Changing the founder of the posting

Early termination of the powers of the executive bodies of the company, as well as the adoption of a decision to transfer powers to another person falls within the competence of the general meeting of the company's participants, if the company's charter does not include the resolution of these issues within the competence of the board of directors (supervisory board) of the company (Articles 32, 33 of Federal Law No. 14 -FZ).

For example, in accordance with clause 1 of Article 8 of the Federal Law dated 02/08/98 N 14-FZ “On Limited Liability Companies,” a company participant has the right to sell or otherwise alienate his share or part of the share in the authorized capital of the company to one or more participants of this company or to another person in the manner prescribed by Federal Law No. 14-FZ and the company’s charter.

Accounting for payment of the actual value of a share

May 19, 2011

Question:

How to reflect in accounting the payment to an LLC participant of the actual value of the share, as well as the transfer of the share to the remaining LLC participant?

Answer:

Legal certificate.

Any participant in an LLC has the right to leave the company by alienating his share, regardless of the consent of other participants or the company, if this is provided for by the company’s charter (clause 1 of article 94 of the Civil Code of the Russian Federation, clause 1 of article 8, clause 1 of article 26 of the Law of 08.02 .1998 N 14-FZ “On Limited Liability Companies”).

In this case, the participant’s share passes to the company, and the company, in turn, within three months from the date of receipt of the participant’s application to leave the company is obliged to pay this participant the actual value of his share in the authorized capital of the company, determined on the basis of the company’s financial statements for the last the reporting period preceding the day of filing an application to leave the company, or with the consent of this company participant, give him in kind property of the same value (clause 6.1, subclause 2, clause 7, article 23 of Federal Law No. 14-FZ). The actual value of a share in the company's authorized capital is paid out of the difference between the value of the company's net assets and the size of its authorized capital. If such a difference is not enough, the company is obliged to reduce its authorized capital by the missing amount (Clause 8, Article 23 of Federal Law No. 14-FZ). When a participant leaves the LLC, his share transferred to the company is distributed among the remaining participants while maintaining the ratio of their shares in the authorized capital of the LLC. Withdrawal of a participant from the company

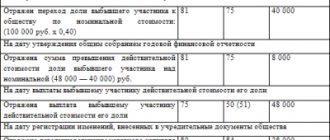

On the date of receipt of an application from an LLC participant about his withdrawal from the company, the debit of account 81 “Own shares (shares)” in correspondence with the credit of account 75 “Settlements with founders” reflects the debt to this participant

in the amount of the actual value of his share .

Payment to the retiring participant of the actual value of the share

is not recognized as an expense

in accounting and is reflected in the debit of account 75 and the credit of account 50 “Cash” or 51 “Settlement accounts”.

According to paragraphs. 3 p. 1 art. 251 of the Tax Code of the Russian Federation, the value of property received as a contribution to the authorized capital is not recognized as income. Thus, based on the norm of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, payment to an LLC participant upon his withdrawal from the company of the actual value of the share within the limits of its nominal value is not taken into account as expenses. As for the amount of excess of the actual value of the share over its nominal value, these expenses are also not recognized in tax accounting, since they are not related to the implementation of activities aimed at generating income (paragraph 4, clause 1, article 252 of the Tax Code of the Russian Federation). The actual value of the share paid to the participant who left the LLC is the income of this participant, subject to personal income tax (clause 1 of article 209, clause 1 of article 210 of the Tax Code of the Russian Federation). The organization paying the income is recognized as a tax agent. In this case, the withdrawing participant does not have the right to a property tax deduction, since passes to the company not on the basis of a purchase and sale agreement (clause 6 of Article 226 of the Tax Code of the Russian Federation). The date of receipt of income is considered the day of actual payment of the actual value of the share (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Taxation is carried out at a rate of 13%. Acquisition of a share by the remaining participant.

The distribution between the participants of the specified share is reflected by an entry in the debit of account 75 and the credit of account 81. Since the remaining participant does not pay for the shares distributed in his favor, the amount reflected in account 75 is written off, in our opinion, from the appropriate sources to the debit of accounts 84 “Retained earnings (uncovered loss)”, 83 “Additional capital”, 82 “Reserve capital”.

In our opinion, in this situation it is advisable to use account 84 “Retained earnings”. That is, when paying the actual value of a share to a participant who left the LLC, and when distributing this share among the participants who remained in the company, expenses are not reflected in accounting. A participant in the company, in whose favor the share in the authorized capital transferred to the company is distributed, receives income in kind, subject to personal income tax (clause 1 of article 210, clause 2 of clause 2 of article 211 of the Tax Code of the Russian Federation). The tax base, in accordance with paragraph 1 of Art. 211, art. 41 of the Tax Code of the Russian Federation is determined based on the actual value of the distributed shares. An organization as a tax agent is obliged to calculate and withhold the amount of personal income tax for any cash payment of income to participants (clause 6 of Article 226 of the Tax Code of the Russian Federation). If the LLC does not make payments to the participant, then it is obliged, no later than one month from the end of the tax period in which the relevant circumstances arose, to notify in writing the LLC participant (taxpayers) and the tax authority at the place of its registration about the impossibility of withholding personal income tax and the amount of tax (clause 5 Article 226 of the Tax Code of the Russian Federation). Conclusions:

The following entries must be made in accounting:

| Debit | Credit | Contents of operations |

| Operations for the withdrawal of a participant from the LLC | ||

| 81 "Own shares" | 75 “Settlements with a participant who left the LLC” | The debt to pay the actual value of the share to the participant who left the LLC is reflected |

| 75 “Settlements with a participant who left the LLC” | 68 "NDFL" | Personal income tax is withheld when paying the actual value of the share to a participant who left the LLC |

| 75 “Settlements with a participant who left the LLC” | 50 (51) | The actual value of the share was paid to the participant who left the LLC |

| Operations to transfer a share to a new participant | ||

| 75 “Settlements with the participant to whom the share has been transferred” | 81 "Own shares" | The debt of the participant to repurchase the share in the LLC is reflected |

| 84 | 75 “Settlements with the participant to whom the share has been transferred” | The cost of the share distributed between the participants is written off at the expense of the sources of formation of the property of the LLC |

Changing the founder of the posting

Thus, the general provisions on purchase and sale (clause 4 of Article 454 of the Civil Code of the Russian Federation) apply to the agreement on the alienation of a share in an LLC as a property right. In accordance with paragraph 1 of Article 454 of the Civil Code of the Russian Federation, under a purchase and sale agreement, one party (seller) undertakes to transfer the thing (goods) into the ownership of the other party (buyer), and the buyer undertakes to accept this product and pay a certain amount of money (price) for it.

According to paragraph 5 of PBU 10/99 “Expenses of the organization”, expenses for ordinary activities are expenses associated with the manufacture of products and the sale of products, the acquisition and sale of goods. Such expenses also include expenses the implementation of which is associated with the performance of work or provision of services.

