What is tax calculated on? Profit, that is, on the difference between income and expenses.

Application of PBU depending on the purpose of the site Before reflecting the land tax paid

Accounting for withholding transactions according to executive documents after tax withholding (Part 1 of Art.

Special sections of the declaration For exporters, the VAT declaration provides: section 4 - for

According to the law, companies accepting payments for goods, services or work in the form of cash

The borrower, in addition to the loan, receives certain financial obligations that cover a certain period of time. Often, life

The concept of sales of goods, works or services Sales of products and services are regulated by tax legislation,

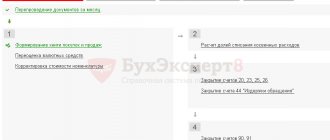

In our article we will look at the procedure for transferring losses from previous periods in the general taxation system,

Working in the Far North forces you to live and work in uncomfortable conditions: extreme frosts,

Do you have doubts about the choice of tax regime? We will help you choose the optimal mode for your business and OKVED