Special sections of the declaration

For exporters, the VAT declaration provides:

- section 4 – to reflect the tax in the case where the zero rate is confirmed;

- section 5 – to reflect tax deductions;

- Section 6 – to reflect tax when the zero rate is not confirmed.

In the same sections, report on exports to member states of the Customs Union. For the purposes of calculating VAT for Russian organizations, the following is equivalent to the export of goods:

- manufacturing of goods intended for export to countries participating in the Customs Union (clause 9 of Appendix 18 to the Treaty on the Eurasian Economic Union);

- transfer of goods under a leasing agreement, which provides for the transfer of ownership to the lessee, as well as under trade credit or trade loan agreements (clause 11 of Appendix 18 to the Treaty on the Eurasian Economic Union).

What are “Commodities” for VAT purposes from July 2021

For Russian taxpayers, from July 2021, the concept of raw materials appeared in the Tax Code of the Russian Federation” for the purpose of calculating VAT, disclosed in paragraph 10 of Article 165 of the code:

Commodities include mineral products, chemicals and related industries, wood and wood products, charcoal, pearls, precious and semi-precious stones, precious metals, base metals and products thereof.

Codes for types of raw materials are established in accordance with the unified Commodity Nomenclature for Foreign Economic Activity of the Eurasian Economic Union and are determined by the Government of the Russian Federation.

04/18/2018 The Government of the Russian Federation has approved a list of codes for types of raw materials for the purpose of calculating VAT on exports.

Read the text of the resolution here.

For reference:

The Unified Commodity Nomenclature for Foreign Economic Activity of the Eurasian Economic Union and the Unified Customs Tariff of the Eurasian Economic Union were approved by a decision of July 16, 2012 of the Council of the Eurasian Economic Commission.

Section 4

In section 4, reflect export transactions for which the right to apply the zero rate has been confirmed. Indicate in it:

- on line 010 – transaction code;

- on line 020 – for each transaction code, the tax base for confirmed export transactions;

- on line 030 – for each transaction code, the amount of deductions of input VAT on goods (work, services) used to conduct confirmed export transactions;

- on line 040 - for each transaction code, the amount of VAT previously calculated for these transactions when the export had not yet been confirmed;

- on line 050 – for each transaction code, the recoverable amount of input VAT previously accepted for deduction when the export had not yet been confirmed.

Lines 040 and 050 of Section 4 must be completed if the organization was previously unable to confirm the export on time.

Fill in lines 070 and 080 when returning goods for which the right to apply a zero rate has not been confirmed. On line 070, reflect the amount of adjustment to the tax base, and on line 080, the amount of adjustment of tax deductions. These lines must be completed in the tax period in which the exporting organization recognized the return of goods (the parties agreed on the return).

If the price of exported goods for which a zero rate was confirmed has changed, indicate the adjustment amounts on lines 100 (if increasing) and 110 (if decreasing). Reflect the adjustment in the tax period in which the exporting organization recognized the price change.

On line 120, reflect the amount of tax to be reimbursed:

| Line 120 = (Lines 030 + Lines 040) – (Lines 050 + Lines 080) |

On line 130, reflect the amount of tax payable:

| Line 130 = (Lines 050 + Lines 080) – (Lines 030 + Lines 040) |

This is stated in section IX of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Situation: how to reflect in section 4 of the VAT return the amount of VAT on the cost of services of a customs broker who carries out customs clearance for the export of goods? The broker works under a fee-based service agreement. Different VAT rates are established for exported goods

The amount of tax deduction for brokerage services must be distributed.

Customs brokerage services may be subject to VAT either at a zero rate or at a rate of 18 percent. The zero rate can only be applied if the broker provides services under a transport forwarding agreement when organizing international transportation. This was stated in the letter of the Ministry of Finance of Russia dated August 14, 2015 No. 03-07-08/46977. In the situation under consideration, there is no such agreement, so the tax rate of 18 percent applies. Since the input tax presented by the broker simultaneously applies to goods subject to VAT at different rates, when filling out section 4, its amount must be distributed.

The fact is that section 4 reflects:

- with code 1011410 – operations for the export of goods for which the VAT rate is set at 18 percent;

- with code 1011412 – operations for the export of goods for which the VAT rate is set at 10 percent.

Transaction codes are indicated on line 010 of section 4 of the VAT return. Line 020 of this section reflects the tax base for confirmed export operations, and line 030 - the amount of tax deductions for goods (work, services) used to carry out these operations.

Such instructions are contained in paragraphs 41.1–41.3 of the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Nothing is said about the reflection of tax deductions for goods (work, services) that simultaneously relate to transactions with codes 1011410 and 1011412 in the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. However, in order to correctly fill out the declaration, the amount of such tax deductions should be distributed proportionally to the tax bases for transactions with codes 1011410 and 1011412. To do this, use the following formulas:

| The amount of tax deduction for goods (work, services) used in the sale of goods for export, not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation | = | The amount of tax deduction for goods (work, services) used in the sale of goods for export, specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation __________________________________________ | × | The cost of goods sold for export not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation |

| The total cost of goods sold for export, specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation |

| The amount of tax deduction for goods (work, services) used in the sale of goods for export, specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation | = | The amount of tax deduction for goods (work, services) used in the sale of goods for export, specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation | – | The amount of tax deduction for goods (work, services) used in the sale of goods for export, not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation |

The amounts of tax deductions received after distribution should be reflected on line 030 of section 4 of the VAT return according to the corresponding transaction code.

An example of reflecting in section 4 of a VAT return the amount of VAT on the cost of brokerage services related to the export of goods specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation

Alpha LLC entered into a contract for the supply to Finland of:

- children's clothing made of natural sheepskin and rabbit (the VAT rate is set at 10% (paragraph 3, subparagraph 2, paragraph 2 of Article 164 of the Tax Code of the Russian Federation));

- products made of genuine leather and natural fur (VAT rate is set at 18%).

The total cost of the export contract is 16,000,000 rubles. At the same time, the cost of children's clothing is 3,200,000 rubles, the cost of products made from genuine leather and natural fur is 12,800,000 rubles.

For customs clearance of goods, Alpha used the services of a customs broker. The cost of brokerage services amounted to 118,000 rubles, including VAT - 18,000 rubles.

Within the prescribed period, the organization collected all the necessary documents confirming the right to apply the zero tax rate. The amount of VAT on the cost of brokerage was distributed in proportion to the cost of children's clothing and products made from genuine leather and natural fur.

In section 4 of the VAT return, Alpha’s accountant indicated:

1) on the line with code 1011410 (sales of goods not specified in clause 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – 12,800,000 rubles;

- on line 030 (tax deductions) – 14,400 rubles. (RUB 18,000: RUB 16,000,000 × RUB 12,800,000);

2) on the line with code 1011412 (sales of goods specified in clause 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – RUB 3,200,000;

- on line 030 (tax deductions) – 3600 rubles. (RUB 18,000 – RUB 14,400).

Documents for the supply of goods to the EAEU countries

The composition of the documents required for the shipment of goods for export is determined by the direction of export (EAEU countries, export outside the Customs Union), the contract (delivery, commission, transportation, etc.), the terms of the contract (which buyer requires the composition of documents, delivery method, storage, etc.), goods (require certificates, customs declarations - DT, etc.).

Since state control during the movement of goods, works, and services between the states of the EAEU has significant features, and at the same time, each state has its own characteristics, each time when concluding an agreement for the supply of goods from Russia to Kazakhstan, Belarus, Armenia and Kyrgyzstan, it is necessary to clarify (form ) an up-to-date list of required documents, and distribute the responsibilities for preparing the necessary documents between the supplier and the buyer.

For example, if a Russian supplier-exporter delivers to a buyer’s warehouse in Kazakhstan, the preparation of transport and shipping documents is the responsibility of the Russian supplier-exporter. If the goods are picked up by a Kazakhstani buyer from the supplier’s warehouse in Russia, the transport documents are prepared by the buyer.

Documents for exporting goods to Kazakhstan include:

- Goods (invoices, certificates, if the goods are from foreign countries - customs declarations (CD), etc.)

- Settlement (Documents for payment for goods - payment orders, etc.)

- Transport (consignment notes, waybills)

- Tax (Invoices, invoices, applications for the import of goods and payment of indirect taxes and excise taxes, etc.)

The list of documents for export can be read here.

How to Confirm export to Kazakhstan, Belarus, Armenia and Kyrgyzstan, read here

How to fill out an international CMR consignment note

Return of imports from Kazakhstan, Belarus - VAT registration

05 August 2021

Tax lawyer Gordon Andrey Eduardovich

Section 5

Section 5 should be completed in the declaration for the period when the right to deduct VAT on export transactions (previously confirmed and not confirmed) arose. For example, if you previously collected documents and confirmed the zero rate, but did not fulfill the conditions for applying the deduction.

On line 010, indicate the year in which the declaration was submitted, which reflected transactions for the sale of goods. On line 020 - tax period code in accordance with Appendix No. 3 to the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Fill out Section 5 separately for each tax period, information about which is reflected in the indicators on lines 010 and 020.

Please indicate:

- on line 030 – transaction code;

- on line 040 - the tax base relating to already confirmed export transactions (i.e. for which Section 4 was submitted to the tax office, but which could not be accepted for deduction at that moment);

- on line 050 – the amount of input VAT related to confirmed exports;

- on line 060 - the tax base related to unconfirmed exports (i.e. for which Section 6 had already been submitted to the tax office, but which could not be accepted for deduction at that moment, for example, in the absence of an invoice);

- on line 070 – the amount of input VAT related to unconfirmed exports.

Such instructions are contained in section X of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

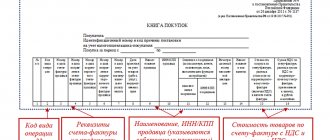

Codes in books and magazines on VAT

It is important not to confuse the codes in question with those that characterize the filling out of various accounting documents by VAT payers - books and magazines. The fact is that they use a different code - a number that corresponds to the name of one or another action of the taxpayer that has economic significance from the point of view of assessing the content of the accounting document, which in the prescribed manner can be transferred to the Federal Tax Service of the Russian Federation. This code facilitates the systematization and subsequent interpretation by tax service specialists of the contents of VAT accounting documents.

Section 6

Section 6 is intended to reflect transactions for which the deadline for submitting documents confirming the right to apply the zero VAT rate has expired.

The duration of this period is 180 calendar days. For exported goods, the 180-day period is counted:

- from the date of shipment (for deliveries to countries participating in the Customs Union) (clause 5 of Appendix 18 to the Treaty on the Eurasian Economic Union);

- from the date of placing goods under the customs export procedure (for deliveries to other countries) (clause 9 of article 165 of the Tax Code of the Russian Federation).

In relation to work (services) related to the export of goods (import of goods into Russia), the procedure for determining the 180-day period depends on the type of work (service).

On line 010, enter the operation code. For each transaction code, fill in lines 020–040.

On line 020 reflect the tax base.

On line 030, indicate the amount of VAT calculated based on the tax base on line 020 and the VAT rate (10 or 18%).

Line 040 reflects the amounts of tax deductions:

- input VAT paid to the seller;

- VAT paid when importing goods into Russia;

- VAT paid by the tax agent when purchasing goods, works, services.

Fill in lines 050–060 only on the first page, and put dashes on the rest.

On line 050, reflect the total amount of VAT (the sum of all lines 030 for each transaction code).

For line 060, enter the summed indicator of lines 040 for each transaction code.

If the buyer returned some of the goods to the exporter, fill in lines 080–100:

- on line 080 – the amount by which the tax base is reduced;

- on line 090 – VAT adjustment (the amount by which the calculated VAT is reduced);

- on line 100 – the amount of VAT that needs to be restored (previously accepted for deduction).

If you increase or decrease the price, fill in lines 110–150:

- on line 120 - the amount by which the tax base is increased;

- on line 130 – the amount by which VAT is increased;

- on line 140 – the amount by which the tax base is reduced;

- on line 150 – the amount by which VAT is reduced.

Calculate the amount of VAT payable to the budget for line 160 as follows:

| Line 160 = (line 050 + line 100 + line 130) – (line 060 + line 090 + line 150) |

Calculate the VAT refund amount for line 170 as follows:

| Line 170 = (line 060 + line 090 + line 150) – (line 050 + line 100 + line 130) |

Please take into account the amounts of VAT payable (reduced) reflected in sections 4–6 when filling out section 1 of the VAT return (clauses 34.3, 34.4 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558) .

New in invoicing since July 2016

Invoices are the basis for accepting tax amounts presented to the buyer by the seller for deduction when the requirements established by clauses 5, 5.1 and 6 of this article are met (clause 2 of Article 169 of the Tax Code of the Russian Federation).

Since July 2021, paragraph 5 of Article 169 of the Code has been supplemented with subparagraph 15, according to which invoices issued by Russian entrepreneurs and organizations must have new details:

code of the type of product in accordance with the unified Commodity Nomenclature for Foreign Economic Activity of the Eurasian Economic Union. The information provided for in this subparagraph is indicated in relation to goods exported outside the territory of the Russian Federation to the territory of a member state of the Eurasian Economic Union.

In our opinion, the absence of new invoice details can be considered by the tax authority as a basis for refusing a deduction, since it does not allow identification of the goods, and therefore, taking into account Law 150-FZ, and the procedure for applying deductions when exporting goods.

Material on the topic of issuing invoices: Registration of the Universal Transfer Document https://new.gordon-adv.ru/articles/universalnyy-per...tochnyy-dokument/

Sections 8 and 9

In section 8, enter information from the purchase book for those transactions for which the right to deduction arose in the reporting quarter.

In section 9 of the declaration, indicate information from the sales book. For more information on the procedure for filling out sections 8 and 9, see How to draw up and submit a VAT return.

If changes have been made to the purchase book or sales book, you will need to fill out Appendix 1 to sections 8 and 9.

An example of filling out a VAT return for export transactions

Alpha LLC is registered in Moscow and is engaged in the production of furniture (OKVED code 36.1). The organization did not carry out any transactions on the domestic market that should be reflected in the VAT return for the first quarter of 2021.

Alpha has a long-term contract for the supply of furniture of its own production to Finland.

In January 2021, under this contract, Alpha supplied:

- children's beds (VAT rate - 10%) (paragraph 5, subparagraph 2, paragraph 2 of Article 164 of the Tax Code of the Russian Federation) - in the amount of 7,800,000 rubles;

- wooden cabinets (VAT rate - 18%) - in the amount of 10,000,000 rubles.

The total cost of the export contract was 17,800,000 rubles.

For customs clearance of goods, Alpha used the services of a customs broker. The cost of brokerage services amounted to 141,600 rubles, including VAT - 21,600 rubles.

In February 2021, the organization collected all the necessary documents confirming the right to apply a zero tax rate, and accepted for deduction the amount of input VAT presented to it when purchasing materials for the manufacture of export products:

- from the cost of materials for children's beds - 57,800 rubles;

- from the cost of materials for wooden cabinets - 89,350 rubles.

The amount of VAT on the cost of brokerage was distributed in proportion to the cost of children's beds and wooden cabinets. The amount of VAT accepted for deduction for each product item is:

- for cabinets - 12,135 rubles. (RUB 21,600 × RUB 10,000,000: (RUB 7,800,000 + RUB 10,000,000));

- for beds – 9465 rub. (RUB 21,600 × RUB 7,800,000: (RUB 7,800,000 + RUB 10,000,000)).

In February 2021, Alpha received an invoice for transportation costs (cost - 118,000 rubles, including VAT - 18,000 rubles) for an export transaction completed in November 2015. Then the organization sold products worth RUB 2,360,000. (including VAT – 360,000 rubles). A package of documents confirming the application of a 0 percent rate for this operation was collected in December 2015; the amount of deduction for raw materials and supplies spent on the production of export products is reflected in the VAT return for the fourth quarter of 2015.

In addition, in February 2021, Alpha expired the period (180 calendar days) allotted for collecting documents confirming the application of the zero VAT rate for the export transaction completed in the third quarter of 2015. The organization’s accountant charged VAT at a rate of 18 percent on unconfirmed export proceeds. At the same time, he prepared an updated VAT return for the third quarter of 2015. In addition to the information previously reflected in the declaration, the accountant filled out section 6. In it, for the transaction with code 1010401, he showed the tax base (912,300 rubles), the accrued amount of VAT (164,214 rubles) and the amount of tax deduction (90,000 rubles).

The Alpha accountant began filling out the VAT return for the first quarter of 2021 with the title page. On it he indicated general information about the organization, as well as the tax office code and the code for the location of the organization - 214.

Then the accountant filled out section 4, in which he indicated:

1) according to code 1010410 (sale of goods not specified in clause 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – 10,000,000 rubles;

- on line 030 (tax deductions) – 101,485 rubles. (RUB 89,350 + RUB 12,135);

2) according to code 1010412 (sales of goods specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – RUB 7,800,000;

- on line 030 (tax deductions) – 67,265 rubles. (RUB 57,800 + (RUB 21,600 – RUB 12,135));

3) on line with code 120:

- RUB 168,750 – the amount of tax calculated for reduction under this section.

After this, the accountant filled out section 5. In it, he indicated the amount of VAT accepted for deduction on transport services in the amount of 18,000 rubles.

The accountant finished drawing up the declaration by filling out section 1. In it, he indicated the total amount of tax to be reimbursed under the declaration - 186,750 rubles. (RUB 168,750 + RUB 18,000).

The VAT return for the first quarter of 2021, signed by the General Director of Alpha Lvov, was submitted by the organization to the tax office on April 22, 2015.

Situation: when do you need to submit a VAT return for export transactions?

Submit sections of the declaration provided for export operations as part of the general tax return.

Starting from January 1, 2015, submit VAT returns to the inspectorate no later than the 25th day of the month following the expired tax period (clause 5 of Article 174 of the Tax Code of the Russian Federation). The expired tax period should be understood as the quarter in which the organization collected documents confirming the right to apply the zero tax rate. Submit supporting documents at the same time as your declaration.

To collect documents confirming the right to apply the zero VAT rate, the organization is given 180 calendar days:

- from the moment of release of goods in the export procedure to countries that are not members of the Customs Union;

- from the moment of shipment of goods to a country that is a member of the Customs Union.

This period is established by paragraph 9 of Article 165 of the Tax Code of the Russian Federation, paragraph 5 of Appendix 18 to the Treaty on the Eurasian Economic Union.

The end of the 180-day period allotted for collecting documents is not associated with the established deadline for filing the declaration, but with the tax period in which this period expires. If the complete package of supporting documents is collected by the organization within a period not exceeding 180 calendar days, reflect export transactions in section 4 of the VAT return for the tax period in which the day the documents were collected falls. Regardless of the fact that this day is not the end of the tax period.

For example, the 180-day period allotted for collecting documents expires on November 20, 2015. In fact, the documents necessary to confirm the right to a zero VAT rate were collected on October 15, 2015. In this case, the right to apply a zero tax rate must be declared in the VAT return for the fourth quarter of 2015, which must be submitted no later than January 25, 2021. If the documents had been collected at least a day later (November 21, 2015), then the organization would not have had any grounds to reflect the export operation in the declaration for the fourth quarter.

This conclusion is confirmed by letters of the Ministry of Finance of Russia dated April 17, 2012 No. 03-07-08/108, dated October 6, 2010 No. 03-07-15/131 and dated June 3, 2008 No. 03-07-08/137 .

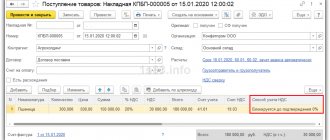

Receipt of advance payment

The receipt of partial payment for the upcoming delivery of goods (operation 3.1 “Receipt of advance payment from the buyer”) is reflected in the program using the document Receipt to the current account with the transaction type Payment from the buyer, which is generated:

- based on the document Invoice for payment to the buyer (menu Sales -> Sales, document log -> Invoices for payment to the buyer);

- or by adding a new document to the Bank statements list (menu Bank and cash desk -> Bank, document journal -> Bank statements).

As a result of posting the document, the following accounting entry is entered into the accounting register:

Debit 51 Credit 62.02 - for the amount of the received prepayment, which is 600,000.00 rubles.

In accordance with paragraph 1 of Article 154 of the Tax Code of the Russian Federation, upon receipt by the taxpayer of payment, partial payment for upcoming supplies of goods (performance of work, provision of services), which are taxed at a tax rate of 0% in accordance with paragraph 1 of Article 164 of the Tax Code of the Russian Federation, such payment to the tax the base does not turn on. Consequently, the seller does not have the obligation to calculate VAT on the received advance payment amount and prepare an invoice.

Read new:

Get ready! New requirements for foreign trade contracts in 2018

From July 2021, the procedure for calculating Value Added Tax (VAT) by Russian exporters . Now the VAT taxation procedure depends on the category of the exported product and the date it was accepted for accounting.

From the same time, invoices for export goods must contain new (additional) information.

As is known, Russian exporters calculate the amount of value added tax (VAT) on operations of selling goods for export, separately for each such operation, as a percentage of the tax base corresponding to the tax rate (clause 6 of Article 166 of the Tax Code of the Russian Federation). There have been no changes in this part. But if exporters have unsold goods left by July 1, 2021, you should be careful during subsequent shipments: VAT taxation on the export of goods accepted for accounting before July 1 and after will be different.