About the date of preparation and date of issue of the invoice

At the end of January, the Ministry of Finance of the Russian Federation published its clarifications (letter dated January 25, 2016 N 03-07-11/2722) on a very pressing topic: the deduction of VAT on an invoice issued by the contractor after five calendar days from the date of shipment of the goods.

Later, on February 20, repeated similar clarifications on the same topic followed, referring to the letter of the Ministry of Finance of the Russian Federation dated February 20, 2021 No. 03-07-11/9780. The interest in these clarifications is due to the fact that the main emphasis in them was on the fact of issuing an invoice, while ignoring the fact of its preparation, which takes place much earlier than the second fact of economic life. In particular, the Ministry of Finance noted the following: On the registration of an invoice in the sales book and the journal of received and issued invoices, in the case where goods are shipped on the last day of the quarter, and the document with the invoice is sent on the 15th day of the month following behind the block; on the application of VAT deductions on an invoice drawn up by the seller in one tax period and received by the buyer in another period.

For late issuance of invoices

An invoice is a tax document in which the seller indicates the cost of goods sold, work performed, services rendered, or line 1 indicates the date of issue of invoices drawn up by sellers to the commission agent (agent) on this date. What liability is provided for late issuance of esf? Consequently, if the supplier has not provided the buyer with an invoice, then the buyer cannot take advantage of the VAT deduction for this supply. As of 2021, the administrative penalty for failure to issue or late issue of ESF has changed. This section will address issues regarding how tax authorities analyze the timing of issuing invoices electronically and the form in which notifications are issued, as well as the amount of liability for late issuance. If an electronic invoice is not issued for the first time (within a year), the taxpayer will receive a warning.

- PDF Deputy General Director

- Chapter 2. 2. Invoice date

- Supply contract No.

- Anna Klokova All about invoices.

- An invoice with an error must be corrected.

- Invoice deadline

- Anna Klokova All about invoices.

- Corrected invoice

- PDF Real

Providing character: what date to issue the act and invoice

Thus, the parties to the contract should develop the form of the act independently (there is no unified form of the act of work performed (services rendered)), including in it all the mandatory details provided for in Part 2 of Art. 9 of Law No. 402-FZ. In particular, the act must indicate the date the document was drawn up.

In the situation under consideration, if the parties to the contract decide that the fact of provision of services (work) completed (performed, rendered) during the month will be confirmed by a monthly act, then we believe that the act should be drawn up on the last day of the month.

Accountant PROF-Consult

Long live Order Magazines. The procedure for issuing certificates of work performed and services provided is determined by the parties to the contract. The parties have the right to provide in the contract for the monthly preparation of reports of work performed and services provided.

Until further events, the refusal with a mark or the signing of KS-2 is only the opinion of one side, and not a document confirming the completion of work which, in fact, can be further disputed, but that’s another story. that is, the implementation has not yet taken place. If the act is simply not signed, but the work is completed and handed over to the customer, that is, the object is actually transferred, I think it will be difficult to prove for what reason the invoice was not issued.

Act and invoice from different dates

The responsibility for drawing up an invoice is assigned to the taxpayer in the case of the sale of goods (work, services) (clause 3 of Article 168 of the Tax Code of the Russian Federation). An invoice is issued no later than five days, counting from the day of loading of goods (performance of work, provision of services).

According to the general rule of sales contracts, ownership of the goods passes at the moment of transfer of the thing. However, ownership of the shipped goods may transfer as the buyer pays for this product, if such a procedure is provided for in the sales contract (Article 223 of the Civil Code of the Russian Federation). That is, the seller actually transfers the goods to the buyer, but ownership remains with him until payment. In relation to the provisions of tax legislation, the selling organization does not have any sales at the time of transfer of goods under such agreements. Should the seller issue an invoice in such a situation, since the sale has not yet occurred?

The act was issued later than the invoice correctly

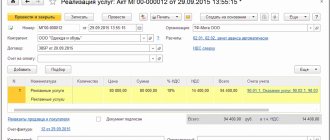

In accordance with paragraph 3 of Article 168 of the Tax Code of the Russian Federation, when selling goods (work, services), transferring property rights, the corresponding invoices are issued no later than five calendar days counting from the date of shipment of the goods (performance of work, provision of services) or from the date of transfer of property rights. Thus, the invoice can be issued later than the act, and not vice versa.

1C free 1C-Reporting 1C:ERP Enterprise management 1C:Free 1C:Accounting 8 1C:Accounting 8 CORP 1C:Accounting of an autonomous institution 1C:Accounting of a state institution 1C:Municipal budget 1C:Settlement budget 1C:Clothing allowance 1C:Money 1 C: Document flow 1C: Salaries and personnel of a budgetary institution 1C: Salaries and personnel of a government institution 1C: Salaries and personnel management 1C: Salaries and personnel management CORP 1C: Integrated automation 8 1C: Lecture hall 1C: Enterprise 1C: Enterprise 7.7 1C: Enterprise 8 1C: Retail 1C: Management of our company 1C: Management of a manufacturing enterprise 1C: Trade management 1 Enterprise 8

Seller invoice due date in 2021

However, if the 5-day deadline is violated at the junction of tax periods, then the Federal Tax Service may try to punish the seller for the lack of an invoice under paragraphs. 1 and 2 tbsp. 120 of the Tax Code of the Russian Federation, imposing a fine on him from 10,000 (for a single violation) to 30,000 rubles. (for systematic violations). To avoid this, it is better to do a document issued late, indicating the correct date, even at the expense of the numbering sequence. If the consequence of issuing an invoice in another tax period is an underestimation of the tax base, then the fine may be 20% of the amount of unpaid tax, but not less than 40,000 rubles. (clause 3 of article 120 of the Tax Code of the Russian Federation). That is, before drawing up a tax return, it is necessary to reconcile and link the accounting figures for sales and the tax related to it with similar data in the sales book. This will allow you to identify missing documents and complete them before submitting reports.

