 20% of the debt amount.

Sidorov will be able to pay only 30,000 rubles (if the calculations are made in a specific example). Everyone has 50,000 debt, everyone must pay 20% - that’s 10,000 rubles. Three participants, therefore, it turns out 30,000 rubles. But not 50,000 rubles! It's all math.

Debtors - do not even think about using this service!!! I strongly recommend avoiding such software. Don't let yourself be deceived!

And do not forget that with 30,000 rubles received from its participants, the software is obliged to pay tax to the state. And such a payment is considered in turn to be of priority than payments to participants or members of the software. The total is not 30,000 rubles, but even less.

Representatives asked me - what does MMM have to do with it, we have practice. And I answer - how and what. Just as MMM printed money out of thin air, for which Mavrodi paid with prison, then the software also prints some kind of virtual money out of thin air. Smells like a scam!

Understand that neither software, nor MMM, nor any other organization (even a commercial Bank!) will be able to print money for you. Just like that - for 20% of the debt amount and your beautiful eyes.

In addition, the bank will not accept the bill until it is cashed. And the worst thing is, and this terrible thing is the main argument. Answer the question: who presents such a bill of exchange to the official body? That's right, the debtor himself.

Not the consumer society, not software representatives, not lawyers and attorneys who promise you “mountains of gold.” Presents to the bailiffs - the debtor. Consequently, he should bear responsibility for the fact that something is wrong with the bill, as with a security.

Remember this.

Difference from a check

What else can a bill be compared to? With a check. Perhaps, these two forms are closer to each other than the previous options, although checks today are a more widespread and convenient means for cashing money. And yet there are quite a lot of differences:

Sign | Bill of exchange | Check |

| Release form | IOU | Cash equivalent |

| Story | Analogs are known in Ancient Greece | Originated in the 17th century, developed rapidly since the 19th century |

| Cashing method | Depending on the document, for example, on a specific date, a year from the date of preparation, etc. | Immediately upon presentation |

| Type of debt | Individuals and legal entities, although a bank or other person may be an additional guarantor of the bill (aval) | Bank liability |

| Decor | Requires acceptance, i.e. registration of consent to the terms of the transaction | Does not require acceptance |

| Time for responsibility | It is difficult to collect on an overdue bill | Typically valid for several years from date of issue |

| Receiving funds | Cash | Crossing is possible, i.e. only transfer the amount to the account |

| Debt dispute | The acceptor pays the bill in any case | The bank can challenge a forged signature |

conclusions

There is only one conclusion.

If you have a paid bill of exchange or any other security in your hands, you can easily carry out the procedure: repaying the debt with a bill of exchange.

It’s paid off, you don’t have a new loan obligation, and someone else doesn’t invest their money for you. Everything is great.

In all other cases, repaying the debt with a bill of exchange is impossible. Don't even fall for such tricks. Believe me, this will not lead to anything good. And there will be only one result: someone may be lucky and have time to get through the program (when the software has its own money), but someone will not have time (and such clients will be the majority).

Well, that's basically all. On this issue, my point of view has been expressed. Write your opinion on this issue in the comments. It is interesting to know what debtors breathe and think about. I want to say that I do not deceive or insult anyone, do not humiliate or scare anyone. If anyone has practical examples that prove the opposite of my point of view, I will be happy to listen and write about this issue.

Although this is unlikely to happen: after all, this whole process was prescribed a long time ago and inventing something new, as they say, is more expensive for yourself!

I also suggest that you learn this whole process: from the very beginning to the very end. To do this, you just need to sign up for training at the first Anti-collector School in Russia, where training is carried out according to my original method. Join us friends!

Peculiarities

- the unconditionality

of a monetary obligation implies that no conditions can cancel the obligation to pay a certain amount to the creditor; - independence

means that the bill is not legally tied to a specific agreement, it arises as a result of a certain transaction, but is separated from it and exists as a separate document; - a strictly defined form of completion

must contain all the necessary details; the absence of at least one of them makes it void.

Subtleties of design

The execution of the act, as well as its text, is entirely left to the compiler. The document can be handwritten or typed on a computer, on letterhead or on an ordinary blank sheet of paper.

The act is always drawn up in at least two copies - one for each of the interested parties, but if necessary, certified copies can be made. In cases where an act is formed between legal entities, information about it must be entered into the documentation journal.

Mandatory details and exceptions to the rules

Let's look at how to properly draw up a bill of exchange. The Regulations of 1937 indicate that the details of a promissory note are:

Translated contains:

The only difference is in the point about indicating the payer. In the first case it is absent, in the second it is a mandatory element.

There are exceptions to the rules:

- The due date may not be specified, in which case the debt must be paid upon presentation.

- If the place of payment is not specified, it is considered that this must be done at the place of drawing up the document at the place of residence of the drawer.

A transferable security may carry interest if it is issued with a maturity date at sight or with payment after some time from sight.

The two main types of bills are as follows:

Transfer of rights

For the mobility of a security, the possibility of its presentation by another person is used. When merchants receive them from counterparties, they can either present obligations for payment or use them to pay for goods and services. This can be done using an endorsement - an endorsement. On the reverse side, the holder of the bill (endorser) indicates to whom he is transferring the form, puts a date and signature.

What are the endorsement options?

The transfer of rights can be complete or partial; the bill of exchange is transferred with or without the details of the beneficiary (personal endorsement). Businessmen insure themselves against joint liability when transferring rights by drawing up non-negotiable bills of exchange, indicating in the note “without negotiability on me.”