Payment for sanatorium-resort treatment for an employee is financial assistance from an employer who is ready to spend money on restoring the health of subordinates. Starting from 2021, employer expenses for paying for employee health vouchers are taken into account when calculating income tax. Let's understand the intricacies of the situation.

In the past, employer payments for spa treatment were very rare. Employers could not take costs into account when taxing, so employees were rarely paid for health vouchers. Since January 2021, officials have adjusted fiscal legislation. Now expenses for the health of subordinates can be included in expenses when calculating income tax and the simplified tax system of 15% (clause 24.2 of article 255 of the Tax Code of the Russian Federation).

Updates in legislation should lead to several positive changes in the lives of taxpayers and the country's economy. Firstly, it is improving the quality of life of workers, as well as members of their families. Secondly, this is the development of Russian tourism. Thirdly, it is a benefit for the employer. Previously, it was not possible to take into account costs when taxing OSNO and simplified tax systems.

Accounting: purchasing vouchers

If the organization purchased the vouchers on its own, take them into account in a separate subaccount 50-3 “Cash documents” (Instructions for the chart of accounts).

Reflect the receipt of vouchers from the seller (for example, from a country stationary children's health camp) by posting:

Debit 50-3 Credit 76 (60)

– vouchers have been received (based on the invoice).

Vouchers will be received at the cost of their purchase (Instructions for the chart of accounts).

Sanatorium and resort institutions do not pay VAT (subclause 18, clause 3, article 149 of the Tax Code of the Russian Federation). Therefore, this tax is not included in the price of the tour.

If vouchers, for example, to children's sanatoriums and health camps, are purchased from a travel agent, then the price may include VAT on the amount of the agent's remuneration (clause 2 of Article 156 of the Tax Code of the Russian Federation). Since vouchers are not used in transactions subject to VAT, do not deduct the input tax, but include it in their cost (subparagraph 4, paragraph 2, article 170 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated July 25, 2005 No. 03-04-11 /174, dated March 16, 2006 No. 03-05-01-04/68).

Accounting: issuing vouchers

The procedure for accounting for the issuance of vouchers purchased (received) by an organization depends on the sources of their payment:

- at the expense of the employee;

- at the expense of the organization;

- through contributions for insurance against accidents and occupational diseases.

The cost of vouchers purchased by the organization independently can be written off either at the expense of the employee or at the expense of the organization’s own funds. In addition, the cost (part of the cost) of vouchers purchased for the children of employees can be compensated from the regional budget.

If the cost of the trip (part of it) is paid by an employee of the organization, make the following entries in your accounting:

Debit 73 Credit 50-3

– the cost of the trip is reflected, subject to reimbursement at the expense of the employee;

Debit 50 (70) Credit 73

– the cost of the voucher is paid into the cash register (deducted from the salary).

If an organization purchases a voucher at its own expense, there are two options. You can use the retained earnings of the current year or the retained earnings of previous years to pay for the trip. Include the cost of the trip among other expenses:

Debit 73 Credit 50-3

– reflects the cost of the voucher issued to the employee;

Debit 91-2 Credit 73

– the cost of the trip is written off from the current year’s profit.

Such entries must be made regardless of whether the retained earnings of previous years or the current year are used to pay for the trip (including profits based on the results of a quarter, half a year, or nine months). The fact is that such expenses cannot be reflected using account 84. These will be other expenses that also affect the financial result of the organization. Accordingly, such expenses must be reflected in the debit of account 91-2. Similar explanations are given in letters of the Ministry of Finance of Russia dated December 19, 2008 No. 07-05-06/260 and dated June 19, 2008 No. 07-05-06/138.

An example of how transactions related to the purchase and issuance of a voucher are reflected in accounting. The organization purchased the ticket independently. The cost of the trip is reimbursed from retained earnings

When distributing net profit for 2014, at the general meeting of shareholders of Alpha LLC, it was decided to reserve 80,000 rubles. to pay for travel vouchers for employees in 2015. On May 18, 2015, “Alpha” purchased a ticket to a year-round children’s health camp for the child of the organization’s manager A.S. Kondratieva. The cost of the tour is 18,400 rubles, the duration of the holiday is 21 days.

