Source:

1. The company paid the employee on the day of dismissal 2. The company paid the employee the day before the dismissal 3. The company withheld vacation pay upon dismissal 4. The company paid wages to the dismissed employee late 5. The company issued wages and benefits on the day of dismissal 6. The company upon dismissal paid severance pay 7. The company paid the dismissed employee on the last day of the reporting period 8. Several employees quit in the first quarter 9. The employee went on vacation with subsequent dismissal 10. The employee went on a business trip before dismissal

The company paid the employee on the day of dismissal

The company paid the employee on the day of dismissal - gave him a salary and compensation for unused vacation.

Upon dismissal, the employee receives income in the form of salary on the last working day (Clause 2 of Article 223 of the Tax Code of the Russian Federation).

Compensation for unused vacation days is not a salary. The date of receipt of income is the day of payment. Since the company paid the employee on the last working day, the dates in line 100 match. Tax on both payments must be withheld on the same day.

Compensation for unused vacation is not vacation pay. The deadline for transferring personal income tax on this amount is the day following the payment, as for salary. All three dates in lines 100–120 match. This means that compensation and salary should be reflected in one block of lines 100–140.

For example.

The employee resigned on June 16. On this day, the company gave him a salary for June - 28,000 rubles, and withheld personal income tax from it - 3,640 rubles. (RUB 28,000 × 13%). The company also transferred vacation compensation - 18,000 rubles, and withheld personal income tax - 2,340 rubles. (RUB 18,000 × 13%). The date of receipt of salary income is the last working day. That is June 16th. For vacation compensation - the day of payment. Also June 16th. The deadline for transfer is June 17. The dates on lines 100–120 are the same, so the company reported them together. The amount of income is 46,000 rubles. (28,000 + 18,000), personal income tax - 5980 rubles. (3640 + 2340). The company filled out Section 2 as in sample 84.

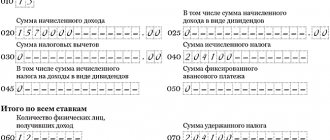

Sample 84. How to fill in the payment calculation on the day of dismissal:

Top

Results

Form 6-NDFL when dismissing an employee is filled out taking into account the nuances of determining the dates of payments accompanying such dismissal. The latter include:

- compensation for unused vacation;

- vacation pay for vacation taken immediately before dismissal;

- severance pay upon dismissal in the amount exceeding the non-taxable limit.

The determination of dates related to these payments is subject to the general rules contained in the Tax Code of the Russian Federation.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The company paid the employee the day before dismissal

The company issued wages and compensation for unused vacation days the day before dismissal. On the same day, the company withheld and transferred personal income tax from these payments.

The Code establishes a special date for receiving income in the form of wages in the event that an employee resigns. Personal income tax must be calculated on the last working day (clause 2 of Article 223 of the Tax Code of the Russian Federation). If the company issued the money earlier, then it withheld tax until the date the income was received.

In this case, in line 100, enter the date of receipt of income according to the code - the last working day. And in line 110 - the day of payment. The date on line 110 will be earlier than the date on line 100. But the program will skip this calculation.

There should be no problems with personal income tax. Inspectors allow tax to be withheld from wages issued before the date of receipt of income.

Compensation for unused vacation days is not a salary. The employee receives such income on the day of payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). This means that the dates in line 100 for salary and compensation will not match. Complete them in different blocks of lines 100–140.

For example

The employee resigns on June 16th. On June 15, the company gave the employee a salary and compensation for unused vacation. Compensation - 9000 rubles, personal income tax - 1170 rubles. (RUR 9,000 × 13%). Salary - 26,000 rubles, personal income tax - 3,380 rubles. (RUB 26,000 × 13%). The date of receipt of income for salary is 06.16.2016, for compensation - 06.15.2016. Therefore, the company completed two blocks of lines 100–140, as in sample 85.

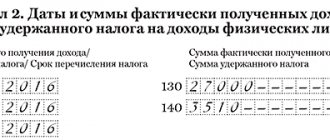

Sample 85. How to fill in the payment calculation the day before dismissal:

Top

Salary for several months in 6-NDFL

The deadline for paying wages in many organizations does not coincide with the month of accrual. For example, salaries for July are transferred only in August. How to fill out a calculation if an employee is paid a salary for several months at once? For example, an employee quits on July 12. By this day, he had not yet been paid his wages for July. Therefore, the final settlement in favor of the dismissed person:

- salary (June + July) - 35,000 rubles;

- compensation - 5000 rubles;

- Personal income tax - 4550 rubles.

Filling procedure:

- In the first section, indicate general indicators.

- In the second section, reflect the salary for June separately from the July payments.

- The deadline for actually receiving income for June is the 30th. For July - the 12th (according to the example conditions).

