Enterprises can receive notary services from public or private specialists. The regulation of the actions of these specialists is carried out through the “Fundamentals of the legislation of the Russian Federation on notaries” (the document was approved on February 11, 1993 under No. 4462-1). State notaries charge a state duty for transactions performed, while private notaries receive payment at a special rate. The recording of such payments has a number of features.

Question: Does a notary have the right to demand mandatory payment for legal and technical services when performing a notarial act? View answer

Features of tax accounting of services provided by notaries

Depending on whether a notarial form is required for a document, notarial acts are divided into mandatory and optional.

For mandatory services, a notary from a state office will charge the client a fee in the amount specified in Art. 333.24 Tax Code of the Russian Federation. For exactly the same actions, a private notary will charge a tariff in the manner set out in Chapter. 25.3 of the Tax Code of the Russian Federation and Art. 22 Fundamentals of the legislation of the Russian Federation on notaries dated 02/11/1993 N 4462-1. But for actions for which the law does not establish a mandatory notarial form, a notary (it does not matter whether private or public) charges tariffs, as required by the Fundamentals of Notaries.

Find out how to transfer a share of an LLC with the participation of a notary here.

In tax accounting, services for the implementation of notarial actions are taken into account exclusively at the tariffs approved by law (subclause 16, clause 1, article 264 of the Tax Code of the Russian Federation). Expenses in excess of these amounts are not taken into account in the calculation of income tax (Clause 39, Article 270 of the Tax Code of the Russian Federation).

If you have access to ConsultantPlus, find out how to take into account notary services when calculating income tax. If you don't have access, get a free trial of online legal access.

***

Expenses for obtaining notary services reduce the income tax base. To do this, they must be economically justified and properly documented.

Similar articles

- Direct income tax expenses: list

- How to issue a power of attorney to receive a salary (sample attached)

- Income and expenses from ordinary activities

- Representation expenses under the simplified tax system “income minus expenses”

- Bank expenses under the simplified tax system: income minus expenses

Required supporting documents

The citizen of the Russian Federation who has received the appropriate license has the right to engage in notarial activities - such rules are enshrined in Art. 3 Basics about notaries. However, a company that seeks help from a notary is not required to attach a copy of this license to the supporting documents received from him.

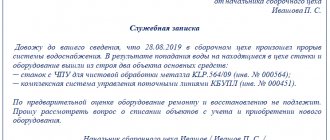

As a rule, a company representative pays the notary immediately as soon as he certifies the required document or performs other work according to his competence. In this case, the notary will issue the client with documents indicating the provision of services and their payment.

Let us note that at the moment, no special unified form of primary document issued by a notary to confirm the facts of the provision and payment of his services has been approved. Typically, in such cases, receipts are issued to the recipients and transcripts of the services provided. All of them are certified by the personal signature of a notary (or his authorized representative) and seal.

But often such papers contain only general phrases: for example, “paid for certification of the accuracy of copies” or “state duty collected for notarial acts.” Of course, such vague wording will not be enough to justify the expenses required by law in paragraph 1 of Art. 252 of the Tax Code of the Russian Federation.

For proper acceptance of services for accounting, the document received from the notary must contain all the mandatory details specified in Art. 9 of the Law of December 6, 2011 No. 402-FZ “On Accounting”. It must certainly list the specific actions performed by the notary and indicate the fees charged for each of them.

When receiving documents at a notary's office, also keep in mind the following possibility: in accordance with Art. 50 Fundamentals of Notaries, all notarial actions are recorded in a special register, the form of which is approved by Order of the Ministry of Justice of the Russian Federation dated April 10, 2002 No. 99. An extract from such a register, issued and certified by a notary, can confirm the client’s expenses.

And, of course, you can draw up an act in the usual manner, which lists in detail all the actions performed, indicating the prices for them.

Advance report form in 2021

The maximum amount of cash payments with a notary within one day is UAH 50,000 thousand. (Clause 1 of the NBU Board Resolution dated 06/06/2013 No. 210).

Debit 76 – Credit 71 – the notary fee was paid to a private notary or state notary, when mandatory notarization is not required (the notary fee is not a state duty).

The first part of the document is filled out by the employee who received the money on account.

- At the beginning, the name of the company is written and its OKPO code (All-Russian Classifier of Enterprises and Organizations) is indicated - this data must correspond to the registration papers of the company. Next, enter the number of the accounting report and the date of its preparation.

- On the left, a few lines are left for the approval of the director of the enterprise: here, after filling out the entire report, the director will need to enter the amount in words, sign and date the document.

- Then comes information about the employee: enter the structural unit to which he belongs, his personnel number, last name, first name, patronymic, indicate the position and purpose of the advance payment issued.

How to write off notary expenses that exceed the norm?

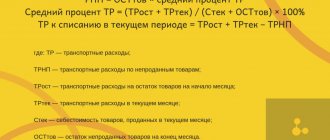

Quite often situations arise when the amount paid to a notary exceeds legal norms. And what to do with those expenses that do not fit into the legal framework? In some cases, they can be taken into account in expenses for other reasons.

