Labor laws require employers to account for employees' working hours. At the same time, there is no established form of accounting - you can use standard forms, or you can develop them yourself. For many, the unified T-13 uniform becomes the optimal solution. In this article we will tell you what it looks like, how to fill it out and how to adapt it to the specifics of your company.

| Valentina Mitrofanova will tell you what's new in labor legislation this week. Watch the new episode of Personnel Review. |

When is Form T-13 used?

Every employer is required to keep records of the working hours of its employees (Article 91 of the Labor Code of the Russian Federation).

For this purpose, he can use any form suitable to the peculiarities of his mode of operation, including those developed by himself. There are 2 forms, approved by one resolution of the State Statistics Committee, which can be used for the purposes of recording time worked, either unchanged or modified:

- Form T-12, the 1st section of which is built as a time sheet.

- Form T-13, which, in fact, is called a time sheet.

Form T-13 was approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. You can download it on our website.

The tables of the 1st section of the T-12 form and the T-13 form are very similar, but there are also differences:

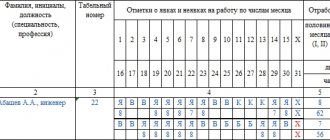

- Data on the days of the month related to a specific employee in the T-12 form are arranged horizontally sequentially from the first to the last day. In the T-13 form they are divided into 2 parts (half of the month), which are located under each other.

- Taking into account the fact that for each day, in addition to the number of hours worked, the reason for the employee’s presence or absence at work is indicated, due to the peculiarities of constructing tables in the T-12 form, each person is allocated 2 lines, and in the T-13 form - 4 lines.

- In the final part of the table of the T-13 form there are columns that are missing in the T-12 form. They reflect the codes of payment types and the corresponding accounting account in which accrued wages will be recorded.

You can use any of the above forms. The very fact of its presence is decisive. Without a reliable time sheet, it is impossible to correctly calculate wages.

Read about what replaces wages for individual entrepreneurs in the material “Individual entrepreneurs do not have the right to pay themselves a salary .

In which columns of the timesheet are wage codes recorded?

A time sheet is a supporting document on the basis of which employees’ salaries are calculated. A Russian organization has the right to independently develop a form for recording the working hours of its personnel or use forms approved by the State Statistics Committee in the form T-12 or T-13.

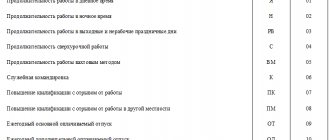

The timesheet records the daily amount of time worked by each employee, as well as the total number of hours of attendance (absenteeism) by type of paid labor. Each type of labor corresponds to a specific code.

Codes for types of remuneration in the T-12 form sheet are filled out only if the organization maintains the second part of the specified form. Here, to reflect information about wages, a whole section is highlighted, which is called “Calculation with personnel for wages”. It indicates the type of remuneration not only in coded form, but also its name, for example salary (name) 2000 (code).

In the form of the T-13 working time sheet, columns 7, 8 and 9 are intended to reflect information on the calculation of wages, which are duplicated twice in this form. The code can be entered in two ways:

- If the type and corresponding account for payroll is the same for all employees indicated in the timesheet, then the code is placed in the line “wage code”, which is located at the top and covers all columns from 7 to 9.

- In the case when there are different types of accrual in the timesheet, the code is entered in the corresponding cell, in column 7, opposite each employee.

Up to 8 such codes can be used for one employee in this form of time sheet.

Approval of the procedure for maintaining form T-13

The procedure for filling out the T-13 form may have its own nuances for each specific employer, so it is advisable to consolidate it in the appropriate document (instructions or manual). The following points will need to be reflected in it:

- Appointment of the person (or persons) responsible for maintaining the time sheet.

- The need to maintain separate time sheets by department.

- Approval of additional codes for exits or absences from work.

- Approval of the order of data reflection in the report card: all facts of presence/absence or only absences.

- Determining the order in which data on outputs/non-exits is reflected in complex or non-standard situations.

Vacation notes

Before marking vacation on your time sheet, it is important to consider the following points:

- what type of leave to indicate;

- vacation period - from what date to what date the employee rests;

- what method is used to fill out the timesheet - continuous or only deviations are recorded?

Different types of leave are indicated by the following abbreviations:

| FROM | regular paid vacation |

| OD | additional paid |

| BEFORE | administrative (without saving salary) |

| U | educational with salary retention |

| UV | on-the-job training (shortened day) |

| UD | educational without saving salary |

| R | for pregnancy and childbirth |

| coolant | child care up to 3 years old |

| OZ | without saving the salary in cases provided for by law |

| DB | additional without saving salary |

When using both methods of filling out a timesheet, a vacation symbol is affixed for each day the employee is absent. It’s just that when using the continuous method, the remaining days are filled with turnouts (conditional code “I”), and when using the deviation accounting method, they remain empty.

Filling out form T-13

The header part of the T-13 form provides information about the employer (name, OKPO code, name of department), number and date of the document, and the period for which it was compiled.

The basis for adding an employee to the time sheet is an order for his hiring, and for exclusion - an order for dismissal. The full name of each employee must be indicated in full. All reasons for absence must be documented.

When filling out data for a specific person, the reason for presence/absence is indicated in the 1st top and 3rd lines from the top using an alphabetic or numeric code, and in the lines below them (2nd and 4th) - the number of hours worked. For data on absence in the lines allocated for the number of hours, either zero or nothing is entered. Days that are extra for a particular month are crossed out with an “X”. Weekend o. The length of a normal working day indicated in the timesheet must correspond to the number of hours established in the employee’s employment contract or determined by law (for example, for shortened pre-holiday days). The duration of overtime work is established by order of the employer.