The company withheld vacation pay upon dismissal

In the first quarter, the employee took his vacation in advance, and in the second quarter he quits. On the day of dismissal, the company withheld vacation pay from the salary for rest days that the employee did not work.

An employee can take vacation time in advance. But upon dismissal, the company has the right to withhold vacation pay for unworked rest days (Article 137 of the Labor Code of the Russian Federation). The company withholds personal income tax from vacation pay at the time of payment. Therefore, if an employee returns vacation pay, the tax must be recalculated.

In this case, personal income tax is not excessively withheld, because the company correctly calculated it on the date of issue of money. In addition, the employee will return only the amount he received, that is, minus personal income tax. This means that the company will not refund the tax to the employee.

The company will be overpaid for personal income tax. To get it back, some tax officials suggest applying for a refund. Others allow the next payment to the budget to be reduced by the recalculated tax. Do as your inspector recommends.

There is no error in the period when the company issued vacation pay. Therefore, do not specify the calculation for the previous quarter. In the current quarter, adjust section 1 - reduce income in line 020 for vacation pay. Reflect the calculated and withheld personal income tax minus the tax on excess vacation pay (letter of the Federal Tax Service of Russia dated May 24, 2016 No. BS-4-11/9248).

As for the salary upon dismissal in Section 2, the procedure for filling out depends on whether the employee returns vacation pay or the company withholds it itself from the last salary. If the employee returned the money to the cashier, show the salary in the amount in which it was accrued. If the company reduces wages for vacation pay, show the income minus the amount withheld. From the same amount, calculate and transfer personal income tax.

For example

The employee quits on April 15. On this day, the company gave him his salary for April. Accrued salary - 18,000 rubles. From this amount, the company withheld vacation pay - 3,000 rubles. (amount to be charged).

Section 1.

In line 020 for the first quarter, the company recorded the employee’s income including vacation pay - 160,000 rubles. Personal income tax in lines 040 and 070 - 20,800 rubles. (RUB 160,000 × 13%). In the second quarter, the company increased income in line 020 by salaries for April and decreased by withheld vacation pay - 175,000 rubles. (160,000 + 18,000 – 3000). Personal income tax - 22,750 rubles. (RUB 175,000 × 13%).

Section 2.

In fact, the company reduced the accrued salary for vacation pay. Therefore, she showed 15,000 rubles in the calculation. (18,000 - 3000). In line 140 I wrote down personal income tax on this amount - 1950 rubles. (RUB 15,000 × 13%). The date of receipt of income is 04/15/2016. The company filled out the calculation as in sample 86.

Sample 86. How to reflect the salary from which the company withheld vacation pay:

Top

The company paid the dismissed employee's salary late

The employee quit. The company gave him his salary only a few days after his dismissal.

Upon dismissal, the date of receipt of income in the form of salary is the last working day (clause 2 of Article 223 of the Tax Code of the Russian Federation). As of this date, the company calculates personal income tax. It doesn't matter when the company issues the money. In line 020 of section 1 of the calculation, include income in the period in which it was accrued. But the company will be able to withhold personal income tax only upon payment.

If the company did not withhold personal income tax in the reporting period. Reflect the income in line 020, and the calculated tax in line 040. Do not show the withheld tax in line 070, as well as in section 2 of the half-year calculation (letter of the Federal Tax Service of Russia dated May 16, 2016 No. BS-4-11/8609).

If the company withheld personal income tax in the reporting period. Reflect the income in line 020, the calculated personal income tax in line 040, and the withheld income in line 070. Reflect the payments in section 2. In line 100, write down the day the employee was dismissed. In line 110 - the date of payment, in line 120 - the next business day.

For example.

The employee resigned on May 16. On this day, the company calculated his salary for May - 34,000 rubles, and calculated personal income tax - 4,420 rubles. (RUB 34,000 × 13%). The company transferred the money only on June 1. On this day I withheld and transferred personal income tax. The date of receipt of income is 05/16/2016, personal income tax withholding is 06/01/2016. The company filled out the calculation as in sample 87

Sample 87. How to fill out a calculation if the company delayed wages upon dismissal:

Top

The company issued wages and benefits on the day of dismissal

The employee brought in sick leave, and a few days later he quit. The company provided the employee with salary and sick pay on the same day.

Upon dismissal, the employee receives income in the form of salary on the last working day (Clause 2 of Article 223 of the Tax Code of the Russian Federation). For benefits, the date of receipt of income is the day of payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Since the company issued benefits and wages on the day of dismissal, the dates in lines 100 match. The company withholds tax on the day of payment. But personal income tax from wages must be transferred no later than the next day. And from benefits - no later than the last day of the month in which the company issued the money (clause 6 of Article 226 of the Tax Code of the Russian Federation). The dates in lines 120 do not match. This means that payments should be filled out in two different blocks of lines 100–140.