Change of participants - accounting features

Describe why you are complaining about this answer

Complaint

Cancel

The new composition of the organization's participants must be reflected in the list of company participants. In addition to information about each participant, this document must contain information about the size of his share, its payment, the size of shares belonging to the company itself, the dates of their transfer to the company, etc. (Article 31.1 of the Federal Law of 02/08/1998 N 14-FZ "On limited liability companies"). In your case, the data of only one founder will be reflected, because complete transfer occurs (100%).

In connection with the withdrawal of the founder (participant) from the company, the organization needs to make changes to the Unified State Register of Legal Entities (clause “d”, paragraph 1, article 5 of the Federal Law of 08.08.2001 N 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”).

ACCOUNTING

You can reflect a change in the composition of participants in accounting by posting:

Debit 80 subaccount “Owner 1” Credit 80 subaccount “Owner 2” – reflects the change in the composition of the company’s participants.

Or do not make any entries in the organization’s accounting records. In this case, on the date of making changes to the constituent documents of the company regarding the change of founder, the organization will have to “correct” the analytical accounting data to account 80 “Authorized capital”.

If an organization decides to reflect the change of founder in accounting, then keep in mind: First of all, let us recall that transactions recognize the actions of citizens and legal entities aimed at establishing, changing or terminating civil rights and obligations (Article 153 of the Civil Code of the Russian Federation). A two- or multilateral transaction is called an agreement (clause 1 of Article 154 of the Civil Code of the Russian Federation). Moreover, in the situation under consideration, the company itself is not a party to the transaction: the subject of the transaction is a share in the LLC, i.e. property right owned by a member of the company. A participant in an LLC can alienate only the paid share (Clause 3, Article 21 of the LLC Law), i.e. the seller of the share or its original owner has already made a contribution to the authorized capital of this company. It is obvious that the cost of the share paid by the buyer to the seller under the purchase and sale agreement is not a contribution to the authorized capital of the company; the authorized capital of the company does not change as a result of the transaction.

Thus, the company itself does not have any rights or obligations (liabilities) that must be reflected on the balance sheet of the LLC from the sale and purchase transaction of the share.

As a general rule, transactions aimed at alienating a share or part of a share in the authorized capital of an LLC are subject to notarization (Clause 11, Article 21 of the LLC Law). Clause 12 of Art. 21 of the Law on LLC establishes that a share in the authorized capital of the company passes to its acquirer from the moment of notarization of a transaction aimed at alienating a share in the authorized capital of the LLC, or from the moment of making appropriate changes to the Unified State Register of Legal Entities on the basis of title documents (in cases that do not require notarization certificates).

In accordance with the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations (approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, hereinafter referred to as the Instructions), account 80 “Authorized Capital” is intended to summarize information on the state and movement of the authorized capital of an organization. The balance of account 80 must correspond to the amount of the authorized capital recorded in the constituent documents of the organization. Entries in account 80 are made when forming the authorized capital, as well as in cases of increasing and decreasing capital, only after making appropriate changes to the constituent documents of the organization.

The Instructions do not mention entries in account 80 in cases of changes in the composition of the organization’s founders. However, it has been established that analytical accounting for account 80 is organized in such a way as to ensure the generation of information (including) on the founders of the organization.

We believe that, by analogy with the reflection on account 80 of information on the formation and change of the authorized capital, data on the change of founders (members of the LLC) are also reflected after making appropriate changes to the constituent documents. Accordingly, a change of founders can be reflected in accounting on analytical accounts to account 80 by internal accounting entries, for example:

Debit 80 subaccount “Owner 1” Credit 80 subaccount “Owner 2” – reflects the change in the composition of the company’s participants.

We also note that since the company itself does not make any settlements with participants under the agreement on the alienation of shares in the LLC, balance sheet account 75 “Settlements with founders” is not used in this case.

Let's move on to accounting for notary expenses. According to clause 5 of PBU 10/99 “Expenses of the organization” (hereinafter referred to as PBU 10/99), expenses for ordinary activities are expenses associated with the manufacture of products and the sale of products, the acquisition and sale of goods. Such expenses also include expenses the implementation of which is associated with the performance of work or provision of services.

From clause 7 of PBU 10/99 it follows that the totality of expenses for ordinary activities is formed taking into account administrative expenses. We believe that these may include, for example, the cost of paying state duties in connection with changes made to the constituent documents, including in relation to the composition of the LLC’s participants. However, the fee for notarization of a transaction made between individuals, i.e. a transaction to which the LLC itself is not a party cannot be recognized as expenses for managing the company.

Expenses other than expenses for ordinary activities are considered other expenses (clause 4 of PBU 10/99). The list of other expenses given in paragraphs. 11, 12 PBU 10/99, is not exhaustive.

Thus, if the final decision is made that the expenses for notary services are incurred at the expense of the LLC itself, then the payment for notarization of the transaction can be reflected as part of other expenses, i.e. on the debit of account 91, subaccount 91-2 “Other expenses”.

REPORTING

A change in the owner of an LLC will not affect the tax accounting of the organization. A legal entity is a payer of the simplified tax system and owes taxes in accordance with the general procedure. The tax return must be submitted only at the end of the year no later than March 31 of the following year (clause 1, clause 1, article 346.23 of the Tax Code of the Russian Federation). The organization must submit the declaration for 2021 no later than March 31, 2017. There are no quarterly reports on the simplified tax system.

If the founders (“new” and “old”) received income from the organization from the LLC, then the LLC is required to file 6-NDFL and 2-NDFL in relation to them. The calculation and certificate are submitted in the general manner.

In relation to the founders who are directors of the organization, it is also necessary to submit a calculation of insurance premiums. The calculation must be submitted even if no payments were made to him.

If an employment contract with the director - the sole founder - has been concluded and the company conducts financial and economic activities, then the company definitely needs to submit SZV-M and individual information for the director.

Possible accounting entries for authorized capital

Account 80 “Authorized capital” was created to reflect all operations of the movement and formation of funds from the enterprise’s stock fund. The account is passive, balance sheet, its amount equivalent indicates the actual amount of capital, it is regulated by the legislation of the Russian Federation and the statutory documents of the organization. Postings on the authorized capital are formed when it is created and when its size changes upward or downward. Any adjustment to the amount indicated in the balance sheet of the enterprise must be agreed upon by all owners and included in the constituent documents. Analytics is carried out for each owner separately. The following accounting transaction is recorded as the first entry for the authorized capital: Debit 75; Credit 80.

By definition, authorized capital is the amount of assets that the owner (founders) invests in the future company. Depending on the registered legal form, the capabilities of the owners and the scope of the organization’s activities, the method of creating a warehouse fund is chosen. As a contribution, the founder can make:

Accounting for additional capital (account 83)

The capital of the organization is not only the authorized capital, but also additional and reserve capital.

To account for additional capital, a passive 83 accounting account is used. Since the account is passive, the credit reflects the increase in additional capital, and the debit reflects its decrease. Based on this, let’s figure out which amounts can be reflected as a debit of the account, and which as a credit?

How is additional capital formed?

