USN or PSN? Special tax regimes help entrepreneurs reduce tax documentation and payments. Every

Hello! Today we’ll talk about personal income tax for individual entrepreneurs on OSNO. Finally, dear readers, we have arrived

If the employer provides compensation payments to reimburse expenses incurred by employees during traveling trips, then

Enterprises can receive notary services from public or private specialists. Regulation of the actions of these

Once again, the rightness of the taxpayer, who provided his employees with free lunches at the expense of the organization, was confirmed by the Arbitration Court

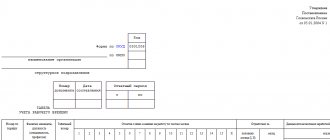

Labor laws require employers to account for employees' working hours. In this case, the established form of accounting

Region codes of the Russian Federation are digital designations (two to three digits) that allow you to identify the region

When calculating the profit tax on OSN, one of the types of allowable expenses is expenses on

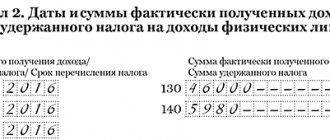

Source: 1. The company paid the employee on the day of dismissal 2. The company paid the employee

Basic concepts Since 2015, the pension rights of citizens are expressed mainly in pension points.