For example

The employee resigned on May 24. On this day, the company gave the employee a salary for May - 29,000 rubles, personal income tax - 3,770 rubles. (29,000 rubles × 13%) and sickness benefits - 9,000 rubles, personal income tax - 1,170 rubles. (RUR 9,000 × 13%). The date of receipt of income and withholding of personal income tax for both payments is 05/24/2016. The deadline for transferring taxes from wages is 05.25.2016, from benefits - 05.31.2016. The company filled out payments in different blocks of lines 100–140, as in Sample 88.

Sample 88. How to reflect benefits and wages issued on the day of dismissal:

Top

6-NDFL: rules for tax reporting

Tax agents, that is, firms and businessmen paying income to Russian citizens, are required to provide a separate form to the Federal Tax Service.

The reporting discloses information about the total amounts of salary accruals and other income, the timing and amount of income tax calculated on payments. Article 230 of the Tax Code of the Russian Federation establishes uniform deadlines for submitting a report to the Federal Tax Service. You need to submit 6-NDFL:

- quarterly, no later than the last day of the month that follows the reporting periods: 1st quarter, half a year and 9 months;

- annually, no later than April 1 of the year following the tax period.

If the organization has separate structural divisions, then you will have to fill out a separate calculation. But the requirement is relevant only for those OPs and branches that independently calculate salaries and transfer income taxes to the budget. If salaries are paid by the head office, then reporting is submitted on its behalf.

The report form is fixed by Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] The form is a title page that must be filled out. And two separate sections disclosing information about income accruals and amounts of calculated personal income tax. Compensation and final settlement upon dismissal in 6-NDFL should be reflected in accordance with the recommendations of the Federal Tax Service. How to fill out the form correctly depends on the period of transfer and the composition of payments in favor of the dismissed person.

IMPORTANT!

Useful: step-by-step instructions for filling out the quarterly 6-NDFL report.

The company paid severance pay upon dismissal

The employee resigned by agreement of the parties. Upon dismissal, the company provided severance pay.

Three average earnings upon dismissal are exempt from personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation). If the company issued compensation within these amounts, it has the right not to reflect them in 6-NDFL.

If the company issued more, reflect in the calculation only the amount that exceeds three average earnings. Write it down in line 020 of the calculation and line 130. The date of receipt of income and withholding of personal income tax is the day of payment. Reflect this date in lines 100 and 110. And in line 120 put the next day.

For example

The company fired the employee by agreement of the parties. On May 20, she paid him severance pay - 90,000 rubles. This is 20,000 rubles. higher than three times average earnings. The company withheld personal income tax from the difference - 2,600 rubles. (RUB 20,000 × 13%). The date of receipt of income is 05/20/2016. The next day, May 21, falls on a weekend, so the company reflected the nearest working day in line 120—05/23/2016. She filled out section 2 as in sample 89.

Sample 89. How to reflect severance pay upon dismissal in the calculation:

Top

Where to submit reports?

All income tax reports must be submitted to the Internal Revenue Service. Typically, individuals submit reports at their place of residence, and legal entities – at their place of registration. But some exceptions are allowed.

| Personal income tax payer | Place of submission of the report |

| Employees of enterprises that have separate divisions | Tax services at the location of separate divisions. The report on form-6 personal income tax should be prepared for each structural unit separately, even if they are registered with the same tax service. If structural units are located in the same area, but are registered with different tax inspectorates, then the calculation is provided at the place of registration |

| Individuals and legal entities (individual entrepreneurs, enterprises and organizations) | At the place of registration |

| Individual entrepreneurs using UTII or PSNO | At the place of registration as a taxpayer of UTII or PSNO |

The company paid the dismissed employee on the last day of the reporting period

The employee resigned on the last day of the quarter—June 30. On this day, the company issued a calculation and withheld personal income tax.

The date of receipt of income in the form of salary is the day of dismissal (clause 2 of Article 223 of the Tax Code of the Russian Federation). And the deadline for tax transfer is the next working day (clause 6 of Article 226 of the Tax Code of the Russian Federation). The employee resigned on the last day of the quarter—June 30. This means that the deadline for transferring personal income tax fell on the next reporting period - July 1.

In section 2 of the 6-NDFL calculation, the payment must be reflected in the period in which the operation is completed. The Federal Tax Service clarified that the operation was completed in the period in which the deadline for personal income tax payment falls (letter of the Federal Tax Service of Russia dated October 24, 2016 No. BS-4-11 / [email protected] ). This means that section 2 should be completed in the reporting for nine months. In this case, reflect the salary in section 1 of the calculation for the six months.

