USN or PSN?

Special tax regimes help entrepreneurs reduce tax documentation and payments. Each mode has its own advantages for certain types of activities. If a businessman has several of them in his arsenal, it is worth thinking hard about the advisability of one or another special regime and, possibly, about replacing or combining them.

Common features of PSN and simplified tax system:

- the same tax rate – 6% of income;

- fixed insurance premiums “for yourself” (depending on the minimum wage);

- annual revenue is limited to 60 million rubles;

- accounting is not necessary;

- You can combine the regimes both with each other and with other tax systems.

What are the differences between the patent system and the “simplified” system?

- There is no need to generate reports and submit declarations, just fill out the Income Book.

- It is not necessary to install cash registers, but to issue strict reporting forms to all clients instead of checks.

- An entrepreneur is not required to pay a number of taxes:

- VAT;

- personal income tax;

- property tax for individuals if they are involved in business.

- The validity of a patent lasts from 1 to 12 months.

- Each subject of the Russian Federation is required to obtain its own patent.

- You can hire workers, but no more than 15 people.

- The single tax cannot be reduced, unlike the simplified tax system, where such a possibility is real for a single individual entrepreneur due to fixed payments.

RESULT: when is it profitable to switch to the patent system? The transition from the simplified tax system to a patent is advisable for an entrepreneur if in a given region he expects income from his activities in an amount significantly greater than the cost of the patent itself.

Don’t be afraid to contact the tax office for clarification.

It just so happens that not all tax authorities adhere to the same position, so if it is important for you to switch to a patent in the middle of the year, communicate personally with your inspectorate. What if she allows it? This could also happen. An official request can be made on the tax website.

Theory and practice

In practice, there were cases when entrepreneurs switched to a patent for the same type of activity in the middle of the year and nothing bad happened. Entrepreneurs simply did not know that this was not possible, and the tax authorities were not interested.

You can only find out that you have transferred your activity from the simplified tax system using primary documents. And income in KUDiR according to the simplified tax system can also come from another business. But if you only have one OKVED, then it’s not worth the risk.

Therefore, it’s up to you to decide whether to take risks or not. If the tax office still wants to punish you, it will charge additional tax to the simplified tax system on all income that you took into account in the patent. Plus late fees. In this case, you will no longer be able to return the cost of the patent.

Who can plan the transition?

Not all businessmen have the right to change the current tax payment system to a patent one. For the replacement to be legally valid, 2 conditions set out by the Ministry of Finance of the Russian Federation in letter No. 03-11-12/50675 dated November 25, 2013 must be met:

- the patent tax regime is permitted for use in the relevant constituent entity of the Russian Federation;

- the type of business activity is contained in the transfer permitted for PSN, clause 2 of Art. 346.43 of the Tax Code of the Russian Federation, and cooperation is allowed with both individuals and organizations.

ATTENTION! This list can be expanded: you can add household services from OKUN to it (clause 8 of Article 346.43 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation No. 03-11-11/45760 dated September 12, 2014), if they are provided only to individuals.

Who can't switch to PSN

If the type of activity of an individual entrepreneur, although included in the list of those permitted for a patent, is carried out under a simple partnership agreement (joint activity) or within the framework of trust management of property, PSN is not available for such persons.

How to calculate and pay tax

In order for the transition to the patent tax system for an entrepreneur to take effect, it is necessary to pay the tax. The tax is paid at a fixed rate of 6%, but regions have the right to change it.

General formula for calculating the contribution:

Patent = (Base / 12 months * PSN validity period) * 6%.

IMPORTANT!

If you apply for PSN for less than six months, pay the tax in one amount. Payments are allowed to be sent during the entire period of validity of the special regime. If the patent is valid for six months or more, send the contribution in installments: a third - within 90 days from the date of commencement of application of the patent, the rest - until the end of the regime (Clause 2 of Article 346.51 of the Tax Code of the Russian Federation).

Fully or partially?

If an entrepreneur has several relevant types of activity in his arsenal, the law allows him to combine the simplified tax system and the PSN in the way that seems more profitable to him. Or you can completely change the “simplified” form to a patent if the activities fall within those permitted under the PSN.

When combining tax systems, it is important to take into account the following nuances:

- profitability under both tax systems together should not exceed the limit of 60 million rubles;

- income from activities on the simplified tax system must be substantiated by a declaration that does not include income from the special tax system; this document is submitted in its own way at the end of the reporting year;

- if there were no violations of the conditions, the right to the simplified tax system, even if the regimes are combined, will remain with the individual entrepreneur for the next tax periods; it does not need to be specifically confirmed.

