The concept of sales of goods, works or services

The sale of products and services is regulated by tax legislation, namely Article 39 of the Tax Code of the Russian Federation. Legal regulation of the sale of goods, works, and services is carried out by the Tax and Civil Codes of the Russian Federation.

The definition of the concept of implementation is presented in Chapter 39 of the Tax Code of the Russian Federation. The chapter determines that sales can only be carried out by organizations and individual entrepreneurs. It is carried out on a reimbursable basis through the transfer of funds or the exchange of goods and services.

In other words, the rights to the property are transferred to the buyer. It is also possible to transfer services free of charge from one person to another. This implementation method is often used when working with non-profits and social enterprises.

The Tax Code of the Russian Federation gives the following definition: the sale of products, work or services by entities (organization or individual entrepreneur) is a paid transfer of property rights in the form of goods or results of the provision of services from one person to another person. The conditions for implementation and its types are provided for by the Tax Code.

Transfer of property rights free of charge is also possible, but only in cases where the transfer is secured by agreement. Such relations are also regulated by the norms of the Tax Code of the Russian Federation and the Civil Code of the Russian Federation.

For tax purposes, for accounting purposes, cost and profit are determined and a statement is drawn up that contains entries for all sales transactions.

To correctly draw up a document, an accountant or company manager must reliably determine cost and profit and make entries. Based on the results of such operations, the final profit (before tax) is determined, which is the subject of income tax.

Cost is the sum of all sales costs - raw materials, wages and related costs for the sale of goods, works and services. The correct preparation of tax returns for income tax, VAT, etc. depends on the correct posting to cost.

Violations in tax calculations entail penalties in the form of fines and penalties.

Accounting for the implementation process

In accounting, the implementation of a particular business transaction is described using correspondence accounts. It is already known that the initial position of inventory items in the warehouse is fixed on 41 accounts. But where do the funds go next, describing the fact of sale?

Regardless of the type of trade and the focus of the enterprise, the implementation process and its results are described by account 90 in accounting. Its subaccounts are designed to collect information both on the amount of revenue and on the amounts of VAT, cost of goods sold and summing up the overall financial result.

Account 90 in accounting is active-passive, the credit indicates the amounts that increase the income of the enterprise, and the debit indicates the results of expenses. It is here that goods sold are written off from account 41 and distribution costs (account 44).

Place and moment of actual sale of goods, works or services

The definition of the second part of the Tax Code of the Russian Federation establishes the place and moment of actual implementation for individual taxes. The basis of Article 147 of the Tax Code of the Russian Federation recognizes the territory of the Russian Federation as the place of sale of products if the following clause is present: the goods must be located on the territory of Russia or in territories under the jurisdiction of the country, and it must be in the process of shipment and transportation.

In other words, the procedure for transferring goods that are transported or shipped to the seller is already controlled by the legal requirements for the sales operation.

Some differences are implied in the implementation of works and services, since these procedures are intangible. The territory of Russia is recognized as a place of sale of services in the following cases:

- if the work is related to real estate in the country (installation, restoration, repair work);

- if the work is related to movable property (cars, trucks, ships and aircraft on the territory of the Russian Federation (assembly, installation, processing and maintenance);

- services provided on the territory of the Russian Federation in the field of art, education, sports and tourism;

- the recipient of works and services carries out work on the territory of Russia.

The buyer’s place of business is recognized as the basis of his actual location on the territory of the Russian Federation on the basis of state registration documents.

In Determination No. 414-O dated November 24, 2005, the Constitutional Court of the Russian Federation indicates that paragraph 1 of Article 39 of the Tax Code of the Russian Federation cannot be considered as a provision that limits or violates the rights of taxpayers. The article is not of an independent regulatory nature.

The moment of sale for tax purposes is the date of receipt of income, regardless of their actual receipt in the seller’s accounts.

Accounting for inventory items for sale

Generalized information about the availability of goods and their movement is contained in account 41. Its use in accounting is typical for trade, supply, and distribution enterprises and catering organizations. Industrial organizations use it very rarely and only in cases where it is necessary to take into account products, the cost of which is reimbursed separately by buyers.

Accounting for goods on account 41 can be carried out both at purchase and sale cost. If the receipt is registered using sales prices, an additional account 42 is opened, in which the amount of the markup is reflected.

What is recognized as the sale of goods, works or services

The following operations are recognized as sales of products, services and works for business tax purposes:

- transfer of ownership rights to goods on a reimbursable basis, including exchange;

- transfer of ownership rights to the results of work from one person to another;

- provision of services on a reimbursable basis;

- provision of services free of charge or transfer of ownership rights free of charge. At the same time, VAT is still calculated on such transactions (according to Article 146 of the Tax Code of the Russian Federation).

For example, a gift agreement, under which one of the parties transfers ownership or property rights to third parties free of charge. This operation is also recognized as a sale, which means an object of taxation arises (personal income tax and VAT).

For income tax (as opposed to VAT), sales income is recognized as proceeds from the sale of goods, proceeds from the sale of property rights and services. That is, in order to determine profit as an object of taxation, revenue is necessary, since transactions on a gratuitous basis are deprived of such an opportunity.

Accounting for implementation purposes is carried out according to regulatory documents unified by the state.

All operations have postings that determine the cost and profit on sales. At the same time, he draws up a statement indicating the amount of each specific transaction.

Identified violations of the legislation on accounting for sales transactions make it possible to determine the location of the violation in order to avoid tax penalties in the future.

We make adjustments to sales and postings

Often in the activities of companies there are situations in which it is necessary to make adjustments to sales transactions of previous periods. Eg:

- the buyer requested a price reduction due to the identification of discrepancies in the characteristics of the already shipped and paid for goods;

- low-quality or defective products from previous months have been returned;

- inaccuracies and errors in accounting due to the fault of responsible persons were identified;

- the companies agreed to provide additional discounts after payment and shipment of goods and materials, provision of services;

- Discounts not specified in the contract were provided by mistake by managers.

In such cases, the accountant should prepare special accounting entries. Moreover, corrections should be made taking into account the result of the implementation. That is, when an adjustment is made upward, additional accrual entries are made similar to those indicated above, and if an adjustment is made downward, a different procedure will apply.

What is not recognized as the sale of goods, works or services

The Tax Code of the Russian Federation establishes operations that are not recognized as sales:

- currency circulation;

- transfer of property of the organization during reorganization;

- transfer of investment funds: deposits, shares;

- transfer of fixed assets to non-profit companies, if the latter are not engaged in entrepreneurial activities;

- return of the initial contribution to the participants of the companies upon their withdrawal from the membership;

- transfer of municipal residential real estate to individuals;

- other operations provided for by the Tax Code.

Types of services

The result of work performed and services provided is included in the implementation. Such relations are regulated by the Civil Code of the Russian Federation under Chapter 37. Sales arise when concluding a purchase and sale agreement or a work contract. In addition, there are other types of contracts.

Modern legislation defines three types of services: actual, legal and financial. In addition to the listed types of contracts, the following are recognized as implementation:

- income from rental property;

- exchange transactions without concluding a contract;

- transfer of property rights of the organization on account of dividends (for VAT);

- receipts when calculating taxes using the simplified tax system;

- transfer of goods to pay off debts.

Operations for the return of debt funds are not recognized as sales for VAT purposes.

Earnings example

70% of retail take goods for sale from the manufacturer . If previously individual entrepreneurs took risks by purchasing goods in bulk from an intermediary or manufacturer, now you can take the goods for sale and remain calm in case of failure. An example is the sale of costume jewelry.

Representatives of the fair sex rarely pass by bright boutiques with jewelry, especially if it is made by hand. The peak of sales falls in the warm season, the target audience is young ladies. The product does not deteriorate and sells out very quickly, so this is an ideal option for making money.

In this case, the principal may be small family contracts that produce home decorations. They set the amount they want to receive from each unit sold, and the commission agent sets a percentage or fixed amount as a reward.

for both parties to cooperate for several reasons: the owner can calmly do what he loves - create, and the commission agent can sell, adding his percentage and extracting maximum profit.

Minuses

The commissioner independently pays for the point or office through which he will carry out sales. Therefore, opening such a business often requires a large starting budget.

In case of unsuccessful cooperation, the commission agent loses time and suffers the main loss - he does not recoup the cost of renting the premises.

However, there is another type of sales that does not require premises - selling goods in apartments and offices, but today it is no longer relevant, since there are social networks.

Composition of financial services

A financial service is a service whose control base is determined by Articles 807, 834 and 927 of the Civil Code of the Russian Federation. These services include:

- services for providing loans and credits;

- services for registration of deposits and shares;

- insurance and assignment of monetary claims (collection) services.

Thus, implementation is a complex legal procedure, so its production requires a good knowledge of the law. The basis for determining taxes for business purposes is recognized as such according to Articles 39-41 of the Civil Code of the Russian Federation.

When calculating income tax, VAT and other types of taxes and fees, any taxpayer must rely on tax legislation.

Author of the article

Creating a Sales Document

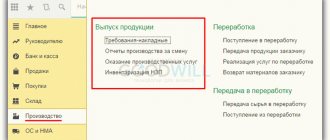

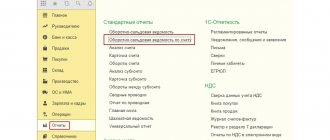

In the “Sales” subsection of the “Sales” menu, select the “Sales (acts, invoices)” item.

Create a new document in 1C 8.3 by selecting the appropriate item in the “Implementation” menu. In this example, we select the “Products (invoice)” item.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Select a counterparty from the directory. The “Agreement” field will be filled in automatically. If this does not happen, add it to 1C. In the contract, indicate the currency, price type and bank details.

If you have not filled out the bank details of your organization, the program will display a corresponding message in the header of the document.

Let's move on to filling out the tabular part of the document. You can do this line by line and using the “Selection” button. The second option is more convenient, as it displays the remaining quantity.

A form for selecting items will open in front of you. On the left side you will see the hierarchy of groups in the “Nomenclature” directory. The right tabular part displays item items indicating the amount of stock remaining in the warehouse. For convenience, there are two modes: “Only leftovers” and “All”. The first mode displays only those positions for which there is a positive balance.

To select specific product items, double-click on them with the left mouse button. In the window that appears, specify the quantity and selling price. Once you are done with the selection, click on the “Move to Document” button.

All goods are transferred to a document with automatic substitution of invoices. Now you can post the document and create an invoice based on it, which is filled out automatically.

For detailed instructions on how to register the sale of goods in 1C, watch the video: