Long-term and short-term financial investments

The placement of an organization's free funds for the purpose of subsequent profit in the form of dividends or interest is called financial investments. The investment periods differ between short-term and long-term investments. The latter include objects with a maturity of more than 1 year. What exactly can the company's funds be invested in? The main forms of long-term financial investments include (clause 3 of PBU 19/02):

- State and/or municipal securities.

- Securities of other companies, including bills and bonds with a precisely defined value and maturity date.

- Deposits in banking institutions.

- Contributions to shareholders or share capital of companies; under simple partnership agreements.

- Interest-bearing loans issued to other organizations.

- Accounts receivable under contracts for the assignment of claims.

- Other long-term investments of a similar nature.

Note! Own securities purchased for the purpose of further cancellation or resale are not recognized as financial investments; investments in precious metals; bills of exchange for mutual settlements with counterparties; investments of the organization in property objects used in rental activities (clauses 3, 4 of PBU 19/02).

The sold bond is recorded using the sale of other assets account.

In particular, the actual cost is debited to the sales account and credited to account 06 Long-term financial investments, subaccount 2 Bonds selling price 50, 51, 62 - 48 financial result is written off to the Profit and Loss account income - 48 - 80/2 losses - 80/2 - 48. Organizations do not contribute value added tax to the budget when selling bonds. [p.107] Subsidiary (dependent) companies are legal entities formed by the parent (parent) organization. When a subsidiary (dependent) company is separated and its authorized capital is 100% formed, correspondence is drawn up in the accounting department of the parent organization on the debit of account 06 Long-term financial investments and the credit of account 78 Settlements with subsidiaries (dependent) companies, in the corresponding subaccounts Settlements with subsidiaries, Settlements with dependent companies. [p.392] In the event that a deposit agreement is concluded for a period of less than 12 months, the deposit amount is reflected using account 58 Short-term financial investments. If the deposit agreement is concluded for a period of more than 12 months, account 06 Long-term financial investments is used to record the deposit amount. For these accounts, separate subaccounts are introduced under a simple partnership agreement, within which analytical accounting is organized for each agreement and type of deposit. Correspondence of accounts for the transfer of property against deposits under the agreement is carried out using sales accounts. Thus, for the value at which the transferred property is accounted for by the partner organization on the date the agreement enters into force, sales accounts are debited - 46, 47, 48 (depending on the type of property transferred) in correspondence with the credit of the corresponding property accounting accounts 01, 04 , 40, 41, etc. [p.396]

Account 06 Long-term financial investments (according to the new Chart of Accounts - account 58 Financial investments in terms of long-term financial investments) [p.11]

Account 04 Intangible assets. The balance sheet is reflected taking into account depreciation, i.e. account balance 05 Depreciation of intangible assets Account 06 Long-term financial investments Account 08 Capital investments Account 10 Raw materials [p.135]

Account 06 Long-term financial investments This account is present in the chart of accounts used by the organization, which is given in the accounting policy. [p.152]

Account 03 Profitable investments in material assets Account 06 Long-term financial investments Account 07 Equipment for installation [p.167]

This article reflects the organization’s activities in the financial market. When filling out, use the data from account 06 Long-term financial investments. These can be long-term (for a period of more than one year) investments of the organization in income-generating assets (securities), authorized capitals of other organizations created in Russia or abroad, government securities (bonds and other debt obligations), etc. , as well as loans provided. Filling out annual reporting requires the enterprise to maintain detailed analytical accounting for the types of long-term financial investments and the enterprises in which these investments were made. [p.177]

Account 06 Long-term financial investments [p.178]

Column 5 provides data related to long-term financial investments. These can be long-term investments (investments) in securities of other enterprises, interest-bearing bonds of state and local loans, authorized funds of other enterprises created in the country, in the capital of enterprises abroad, etc., as well as loans provided by the enterprise to other enterprises. Long-term financial investments made by the enterprise are reflected in the debit of account 06 Long-term financial investments and the credit of cash accounting accounts 50 Cash, 51 Current account, 52 Currency funds (with the transition to the new Chart of Accounts, all financial investments are accounted for in account 58 Financial investments). [p.233]