On May 22, 2015, the permit was issued to Kondratiev. The calculation of the cost of a trip paid from retained earnings is documented in an accounting certificate.

The following entries were made in the organization's records.

May 18, 2015 (receiving a voucher from the seller):

Debit 50-3 Credit 76 – 18,400 rub. – a voucher was purchased for the child of an employee of the organization;

Debit 76 Credit 51 – 18,400 rub. – the cost of the tour has been paid to the seller.

May 23 (issuance of a voucher to an employee):

Debit 73 Credit 50-3 – 18,400 rub. – reflects the cost of the voucher issued to the employee;

Debit 91-2 Credit 73 – 18,400 rub. – the cost of the trip was written off from retained earnings from previous years.

Accounting: compensation from the regional budget

The cost (part of the cost) of vouchers purchased at the expense of the organization for the children of employees can be compensated by the regional budget. When receiving such compensation, make the following entries in your accounting:

Debit 76 Credit 91-1

– the budget debt for the amount of compensation for the cost of vouchers is reflected;

Debit 51 Credit 76

– the amount of compensation for the cost of vouchers purchased by the organization was received from the budget.

This conclusion can be made by the provisions of paragraph 10 of PBU 13/2000.

Insurance premiums

Situation: is it necessary to charge insurance premiums on the cost of travel packages that the organization purchased for an employee?

Answer: yes, it is necessary, regardless of the source of funding.

The fact is that payment of the cost of employee vouchers at the expense of the employer is not mentioned in the closed lists of payments not subject to insurance contributions (Article 9 of the Law of July 24, 2009 No. 212-FZ, Article 20.2 of the Law of July 24, 1998 No. 125-FZ). Therefore, contributions must be calculated on such amounts. Similar clarifications are in letters of the Ministry of Labor of Russia dated December 5, 2013 No. 17-3/2055 and the Federal Social Insurance Fund of Russia dated November 17, 2011 No. 14-03-11/08-13985.

Let us add that the source of funding is not important. That is, insurance premiums must be charged, even if contributions for insurance against accidents and occupational diseases are spent for these purposes. We are talking about a situation where an organization purchased vouchers for sanatorium and resort treatment for people who work in harmful or dangerous conditions. And in the future, the employer counted the money spent towards the payment of contributions “for injuries”. This is exactly what the FSS of Russia thinks (letter dated April 14, 2015 No. 02-09-11/06-5250).

Advice: the organization may not charge insurance premiums when paying for a trip to a sanatorium-resort treatment for an employee. But be prepared to argue with the inspectors. The following arguments will help.

Insurance premiums are charged only for payments within the framework of labor relations and civil contracts (Part 1, Article 7 of the Law of July 24, 2009 No. 212-FZ, Clause 1 of Article 20.1 of the Law of July 24, 1998 No. 125- Federal Law). Payment for vouchers for sanatorium-resort treatment cannot be classified as such. After all, this is a social payment, which is based on a collective agreement, is not stimulating, does not depend on the qualifications of employees, complexity, quality, quantity, conditions of the work itself, and is not remuneration for employees. This means that there is no need to pay insurance premiums for it. The judges also agree with this (see, for example, the ruling of the Supreme Court of the Russian Federation dated February 19, 2021 No. 303-KG15-20158, the resolution of the Arbitration Court of the Far Eastern District dated October 22, 2015 No. F03-4566/2015, the Federal Antimonopoly Service of the Ural District dated July 2, 2014 No. F09-3724/14, Volga District dated June 23, 2014 No. A72-14159/2013, Central District dated April 3, 2014 in case No. A14-2025/2013, etc.).

However, given the position of the regulatory agencies, the organization will most likely have to defend its point of view in court.

Situation: is it necessary to charge insurance premiums on the cost of travel packages that the organization purchased at its own expense for minor children of employees and other members of their families?

Answer: no, it is not necessary.

Contributions to compulsory pension (social, medical) insurance are accrued for any remuneration (in cash and in kind) paid to employees:

- within the framework of labor relations;

- under civil law contracts, the subject of which is the performance of work, provision of services;

- under copyright contracts.