As mentioned above, the formation, that is, the increase and replenishment, is reflected in the credit of account 83. And the decrease is reflected in the debit of account 83. In what cases does an increase or decrease in capital occur?

Revaluation of assets

Revaluation of the value of an organization's assets with a useful life of more than one year, that is, fixed assets and intangible assets, is carried out regularly so that their value is as close as possible to the real market value.

If, during revaluation, the value of an asset increases, then the difference between the new value and the original value is called revaluation. The amount of revaluation is included in the additional capital of the organization.

Not only the value of the asset is subject to revaluation, but also the depreciation accrued on the object; it is also recalculated in proportion to the revaluation received. Overestimation of depreciation reduces additional capital.

The corresponding entries for revaluation are as follows:

D01 K83 – reflects the increase in additional capital by the amount of the additional valuation of the asset.

D83 K02 – reflects a decrease in additional capital by the amount of additional assessment of asset depreciation.

If, during revaluation, the value of an asset has decreased, then the difference between the original value and the new (replacement) value is called a markdown. The amount of the markdown reduces the additional capital.

At the same time, when depreciating the value of an asset, it is necessary to proportionally reduce the depreciation accrued on it.

The corresponding transactions for markdowns are as follows:

D83 K01 – reflects the decrease in additional capital (AC) by the amount of the depreciation of fixed assets or intangible assets.

D02 K83 - reflects an increase in DC due to a decrease in accrued depreciation during markdown.

Exchange differences

If the founders (participants) contribute to the authorized capital of the company in the form of foreign currency, then exchange rate differences, positive or negative, inevitably arise.

A positive exchange rate difference increases the company's additional capital, the corresponding entry looks like:

D75 K83 – reflects the increase in DC due to positive exchange rate differences.

A negative exchange rate difference reduces capital, the corresponding entry looks like:

D83 K75 – reflects the decrease in DC due to negative exchange rate differences.

Share premium

Share premium is received by joint stock companies if the company's shares are sold at a higher price than the nominal price. The received share premium is included in the additional capital of the joint-stock company:

Posting D75 K83 – reflects the increase in DC due to share premium.

Additional contributions from founders

If the founders make additional contributions in the form of property or cash, then they can also be included in the additional capital of the organization:

D08 K83 - reflects the increase in DC by the cost of the fixed asset contributed by the founder.

D51 (50) K83 - reflects the increase in DC by the amount of funds contributed by the founder (non-cash or cash).

Increase the authorized capital

Using additional capital, you can increase the size of the organization's authorized capital. Increasing through additional capital is one of the possible ways. The corresponding wiring looks like:

D83 K80 – reflects the increase in the capital at the expense of the DC funds.

Distribution of additional capital between founders

Additional capital funds can be distributed among the company's participants, and the following is posted:

D83 K75 – reflects the distribution of DC funds between the founders.

Authorized capital: postings

Authorized capital is part of the organization’s own capital, representing the amount of funds invested by the owners to ensure authorized activities recorded in its constituent documents. This value determines the minimum size of property that guarantees the interests of creditors. Depending on the organizational and legal form, the authorized capital of an organization may be called authorized capital, mutual fund, or share capital. We will talk about synthetic and analytical accounting of authorized capital in our consultation.

Account 80 is also used to account for contributions to common property under a simple partnership agreement. In this case, account 80 is called “Comrades’ Contributions”. Analytical accounting for account 80 “Deposits of partners” must be maintained for each simple partnership agreement and each participant in the agreement.

Authorized capital - what is it and what is it used for?

Any newly created enterprise needs initial funds to conduct financial and economic activities and create sources of income. These funds can be expressed in cash, securities, property or rights to it. Taken together, they form the authorized capital. How is the authorized capital formed, why is it needed, how is it taken into account in accounting, let’s look at the accounting entries for the authorized capital (account 80). The concept of authorized capital (AC).

Authorized capital means the amount of funds initially invested by the owners or founders necessary to carry out activities in accordance with the charter. In the case of a state or municipal enterprise, the concept of authorized capital is used. Authorized capital funds are assets with which an economic entity is liable to creditors.

Important functions of the authorized capital:

- Providing the enterprise with initial funds to carry out commercial and other activities.

- Guarantee of fulfillment of accepted obligations to creditors.

- Determination of the share of each owner or shareholder in the total capital and income.

For each type of enterprise, the relevant laws determine the minimum allowable amount of authorized capital. It amounts to:

- for LLCs and partnerships – 10,000 rubles

- for closed joint stock companies – 100 minimum wages (current value of the minimum wage)

- for OJSC – 1000 minimum wage

- for a municipal enterprise – 1000 minimum wage

- for a state-owned enterprise – 5000 minimum wage

It should be noted that in modern conditions, the minimum authorized capital is often insufficient both to carry out competitive activities and to be able to provide security for funds raised. Therefore, many enterprises strive to declare their authorized capital in accordance with real market needs. In general, it should be understood that the amount of authorized capital is considered a very conditional indicator of the financial position of the enterprise. For example, shares are accounted for at their nominal value, while their real value can increase several times.

Formation of authorized capital

When registering, an economic entity independently determines the size and structure of its authorized capital, taking into account the minimum amount established by law. To deposit the monetary component of the capital, a bank account is opened, which will subsequently be used as the current account of the enterprise. State registration is carried out upon depositing 50% of the authorized capital into this account. When creating joint stock companies, payment of half of the required amount must be made within three months after registration, and full payment - within a year.

The method of forming the authorized capital depends on the organizational and legal form of the economic entity. For limited liability companies (LLC) and business partnerships, the authorized (share) capital is formed from contributions of their participants and is divided among investors in accordance with the contributed shares. For joint stock companies (JSC), the authorized capital is created through the initial issue of shares and represents the total par value of the issued securities. For state and unitary enterprises, the authorized capital is created by the state or local government body.

If the organizational and legal form of the entity changes or other circumstances arise, the authorized capital may change in one direction or another.

An increase in the authorized capital can be made in the following cases:

- lack of working capital

- requirements of licensing authorities for the amount of authorized capital

- admission of new participants contributing to the authorized capital

- using part of unspent profit to contribute to the authorized capital

- increase in the par value of shares, additional issue (for joint stock companies).

To increase the authorized capital, it is necessary to fulfill a number of conditions related to its size and the value of the enterprise’s net assets. The decision to increase the capital is made by the general meeting and documented in the appropriate minutes. Then changes in the constituent documents are confirmed by the registering authorities.

A decrease in the authorized capital may occur in the following cases:

- retirement of the founders and the need to return their contributions (withdrawal of the founder from the LLC)

- when the par value of shares is reduced or they are repurchased

- in case of failure to cover the accepted authorized capital by subscription to shares

- in other cases provided for by law.

The decision to reduce is also made by the general meeting of co-founders (shareholders), at which all emerging changes in the constituent documents are recorded. It is necessary to notify creditors of the accepted reduction in the capital. Next, a package of documents is prepared and the reduction of the authorized capital is registered.