The Financial Investments section deciphers the composition of the organization's long-term and short-term financial investments in Russian and foreign currencies, which are accounted for in accounts 06 Long-term financial investments and 58 Short-term financial investments. [p.255]

The procedure for reflecting transactions with securities in accounting, approved by order of the Ministry of Finance of the Russian Federation dated January 15, 1997 No. 2 [23], to account for acquired securities, organizations use account 06 Long-term financial investments (when their established repayment period exceeds one year or investments are made with the intention of receiving income on them for more than one year) and account 58 Short-term financial investments (when the established maturity date does not exceed one year or the investments were made without the intention of receiving income on them for more than one year). Thus, this Procedure provided for two criteria for dividing financial investments into long-term and short-term. [p.250]

The classification of financial reporting indicators is presented in PBU 4/99 [7]. It is well known that this classification is given in the specified PBU without reference to accounting account numbers. In this sense, it is possible to draw up financial statements that would satisfy the interests of users, with the same result, on the basis of accounting data obtained using both the 1991 Chart of Accounts and the new Chart of Accounts. For example, the absence of account 06 Long-term financial investments in the new Chart of Accounts does not eliminate the requirement to classify financial investments into short-term and long-term for the purposes of preparing financial statements. [p.545]

Analytical accounting cards for accounts 06 “Long-term financial investments”, 58 “Short-term financial investments”, 55 “Special bank accounts”, 56 “Cash documents”. [p.532]

Note Analytical accounting for accounts 06 “Long-term financial investments” and 58 “Short-term financial investments” is carried out by type of long-term (short-term) financial investments and the objects in which these investments were made (enterprises that sell securities, other enterprises in which the audited organization is a participant , deposits, borrowing enterprises, etc.). At the same time, the construction of analytical accounting should provide the possibility of obtaining data on long-term (short-term) financial investments in objects in the country and abroad. [p.533]

The movement of government and corporate debt securities purchased on the market is recorded in accounts 06 Long-term financial investments and 58 Short-term financial investments in correspondence with accounts 76 Settlements with various debtors and creditors, 83 Deferred income, 31 Deferred expenses, etc. Removal of financial The result from the sale (or redemption) of securities, payment of coupons or other income affects account 80 Profit and loss and financial investment accounts. The use of account 76 Settlements with various debtors and creditors to determine tax obligations for payments to the budget confirms the prevalence of fiscal interest over economic interest. As soon as the joint stock company reflects the repayment of the corresponding debt in this account, the obligation to pay tax immediately arises, while the funds may arrive in the current account with a significant gap in time. [p.256]

Column 5 Used reflects data on the distribution of sources of own and borrowed funds, taking into account the costs and investments actually made in the reporting period in the debit of accounts 06 Long-term financial investments, 07 Equipment for installation, 08 Capital investments (both fixed and intangible assets) and 61 Calculations for advances issued (in terms of advances transferred by the organization to construction and other organizations to cover their costs for the construction of facilities). It should be borne in mind that, when separating the size and types of sources for the further implementation of the process of long-term investments (column 6), first of all, depreciation charges for the complete restoration of fixed assets are considered to cover capital investments, and for the acquisition of intangible assets - their depreciation . When allocating sources taking into account actual costs incurred, it is necessary to keep in mind the previously taken into account source of coverage in the part related to the cost of equipment requiring installation and included in the co- [p.183]

The Other item shows the amount of the organization's investments in deposits (savings certificates, deposit accounts in banks, etc.) and other areas of investment accounted for in accounts 06 Long-term financial investments and 58 Short-term financial investments. [p.185]

Transactions with securities are mainly reflected in the following accounts 06 “Long-term financial investments”, 48 “Sale of other assets”, 56 “Cash documents”, 58 “Short-term financial investments”, 62 “Settlements with buyers and customers”, 68 “Settlements with budget", 70 "Settlements with personnel for wages", 75 "Settlements with founders", 76 "Settlements with various debtors and creditors", 80 "Profits and losses", 81 "Use of profits", 82 "Valuation reserves", 85 “Authorized capital”, 86 “Reserve capital”, 87 “Additional capital”, 88 “Special purpose funds”, 94 “Short-term loans”, 95 “Long-term loans”. [p.249]

Active bank account 06 “Long-term financial investments” reflects the enterprise’s investments (investments) in the following types of assets [p.267]

Fixed assets transferred as a contribution to the authorized capital (fund) of other organizations are reflected at the cost determined by agreement of the parties, by the debit of account 06 “Long-term financial investments” and the credit of account 47 “Sales and other disposal of fixed assets”. The initial cost of fixed assets is written off from the credit of account 01 “Fixed Assets” to the debit of account 47, and the amount of depreciation on transferred fixed assets is written off to the debit of account 02 “Depreciation of fixed assets” from the credit of account 47. Additional expenses associated with the transfer of fixed assets are written off to the debit of account 47 from the credit of the corresponding accounts. [p.84]

Long-term financial investments are accounted for in active account 06 “Long-term financial investments”, to which sub-accounts can be opened [p.265]

Contributions to the authorized capitals of other organizations are recorded in account 06 “Long-term financial investments”, subaccount 1 “Units and shares”. [p.267]

Debit account 06 “Long-term financial investments”. 62,000 rub. Credit to account 08 “Capital investments”, sub-account “For operations with debt obligations” [p.273]

Credit to account 06 “Long-term financial investments” - for the annual part of the difference between the purchase and nominal prices (1000 rubles), [p.274]

If the purchase price of securities is lower than the par value, then each time the income due on them is accrued, part of the difference between the purchase and par value is additionally accrued. In this case, for the amount of income due on securities, account 76 “Settlements with various debtors and creditors” is debited for the part of the difference between the purchase and nominal value attributable to the given period, account 06 “Long-term financial investments” or 58 “Short-term financial investments” is debited for the total amount of income and part of the difference between the purchase and nominal prices is credited to account 80 “Profits and losses”. [p.274]

Debit of account 06 “Long-term financial investments” [p.274]

Regardless of the price at which the securities were purchased, by the time of their redemption (redemption), the valuation in which they are recorded in accounts 06 or 58 must correspond to the nominal value. When redeeming or selling securities, they are written off from the credit of account 06 “Long-term financial investments” to the debit of account 48 “Sale of other assets” at their value at the time of sale. Proceeds from the sale of securities are credited to cash accounts from the credit of account 48 “Sale of other assets”. Profit or loss from the sale of securities is written off from account 48 “Sale of other assets” to account 80 “Profits and losses”. [p.275]

Cash and other loans provided to other organizations are taken into account depending on the period of provision in the debit of accounts 06 “Long-term financial investments”, subaccount 3 “Loans provided”, or 58 “Short-term financial investments”, subaccount 3 “Loans provided”, from monetary and other loans accounts (account 10 “Materials” - for the cost of transferred materials, etc.). A loan agreement can be compensated (with payment of interest) or gratuitous. [p.275]

Debit of account 06 “Long-term financial investments” (for the difference on transactions with long-term financial investments) [p.316]

In the participant’s (owner’s) organization, if the purchase price exceeds the estimated one, the actual expenses for the acquisition of property are reflected in the debit of account 06 “Long-term financial investments” and the credit of cash accounts. [p.329]

Purchased financial bills are recorded in accounts 06 “Long-term financial investments” (if it is expected to receive income on them for more than 1 year) or 58 “Short-term financial investments” (if it is expected to receive income on them within 1 year). [p.338]