This procedure is provided for in Part 1 of Article 7 of the Law of July 24, 2009 No. 212-FZ.

The organization does not have labor or civil law relations with children and other family members of employees. Therefore, contributions to compulsory pension (social, medical) insurance do not need to be charged on the cost of vouchers purchased in their favor.

Similar clarifications are contained in the letter of the Ministry of Labor of Russia dated December 5, 2013 No. 17-3/2055.

The age of the children does not matter in this case. In particular, despite the fact that a minor child is in the care and support of his parents (i.e., in fact, the voucher is purchased in favor of the parent employee), the cost of the voucher is not subject to insurance premiums. A different approach, other things being equal, would put parents with minor children at a disadvantage compared to parents of adults (Article 19 of the Constitution of the Russian Federation).

This conclusion is confirmed by the Ministry of Health and Social Development of Russia in letters dated March 12, 2010 No. 559-19, dated March 11, 2010 No. 526-19, dated March 1, 2010 No. 426-19. These clarifications indicate that insurance premiums are not charged on the cost of trips paid by the organization to family members of the employee (including his children). However, the letters do not say anything about the fact that this benefit applies only to adult children.

What types of vouchers are there for employees at the expense of the enterprise?

An employer can provide an employee with rest by giving him:

- A voucher issued in accordance with obligations under an employment contract or collective agreement. The cost of a trip may include a variety of expense items, for example:

- for accommodation;

transport (moving or flying to a vacation spot and back, using public transport within the resort);

- nutrition.

In this case, the voucher can be represented by a single package of tourist services (tourist voucher) or a set of options from disparate expenses, which essentially also constitute a voucher. That is, the employer can sequentially:

- book and pay for a hotel room;

- to buy tickets;

- purchase restaurant vouchers.

Donations can be:

- travel package as a package service;

the above services as part of a set of options.

Personal income tax

Do not withhold personal income tax from the cost of a voucher provided to an employee free of charge if the voucher is paid for:

- or at the expense of the organization, provided that such expenses do not reduce profit tax, if the organization is a profit tax payer;

- or at the expense of the organization’s funds received from activities using the simplified tax system, if the organization uses the simplified tax system;

- or at the expense of the organization’s funds received from activities on UTII - if the organization pays UTII;

- or at the expense of the Federal Social Insurance Fund of Russia (through contributions for insurance against accidents and occupational diseases) - regardless of the taxation regime that the organization applies.

In addition to the listed requirements, the cost of a trip is exempt from personal income tax if the following conditions are simultaneously met:

- the voucher is not a tourist one (i.e. it involves a set of recreational activities);

- the voucher was issued to a health or sanatorium-resort institution located on the territory of Russia (including in the Republic of Crimea and the city of Sevastopol);

- the person who will be on holiday is an employee or family member of an employee of the organization. For example, a trip is paid for the employee’s natural or adopted child;

- a child (who is not a family member of an employee of the organization) who will be vacationing on a vacation package is under 16 years of age. This condition applies if the trip is paid, for example, to the brother or niece of an employee, and also if the child’s parents do not have an employment relationship with the organization;

- the intended use of the voucher is documented.

These rules also apply in cases where the cost of the trip is subsequently compensated by the regional budget.

This procedure is provided for in paragraph 9 of Article 217 of the Tax Code of the Russian Federation and is explained in letters of the Ministry of Finance of Russia dated July 1, 2013 No. 03-04-06/24981, dated June 28, 2013 No. 03-04-05/24690, dated November 30, 2011 No. 03-04-06/6-325 and the Federal Tax Service of Russia dated August 11, 2014 No. PA-4-11/15746, dated December 18, 2012 No. ED-4-3/21567.

If all of the above conditions are met, the cost of the voucher purchased by the organization is not subject to personal income tax, regardless of the method of its acquisition and issuance. So, for example, a trip can be awarded to a person as a prize (letter of the Federal Tax Service of Russia dated October 26, 2012 No. ED-3-3/3887).