Accounting of authorized capital (postings)

According to the Chart of Accounts, accounting of the authorized capital occurs on account 80, intended for entering information about the state and changes in the authorized (share) capital of the enterprise. After registering the enterprise, account 80 indicates the value of the authorized capital with the accrued debt of the founders on deposits. Redemption of a share in the authorized capital, that is, the receipt of funds from the founders occurs on the credit of the account “Settlements with founders” (account 75).

The posting reflecting the formation of the authorized capital has the form D75 K80.

The entries for accounting for contributions to the authorized capital D50 (51, 52, 55, 10, 41) K75 depend on how the founder repays his share.

Account balance 80 corresponds to the accepted amount of the authorized capital. Postings to the account occur during the formation of the management company, and then in case of changes in the value of capital, after they are recorded in the constituent documents. For joint-stock companies, this account may have sub-accounts by type of shares (common or preferred) and by stages of formation of the authorized capital. Analytical accounting of the authorized capital is carried out according to the founders of the enterprise and the types of changes in capital.

The accounting procedure for authorized capital in economic entities of various forms of ownership is regulated by relevant federal laws and regulations. The correctness of management accounting is monitored by periodic audits of enterprises.

The authorized, additional and reserve capital form the company's own capital.

Accounting for authorized capital and settlements with founders (accounts 80 and 75) in 2021

I would like to draw your attention to the fact that passive account 80 will always have a credit balance, and it will change only in one case, if the board (meeting) of founders decides to change the authorized capital (read more about increasing capital in this article). After these changes are approved by the relevant order and changes are made to the constituent documents of the enterprise, it will be possible to change the amount of the authorized capital on the account. 80, increasing or decreasing it by appropriate wiring. This happens extremely rarely, so, as a rule, every month, when we close an account, we receive the same credit balance and carry it over to the next month. And we will continue to do this from month to month until the founders decide to liquidate the LLC for any reason, then count. 80 will be closed by writing the same amount as a debit and the ending balance will become equal to 0.

Formation of authorized capital in 1C 8

- Contribution of fixed assets. For example, the founder decided to repay the debt on the authorized capital in the form of equipment that can be immediately put into operation. In this case, two entries will be generated: Dt 08 – Kt 75.01 (repayment of debt on the authorized capital);

- Dt 01 – Kt 08 (commissioning of equipment).

Please note that if the debt on the authorized capital is repaid not in money, an assessment of this property must be carried out. The founders have the right to produce it themselves if the cost does not exceed 20,000 rubles. Otherwise, an external appraiser must be involved.

Accounting accounts 80 and 75

The cost of capital is entered into credit 80, while not forgetting the principle of double entry. This principle applies to every business transaction, and if we deposit something on credit, then we deposit the same amount in debit; all that remains is to determine which account should be debited with this amount. There is an account. 75 “Settlements with founders”, the cost of the starting capital is entered into its debit. That is, in this case, the posting will look like: Debit 75 Credit 80 ( D75 K80 ).

There is such a thing as the minimum amount of authorized capital . Its value varies depending on the type of property. Mainly, the minimum value depends on the size of the minimum wage (minimum wage), which is indexed annually. For example, in 2013 the minimum wage was 5,205 rubles, in 2014 – 5,554 rubles. Only the minimum value of the charter capital for an LLC does not depend on the minimum wage and is a fixed value, and quite small.

Accounting for transactions upon alienation of LLC shares

Transactions with shares in the authorized capital of a company are carried out infrequently in practice and traditionally raise many questions among accountants. Let's look at how to formalize some of them in accounting.

Determining the value of a share

When alienating a share or part of a share in the authorized capital of a company, its correct assessment is of great importance.

Clause 4 of Art. 21 of the Federal Law of 02/08/98 No. 14-FZ “On Limited Liability Companies” (hereinafter referred to as Law No. 14-FZ) establishes that the purchase price of a share or part of a share in the authorized capital can be established by the company’s charter in a fixed amount of money or on the basis one of the criteria determining the value of the share:

— the value of the company’s net assets;

— the book value of the company’s assets as of the last reporting date;

- net profit of the company.

The most common criterion for determining the value of a share is traditionally the value of the company's net assets.

The term “net assets” is not disclosed in the current legislation or documents of the accounting regulatory system.

In paragraph 1 of the Procedure for assessing the value of net assets of joint-stock companies, approved by order of the Ministry of Finance of Russia and the Federal Commission for the Securities Market of Russia dated January 29, 2003 No. 10н/03-6/пз (hereinafter referred to as the Procedure), only the definition of the value of net assets is introduced: “...under the value of the net assets of a joint-stock company company is understood as a value determined by subtracting from the amount of assets of the joint-stock company accepted for calculation the amount of its liabilities accepted for calculation.”

It is easy to see that this definition does not reveal either the economic or financial component of the organization’s net assets.

In fact (from the requirements of legislation and accounting regulations) we can conclude that net assets are the difference between the value of all assets (property) of the organization and the amount of accounts payable. In other words, the size of net assets shows what part of the property was acquired at the expense of the organization’s own funds - authorized and additional capital and retained earnings.

At the same time, the use of the net asset indicator in the modern legislative framework is becoming increasingly widespread.

In almost all federal laws regulating the activities of individual organizational and legal forms, the size of net assets plays a role in restrictions on the use of financial resources of organizations.

Currently, the Procedure is used to evaluate net assets. Not only joint stock companies, but also organizations of other organizational and legal forms apply its provisions, taking into account the specifics of their activities, settlements with participants, creditors, etc.

The assets accepted for calculation include:

— non-current assets reflected in the first section of the balance sheet (intangible assets, fixed assets, construction in progress, profitable investments in tangible assets, long-term financial investments, other non-current assets);

- current assets reflected in the second section of the balance sheet (inventories, value added tax on acquired assets, accounts receivable, short-term financial investments, cash, other current assets), with the exception of the cost in the amount of actual costs for the repurchase of own shares purchased by the joint stock company company from shareholders for their subsequent resale or cancellation, and debts of participants (founders) for contributions to the authorized capital.

The liabilities accepted for calculation include:

— long-term liabilities for loans and credits and other long-term liabilities;

— short-term obligations for loans and credits;

- accounts payable;

— debt to participants (founders) for payment of income;

— reserves for future expenses;

— other short-term liabilities.

Assets and liabilities also include deferred tax assets and deferred tax liabilities, respectively.

The data on the value of other long-term and short-term liabilities shows the amounts of reserves created in accordance with the established procedure in connection with contingent liabilities and termination of operations.

Calculation of the amount to be paid to a participant leaving the LLC

Based on the requirements of Art. 21, 23 and 26 of Law No. 14-FZ, we can conclude that in order to correctly determine the amount to be paid to the withdrawing participant, the following calculation scheme must be followed.

1. The share of the exiting participant is determined. It should be determined based on the results of financial statements. That is, it is recommended to take the value of the company’s net assets as a basis. Let us recall that the size of net assets is determined as the difference between the value of the assets involved in the calculation and the value of the liabilities involved in the calculation. In this case, three situations may arise:

— net assets are greater than the authorized capital;

— net assets are equal to the authorized capital;

— net assets are less than the authorized capital.