Let's try to take advantage of the fact that in addition to direct notarial services, notary offices also provide some others: legal, informational, consulting, etc., and their list is open (subclauses 14 and 15 of clause 1 of article 264 of the Tax Code of the Russian Federation). The company's expenses for providing these services by a notary can be taken into account in other production and sales expenses (letter of the Ministry of Finance of the Russian Federation dated August 26, 2013 N 03-03-06/2/34843).

For example, the performance of technical work by notaries is provided for in Art. 23 Basics about notaries. There is no state duty (or tariff) for such services - the notary has the right to set prices for them at his own discretion. The Tax Code of the Russian Federation also does not provide for any restrictions on these expenses. Therefore, they can be fully accepted when calculating income tax as legal services.

However, in doing so, you should agree with the notary so that in his decryption certificate he divides the full amount into two components: directly for the notarization and for information (consulting, legal) services. Then it will be possible to fully recognize amounts in excess of the norms in tax accounting, such as, for example, the costs of legal advice.

Insurance premiums

Privately practicing notaries and lawyers are required to pay insurance premiums both for themselves and for employees (if any).

Due to the transfer of contributions to the jurisdiction of the Federal Tax Service of the Russian Federation in 2021, all insurance payments, except for payments for injuries, are transferred according to the details of the tax service. The rates for fixed contributions have not changed and remain as follows:

- 26% - for pension insurance;

- 5.1% - for health insurance;

Social insurance contributions are transferred at will.

Contributions are calculated based on the minimum wage established for the reporting period. In 2021, the minimum wage is 7,500 rubles, and therefore contributions are:

- RUB 23,400 — for pension insurance;

- RUB 4,590 - for health insurance.

The total amount of insurance payments in 2021 is 27,990 rubles.

Also, if income exceeds 300,000 thousand rubles, 1% must be paid on the difference.

Let's say that for 2021 an income of 1,500,000 rubles was received. From a difference of 1,200,000 rubles. (1,500,000 – 300,000 rubles) you must pay 12,000 rubles.

Additional restrictions on accounting for notary expenses

When thinking about the possibility of including notary expenses in tax expenses, it is also necessary to take into account the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, from which it follows that only the notary fee that is charged for the preparation of papers necessary for activities involving the receipt of income can be attributed to expenses.

In this case, can notary services related to legal registration, carried out before the state registration of the company, be attributed to expenses? No, they cannot be reflected either in accounting or tax accounting, since at the time of their implementation the company did not yet exist. Such expenses can be attributed to the expenses only of those persons who directly incurred them.

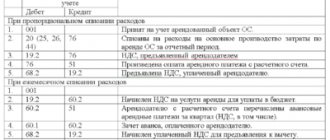

To what account should the state duty be attributed?

In accounting, the payment of state duty is reflected by the entry Dt 68 Kt 51.

The question often arises: to what account should the state duty be attributed? The answer to this depends on the reasons for which it is paid. If the state duty is paid in connection with the acquisition or creation of property, then it is reflected in the accounts for accounting for this property.

If the payment of the state duty is related to the current activities of the organization (for example, certification of contracts, charter, signature cards), then the accrual of the state duty will be reflected by posting Dt 26 (44) Kt 68.

The state duty, which is paid, for example, when selling assets (except for cash, goods, products), must be taken into account by posting Dt 91 KT 68.

See also “Main entries in accounting for state duties”.

An equally common question is: what account does the state duty paid when registering an enterprise go to? Unfortunately, the newly created organization will not be able to take these expenses into account either in accounting or tax accounting, since they were incurred by the founders even before its creation.

Find out how to take into account notary services in accounting in ConsultantPlus. Learn the material by getting trial access to the system for free.

Results

Thus, excess notary fees are not taken into account for tax purposes:

- if a notary charges a tariff in excess of the state duty for carrying out mandatory actions;

- if for optional actions they charge a tariff higher than established by art. 22.1 Basics about notaries.

However, amounts in excess of legal norms, subject to proper execution of supporting papers and provided that they meet the criteria of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, can be taken into account as expenses such as, for example, legal services and some others.

The answer to the question on which accounting account the state duty is accounted for depends on its type and the reasons for which it is paid.

Sources:

- Tax Code of the Russian Federation

- Law “On Accounting” dated December 6, 2011 N 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The procedure for conducting cash transactions

The issuance of cash from the cash desk on account of expenses associated with the organization's activities is carried out according to the Cash Expenditure Order (unified form N KO-2, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 N 88 <*>), which is drawn up on the basis of an application from the accountable a person drawn up in any form (clauses 1.8, 4.1, 4.4 of the Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation, approved by the Bank of Russia on October 12, 2011 N 373-P). Note that the issuance of cash on account is carried out subject to full repayment by the accountable person of the debt on the amount of cash previously received on account (clause 4.4 of the Regulations on the procedure for conducting cash transactions). Within a period not exceeding three working days after the expiration date for which cash was issued on account, the accountable person is obliged to submit an advance report (for example, according to the unified form N AO-1, approved by Resolution of the State Statistics Committee of Russia dated 01.08.2001 N 55 <* >) about the amounts spent with supporting documents attached. In this case, such a document is a receipt issued by a notary or another document confirming payment for notarial services. Checking the advance report, its approval by the manager and the final settlement of the advance report are carried out within the time period established by the manager (clause 4.4 of the Regulations on the procedure for conducting cash transactions).