For example

The company fired the employee on June 30. On this day, I paid out a salary - 76,000 rubles, calculated and withheld personal income tax - 9,880 rubles. (RUB 76,000 × 13%). The date of receipt of income and withholding of personal income tax is 06/30/2016. The deadline for tax payment is 07/01/2016. The company withheld tax in the second quarter, so it reflected the payment in section 2 of the calculation for nine months as in sample 90.

Sample 90. How to fill out section 2 if the personal income tax payment deadline falls in the next quarter:

Top

Several employees left in the first quarter

In March, several employees quit, whose income the company reflected in the calculation of 6-personal income tax for the first quarter.

The company fills out section 1 of the calculation with a cumulative total (clause 3.1 of the Procedure, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] ). Including line 060, which counts the number of “physicists” who received income in the reporting period. Therefore, even if employees quit last quarter and no longer received income, they need to be counted in line 060 of the half-year calculation.

For example

In the calculations for the first quarter, the company reflected the income of 15 “physicists”. In line 020 I wrote down 600,000 rubles, in lines 040 and 070 the calculated and withheld personal income tax from this amount is 78,000 rubles. (RUB 600,000 × 13%). At the end of the first quarter, 5 employees left and were no longer receiving income from the company. For April, May and June, the company paid income to the 10 remaining employees - 450,000 rubles, calculated and withheld personal income tax - 58,500 rubles. (RUB 450,000 × 13%).

The company reflected income and personal income tax on an accrual basis. In line 020 - 1,050,000 rubles. (600,000 + 450,000), in lines 040 and 070 - 136,500 rubles. (78,000 + 58,500). In line 060, the company counted all the “physicists” to whom it accrued and paid income during the six months. In the first quarter, 15 employees received income, in the second, 10 employees out of the same 15 people. The second time, the company did not take into account the “physicists”, but included those laid off in the calculation. The company filled out Section 1 of the calculation as in sample 91.

Sample 91. How to reflect dismissed employees in the calculation:

Top

The employee went on vacation and was subsequently fired

The employee went on vacation and was subsequently fired. The company gave him a paycheck and vacation pay.

Upon dismissal, the employee receives salary income on the last working day for which the company accrued money (Clause 2 of Article 223 of the Tax Code of the Russian Federation). If an employee goes on vacation with subsequent dismissal, the date of termination of the contract is considered the last day of vacation (Part 2 of Article 127 of the Labor Code of the Russian Federation). But the company pays off and issues a work book before the vacation (Part 4 of Article 84.1 of the Labor Code of the Russian Federation). The last day for which the company calculates wages is the last working day before vacation. This means that this is the date of receipt of income.

No later than three calendar days before the start of the vacation, the company transfers vacation pay. On this day the employee receives income. The deadline for transferring tax on this payment is the last day of the month in which the company issued the money (letter of the Federal Tax Service of Russia dated May 11, 2016 No. BS-3-11 / [email protected] ). This day should be written on line 120.

For example

The employee went on vacation and was subsequently fired. The last working day before vacation is May 20. And the date of termination of the employment contract is June 10.

Vacation pay. On May 16, the company issued vacation pay - 32,000 rubles, personal income tax - 4,160 rubles. (RUB 32,000 × 13%). The deadline for transferring personal income tax from vacation pay is 05/31/2016.

Salary. The company paid the employee on the last working day before the vacation - May 20. I gave him a salary - 58,000 rubles, personal income tax - 7,540 rubles. (RUB 58,000 × 13%). The deadline for transferring personal income tax is May 21, which happened to be a weekend. Therefore, in line 120 the company wrote 05/23/2016.

In section 2, the company filled out payments as in sample 92.

Sample 92. How to fill out a calculation if an employee goes on vacation with subsequent dismissal:

Top

We reflect the dismissal if the vacation is taken in advance

Let's consider a particular situation, how to reflect the dismissal of an employee in 6-NDFL if he was given leave in advance and it was not worked on the day of dismissal. In this case, the employee is deducted for unworked vacation days. In this case, the employee’s personal income tax base is reduced by the amount of deduction. Therefore, in the reporting form it is necessary to show the amounts of the final payment minus the deduction for unworked vacation.

Let's return to our example: let the employee not receive compensation, but a deduction for unworked vacation in the amount of 5,000 rubles.

Filling out when dismissing an employee with withholding payment for unworked vacation

What should you do if the accrued final payment turns out to be less than the deduction for unworked vacation? It is impossible to reflect the amounts of accruals and taxes in the report with a minus. In this case, you will have to submit an updated 6-NDFL report for the period in which vacation pay was paid. In this report you will have to reduce the amount of accrued vacation pay.