If, according to the financial statements, the authorized capital is greater than the net assets, it must be reduced by the appropriate amount. Of course, this must be done before the start of settlements with the retiring participant. Thus, of the above, only the first two situations are possible.

2. The amount to be paid (or issued in kind) is determined from the difference between net assets and authorized (share) capital.

3. Depending on the results of the second stage, the payment is made entirely from the difference between net assets and authorized capital, or the authorized capital is subject to reduction.

Example 1

The LLC consists of five founders who equally participated in the formation of the authorized capital. Authorized capital - 500,000 rubles, net assets - 650,000 rubles. One of the participants leaves the society.

In this case, the share of the withdrawing participant will be determined in the amount of 130,000 rubles. (650,000 rubles: 5 participants) and the entire payment can be made from the difference between the size of net assets and authorized capital, since this difference is greater than the share of the withdrawing participant: (650,000 rubles – – 500,000 rubles) > 130,000 rub. Nevertheless, changes to the constituent documents should still be made, since the share in the authorized capital of each remaining participant will increase from 100,000 to 125,000 rubles. (respectively 500,000 rubles: 5 and 500,000 rubles: 4).

The reflection of the transaction in accounting will depend on what caused the difference between net assets and authorized capital. Most often, the source of the difference will be the amount of profit allocated to the corresponding subaccounts of account 84 “Retained earnings (uncovered loss)”.

Therefore, the following transactions will be issued:

Debit 84 Credit 75

— for the amount of debt to the exiting participant;

Debit 75 Credit 50

- for the amount of the paid share.

In the case where the payment is made in kind, the property accounts will be credited in the last entry.

Note that the posting of Debit 75 Credit of property and inventory accounts is not provided for in the Instructions for using the Chart of Accounts. Based on this, individual tax inspectorates may require that the value of disposed property be reflected through sales accounts. But the Instructions for using the Chart of Accounts and the correspondence of accounts for sales and other income and expenses with account 75 do not imply.

Nevertheless, no one doubts that the amounts to be paid should be credited to account 75. Thus, reflecting the value of retiring current assets on account 91 is not at all necessary.

As for the cost of retiring fixed assets, we adhere to the point of view according to which any disposal of fixed assets should be reflected in account 91.

That is, the following transactions must be completed:

Debit 01, subaccount “Disposal of fixed assets” Credit 01

- the amount of the initial or replacement cost of fixed assets to be transferred;

Debit 02 Credit 01

- the amount of accrued depreciation;

Debit 75 Credit 91

- the amount of the residual value of fixed assets transferred to the withdrawing participant.

We emphasize that the reflection of amounts in account 91 does not mean their automatic inclusion in the tax base for value added tax.

If in the above example the size of net assets is 600,000 rubles. (the participant’s share is 120,000 rubles), then a payment of 100,000 rubles. should be made at the expense of the difference between net assets and authorized capital, and by 20,000 rubles. in accordance with the established procedure, reduce the size of the authorized capital. In this case, the amount of debt to the founder is 100,000 rubles. will be written off at the expense of the sources of formation of such a difference (Debit 84 Credit 75), and 20,000 rubles. — from the account of the authorized (share) capital (Debit 80 Credit 75). The rest of the wiring will be similar. The share of the remaining participants will increase to 120,000 rubles. (RUB 480,000: 4, where RUB 480,000 is the amount of the authorized capital after reduction).

If at the end of the reporting period the size of net assets is equal to the size of the authorized capital, all debt to the exiting participant will be written off by reducing the authorized capital. In this case, the share of the remaining participants will not increase.

Finally, if the size of net assets is less than the size of the authorized capital (according to the example - 400,000 rubles), then first the authorized capital of the company should be reduced in accordance with the established procedure with mandatory amendments to the constituent documents (this element, in addition to the legal aspect, also has a pronounced practical aspect — through such an operation, the filing of claims by the withdrawing participant is excluded). The share to be paid will be reduced accordingly. Further calculations are made in the same order as in the previous case. After this, changes should be made again to the constituent documents, since the authorized capital will again decrease (in this example - to 320,000 rubles).

In connection with the need to reduce the authorized capital due to the negative difference between the size of net assets and the size of the authorized capital, a situation may arise when the authorized capital will actually be less than the amounts by which it should be reduced. This situation may occur when, as a result of revaluation, the organization’s own funds increased, but no increase in the authorized capital was carried out. In this case, you should first increase the authorized capital, that is, formalize this by decision of the general meeting and make changes to the constituent documents. The following entries will be made in accounting:

Debit 83 subaccount “Increase in property value due to revaluation” Credit 80.

In this case, the amount of the increase must be chosen in such a way that after the change, the authorized capital does not exceed the size of net assets.

Reflection of settlements with the withdrawing participant in accounting will depend on how the difference between net assets and authorized capital was formed. Most often, the source of the difference will be the amount of profit allocated to the corresponding subaccounts of account 84 “Retained earnings (uncovered loss)”. When making entries, you should keep in mind that from the moment the application for withdrawal is submitted, the share owned by the participant is transferred to the company. In accordance with the Instructions for using the Chart of Accounts, such shares are accounted for in account 81 “Own shares (shares)”.

Therefore, the following transactions will be issued:

Debit 81 Credit 75

- for the amount of the share of the withdrawing participant, which passes to the disposal of the company;

Debit 84 Credit 75

- for the amount of debt to the withdrawing participant in terms of the difference between the part of the value of net assets subject to payment and the share of the withdrawing participant;

Debit 75 Credit 50

- for the amount of the paid share.

In the case where the payment is made in kind, the property accounts will be credited in the last entry.

When transferring property to an exiting participant, the following entries must be made:

Debit 91 Credit 01

— for the amount of the balance sheet (residual) value of fixed assets subject to transfer;

Debit 75 Credit 91

— the amount of the residual value of fixed assets transferred to the retired participant;

Debit 91 Credit 04

— the amount of the residual value of the transferred intangible assets;

Debit 75 Credit 91

— the amount of the residual value of the transferred intangible assets;

Debit 91 Credit 10 and

Debit 75 Credit 91

- for the amount of the cost of transferred inventories, etc.

After completing the above transactions, it is necessary to write off the debit balances formed on account 81.

In the case when a decision is made to distribute the share among other participants, in our opinion, the amount of the cost of the share should be repaid from net profit:

Debit 84 Credit 81

- for the amount of the debit balance in the subaccount “Share of a withdrawn participant” of account 81.

When this entry is made, the size of the company's net assets will decrease exactly by the amount paid to the withdrawing participant, the size of the authorized capital will not change and will not be less than the size of the net assets.

If the remaining participants decide to buy out the share, the following entry is made:

Debit 50 (51) Credit 81

- for an amount corresponding to the share redeemed by the remaining participant or participants. It is possible that part of the share will not be repurchased and will be repaid from net profit. Of course, the redemption of a share by one of the participants (or several participants) must be carried out taking into account the restrictions established by Law No. 14-FZ.

In the practical activities of limited liability companies, situations may arise when the retiring participant himself requires settlements (in whole or in part) at the expense of the company’s property other than cash.

The most common case is the reclaiming of certain types of intellectual property, in particular a trademark or patent.

In such situations, to assess the legality of the demands of the withdrawing participant, one should be guided by the norms of civil law. In particular, with regard to objects of intellectual property, it is necessary to determine under which agreement the right to use certain objects of intangible assets was transferred to the company.

Thus, if an object was transferred under an author’s order agreement, and the ownership of it transferred to the company, then the participant does not have the right to demand the return of the object. If the right is transferred under a license agreement, then one should proceed from the validity period of the agreement. If the period is not specified, it is equal to ten years.

In any case, demands for the return of such property may be considered unlawful based on clause 4 of Art. 15 of Law No. 14-FZ, according to which property transferred by a company participant for the use of the company to pay for his share, in the event of withdrawal or exclusion of such a participant from the company, remains in the use of the company for the period for which this property was transferred, unless otherwise not provided for in the agreement on the establishment of the company.

In the event of the withdrawal of a participant, if, in accordance with the requirements of Law No. 14-FZ, the company does not have the right to pay the actual value of the share in the authorized capital of the company or to issue in kind property of the same value, the company, on the basis of a written application submitted no later than within three months from the date of expiration of the period for payment of the actual value of the share, the person whose share has transferred to the company is obliged to reinstate him as a participant in the company and transfer to him the corresponding share in the authorized capital of the company.

Foreclosure of a participant's share at the request of creditors

Article 25 of Law No. 14-FZ provides for the possibility of foreclosure at the request of creditors on the share of a participant (only on the basis of a court decision if other property of a company participant is insufficient to cover the debts).

Of course, in this case, the amount of claims of the participant’s creditors cannot exceed the value of his share. That is, if there is information about the status of the participant’s payments (whose creditors may turn to the company to collect the debt), the company has the opportunity to minimize possible losses.

The value of a participant's share is determined by the size of net assets. Consequently, through formally absolutely legal actions, the share of such a participant can be brought to the nominal value of the share in the authorized capital.

For example, in the reporting period based on the results of which net assets are determined, decisions may be made on the maximum use of balance sheet profit, for example, on the payment of dividends in the maximum amount.

Using additional and reserve capital funds, however, will be more difficult - this requires conditions under which the use of such funds becomes possible.

An increase in accounts payable (or artificially inflating it) does not lead to a decrease in net assets, since at the same time the corresponding assets of the organization increase or the structure of accounts payable changes.

If the company pays the actual value of a share or part of a share of a company participant, at the request of its creditors, part of the share, the actual value of which was not paid by other company participants, passes to the company, and the rest of the share is distributed among the company participants in proportion to the payment they made.

Example 2

Creditors' claims were presented to the company for a total amount of RUB 1,500,000. The actual value of the participant's share, which is being foreclosed on, is 2,000,000 rubles, of which 1,000,000 rubles were paid by the participant himself, and 500,000 rubles by other participants.

In this case, 500,000 rubles. must be distributed among the participants, part of the share in the amount of 1,000,000 rubles. goes to the company in the amount of 500,000 rubles. (not paid by the participant whose share is being foreclosed on by creditors) can be sold to other participants or third parties. Otherwise, the authorized capital of the company must be reduced by this amount.

In accounting, the listed transactions will be reflected as follows:

Debit 75 Credit 76

— 1,500,000 rub. - for the amount of debt presented by creditors;

Debit 76 Credit 51

— 1,500,000 rub. - for the amount of funds transferred to repay debts to creditors of the company member whose share was foreclosed on;

Debit 81 Credit 75

— 1,000,000 rub. — on the value of the part of the participant’s share transferred to the company;

Debit 75 Credit 75

— 500,000 rub. — for the amount of a part of the participant’s share distributed among other participants;

Debit 80 Credit 75

— 500,000 rub. — for the amount of the part of the share not paid by the participant aimed at reducing the authorized capital.

Redemption and sale of shares by the company

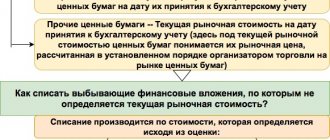

Accounting for shares transferred to the company or purchased by the company is kept on account 81.

Since the economic essence of the transfer of a share comes down to the movement of funds accounted for as part of the authorized capital, the question arises: should the size of the authorized capital be reduced? In our opinion, such an operation is not only unnecessary, but also undesirable.

The fact is that reducing the authorized capital is not limited to introducing changes to the constituent documents. The authorized capital of a company is the amount that creditors can claim in the event of reorganization or liquidation of the company.

Consequently, any reduction in the authorized capital affects the interests of creditors and must be made with their consent. More precisely, creditors must be notified of a reduction in the authorized capital and have the right to present their claims against the company within a month, up to the termination of business contracts.

Considering the fact that the authorized capital of limited liability companies in most cases does not differ significantly from the minimum amount (RUB 10,000), we can conclude that the potential losses associated with the reduction may be much higher than the costs associated with the compensation of property on account exited (monies paid or assets transferred to the withdrawing participant).

Let's look at how the most common transactions involving the transfer of shares should be recorded in accounting.

1. Alienation of a share (part of a share) due to non-payment

In this case, two circumstances should be kept in mind.

Firstly, civil legislation allows the amount of the authorized capital to exceed the amount of net assets as of the end of the first year of the organization’s activity. Secondly, the current version of Law No. 14-FZ (taking into account the amendments made by Federal Law No. 312-FZ of December 30, 2008) no longer contains a requirement for the alienation of the entire share of a participant in the event of partial non-payment before the expiration of the established period. Moreover, the newly introduced clause 3 of Art. 16 of Law No. 14-FZ expressly stipulates that in case of incomplete payment of the share in the authorized capital of the company within the established period (one year from the date of state registration of the company), determined in accordance with clause 1 of Art. 16, the unpaid part of the share goes to the company. Such part of the share must be sold by the company in the manner and within the time limits established by Art. 24 Law No. 14-FZ. The agreement on the establishment of a company may provide for the collection of a penalty (fine, penalty) for failure to fulfill the obligation to pay for shares in the authorized capital of the company.

However, such a scheme can hardly be considered the most rational from a practical point of view. After all, the sale of a share to third parties during the second year of the LLC’s existence can be very problematic, and the sale of a part of the share to other participants will entail a change in the size of their shares, which, in turn, will necessitate the need to change several provisions of the company’s charter.

In any case, when only part of the share is alienated, the size of the share belonging to the participant who has not paid in full will also change, and the ratio of shares of individual participants in the company will also change, which is also associated with the need for a serious revision of the constituent document (charter). Moreover, from a pragmatic point of view, participants who have fully fulfilled their obligations to society are unlikely to want to continue cooperation with a participant who shirks such responsibilities at the very beginning of work.