If the purchase price of debt securities is higher than their par value, then when calculating income on debt securities, the corresponding part of the difference between the purchase price and par value is written off from the credit of accounts 06 “Long-term financial investments” or 58 “Short-term financial investments” to the debit of account 80 “ Profit and loss". [p.371]

Long-term financial investments are accounted for in the active account 06 Long-term financial investments, to which subaccounts 06-1 Shares and shares are usually opened, 06-2 Sticky, 06-3 Loans provided, 06-4 For joint activities, etc. [p.199]

Fixed assets transferred as a contribution to the authorized capital (fund) of other enterprises are reflected at the contractual value (determined by agreement of the parties) in the debit of account 06 Long-term financial investments and the credit of account 47. The disposal of fixed assets is recorded according to the general scheme. [p.249]

F- bringing the purchase price of government securities to their par value in the event of purchasing securities below their par value (debit of accounts 06 Long-term financial investments and 58 Short-term financial investments and credit of account 80) [p.425]

All types of long-term investments are accounted for in account 06 Long-term financial investments. Long-term investments in the authorized (share) capital of business companies and partnerships, created subsidiaries are reflected in the debit of the Long-term financial investments account and the credit of the Cash, Inventory, Fixed Assets, Finished Products and Goods accounts. Moreover, the transfer of property is carried out through the corresponding sales accounts (46, 47, 48). [p.106]

In organizations that use computer technology in accounting, machinograms for accounts 06 Long-term financial investments, 08 Capital investments, 48 Sale of other assets, 55 Special bank accounts, 56 Cash documents, 58 Short-term financial investments, 82 Valuation reserves. [p.518]

Resolution of the Federal Commission for the Securities Market of Russia “On approval of the rules for the reflection by professional participants of the securities market and investment funds in the accounting of certain transactions with securities” dated November 27, 1997 (effective from January 1, 1998) provides for the accounting of transactions for the acquisition, sale and other disposal securities on the date of transfer of rights to securities. When organizing accounting for accounts 06 “Long-term financial investments” and 58 “Short-term financial investments”, separate accounting is provided for securities acquired as financial investments for one’s own needs (in order to obtain investment income) and for resale (in order to obtain income from their sale ). [p.250]

Fixed assets transferred as contributions to the authorized capitals of other organizations are reflected at a value determined by agreement of the parties in the debit of active account 06 “Long-term financial investments” and the credit of account 47. The initial cost of these funds is written off from the credit of account 01 to the debit of account 47, and the amount of depreciation is debited to account 02 (passive) “Depreciation of fixed assets” from the credit of account 47. Additional expenses associated with the transfer of fixed assets are reflected in the debit of account 47 from the credit of the corresponding cost accounts. Income from such an operation, which is generated by the excess of the contract value together with depreciation over the original cost plus additional expenses, is charged to account 80. [p.12]

Accounting for long-term investments and financial investments

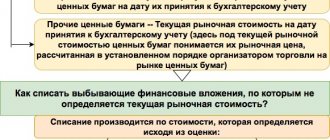

Accounting for long-term and short-term financial investments is carried out on the account. 58 in the manner prescribed by Order of the Ministry of Finance No. 94n dated October 31, 2000. Information on invested funds with the opening of the corresponding sub-accounts is summarized here. Analytical accounting of long-term financial investments is carried out by type of investment, counterparties, and terms.

Subaccounts to the account 58:

- 58.1 – records of shares and shares are kept here.

- 58.2 - to display transactions on investments in securities - both public and private.

- 58.3 – loans provided to other enterprises (individual entrepreneurs, individuals) – cash and others – are taken into account here.

- 58.4 – intended to display contributions based on simple partnership agreements.

Note! Currently, for the correct accounting of long-term financial investments, account 06 of the same name is no longer used. According to Order No. 94n, this account was excluded from the current Chart of Accounts of enterprises and was replaced by an account. 58.