Combination of tax regimes

Before moving on to the description of the process of changing the simplified tax system to a patent, we note an important nuance: it is impossible to work only on a patent, since only some types of activities are transferred to this special regime.

The patent is valid in the region where it was issued. If you carry out a business transaction that does not fall under the PSN, or conduct activities similar to the patent in another region, then the income from such a transaction/activity is taxed according to the rules of the general taxation system or the simplified taxation system, if, of course, you submitted a notification of its application. Therefore, when registering a business, we recommend submitting documents to apply the simplified taxation system in parallel with documents on PSN.

This threatens only by filing a zero declaration once a year under the simplified tax system. But if you carry out a transaction outside the scope of the PSN, you will not have to pay taxes under the general taxation system.

What is needed to switch from the PSN to the simplified tax system is described in detail in the ready-made solution from ConsultantPlus. You will receive even more relevant information if you sign up for a free trial access to K+.

Algorithm for switching to a patent

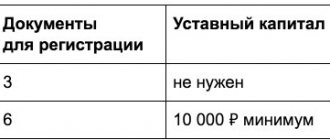

An individual entrepreneur can choose the option in which part of his activities will be taxed under a simplified system, and the part that is suitable by law is transferred to the STS, or make a complete transition, completely abandoning the simplified tax system. To do this, the following steps are required:

- Submitting an application at least ten days before the planned start of work on the patent, and it is required to indicate the desired period of activity of the patent (up to 12 months or before the end of the calendar year). It is enough to contact the tax office at the place of registration of the individual entrepreneur. You can submit a document:

- during a personal visit;

- through a representative (by proxy);

- send by mail;

- through the Internet.

- 5 days of waiting for the application to be considered by tax authorities.

- Issue of a patent in the form approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/599 dated November 26, 2014, or refusal to issue in the form from Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/957 dated December 14, 2012. Simultaneously with the patent, the individual entrepreneur will receive a certificate stating that he is registered as a PSN payer (letter of the Federal Tax Service No. PA-4-6/22635 dated December 29, 2012).

IMPORTANT! A document confirming payment of tax under the patent system is not provided to the tax office.

NOTE! A newly minted individual entrepreneur can immediately choose a patent taxation system by indicating this in the application. Then he will be issued a patent simultaneously with registration documents.

Important clarification on the types of activities on PSN

At the end of 2021, the Ministry of Finance published letter No. 03-11-11/116986 dated December 30, 2020. It states that entrepreneurs under the patent tax system have the right to sell alcohol and cigarettes.

The logic of the Ministry of Finance is as follows. PSN is used by entrepreneurs who carry out retail trade for cash or non-cash (by bank card) payment at stationary or non-stationary retail outlets with an area of up to 50 sq.m. At the same time, entrepreneurs with a patent cannot sell excisable goods that are listed in paragraphs. 6-10 p. 1 tbsp. 181 Tax Code. Such goods include, for example:

- cars;

- motorcycles with engine power over 150 hp;

- gasoline and diesel fuel;

- motor oils for some engines.

But alcohol and tobacco are recognized as excisable goods on the basis of other clauses of the Tax Code of the Russian Federation:

- Alcohol products with a volume fraction of ethyl alcohol of more than 0.5% and beer up to 0.5% inclusive - paragraphs. 3 and 3.1 clause 1 art. 181 Tax Code of the Russian Federation.

- Tobacco products and tobacco intended for consumption by heating - paragraphs. 5 and 17 paragraph 1 art. 181 Tax Code of the Russian Federation.

Based on this, the Ministry of Finance concludes:

Taking into account the above, in relation to income from retail trade in alcohol and tobacco products, an individual entrepreneur has the right to apply PSN.

Why can the Federal Tax Service refuse a patent?

The tax authority, having considered the submitted application, may not allow the entrepreneur to apply the PSN. There may be the following reasons for this:

- These types of activities do not fall under Art. 346.43 of the Tax Code of the Russian Federation, limiting the use of the patent system;

- the validity period of the patent is indicated incorrectly: it exceeds a calendar year, or this year no activity recognized as patent was carried out, or the conditions for the patent were not met;

- the individual entrepreneur has a tax arrears under the PSN;

- non-compliance with the conditions for PSN (based on the number of hired workers and/or annual income);

- the entrepreneur did not fill out all the required items in the application form.

How to apply

To obtain a patent, a completed copy of the application is submitted to the Federal Tax Service (form No. 26.5-1, recommended by letter of the Federal Tax Service dated February 18, 2020 No. SD-4-3 / [email protected] ). The document can also be submitted to the MFC or sent by mail (by a valuable letter with an inventory). It is allowed to send a notification electronically via TKS, if the entrepreneur has an electronic signature. The application will be considered within 5 days, after which the individual entrepreneur will be issued either a patent or a written refusal. The list of reasons why you can be refused the use of a special regime is given in paragraph 4 of Art. 346.45 Tax Code of the Russian Federation:

- discrepancy between the declared type of activity and the list of types for which PSN can be applied, in accordance with regional legislation;

- the patent validity period is indicated incorrectly;

- violation of established limits for the use of PSN;

- All required fields are not filled in in the application;

- The individual entrepreneur has an arrears under the patent.

The beginning of the validity period is indicated in the patent itself. It is allowed to issue several patents at the same time - for different types of activities or for individual objects. Their validity periods may not coincide.

“No” simplified tax system, “yes” PSN

If an entrepreneur has made a choice in favor of a complete transition to a patent, he will lose the right to use the “simplified version”. In this case, you need to fully pay off the relevant tax payments and report on them:

- Patent tax is paid at the beginning of the quarter in which the entrepreneur loses the right to the simplified tax system.

- If monthly payments under the simplified tax system were not made on time, fines and penalties are calculated for this and they do not apply to the quarter in which the entrepreneur switched to the simplified tax system.

- It is necessary to notify the Federal Tax Service of the termination of the simplified tax system. To do this, the individual entrepreneur has a period of 15 days after completion of the “simplified” work.

- If an individual entrepreneur plans to later return to the simplified tax system, he will have to work in a different tax regime for at least a year (clause 7 of article 346.13 of the Tax Code of the Russian Federation).

Is it true that a patent is always more profitable than the simplified tax system?

A patent is more profitable than the simplified tax system if the actual income of the entrepreneur is significantly higher than the potential income under the patent. Let's look at the example of a retail store in Kazan with an area of 50 m2. Potential income from a patent without employees is 3,450,000 rubles. for 2021. If, according to your calculations, you earn less in a year, the simplified tax system will be more profitable for you than a patent. But amendments may still be made to the law of Tatarstan on the patent regime; changes need to be monitored.

In addition, some regions have reduced rates for the simplified tax system for 2021; accordingly, the tax on the simplified tax system will be lower. Each case is individual and depends on regional laws and the actual income of the entrepreneur.

Tax exemption

When applying PSN, entrepreneurs are exempt from paying the following taxes:

- property tax for individuals - on property used within the framework of the PSN;

- Personal income tax - on income received under the PSN;

- VAT on transactions within the PSN.

However, the obligation to pay VAT remains in the following cases:

- when carrying out types of business activities for which the PSN does not apply;

- when importing goods into the territory of the Russian Federation and other territories under its jurisdiction;

- when carrying out transactions taxed in accordance with Article 174.1 of the Tax Code of the Russian Federation.

Separate accounting

An individual entrepreneur on a patent and the simplified tax system must separately keep records of property, transactions and obligations. In this case, we are talking only about tax accounting, since an individual entrepreneur is not required to maintain accounting records. It is also necessary to maintain separate personnel records for personnel engaged in activities under different tax regimes.

Free accounting services from 1C

The entrepreneur keeps his records in the book of income and expenses (KUDiR). An individual entrepreneur on the simplified tax system keeps this book for the simplified system, and an individual entrepreneur on a patent keeps this book for the patent system. When combined, both books are filled out.

The essence of separate income accounting is to record in the appropriate accounting book the revenue that is received from activities within the framework of a particular tax regime. Revenue control is needed in order not to miss the moment of possible loss of the right to use a patent and to correctly calculate the tax under the simplified tax system.

Similarly, when combining PSN and simplified tax system, expenses are also taken into account. But some of them cannot be attributed to one or another regime. This usually concerns the costs of paying management and support workers, rent and utility bills.

Therefore, individual entrepreneurs on a patent and the simplified tax system often have a question at the same time: how to keep track of such expenses? It's actually simple. They need to be distributed in proportion to the income received from the patent and from “simplified” activities.

For example, an individual entrepreneur received the following income:

- according to the simplified tax system - 200 thousand rubles;

- for a patent - 100 thousand rubles.

At the same time, the total costs for both systems amounted to 30 thousand rubles. They will be distributed in this way: 20 thousand will be allocated to the simplified tax system, and 10 thousand to patent activity.