Therefore, in our opinion, most often companies will use the right granted to them by Art. 10 of Law No. 14-FZ and initiate judicial review of the exclusion from the company of a participant who has not fully paid his share (since it is not difficult to prove the fact that such a participant grossly violates his duties or by his actions (inaction) makes the company’s activities impossible or significantly complicates it ).

In this case, the participant’s share is transferred to the company in full (paid and unpaid parts). Taking into account the foregoing (if the exclusion occurs during the second year of the LLC’s activity), the amount of the value of the property due to the exiting participant may be less than part of the net assets. As of the date of the decision to alienate the unpaid share, the balance sheet lists the debt owed by this participant in account 75 “Settlements with founders.” At the same time, the company incurs a debt to the withdrawing participant in the amount of the value of the property corresponding to his contribution. Subsequently, the cost of the paid contribution must be charged to the debt of other participants.

Consequently, the following entries will be made in accounting:

Debit 81 Credit 75

— the amount of the company’s debt to the exiting participant;

Debit 75 Credit 50

- for the amount of the cost of the share paid in cash (to the participant - an individual);

Debit 75 Credit 51

- for the amount of the cost of the share paid by bank transfer (to a participant - a legal entity);

Debit 91 Credit 08 and

Debit 75 Credit 91

- for the amount of the cost of the share paid in kind (fixed assets or intangible assets, inventories, etc.);

Debit 75 Credit 81

- for the amount of the share of the withdrawing participant, subject to payment by other participants of the company.

At the same time, in analytical accounting it is necessary to register the transfer of debt on contributions to the authorized capital from the withdrawing participant to the participants who must pay for the purchased share.

If at the time of the decision the size of net assets still exceeded the size of the authorized capital, the amount of debt to the participant must be increased by the amount of the difference between the participant’s share in the amount of the contribution to the authorized capital and the net assets in the part corresponding to the paid share of the withdrawing participant. In addition, it should be borne in mind that this part of the payment made is subject to personal income tax (if the retiring participant is an individual) or income tax (if the participant is a legal entity). In this case, personal income tax must be accrued and transferred to the budget by the paying party, that is, the company from which the participant leaves:

Debit 84 “Retained earnings (uncovered loss)” Credit 75;

Debit 75 Credit 68 “Calculations with the budget”

- the amount of accrued income tax.

Income tax is paid by the party who receives the profit.

The rest of the wiring is done the same way.

2. Purchase by the company of the share of an exiting participant

In this case, the wiring is the same as in the previous case. The difference is that in this situation, as a rule, there will be no balance on account 75, and net assets will exceed the amount of the authorized capital.

If, nevertheless, a decision is made to reduce the authorized capital due to the withdrawal of a participant, the following entries must be recorded in the accounting records:

Debit 81 Credit 75

- for the amount of debt to the retiring participant in the part corresponding to the contribution to the authorized capital;

Debit 84 Credit 75

- for the amount of debt to the retiring participant in the part corresponding to the difference between net assets and authorized capital;

Debit 80 Credit 81

— by the amount of reduction of the authorized capital;

Debit 75 Credit to cash accounts and sales accounts and other income and expenses

- the amount of payment made.

3. Sale of a share by a participant to third parties upon gratuitous assignment of the share to the company

Since in these situations there is actually no movement of value, then, in our opinion, these operations should not be reflected in system accounting - all changes are made only in analytical accounting and, if necessary, in the constituent documents of the company.

Thus, the general scheme of accounting entries for the repurchase and sale of shares may look like this (see table).

Table. Scheme of accounting entries for transactions of repurchase and sale of shares by the company

| Contents of operation | Debit | Credit |

| Shares in the authorized capital of limited liability companies were purchased for cash | 81 | 50 |

| Shares in the authorized capital of limited liability companies were purchased by non-cash transaction | 81 | 51 |

| Shares in the authorized capital of limited liability companies were purchased for foreign currency | 81 | 52 |

| Shares in the authorized capital of limited liability companies were purchased using funds accumulated in special bank accounts | 81 | 55 |

| The purchased shares were transferred to other participants | 75 | 81 |

| The purchased shares were sold to third parties | 91 | 81 |

| Revenue received for shares sold | 51 | 91 |

| The negative difference between the actual costs of repurchasing shares and their nominal value is included in other income | 81 | 91 |

| The cancellation of the purchased shares is reflected (with a simultaneous reduction of the authorized capital) | 80 | 81 |

| The positive difference between the actual costs of repurchasing shares and their nominal value is included in other expenses | 91 | 81 |

How is the procedure for reducing the authorized capital carried out?

The authorized capital is the totality of contributions from the founders of the organization. Based on it, the minimum amount of company property is calculated. In a situation of financial crisis, outstanding debts of the management company are used for settlements with creditors. It guarantees that the interests of the persons providing loans are respected. There is a minimum size of the charter capital. You cannot reduce it yourself. All changes must undergo state registration. The corresponding data is also entered into the Unified State Register of Legal Entities.

- DT 80 CT 81 . Applies in case of failure to pay the share.

- DT 80 CT 84. Applicable when the amount of the capital exceeds the size of net assets. By reducing capital, existing losses are closed.

Postings of change of founders in the authorized capital

Account 80 is passive, the balance of account 80 “Authorized capital” corresponds to the amount of the authorized capital defined in the constituent documents of the company. A decrease or increase in the authorized capital must be documented and recorded in changes to the authorized capital.

In simple partnerships, account 80 contains information about the status and movement of the share of the contribution of each participant in the partnership to the common property according to the agreement. Account 80 in this case is referred to as “Comrades' Deposits”.

Stage 1. Deciding to increase capital

During the first stage, a decision is made to increase the authorized capital of the LLC. Only the company participants specified in the Constituent Documents of each legal entity can perform this action. The importance of performing this procedure can be explained by the fact that most legal disputes arise due to a negligent attitude towards this, in the opinion of many managers, formality. As a rule, the procedure for holding a meeting of participants, the rules for counting votes and the established quorum are prescribed in the Charter of the enterprise. Our legislation has given legal entities the right to resolve these issues independently. But there are a number of conditions, without which further actions are impossible.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Conditions under which the authorized capital can be increased:

- firstly, the founders of the Company should not have any debt in payment of the initial authorized capital;

- secondly, the amount of increased funds should not be greater than the difference between the Company’s net assets, the amount of capital specified in the Charter, and the value of the legal entity’s reserve fund.

- thirdly, if after the end of the second and third financial years the indicator of the value of net assets was significantly less compared to the amount of capital stated in the Charter of the Company, then increasing its size is not legal, and the legal entity must declare a decrease in the authorized capital and proceed to carry out this procedure in accordance with the procedure established by law.

In addition, the Company is subject to liquidation if it turns out that at the end of the second and subsequent financial years the net asset value is less than the original authorized capital.

Account 80: entries for authorized capital - examples of formation and increase

The participants of Phantom LLC, whose authorized capital is 954,000 rubles, are K.P. Malyshev. (share 22%) and JSC Aurora (share 78%). On 02/02/2016, the minutes of the board’s decision recorded an increase in the authorized capital of Phantom LLC by 265,000 rubles. For the preparation of documents, Phantom LLC paid a state fee in the amount of 780 rubles.