FV: essence, types, what to relate to

To begin with, let’s define what financial investments are: this is a purposeful activity of a company, which is not the main one, and is aimed at investing freely available funds in circulation into the financial assets of other enterprises.

However, not every financial asset that enters the balance sheet of an enterprise can be recognized as an investment. It must be acquired solely for the purpose of making a profit or for the purpose of further resale.

At the same time, there are long-term and short-term financial investments (it all depends on the duration of such assets):

- Short-term investments are those assets of an enterprise whose duration in circulation does not exceed one year;

- Long-term investments are those investments whose duration exceeds one year.

Accounting for long-term investments and financial investments is carried out in the context of the types of financial assets in which such investments are made.

Long-term PV include:

- A variety of securities: for example, shares, government bonds;

- Investing cash in the authorized capital of other companies, corporations, etc.;

- Deposits in a variety of current accounts with financial institutions;

- Interest-bearing loans to other enterprises;

- Accounts receivable due to the acquisition of the right to claim the debt from the debtor;

- Other types

Financial investments are reflected in the balance sheet

Long-term financial investments - an asset or a liability?

Account 58 is active. The debit reflects the actual investments of the enterprise in correspondence with the accounts of valuables. For example, this is an account. 51, 50, 52, 01, 10, 91, 75, 80, 76, 98. Accordingly, the disposal of investments when the debtor repays obligations is reflected in the loan account. 58 in correspondence with property or other accounts. These are accounts such as - 52, 50, 51, 76, 90, 80, 91, 99, 04, 01.

Note! The procedure for accepting financial investments for accounting is given in clauses 8-17, 18-24 PBU 19/02; upon disposal, you must follow the requirements of clauses 25-33 of the PBU.

Long-term financial investments on the balance sheet

Regardless of the type of investment, long-term financial investments in the balance sheet are line 1170. Information about the balances at the end of the reporting period for issued interest-bearing loans, purchased securities, deposits, contributions to share capital, charter capital and other investment objects with a validity period of more than 12 months Financial investments of a short-term nature, that is, with a repayment (circulation) period of less than a year, must be reflected on line 1240, excluding cash equivalents.

Note! If an enterprise creates a reserve for the depreciation of the value of investments, the value indicator minus the amount of deductions to the reserve is entered on line 1170.

Conditions for recognition in accounting

In order to take financial investments into account, a number of conditions must be met, and only if all of them are met is it possible to account for assets of this type:

- There must be documents that indicate that the organization has the right to engage in investments, confirmation of the right to receive funds or other assets arising from this right.

- Organization of monetary risks that are directly related to financial investments. This may be a liquidity risk, a decrease in value, or the insolvency of the debtor.

- Investments must be able to bring economic benefit to the organization, which is expressed by interest received, increase in value, and dividends.

What is recognized as a unit of accounting object

Companies themselves, by their own decision, choose the unit of accounting for financial investments. This is done in such a way that it is possible to generate complete and reliable information about existing assets and the ability to control their storage and movement. Depending on the nature, order of purchase and use of the PV unit, you can, for example, a batch or a series - everything that meets the classification criteria.

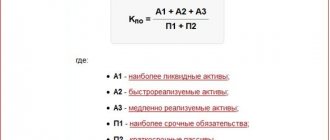

Analysis of long-term financial investments

In order to improve the efficiency of managing an enterprise's available funds, it is necessary to analyze financial investments. The procedure may include a multifactor analysis of the composition and horizontal structure of investments; long-term calculation of investment results; choosing the most profitable direction, etc. At the same time, an increase in long-term financial investments indicates that the company has a significant amount of available funds that can be used for long-term investment.

On the one hand, this indicates the success of the business. But on the other hand, it is fraught with a decrease in business activity in the main work activity, which in the future may cause a decrease in profits for the reporting period. Therefore, it is optimal to analyze indicators over time, and not just over a short period of time.