Attention: subject to the conditions provided for in paragraph 9 of Article 217 of the Tax Code of the Russian Federation, only the cost of the trip itself without commission paid to the selling organization (for example, a travel agency) is not subject to personal income tax (letter of the Ministry of Finance of Russia dated May 13, 2008 No. 03-04- 06-01/132, Federal Tax Service of Russia dated July 25, 2014 No. BS-4-11/14505). Therefore, if the commission amount is allocated in the documents for the purchase of a voucher, include it in the tax base for personal income tax. Otherwise, the organization may be fined for failure to fulfill the duty of a tax agent (Article 123 of the Tax Code of the Russian Federation).

Income tax

When calculating income tax, the cost of vouchers issued to employees is not taken into account (clause 29, article 270 of the Tax Code of the Russian Federation).

Situation: when calculating income tax, is it necessary to include in income funds allocated from the budget to compensate part of the cost of vouchers purchased by the organization for the children of employees?

Regional authorities can establish compensation for the cost of travel packages purchased by the organization for the children of employees.

When calculating income tax, reflect the entire amount of compensation received in income. This position is explained as follows.

Income that does not increase taxable profit is indicated in the list given in Article 251 of the Tax Code of the Russian Federation. This list includes property (including money) received by organizations:

- within the framework of targeted financing (subclause 14, clause 1, article 251 of the Tax Code of the Russian Federation);

- in the form of targeted revenues received by non-profit organizations for their maintenance and conduct of statutory activities (clause 2 of Article 251 of the Tax Code of the Russian Federation).

The list of targeted financing funds given in subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation is closed. It does not provide for budgetary funds received by commercial organizations to compensate for any expenses. Therefore, this legal norm cannot be followed. Commercial organizations also cannot be guided by the provisions of paragraph 2 of Article 251 of the Tax Code of the Russian Federation.

Thus, include the compensation allocated from the budget for the cost of vouchers purchased by the organization as part of taxable income.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated October 13, 2011 No. 03-03-06/4/116 and dated November 1, 2010 No. 03-03-06/1/680.

What services can you pay for?

Part 2 of Article 255 of the Tax Code of the Russian Federation has been supplemented with a new clause 24.2, according to which the following services are recognized as services for the organization of tourism, sanatorium-resort treatment and recreation on the territory of Russia, provided under an agreement on the sale of a tourist product, concluded by the employer with a tour operator or travel agent (clause b Clause 1 of Article 1 of Law No. 113-FZ):

- services for transporting tourists across the territory of Russia by air, water, road and (or) rail to their destination and back or along another route agreed in the contract for the sale of a tourist product;

- tourist accommodation services in a hotel(s) or other accommodation facility(s), sanatorium-resort treatment and recreation facility, including tourist food services, if they are provided in conjunction with accommodation services;

- health resort services;

- excursion services.

According to the new clause 24.2, part 2, article 255 of the Tax Code of the Russian Federation, tourism, health resort treatment and recreation services on the territory of Russia can be purchased by employees, their spouses, parents, children (including adopted children) and wards under the age of 18 years, as well as children (including adopted children) and wards under the age of 24 years, studying full-time (subclause b, clause 1, article 1 of Law 113-FZ).

Yes, I have. The limit on such expenses should be no more than 50,000 rubles in total per year for each person (clause 24.2, part 2, article 255 of the Tax Code of the Russian Federation).

The company has the right to pay:

- round trip travel costs (air and train tickets, water and road transport);

- accommodation in a hotel, sanatorium, or other places of accommodation;

- meals in hotels and sanatoriums;

- spa services and excursions.

VAT

Situation: does an organization need to charge VAT when paying for and transferring vouchers to its employees?

Answer: no, it is not necessary.

In this case, the employer does not provide or receive services. The transfer to an employee of a voucher, that is, a document that confirms the right to use such services, is not recognized as a sale (Article 39 of the Tax Code of the Russian Federation). This means that the organization does not have an object of VAT taxation when paying for and transferring a voucher to its employee.

A similar position is set out in letters of the Ministry of Finance of Russia dated June 3, 2014 No. 03-07-11/26545, dated March 16, 2006 No. 03-05-01-04/68 and the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 3, 2006 No. 15664/05.

If in accounting the costs of purchasing a voucher are included in other expenses, reflect the permanent tax liability (clause 7 of PBU 18/02).

An example of how transactions related to the purchase and issuance of a voucher are reflected in accounting and taxation. The general regime organization purchased the ticket independently

On May 18, 2015, Alpha LLC purchased a trip to the sanatorium for the organization’s manager A.S. Kondratieva. The cost of the tour is 23,400 rubles, the duration of the holiday is 21 days.

According to the decision of the founders, “Alpha” pays for the cost of the trip from its own funds.

On June 22, 2015, an Alpha accountant issued a voucher to an employee of the organization.

The following entries were made in the accounting.

May 18 (receiving a voucher from the seller):

Debit 50-3 Credit 76 – 23,400 rub. – a voucher was purchased for an employee of the organization;

Debit 76 Credit 51 – 23,400 rub. – the cost of the tour has been paid to the seller.

June 22 (issuance of a voucher to an employee):

Debit 73 Credit 50-3 – 23,400 rub. – reflects the cost of the voucher issued to the employee;

Debit 91-2 Credit 73 – 23,400 rub. – the cost of the trip was written off at the expense of the organization’s own funds.

In June, the accountant added contributions to the cost of the trip for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases. The accountant calculated insurance premiums at a total rate of 30 percent. The rate for premiums for insurance against accidents and occupational diseases is 0.2 percent. At the same time, the following entries were made in accounting:

Debit 91-2 Credit 69 subaccount “Settlements with the Pension Fund” – 5148 rubles. (RUB 23,400 × 22%) – pension contributions accrued;

Debit 91-2 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 678.60 rubles. (RUB 23,400 × 2.9%) – insurance premiums are accrued to the Federal Social Insurance Fund of Russia;

Debit 91-2 Credit 69 subaccount “Settlements with FFOMS” – 1193.40 rubles. (RUB 23,400 × 5.1%) – insurance contributions to the Federal Compulsory Medical Insurance Fund have been calculated;

Debit 91-2 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 46.80 rubles. (RUB 23,400 × 0.2%) – premiums for insurance against accidents and occupational diseases have been accrued.

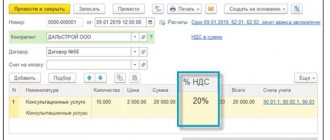

Alpha pays income tax monthly and uses the accrual method. The amount spent by an organization on the purchase of a voucher does not reduce its taxable profit. Therefore, on June 30, 2015, Alpha’s accountant recorded a permanent tax liability:

Debit 99 Credit 68 subaccount “Calculations for income tax” – 4680 rubles. (RUB 23,400 × 20%) – reflects the amount of permanent tax liability on the cost of the trip, which does not reduce taxable profit.

When calculating income tax, Alpha's accountant reflected insurance premiums in the amount of RUB 7,066.80 as expenses. (5148 RUR + 678.60 RUR + 1193.40 RUR + 46.80 RUR).

simplified tax system

Organizations with the object of taxation “income reduced by the amount of expenses” do not take into account the cost of vouchers paid from the organization’s funds when calculating the single tax. After all, such expenses are not included in the closed list of expenses given in paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. At the same time, organizations that pay a single tax on the difference between income and expenses include in expenses the amounts of insurance premiums accrued on the cost of vouchers (subclause 7, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Organizations that pay a single tax on income do not take into account any expenses when calculating the tax (Clause 1, Article 346.18 of the Tax Code of the Russian Federation).

However, the single tax (advance payment) can be reduced by the amount of contributions to compulsory pension (social, medical) insurance and contributions to insurance against accidents and occupational diseases actually paid (within the limits of accrued amounts) in the period for which the single tax was assessed. In this case, the total amount of the deduction should not exceed 50 percent of the amount of the single tax (advance payment). This is stated in paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation. For more information about what amounts are included in the tax deduction when calculating the single tax, see How to calculate the single income tax using the simplified tax system.

Who can claim paid leave?

Russia currently has a population of 145 million people. Of the total population, only 28% of residents vacation in the Russian Federation, and only 12% travel abroad. Based on this, we can conclude that more than half of all citizens do not travel at all. The main reason is the lack of basic financial opportunity.

The new bill makes it possible to solve several problems at once - to ease the financial situation of enterprise employees, provide the opportunity to travel and become familiar with the culture of the Russian Federation. In this case, not only the employee of the enterprise benefits, but also the country’s economy. On the one hand, tax will be paid on the compensation received, on the other hand, the rapidly developing tourism sector will begin to transfer tax on profits to the budget.

The opportunity to go on vacation profitably and entirely at the employer’s expense is provided to all employees, without exception, along with their families. The manager can easily pay expenses for the following categories of persons:

- Directly the employee himself;

- Employee's spouse;

- Parents;

- The employee’s children and all his wards are under 18 years of age in the usual case and up to 24 years of age if he is studying at a university.

Based on this, we can conclude that the opportunity to rest is open to all employees, without exception, as well as their loved ones. For many, this opens up unique opportunities.

UTII

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, expenses associated with paying for travel packages for employees do not affect the calculation of the tax base.

Insurance premiums accrued from the cost of the trip and actually paid (within the accrued amounts) in the period for which the single tax is calculated can be deducted from the amount of the single tax. In this case, the total amount of the deduction should not exceed 50 percent of the UTII amount. This is stated in paragraphs 2 and 2.1 of Article 346.32 of the Tax Code of the Russian Federation. For more information about what amounts are included in the tax deduction when calculating UTII, see How to calculate UTII.

Why is this law needed?

The law is expected to benefit both workers and the state. Let's consider the purposes of its introduction:

- Increasing social protection of workers.

- Development of tourism within Russia.

- Encouraging employees, increasing their loyalty.

- Deduction of personal income tax to the country's budget.

- Payment of insurance premiums.

The disadvantages of the innovation are obvious. The law primarily affects the entrepreneur. A large company with a large turnover can afford to finance the holidays of its employees. But there are also small businesses that cannot freely withdraw 50,000 rubles from circulation. An additional financial burden on the employer may simply lead to the fact that employees will not be officially registered for the position. No employment contract - no responsibilities. A business with low turnover can suffer big losses.

OSNO and UTII

Organizations that apply a general taxation system and pay UTII must keep separate records of income and expenses received from different types of activities (clause 9 of Article 274 and clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

However, the cost of a voucher provided to an employee free of charge cannot be taken into account when calculating income tax (Clause 29, Article 270 of the Tax Code of the Russian Federation). The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). The organization's expenses do not affect the calculation of this tax. Thus, for tax purposes, there is, as a rule, no need to distribute expenses associated with issuing vouchers to employees between different types of activities.

An exception is the case when an organization compensates the cost of a trip to employees engaged in both types of activities, and contributions to compulsory pension (social, medical) insurance, as well as contributions to insurance against accidents and occupational diseases, are calculated on its cost. Calculate insurance premiums separately depending on the type of activity the payments received by the employee relate to.

What does the employer pay for?

Payment of vacation compensation is an economically justified expense for every employer. In addition to receiving the required tax benefits, the manager significantly increases his prestige. This gives him the opportunity not only to attract highly qualified personnel to his company, but also to retain them.

Income tax is reduced for the reason that the organization takes on the functions of providing assistance to its socially vulnerable employees. Another reason for reducing the tax is an increase in the total number of clients of organizations participating in the process of formation and sale of a certain tourism product. This directly applies to hotels, cafes, as well as companies providing transport and excursion services.

The head of the enterprise can purchase a ticket from the travel agency employees. If a person himself purchased a ticket from one of the official dealers, the boss simply compensates for the cost with an increase in salary. Among the main expenses that a director can pay are the following:

- Services for transporting an employee and his relatives throughout the Russian Federation by road, water, air and railway transport. Payment is made to the destination and back. The employer will follow the route specified and approved in the voucher.

- Staying in a hotel or other place of accommodation. These are sanatoriums and resorts in Russia. If food is included in the package and is provided with accommodation, it will also be paid for.

- Services of high-quality sanatorium therapeutic treatment and resort services.

- Providing quality excursion services.

The adopted addition to the law for a large number of families with a small income becomes the optimal opportunity to spend a vacation in places of Russia that are interesting in nature and history.