For types of absence counted in calendar days (vacation, sick leave), the mark is affixed in a continuous manner, i.e. including on weekends. Departure/arrival on a day off related to a business trip is noted as a business trip day.

You can download a sample of filling out the T-13 form for an 8-hour working day with a 40-hour working week on our website.

In this example, work takes place on a weekend. It is carried out by order of the manager with the consent of the employee. The order must indicate how this day will be paid: either double (Article 153 of the Labor Code of the Russian Federation), or by providing time off on a working day.

If you have access to ConsultantPlus, check whether you filled out the timesheet correctly. If you don't have access, get a free trial of online legal access.

Read more about payment for work on a day off in the material “Art. 153 Labor Code of the Russian Federation: questions and answers.”

List of wage type codes

Let's look at the codes from the list for the tax office that can be used in timesheets:

- 2000 is the main code, it is used to reflect wages, that is, all amounts accrued for the employee’s performance of his job duties, with the exception of bonuses;

- 2002 - the amount of bonuses for the performance of labor duties, which are paid not at the expense of the organization’s profits, that is, they participate in reducing the tax base on profits;

- 2003 - bonus amounts paid from the organization’s profits or targeted cash receipts;

- 2012 - payment of annual paid vacations;

- 2300 — payment of sheets for temporary disability;

- 2530 - code reflecting amounts paid to the employee in kind, that is, not in cash; This code can be entered only if it is possible to indicate the exact number of days (hours) for which the salary is paid.

ATTENTION! The list of codes for tax purposes has been supplemented with new income codes that will be applied from the beginning of 2018.

See details.

It seems difficult to reflect the entire accrued salary of an employee in the timesheet. This is the main reason why time sheets are most often used only to record time worked.

Where to get codes for form T-13

The most frequently used presence/absence codes (alphabetic and numeric) are located on the 1st sheet of the T-12 form. If necessary, you can develop additions to them or your own table of such codes.

As payment type codes entered when filling out the final part of the table of form T-13, which is not included in form T-12, for the purpose of data comparability, it is more reasonable to use the codes given in Appendix 1 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. MMV-7- 11/ [email protected] Codes from this application are used when filling out form 2-NDFL.

Sources:

- Labor Code of the Russian Federation

- Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1

- Order of the Federal Tax Service of Russia dated September 10, 2015 N ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is a corrective time sheet?

The information in the time sheets may not correspond to reality as they are filled out. For example, a common situation is when an employee who did not show up for work for one or several days presented documents indicating that he was in the hospital. In this case, instead of the entered code NN (failure to appear for unknown reasons), it is necessary to enter code B (sick leave) on the report card. But if the salary is calculated 2 times a month, the report card may already be submitted. Moreover, the rules for maintaining it do not allow for either corrections or erasures.

Meanwhile, sick leave must be paid, and any expenses of the organization (including payments to employees) must be confirmed by primary documentation - otherwise the tax office will not take these expenses into account. What should a personnel officer and an accountant do in this case?

In this situation, an additional document is used - a correction sheet. As a rule, it is prepared at the end of the billing period separately for each employee for whom the adjustment is made. The corrective time sheet is usually accompanied by a memo from the person responsible for maintaining the time sheet. This note briefly explains the reasons why the corrective document was drawn up (a certificate of incapacity for work was presented for the previous period, sick leave was withdrawn, etc.).

Subscribe to our newsletter

Based on the corrective sheet, if necessary, the accrued salary is recalculated. HR officers usually draw up this document precisely at the request of the accounting department, which needs to make changes to the employee’s payments.

How to prepare a corrective time sheet

Correction of data regarding working time recording is usually made in the following order:

- It is established that an adjustment is necessary (for example, late submission of documents on the basis of which the timesheet is filled out).

- An explanatory note from the employee responsible for maintaining the time sheet is being prepared. This note is not mandatory even in public sector organizations, but experts recommend that it be compiled for each case when data is adjusted.

- The adjustment sheet itself is compiled directly. It is prepared according to the same rules as the main one. The only significant difference will be the inclusion of the name “Correcting” in the “Ticket Type” line. Also, if the form contains the value “Adjustment number”, it indicates the serial number of the timesheet, starting from 1 (in this case, the primary timesheet, previously submitted, is not taken into account in the numbering). Numbering is necessary for cases when several corrective time sheets are compiled for the same department at different times.

There are different approaches regarding what should be contained in the correction report:

- It must completely repeat the contents of the main report card submitted earlier. Of course, taking into account the corrections made. This position is shared by specialists from the Ministry of Finance of the Russian Federation, who have repeatedly given clarifications regarding the application of Order No. 52n since March 2015. However, the order itself does not contain a requirement for complete duplication of information contained in the main report card.

- The corrective time sheet contains only corrections - that is, information on those employees for whom the accounting data has changed. This approach to drafting is less common, but does not contradict the law and, therefore, can be used if desired. This is what some personnel officers do.

The lack of clear legislative regulation regarding the procedure for filling out the correction report card gives HR specialists a certain freedom of action, because no liability is provided for the incorrect completion of this document. But if we take into account the availability of clarifications from the Ministry of Finance of the Russian Federation, the first approach should be considered recommended.

It is also necessary to remember: corrective documents are filled out by personnel numbers, and not by specific individuals. The fact is that if an employee combines 2 positions at one enterprise, 2 personal cards must be filled out for him and 2 numbers assigned. When making an adjustment, accordingly, 2 separate time sheets are either drawn up for this employee, or in general he is indicated 2 times.