One of the main stages of creating an organization is the formation of its authorized capital. In the course of business, the size of the authorized capital can be either increased or decreased. In addition, it is possible to sell the share of the authorized capital of the founder or participant. The amount of the authorized capital for accounting purposes is reflected in account 80 of the accounting department. In the article we will look at each of these operations under the Criminal Code using examples of postings.

Stage 2. Contribution of the required amount to the Authorized Capital

During the second stage, funds are transferred to increase the financial equivalent of the amount specified in the Charter of the company. This can be done by depositing additional funds into the company's current account. In some cases, the founders increase the property of a legal entity or its property rights. Let's consider each option in more detail. Changing the authorized capital of an LLC is possible at the expense of the net assets of the enterprise, which include the book value of the property minus the liabilities of the legal entity. In some sources, net assets are the financial equivalent of an enterprise's property according to financial statements.

In this case, to register changes, it is necessary to collect a package of documents.

Increasing the authorized capital of LLC documents:

- applications to change the authorized capital of an LLC in the prescribed form, indicating the new amount of capital;

- updated version of the Charter with changes already made;

- minutes of the general meeting or a decision of the sole participant of the LLC;

- balance sheet for the previous financial year;

- a receipt confirming payment of the state fee.

The state duty for increasing the authorized capital is 800 rubles (for 2021). You can generate a receipt for payment on the official tax service

It is also possible to increase the capital specified in the Charter of the Company by obliging all its participants to make additional contributions. In this case, the amount of the authorized capital changes by a nominal value equivalent to the amount of additional deposits, therefore, the financial component of the nominal share of each participant increases.

In this case, in addition to the standard package of documents described above, it is necessary to submit financial documents that confirm the transfer of additional funds in the amount of 100%, or, if the contribution is not monetary, then its expert assessment. If the Company's authorized capital is increased at the expense of additional funds, but not of all participants, or at the expense of third parties, then not only the monetary value of the nominal shares will change, but also their size. Typically, such changes lead to a different distribution of profits received from the Company’s commercial activities. In addition, such a method may affect the composition of the founders of the Company by including third parties in their composition. Despite the complexity of the option, the composition of the package of documents for registering changes in the authorized capital will be the same as in the second option.

Return of authorized capital: rules and procedure

If there is no positive dynamics in the enterprise’s recovery from the crisis, bankruptcy proceedings are initiated. At this stage, liquidation of the enterprise due to bankruptcy already becomes inevitable. At this stage the following is carried out:

The founders have the absolute right to receive residual funds after the liquidation of the company in accordance with the provisions of Article 67 of the Civil Code of the Russian Federation. The provisions of this article provide for the variability of the return of authorized capital: in material assets or money. It turns out that, at the request of the founders, the material assets remaining after settlements with creditors can also be sold, since the founders want to receive cash.

Postings of change of founders in the authorized capital

When purchasing a share from a founder (participant), in the debit of account 81 “Own shares (shares)”, reflect the amount of actual costs (amount paid) (Instructions for the chart of accounts). The LLC must buy back the share from the participant at its actual value (clause 2 of Article 23 of the Law of February 8, 1998 No. 14-FZ). Therefore, debit account 81 “Own shares (shares)” with the actual value of the share.

A.V.'s share Lvov – 2500 rubles; share of A.S. Glebova – 2500 rubles; share of V.K. Volkova – 5,000 rubles. Glebova decided to sell her share in the authorized capital. On July 16, she sent her demand to the organization to buy out the share. The actual value of Glebova’s share is 27,000 rubles. On August 20, the Hermes cashier paid Glebova the amount due to her.

Exit of the founder from the company, cost of the share, personal income tax and postings, application for exit

To leave the LLC, the founder (participant) must submit a written application to the organization (Clause 1 of Article 94 of the Civil Code of the Russian Federation, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 18, 2021 No. 11809/04). (clause 1 of article 26 of the Law of February 8, 1998 No. 14-FZ, clause 2 of the letter of the Federal Tax Service of Russia dated January 11, 2021 No. GD-4-14/52).

Gromova decided to leave the founders. On July 15, 2021, she sent her application to the organization. The actual value of Glebova’s share is 52,500 rubles; on August 20, 2021, the Hermes cashier paid Gromova the amount due to her. Gromova is a resident of Russia.

Postings for accounting of authorized capital

A feature of the accounting of the authorized capital is the mandatory compliance of the size of the fund with the constituent documentation. All accounting entries for changes in its value are displayed only after registration of changes in the Unified State Register of Legal Entities.

- Certificate of acceptance and transfer of property (with an attachment of an assessment report).

- Company bank account statement.

- Payment order from the founder (the purpose of payment indicates the direction of transfer of funds to the authorized capital).

- Copies of primary payment documents for cash payments.

Topic: postings when changing the composition of the founders

the company had two founders, the management company was paid in full, one founder sold his share to the second founder, it turns out I am making a posting D 80 K 80, which is not provided for in the correspondence of accounts?

Dear accountants. The situation is this: when registering an LLC, according to the charter, there was one founder, as a contribution to the management company, a fixed asset in the amount of 10 thousand rubles. A month later, changes were made to the Charter: two founders, deposits den. funds 50/50 in the amount of 10,000 rubles. Question: what postings should be made: D75 (1 founder) - K80 (1) - 10,000 rubles. D08 - K75(1) - 10,000 rub. D01-K08 - 10,000 rub. D80(1) - K 80(2) 5,000 rubles. transfer of share to another participant D75(2) - K. 80(2) 5,000 rubles. D50 - K75(2) 5,000 rub. I think something's wrong. Tell. And what about the fixed asset, what about VAT on the fixed asset? means (ignore or what?). Both founders are individuals.

Change of founder posting

IMPORTANT! Reducing the capital on a voluntary basis cannot be a method of avoiding the company's liability to creditors. In particular, an organization cannot avoid paying its debts in this way. Creditors to whom there are early obligations must be notified of the changes being considered. The presence of the notification must be confirmed.

The Instructions do not mention entries in account 80 in cases of changes in the composition of the organization’s founders. However, it has been established that analytical accounting for account 80 is organized in such a way as to ensure the generation of information (including) on the founders of the organization.

Authorized capital: purpose, postings, features of reflection in accounting

- Limited liability companies (LLC) – RUB 10,000.00.

- Closed joint stock companies – 100 times the minimum wage for the corresponding year. This indicator is constantly indexed (prescribed in the budget of the corresponding year).

- Open joint stock companies – 1000 minimum wages.

- Municipal enterprises – 1000 minimum wages.

- State enterprises – 1000 minimum wages.

To carry out the subsequent activities of the enterprise, its founders form start-up capital in the form of their contributions. These may include inventories, securities, non-current assets, money and others. The size of the dividends received depends on the size of their deposits. In addition, the formed capital acts as a kind of guarantor for the credit obligations of the enterprise. Its size can either increase or decrease according to the decision of its founders: