From time to time, every legal entity or individual may need to find out the code of the tax authority to which

A limited liability company is a commercial entity created to make a profit. Get yours

A waybill for a truck of an individual entrepreneur or organization is a document that the organization needs

2.1. Non-stationary trading network Let us turn again to the Tax Code of the Russian Federation, according to Art. 346.27 of which

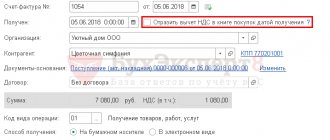

Accounting of funds in the current account is carried out in order to ensure the correct reflection of settlement, cash, credit

The situation often arises that before the beginning of the year, for various reasons, changes are made to the Accounting

As you know, “children’s” benefits are accrued upon the birth of a child. As noted

Author: Ivan Ivanov Unfinished construction are those costs incurred by the developer during the construction of real estate

Accounting for receipt of materials Receipt of materials to the warehouse is reflected in accounting account 10 “Materials”. Debit

From January 1, 2021, UTII will be abolished, so many legal entities are thinking about how to replace the usual