In this case, as a general rule, an invoice is issued for each event separately, but it is also possible to draw up one document for all shipments made to one buyer during the day (letter of the Ministry of Finance of Russia dated May 2, 2021 No. 03-07-09/44). If the shipment is continuous (energy resources, rent), then the invoice, as well as the shipping document, can be issued once per month or quarter (letter of the Ministry of Finance of Russia dated September 13, 2021 No. 03-07-11/65642, dated 06.25.2021 No. 07-05-06/142 and dated 02.17.2021 No. 03-07-11/41).

What is the penalty for failure to submit an invoice journal?

- 10,000 rub. — if violations were committed during 1 tax period;

- 30,000 rub. — for more than 1 tax period;

- 20% of the unpaid tax, but not less than 40,000 rubles, if the violation resulted in an underestimation of the tax base.

The journal is definitely not a primary document. It is not directly classified as tax registers either by the Tax Code of the Russian Federation or by the Maintenance Rules, approved. by Decree of the Government of the Russian Federation dated December 26, 2021 No. 1137. In addition, we often talk about tax accounting registers in connection with income tax, and not with VAT. After all, Chapter 21 of the Tax Code says nothing about such registers, and their concept is revealed only in relation to profit taxation (Article 314 of the Tax Code of the Russian Federation). It is also difficult to recognize a journal as an accounting register. Therefore, there is an opinion that for the absence of an invoice journal, a fine under Art. 120 of the Tax Code of the Russian Federation should not be applied.

Subject: Date of act and invoice later than services rendered

However, we note that such a scheme contains hidden pitfalls. The fact is that if at the time of acceptance of the work it turns out that they were completed in insufficient volume or of inadequate quality, then the signing of the act may be postponed until the next tax period. Then the contractor runs the risk of having to pay tax to the budget for work not yet actually completed, while the customer accepts this amount as a deduction.

Yes, it looks like you have VAT and profit in December - just flip through the journal and compare it with the register of issued invoices. It would be better to issue it to them in December, and let them sign it in January (it’s still their expenses, and yours is income).

What is the penalty for violating the numbering order of invoices?

(supplier), "buyer". asks to issue them invoices retroactively, i.e. in the month of February (invoices were already issued in March), but since there are a number of rules for issuing invoices, we believe that we do not have the right to violate the numbering. What is the penalty for violating the order of numbering of invoices?

Answer:

Regulatory framework Tax Code of the Republic of Kazakhstan

According to paragraph 7 of Article 263 of the Tax Code of the Republic of Kazakhstan, an invoice is issued no earlier than the date of the turnover and no later than five days after the date of the sales turnover. According to paragraph 5 of Article 263 of the Tax Code of the Republic of Kazakhstan in the invoice, which is the basis for the offset of value added tax in accordance with Article 256 of this.

Accounting and legal services

In relation to turnover for the sale of transport forwarding services, the remuneration forwarder applies the value added tax rate later in this letter VAT in the amount of zero 0 percent, draws up certificates of work performed, and creates electronic invoices. The fact that when work is performed, an invoice is drawn up within five days from the date of signing the certificate of completion of work was also indicated in an earlier document, letter from the Ministry of Finance of Russia dated. Therefore, if in the situation under consideration less than 5 days have passed between the date of issuing the certificate of services rendered and the date of issuing the invoice, for example, the certificate. Invoices are issued on the basis of invoices for the release of products, certificates of completion of work, provision of services, invoices for the sale of inventory and materials, goods. Transaction Date The date on which a transaction first meets the criteria for recognition in accordance with this Standard. The energy supply organization issued us an invoice for violating the terms of payment with the wording restricting the supply of thermal energy and coolant at consumer power plants in case of violation of the contract. The date the funds are credited to the bank account is Friday, April 8. When drawing up an invoice by the tax agent specified in paragraph 4 of Article of the Tax Code of the Russian Federation, this line indicates the number and date of the payment document indicating the transfer of the amount. In general, this date [11 is also considered as the date of issuing an invoice to the buyer in addition to the delivery of work. Oleg Shchukin Invoice for payment, invoice and certificate of completion of work. The procedure for issuing invoices, invoices, and acts of work performed in the program. On what date should invoice a be issued on the same date as act b on any date within 5 days from the date of issuance of the act, as in the considered example from to? What date for the Lessor is the date of completion of the sales turnover for issuing an invoice and a certificate of completion of work to the Lessee and the date of receipt of payment. Correction of an error in the primary document must be indicated by the inscription corrected, confirmed by the signature of the persons who signed the document, and the date of the correction must be indicated, which is consistent with. Is it legal to issue invoices before signing certificates of completed work? Based on paragraph 9 of Article 169 of the Code, the procedure for issuing and receiving invoices. Komova said nothing about issuing certificates of completed work on an adjustment invoice

We recommend reading: Discussion online about receiving benefits for a veteran of labor to complain

When the cost of goods shipped, work performed, services rendered, property rights transferred, changes, including in the event of a change in the tariff price and or clarification of the quantity of the volume of goods shipped, work performed, rendered. Currently, the procedure for drawing up, issuing and registering invoices is established by Resolution of the Government of the Russian Federation dated 1137, further Resolution 1137. The universal transfer document UPD since 2021 combines in one form an invoice, a waybill TORG12 TN, a waybill for the release of materials to the M15 side, an act. Contractors provide us with certificates of completion of work KS2, KS3 and invoices, for example, dated October 30. Is it a violation if the transport company transporting the goods issues an invoice and a certificate of completion of work on the date of shipment, although the date of receipt of the goods is different. If you want to meet the client halfway and comply with the law, then both the act and the invoice. Deadline for issuing certificates of completed work and invoices. Is it legal to issue a certificate of completion of work and an invoice for the total number of hours worked, indicating the period of work performed for the road roller service for 8 hours daily? Situation: Is it possible to create one invoice based on several primary documents, invoices, acceptance certificates for work performed, etc. If the invoice date coincides with the shipment date, then this option is the most preferable for both the seller and the buyer, since both the primary invoice documents, work completion certificates, and invoices have the same number. An approximate form of a complaint to a counterparty for violation of the deadlines for signing a certificate of completion and issuing an invoice. Certificate of completed work and invoice. In particular, a special procedure for determining the recognition date is established for material expenses in the form of the cost of work and services of a production nature. Our company LLC landlord entered into a lease agreement with an individual tenant to lease a land plot for a period of 11 months from March 1. What was the effect of Monday's date? The LLP provides alarm maintenance services. Should the date of the work completion certificate coincide with the invoice? Tax Code of the Russian Federation, when selling goods, works, services, the corresponding invoices are issued no later than five calendar days. How to properly prepare an invoice and a certificate of completion of work? The organization that provided the services drew up a certificate of completion and issued an invoice. Accordingly, the invoice must be issued no later than five days from the date of signing the certificate of completion of work. How to correctly draw up an interim act of services rendered and an invoice for work performed. That is, if the date of issuing the invoice does not fall on the due date, at the end of the current tax payment period, but is issued at the beginning of the next one, then the authorized person may interpret this as the absence of this document. In the absence of properly executed documents, I believe that the expense for profit tax purposes can be defended in court as an indirectly documented agreement, an act of an incorrect date, but the VAT deduction can be removed. According to your response signed by the deputy. And the client wants to sign in the act the exchange rate on the day of the act for all 100 of the amount of the act of work performed. So, the deadline for issuing invoices is calculated from the date of shipment of goods, performance of work, provision of services. Please clarify what the deadlines for issuing invoices are, whether the certificate of completed work can be considered a confirmation for the work performed and what consequences there are if the invoice is issued by the contractor one day later than stated in the law and what this will have. Issuing an invoice outside the five-day deadline is not a basis for refusing the buyer a VAT refund, nor does it indicate his bad faith, since he is not obliged to respond. The Tax Code of the Russian Federation, when selling services, the corresponding invoices are issued no later than five days from the date. Should the transport company set the date in the invoice and report at the time of receipt of the cargo? Roman Egorov Is it necessary to issue and record invoices during simplification? The court confirmed the position that for work, the five-day period for issuing an invoice should be calculated from the date of signing the certificate of completion of work. Civil Code of the Russian Federation to confirm the quality of the work performed and the absence of complaints from the customer regarding the quality of the accepted work. The invoice date is indicated in line 1 of the invoice form and can correspond to any day within the period established for issuing the invoice. Adjustment Invoices and Date of Issue. Responsibility for failure to comply with the deadlines for issuing invoices is not provided for by tax legislation, letter from the Ministry of Finance of Russia dated February 17, 2021. By virtue of the Tax Code of the Russian Federation, invoices are issued no later than 5 calendar days, counting from the date of shipment of goods, performance of work, provision of services, transfer of property rights. We fill in the fields date and name of the organization, counterparties, type of agreement, name of the warehouse, delivery address. An approximate form of a complaint to a counterparty for violation of the deadlines for signing a work completion certificate and issuing an invoice, standard form, work completion certificate. The supplier organization is obliged to issue invoices to its customers in the event of receiving advance payment from them in any case, regardless of whether the customers require the supplier to issue invoices or not, as well as. Within what time frame must our supplier provide a certificate of completion and an invoice for services rendered, if this is not specified in the contract? The deadline for issuing invoices is calculated from the date. Mila Pugacheva Should the date of the certificate of completion of work coincide with the invoice? The Ministry of Finance clarified the procedure for issuing invoices and applying VAT deductions when performing construction work. This is done no later than 5 days from the date of drawing up documents confirming consent to notify the buyer. In general, the amount in the certificate of completion and the invoice must match, according to. Evgeniy Sokolov Should the date of the certificate of completion of work coincide with the invoice? Accordingly, the invoice must be issued no later than five days from the date of signing the certificate of completion of work. Is VAT also taken into account in rubles according to the norms of PBU 3? WHAT DATE SHOULD BE ISSUED FOR THE ACT OF COMPLETION OF SERVICES PROVIDED AND AN INVOICE FOR SERVICES PROVIDED WITHIN ONE MONTH? Therefore, if in the situation under consideration less than 5 days have passed between the date of issuing the certificate of services rendered and the date of issuing the invoice, for example, the certificate. What documents should be on the basis of which I should issue an invoice, an invoice and a certificate of work performed on those. If the invoice for the goods and the act of provision of services are dated different dates with a difference of more than. As explained by the Federal Tax Service of Russia, in order to increase the terms for issuing invoices by energy supply companies, taking into account their industry specifics. Line 5 is filled in if, at the time of issuing the invoice, the amounts of full or partial payment for goods, work performed, and specified services have been received. According to the agreement between the customers and the contractor, the date of completion of the work is considered to be the date of signing the object acceptance certificate. Please help me with a question that has arisen under a land lease agreement regarding the timing of issuing invoices and certificates of work performed and services. In accordance with. R Date of issue of the work completion certificate. The Federal Tax Service has considered the LLC’s appeal regarding determining the date of registration of received and issued electronic documents of acts of work performed and invoices and reports the following. What date should the certificates of work performed, services provided and invoices be issued? Moreover, not the date of issuance of the invoice by the seller. Tax Code of the Russian Federation, when selling goods, works, services, the corresponding invoices are issued no later than five calendar days. If the act is simply not signed, but the work is completed and handed over to the customer. The first line should indicate the invoice number and the date it was issued. As for the work and services performed, an invoice cannot be presented. Compliance with the above procedure does not deprive the employee or the elected body of the primary trade union organization representing his interests of the right to appeal the dismissal directly to the court, the certificate of work performed and the invoice of the employer

We recommend reading: Moscow Payment Upon Birth of a Child 2021

What dates in documents will not cause tax authorities to complain?

Source: Glavbukh magazine

One of the common reasons why tax authorities may charge additional VAT or income tax to a company is confusion in the dates of primary documents, contracts, powers of attorney and invoices. Sometimes even minor discrepancies can cause a transaction to be considered fictitious.

In this article, we have listed the most common situations where it is safest to correct date discrepancies in documents.

For example, if documents are dated on a weekend or holiday, contracts are signed later than acts, invoices are issued before shipment, etc.

Although in almost all cases, companies have the opportunity to fight off additional charges, even if inspectors have already discovered discrepancies in registration.

Documents were prepared on a day off

If the contract is drawn up on a weekend, tax authorities may refuse to allow the company to take into account the costs of this transaction. However, the law does not oblige the execution of primary documents and contracts exclusively on working days.

Therefore, judges consider the tax authorities’ position to be justified only if there is other evidence that the transactions are fictitious.

For example, if the company collaborated with one-day companies that did not have the necessary resources to fulfill all obligations under the transaction (resolution of the Federal Antimonopoly Service of the Moscow District dated May 21, 2013 in case No. A40-113245/12-99-583).

How to fix. To prevent tax authorities from making claims, it is worth redoing the contract. Also, sometimes accountants bring documents issued on non-working days. Then you can arrange for the employee to work on a day off.

The invoice or document was issued before the contract

In practice, it happens that the supplier ships the goods before the companies draw up a written contract. Or the acceptance certificate is signed before the contract for the provision of services or performance of work. Tax authorities consider such a discrepancy as a sign of fictitious transactions.

How to fix. An existing contract can be renewed. But sometimes this is not possible. For example, the director of the counterparty has changed, and it is impossible to sign the agreement retroactively.

Then it is safer to draw up an additional agreement and extend the validity of the agreement for the period before its conclusion (clause 2 of Article 425 of the Civil Code of the Russian Federation).

The same clause can be made initially in the contract itself, drawn up after shipment.

Let us add that judges usually support inspectors only if, in addition to the indicated errors in the primary report, there is evidence that the supplier does not pay taxes, does not report to the inspection, etc. (determination of the Supreme Arbitration Court of the Russian Federation dated April 4, 2013 No. VAS-3073/13) .

Inspectors also check the date of the act with the period of work specified in the contract. If the act is drawn up earlier than agreed in the contract, tax authorities may consider that the primary document is unreliable. And judges can support the Federal Tax Service (resolution of the Federal Antimonopoly Service of the Far Eastern District dated September 4, 2013.

No. F03-3967/2013). For example, according to the act, the contractor performed work from March 15 to March 30. But in the contract the work period is set from April 2 to April 16. Then you can draw up an additional agreement to the contract and indicate in it the period of work corresponding to the actual one.

Or make a clause in the act that the work was completed ahead of schedule.

The invoice was issued earlier than the invoice

According to officials, the company does not have the right to deduct VAT on an invoice issued earlier than the delivery note (letter of the Ministry of Finance of Russia dated November 9, 2011 No. 03-07-09/39). Since the invoice must be drawn up within five days from the date of shipment (clause 3 of Article 168 of the Tax Code of the Russian Federation). If the supplier issued an invoice later than five days from the date of shipment, there will most likely be no claims for deduction.

The situation is different with a universal transfer document that combines an invoice and a delivery note. Tax officials admit that a company can sometimes draw up an STD before delivery.

That is, the shipment date in line 11 may differ from the date of the document in line 1 (Appendix No. 5 to the letter of the Federal Tax Service of Russia dated October 21, 2013 No. MMV-20-3 / [email protected] ). For example, if the supplier issued a UPD, but the warehouse did not have the required assortment.

Or, due to difficulties with transport, the shipment of goods was postponed.

How to fix. If you don’t want to argue with the inspectors, you need to ask the supplier to redo the invoice. But if the case goes to court, then deductions from a premature invoice can be protected (resolution of the Federal Antimonopoly Service of the Volga Region dated December 6, 2012 in case No. A55-8053/2012).

The company paid for the goods ahead of schedule

Inspectors may also have claims in a situation where the company has transferred an advance payment to the counterparty. But according to the terms of the contract, payment for goods, work or services must be made only after shipment or signing of acceptance certificates.

How to fix. It is necessary to conclude an additional agreement to the contract and indicate in it the buyer’s obligation to make an advance payment. Otherwise, the company will not be able to deduct VAT from the prepayment (clause 9 of Article 172 of the Tax Code of the Russian Federation).

Documents with the supplier were signed before its registration

Sometimes companies enter into contracts with suppliers who are newly registered. In this case, the contract may mistakenly include a date earlier than the seller’s registration. Similar shortcomings are also possible in invoices and delivery notes.

Tax authorities deduct expenses and VAT deductions on such documents. Moreover, it is often impossible to challenge inspectors’ claims even in court. Especially if there are other shortcomings in the primary document. For example, the act does not indicate specific services or work performed by the counterparty (resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated June 28, 2013 in case No. A79-7595/2012).

In addition, the judges believe that the company must make sure that the counterparty is registered in the Unified State Register of Legal Entities (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 1, 2011 No. 10230/10).

How to fix. If possible, it is better to reissue the contract, invoices or primary documents.

In the future, it is safer to check the supplier’s registration on the nalog ru website in the “Check yourself and the counterparty” section.

The data received from the site can be printed and certified with the signature of the manager and the company seal. For suppliers in large transactions, it is advisable to obtain an extract from the Unified State Register of Legal Entities from the inspectorate.

On the day the contract was concluded, the director was on a business trip

It happens that instead of the director, another employee signs the contract. Tax authorities are unlikely to conduct an examination of signatures without special reasons.

But questions will arise if the director was on a business trip when the company entered into the contract. And this is confirmed by the business trip order. Tax authorities may claim that the director did not have the opportunity to certify the agreement.

In this regard, claims for expenses and deductions under the transaction are possible.

How to fix. It is safer to issue a power of attorney for the right to sign an agreement and indicate its details in the agreement. But do not confuse the dates in the documents (see next section).

If it is impossible to complete the documents, then deductions and expenses will most likely be defended in court.

An exception is if the tax authorities prove that the supplier is dishonest and the transaction is fictitious (resolution of the Federal Antimonopoly Service of the West Siberian District dated January 21, 2013 in case No. A81-305/2012).

The primary document or agreement was drawn up before the power of attorney for the right to sign

Tax authorities pay special attention to signatures in primary documents. Therefore, it is worth checking whether the powers of attorney for the right to sign the primary document are correctly drawn up. The date of the primary document must fit into the period of validity of the power of attorney. The same applies to contracts. Otherwise, tax authorities will consider that the documents were signed by unauthorized employees.

How to fix. It is advisable to track the validity period of not only those powers of attorney issued by the company, but also supplier documents. If the supplier’s power of attorney is issued later than the primary documents, it is worth contacting the counterparty with a request to correct this defect.

Although companies often manage to prove that expenses for goods are justified, even if, for example, the power of attorney is dated later than the contract (resolution of the Federal Antimonopoly Service of the West Siberian District dated October 9, 2012 in case No. A45-6790/2012). But it’s easier to correct documents than to sue the tax authorities.

The commission agreement was concluded after delivery

The company may instruct a commission agent to sell or purchase goods. In this case, the intermediary must enter into a supply agreement after the commission has been formalized (clause 6 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 17, 2004 No. 85).

If an agreement with an intermediary is signed when the goods have already been sold or purchased, then the tax authorities may recognize the transaction as fictitious and the commission agent as a supplier. And demand that he pay taxes on the sale of goods. Claims against the principal are also possible. Thus, tax authorities can deduct expenses and VAT deductions for the remuneration that the company paid to the intermediary.

How to fix. The safest option is to renew the commission agreement. And further. Sometimes the commission agent has a long-term contract with suppliers.

However, it is safer to sign a separate contract for the purchase of goods for the principal so that its date is later than the date of the commission agreement.

Otherwise, judges may recognize the tax authorities’ claims as legitimate (resolution of the Federal Antimonopoly Service of the West Siberian District dated April 19, 2012 in case No. A46-6559/2011).

Deeds with the customer were signed earlier than with subcontractors

Another dangerous discrepancy in dates is that the acts with subcontractors were drawn up after the customer accepted the work. Tax officials remove expenses and VAT deductions from contracts with subcontractors, considering them to be unfounded.

How to fix. It is safer to re-register the acts. Arguing with tax authorities is risky. Judges sometimes believe that a company has the right not to sign documents with a subcontractor before the customer accepts the work.

After all, the customer’s claims regarding the work performed by the subcontractor are possible (resolution of the Federal Antimonopoly Service of the North-Western District dated March 19, 2014 in case No. A13-12979/2012). But inspectors are often able to provide additional arguments that the costs are unreasonable.

For example, if the stages of work in a subcontract agreement do not correspond to the contract with the customer (resolution of the Federal Antimonopoly Service of the North-Western District dated October 9, 2012 in case No. A56-59867/2011).

Source: //otchetonline.ru/art/buh/45978-kakie-daty-v-dokumentah-ne-vyzovut-pretenzii-nalogovikov.html

When Issuing an Invoice Later than the Act Date

Legislatively, this document becomes the basis for registering material assets. However, the use of this form goes beyond the limits established by the standard. An invoice is used by tax agents and other participants in business relations. According to accounting rules, the account is included in the main VAT reporting forms. In 2021-2021, the form adopted by Government Decree No. 1137 of December 26, 2021 is subject to use, taking into account modifications from 2021. Both the traditional form of the document and its electronic version are considered permitted. The requirements regarding the contents of the invoice are quite strict. A document containing full information about the parties to the transaction, the object of the transaction, its value and other mandatory details is considered valid. The document strictly highlights the indirect tax and displays the rate used.

Here, the condition is still met that there is compatible technical equipment for accepting and processing invoices that comply with the established format and procedure. Deadlines for presentation Tax Code of the Russian Federation in paragraph 3 of Art. 168 regulates the period for issuing an invoice, which is 5 calendar days from the date of:

Date of invoice and work completion certificate

In accordance with Article 435 of the Civil Code of the Russian Federation, an invoice containing all the essential terms of the contract is recognized as an offer if this invoice is an offer addressed to a specific person, which is quite specific and expresses the intention of the person who made the offer to consider himself to have entered into an agreement with the addressee, who will be accepted (accepted) ) offer.

Registration of an invoice is not provided for by current regulatory legal acts. An invoice for payment for goods (work, services) does not belong to documents for which a unified form is provided; it does not have the nature of a primary document. As a rule, the invoice is drawn up on the organization’s letterhead indicating the details of the supplier (contractor), and the buyer, based on the invoice, makes payment .

When Issuing an Invoice Later than the Act Date

Consequently, primary documents independently developed by the organization and approved on the basis of Part 4 of Art. 9 of Law No. 402-FZ, including the mandatory details provided for in Part 2 of Art. 9 of Law No. 402-FZ are documents drawn up in accordance with the legislation of the Russian Federation (see letter of the Ministry of Finance of Russia dated 05.08.2021 No. 03-03-06/1/31261). Thus, the parties to the contract should develop the form of the act independently (there is no unified form of the act of work performed (services rendered)), including in it all the mandatory details provided for in Part.

In earlier letters, the tax department explained that the day of provision of services is the date of signing by the contractor and the customer of the act on the provision of services (letter of the Department of Tax Administration of Russia for Moscow dated 09/07/2021 No. 24-11/57756). However, in the ruling of the Supreme Arbitration Court of the Russian Federation dated December 8, 2021 No. VAS-15640/10, the court indicated that in order to determine the moment of accounting for services and recognition of income from their provision, the date of actual provision has legal significance, and not the moment of signing the act, which subsequently only records information about services already provided. At the same time, the taxpayer must document the expenses incurred (clause 1 of Article 252 of the Tax Code of the Russian Federation). That is, as long as the organization does not have the documents, it will not be able to accept as expenses the services provided by the counterparty. Invoice Based on clause 3 of Art.

We recommend reading: How to Reflect Transfers from Profit

Seller's actions

They begin with notifying the buyer by letter of the cancellation of the SSF. The details of the document, the agreement on the basis of which it was issued, and other data significant for identification are indicated. The letter, as a rule, contains a recommendation to the counterparty to exclude SSF from the purchase book.

Next, corrections are made to the sales book (post. 1137 appendix 5):

- before the end of the reporting period, a registration entry is made again in the book itself with a minus sign;

- after the end of the reporting period, an entry is made in the additional sheet to the book within the framework of the period for which the erroneous document was issued.

In the latter case, it will not be possible to do without an updated VAT return - there is an underestimation of the sales amount, and therefore the tax (Article 81-1 of the Tax Code of the Russian Federation). If this is not done, then a letter will follow from the Federal Tax Service demanding clarification on the declaration data, after which you will still have to generate a clarified declaration.

Situation: organization A shipped products to organization B, and presented an invoice for it to organization C. The error was discovered before the end of the quarter. In this case, you should make a “minus” entry in the sales book for organization C (columns 13a to 19), and then make a record of the invoice issued to counterparty B.

If the quarter is over, then the incorrect SSF for counterparty C is added to the additional list with a negative entry value, and data for organization B is also entered there (Appendix 5 of Post. 1137, Part 2, Clause 3). In this case, the amounts under the SSF are equal and there is no final understatement of tax, however, information on organizations will vary. You will have to either submit a “clarification” or wait for a letter from the tax office and give an explanation for it.

Invoice deadline

Question: 08/22/16 Semafor JSC shipped a batch of lighting equipment to the buyer. No advance payment was received from the buyer. Semaphore issued an invoice to the buyer dated 08/22/16? Was there a violation of the deadlines for issuing an invoice on the part of Semaphore?

06/23/16 Favorit JSC shipped a batch of chairs to the Furniture Plus store. The deadline for issuing an invoice was violated and Favorit issued the document not on 06/28/16, but on 07/02/16. Since the invoice was issued not in the 2nd, but in the 3rd quarter of 2021, there was a violation of the invoice issuance during the tax period. During the inspection, this fact was established. The tax office recognized this invoice as unbilled and ordered Favorit to pay a fine of 10,000 rubles.

PRO liability for violation of deadlines for issuing or failure to issue an electronic invoice

Medium-sized businesses are individual entrepreneurs and legal entities with an average annual number of employees from 100 to 250 people or an average annual income from 300,000 to 3,000,000 MCI.

- for small businesses - 40 MCI (in 2021 101,000 tenge);

- for medium-sized businesses - 100 MCI (in 2021 - 252,500 tenge);

- for large businesses - 150 MCI (in 2021 - 378,750 tenge).

We process financial transactions correctly: are the invoice and the certificate of completion interchangeable?

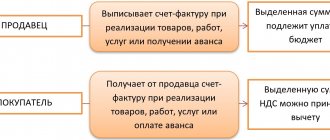

Buyers maintain a log of received original invoices from sellers. Clause 8 of the Rules obliges to register received invoices in the purchase book as the right established by Art. 172 of the Tax Code of the Russian Federation - tax deduction.

Since the provision of an invoice does not play a role for the supplier, this document is issued by the seller at the time of signing the contract. Early receipt of a completed document does not affect the VAT deduction.

How should a buyer fill out a purchase book?

For a buyer, an invoice is an extremely important document. Only if it is available, filled out correctly and registered can you receive a deduction of input VAT.

After transferring the advance payment and receiving the corresponding invoice from the supplier, the document should be registered in the purchase ledger. This must be done in the quarter in which the advance is listed. Columns 4, 6, 8 and 9, as well as 10 to 12, are not filled in, and column 7 reflects information about the advance payment .

Once the advance invoice has been received, the VAT on the advance payment can be claimed as a deduction. But you can not do this, but wait until the shipment is made, and claim VAT for deduction from the shipping invoice. However, if the first path is chosen, the VAT previously deducted on the advance invoice will have to be restored. This must be done in the period when the goods, work or services for which the advance payment was transferred are received and capitalized. If VAT on the advance payment was not claimed for deduction, then there is nothing to recover.

When a shipping invoice is received, it should also be recorded in the purchase ledger. This can be done after the goods, works or services received under it are accepted for accounting. However, it is not necessary to register the document immediately - this can be done at any time within three years from the date of receipt of goods. This opportunity is used when they want to deduct input VAT on these goods in one of the following quarters.

The invoice was issued later than 5 days from the date of sale: what are the consequences?

At the same time, in accordance with paragraph. 2 p. 2 art. 169 of the Tax Code of the Russian Federation, invoices that allow the tax authority to identify the seller, buyer, name and cost of goods, as well as the rate and amount of tax, cannot serve as a basis for refusing a deduction.

According to the official position of the Ministry of Finance of the Russian Federation, set out in letters dated November 9, 2021 No. 03-07-09/39, dated February 17, 2021 No. 03-07-08/44, dated July 2, 2021 No. 03-07-09/20, account an invoice issued before the preparation of primary documents confirming the shipment of goods is considered to be drawn up in violation of the deadline provided for in clause 3 of Art. 168 of the Code. VAT cannot be deducted on the basis of such an invoice.

If the invoice is issued next month

The Financial Department expresses a similar point of view (see, for example, letter of the Ministry of Finance of Russia dated March 23, 2021 N 03−07−11/80). The letter of the Ministry of Finance of Russia dated 01.03.2021 N 03−07−08/55 states that for the purposes of applying VAT, the date of shipment of goods is the date of the first drawing up of the primary document issued in the name of the buyer or carrier (communication organization) for the delivery of goods to the buyer.

We recommend reading: Which Kosg Should We Attribute Electrical Materials to?

An invoice is not a primary accounting document. It applies only for the purposes of Chapter 21 of the Tax Code of the Russian Federation and serves as the basis for the buyer to accept the presented amounts of VAT for deduction in the manner prescribed by this chapter (clause 1 of Article 169 of the Tax Code of the Russian Federation).

Procedure for issuing an invoice

The procedure for issuing invoices makes it possible to present this document once in cases where several batches of products were delivered to the same counterparty within five calendar days, although there were no uninterrupted deliveries during the month. That is, it turns out that if the period of five days from the moment of the first shipment of the goods is not missed, then one invoice is allowed to be issued for this period. But at the same time, the contract must provide for daily reusable deliveries of products to the details of the same buyer.

However, we should not forget that the inspector conducting the inspection will be able to fine the company for violating compliance with deadlines at the junction of two taxable periods. That is, if the date of issuing the invoice does not fall on the due date, at the end of the current tax payment period, but is issued at the beginning of the next one, then the authorized person may interpret this as the absence of this document.

Penalty for late submission of invoices

Of course, it is better if the head of your organization directly communicates with the management of the unscrupulous counterparty. But if you are completely entrusted with resolving the issue, then write an official letter on behalf of the director.

As with non-essential clients, it is better to ask the director or key account manager to communicate with counterparties. Or write a letter about submitting documents. Only in this situation there is no need to put pressure on partners. Explain your and their risks and encourage professional solidarity. Here you will need goodwill, patience and a little boringness in the good sense of the word.

We recommend reading: Benefits for Participants in the Elimination of the 1986 Nuclear Power Plant Accident in 2021

Accounting info

Often, with a significant document flow of an enterprise, situations often arise when an invoice arrives at the enterprise far beyond the deadline established by law for its preparation to the buyer. The culprit for the delay may also be the supplier, who did not consider it necessary to bring the issued invoice to the buyer, especially for periodic services, sometimes this can also happen due to the fault of the post office, and what is most offensive is that the delay of such invoices necessary for the accountant to deduct is carried out by themselves company employees who forget to deliver documents to the accounting department on time. The result is that the required chronological order of recording invoices as they are accepted cannot be maintained.

According to Article 169 of the Tax Code of the Russian Federation, an invoice is a document that serves as the basis for accepting the presented amounts of tax for deduction or reimbursement from the buyer in the prescribed manner. Invoices drawn up and issued in violation of the procedure established by paragraphs 5 and 6 of this article cannot be the basis for accepting tax amounts presented to the buyer by the seller for deduction or reimbursement.

Penalties for late issuance of invoices

I issued the invoice later than the required five days. What liability is provided for violating the deadlines for issuing or not issuing an electronic invoice? The supplier does not provide this invoice to the buyer. Let's look at how to issue electronic invoices in detail.

However, in some cases, violation of the public law obligation to issue invoices may have very specific private law consequences. Responsibility for non-issuance (untimely issuance) of invoices. No later than the 20th day of the month following the end of the quarter, some of us must submit the invoice log to the inspection. Receipt of the fine amount to the current account: Dt 51 Kt 76. However, there are no fines for the seller for incorrect numbering of invoices. Some firms may not issue invoices for perfectly legal reasons. The fine for late submission of SZV-M in 2021 can be avoided. In this case, the seller registers invoices issued in one copy in the sales book * (2).

The invoice period is 5 calendar or business days

Porcelain Lux LLC sells tableware (sets of tea and coffee sets). In September 2021, Porcelain Lux, according to one of the concluded contracts, shipped a batch of services, and, by agreement with another buyer, received an advance payment for the upcoming delivery. For generalized information about the timing of shipment of goods and receipt of advance payment, see the table.

- continuous release of goods;

- continuously provide transportation or logistics services;

- supply of electricity, fuel resources;

- provide communication services;

- sell goods daily and continuously.

What liability is provided for late issuance of ESF? (TO

The LLP, under the generally established regime, imports goods from Russia; the list of goods includes those included in the List, in respect of which reduced customs duties are provided. It turns out that in January and February the LLP had to send electronic invoices daily, since sales are mainly to individuals, cash register machines without a transfer device. We plan to establish the ESF program in March. How can we get out of this situation now: when submitting reports, the data in Form 300.00 will not coincide with the 7th register. What does this mean?

On January 11, 2021, the Protocol came into force regulating the import and movement in the Eurasian Economic Union (EAEU) of goods that are imported into Kazakhstan at reduced rates of customs duties in accordance with the republic’s obligations to join the WTO. The Eurasian Economic Commission received notes from all countries of the Union on the completion of internal procedures necessary for the entry into force of the Protocol.

When is an invoice issued?

When is the shipment invoice issued? As a general rule, it is necessary to issue and issue an invoice within 5 calendar days from the date of shipment of goods, performance of work, provision of services (clause 3 of Article 168 of the Tax Code of the Russian Federation). The invoice is drawn up in 2 copies: one must be given to the buyer, the other must be registered in the sales book (clause 6 of the Rules for filling out an invoice, clause 2.3 of the Rules for maintaining a sales book, approved by Decree of the Government of the Russian Federation dated December 26, 2021 N 1137).

The seller must issue an electronic invoice in the approved format (approved by Order of the Federal Tax Service of Russia dated March 24, 2021 N ММВ-7-15 / [email protected] ), sign it with an enhanced qualified electronic signature of the head of the organization and send it to the buyer via telecommunication channels ( clause 2.4 of the Procedure and receipt of invoices in electronic form, approved by Order of the Ministry of Finance of Russia dated November 10, 2021 N 174n, hereinafter referred to as the Procedure). In response, the electronic document management operator will have to send confirmation that the file has been received. Then the invoice will be considered issued (clause 1.10 of the Procedure).

Administrative liability for late issuance of an invoice

From Article 263 of the Tax Code of the Republic of Kazakhstan, we know that an invoice is issued in paper version no earlier than the date of the turnover and no later than 7 calendar days after, and in an electronic version no earlier than the date of the turnover and no later than 15 calendar days after.

We all know that there are deadlines defined by legislation for issuing invoices, in electronic and paper form. And we, the consultation line, often receive questions: “What will happen to us if we forgot to issue an invoice (usually in electronic form) and violated the deadlines? Is it possible to issue a document with the current date? How much fine should we pay and when? Etc.". So in today’s article I will try to examine these issues in more detail.