As you know, “children’s” benefits are accrued upon the birth of a child. As stated in Federal Law No. 81-FZ dated May 19, 1995 “On state benefits for citizens with children,” child benefits include:

- allowance for seeking consultation and registration in early pregnancy (up to 12 weeks);

- lump sum benefit at the birth of a child (based on a certificate from the maternity hospital);

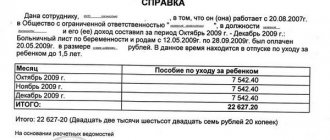

- monthly child care allowance up to the age of 1.5 years;

- maternity benefits (sick leave);

A woman who has given birth to a child receives all of the listed benefits from her employer. Everyone needs to know the principle of calculation, as well as the upper and lower limits of child benefits - both managers and mothers themselves.

When is it issued?

A sick leave certificate is issued to an employee by a medical institution as evidence of temporary disability.

This is a strict reporting document that records the employee’s absence from work and ensures payment of sickness benefits. Everything related to sick leave is regulated by Federal Law No. 255-FZ of December 29, 2006 (Articles 6, 7 255-FZ). Sick leave is provided to an employee in the following insurance cases:

- disease;

- injuries;

- pregnancy;

- quarantine;

- forced sanatorium treatment;

- prosthetics or installation of stimulators that ensure vital functions.

The start date of the sick leave is the day and month of the visit to the medical institution.

Sample application for payment of sick leave at the expense of the employer

an application for payment along with the ballot

sick leave.

The form is free. Below is a sample application

for payment of sick leave.

Applications for payment of sick leave can be found here.

When paying for sick leave for an injury at work or an occupational disease, an accident report or a case of occupational disease is additionally attached. Documents are submitted within six months from the date of restoration of working capacity (establishment of disability) or the end of sick leave for care ( Article 12 of the Federal Law-255

).

Who is paid the benefit?

According to current labor legislation, sickness benefits are received by:

- employees of institutions signed under employment contracts;

- employees of individual entrepreneurs;

- employees employed in accordance with civil contracts with conditions included in the contract for the provision of a social package;

- citizens who are members of consumer cooperatives;

- citizens of the Russian Federation who voluntarily pay contributions to the Social Insurance Fund.

Payment of amounts on a certificate of incapacity for work is mandatory for working pensioners. The maximum and minimum amount of sick leave in 2021 for this category of citizens are determined according to the general rule.

When an employed pensioner is dismissed, the amount of sickness compensation must be paid to him within one month. The exception is cases where a working pensioner takes sick leave to care for a sick relative. Such sheets are not subject to payment.

Who can apply for compensation?

The above-mentioned law of the Russian Federation provides for the payment of benefits to citizens when the following situations occur:

- Employees who have become unable to work due to illness or a traumatic situation. This also includes abortion and in vitro fertilization;

- When caring for one of the family members (for example, an employee may have a wife with a disability to support, etc.);

- Those who are in quarantine due to their own illness or the illness of children under seven years of age;

- For the installation of prostheses as prescribed by doctors in public hospital clinics;

- During the period when citizens are sent to sanatorium resorts located on the territory of the Russian Federation for further treatment or to have prosthetics installed.

When can compensation be denied?

The grounds for a negative response to payment to a temporarily disabled citizen may be the following:

- In case of intentional harm to one’s own health;

- If the damage was caused to oneself under the influence of alcohol or other types of deliberate impairment of consciousness;

- Failure of an employee to appear at a medical institution at the appointed time for examination without an obvious reason. Significant factors are those in which a person is physically unable to appear for examination;

- Acquiring disability at the time of committing a crime of any kind (for example, after an illegal theft at the workplace, an employee tried to climb over a fence and broke his leg).

If one of the above conditions is observed, benefits for the loss of the ability to carry out work activities are significantly reduced or completely canceled.

For how long is it issued?

A certificate of temporary incapacity for work is issued for a period of ten days, but if the illness becomes more complicated, the doctor has the right to extend it up to one month. The maximum limit of sick days per year per person is 30 days. The following cases are exceptions:

- pregnancy and childbirth without identified complications - 140 days;

- pregnancy and childbirth with complications - 156 days;

- multiple pregnancy - 194 days;

- care for a child due to his illness - 30 - 60 days;

- disability - up to 5 months.

The maximum period of sick leave reaches 12 months if the patient is diagnosed with severe pathologies, complicated fractures and diseases requiring long-term treatment.

Read more: “For how many days is sick leave issued?”

Maximum sick leave period

Speaking about the maximum sick leave payment in 2020-2021, one cannot help but recall the 2nd part of the final calculation formula - the duration of the period of illness in calendar days. Sick leave is issued according to strictly regulated rules for a period established by law.

The most common maximum terms are:

- For outpatient treatment - 15 days inclusive.

- Inpatient treatment - the period of stay in a hospital plus up to 10 days inclusive after hospitalization on an outpatient basis.

- Continuation of treatment in sanatorium-type institutions - 24 days inclusive.

NOTE! If the illness (injury) is related to the professional activity of the sick person, the travel time to the medical institution and back is included in the sanatorium sick leave.

- For pregnancy and childbirth - 140–196 days (depending on the situation).

- Caring for a sick child:

- up to 7 years - for the entire period of illness;

- from 7 to 15 years - for 15 days inclusive;

- over 15 years of age for outpatient treatment - for 3 days.

IMPORTANT! Standard treatment periods can be extended, but only by decision of a special medical commission.

Read about the rules for filling out sick leave brought by an employee in the material “An example of filling out a sick leave by an employer .

How to calculate

The rules for calculating the amount of sick leave benefits are as follows:

- The accountant determines the income base and average daily earnings, focusing on the hospital limit in 2021 for insurance premiums for temporary disability and maternity. The basic value is calculated for the 2 years preceding the insured event. Average daily earnings are calculated using the following formula: employee income for the pay period / 730 days.

- Next, the calculated amount of average daily earnings is multiplied by the number of days missed.

- The final benefit is calculated using the formula: SDZ × percentage depending on the employee’s length of service. If the experience is less than 5 years, then 60% of the calculated benefit amount is paid, if the experience is from 5 to 8 years, then 80% will be paid. Temporary disability certificate is paid in full (100%) if the employee’s work experience is more than 8 years.

Common errors on the topic

Mistake #1:

I have no work experience, I just got a job and got sick, the accountant says that I won’t be paid for sick leave

A comment:

No, in any case, you are required to pay it based on the minimum wage, according to the minimum calculation, it cannot be lower than this figure, for this purpose the minimum amount of money is taken for the calculation and multiplied by the number of sick days.

Mistake #2:

My salary for 2021 and 2021 exceeded the maximum possible for calculating benefits, will I be paid less?

A comment:

You will be paid based on the maximum possible figure, that is, no more than 2150.68 per day

Mistake #3:

Paper sick leave is no longer accepted

A comment:

This is a misconception, since an electronic sick leave in no way replaces a paper one, anyone who is comfortable can use it, especially since not all organizations have entered into an agreement with the Social Insurance Fund and registered in their personal account, and also issued an electronic signature to work on their website.

What are the features of calculation in 2021

Due to the coronavirus pandemic, adjustments have been made to the procedure for paying sick leave. From April 1 to December 31, 2021, when calculating benefits, the accountant is guided by the minimum wage and the maximum amount of daily sick leave benefits in 2021 (Article 1 No. 104-FZ of 04/01/2020). Until December 31, 2020, consider the benefit as follows:

- Calculate your average daily earnings (ADW).

- Determine the amount of daily sick pay for SDZ, taking into account the length of service.

- Withdraw your daily minimum wage. The current minimum wage for calculating sick leave in 2021 is 12,130 rubles. Index daily earnings according to the minimum wage according to the employee’s rates and length of service, and if necessary, apply the regional coefficient.

- Compare both amounts (from paragraph 2 and paragraph 3). Select the highest value.

- Calculate the final payment for sick leave by multiplying the selected daily value by the number of sick days.

Introductory information about maternity pay

Maternity benefits paid by employers are not indexed annually. However, the maximum benefit will increase on 1 January 2021 because the accountant will need to take the new maximum average daily earnings into account when calculating benefits.

Let us remind you that maternity benefits are paid in a lump sum and in total for the entire period of maternity leave, which is (Part 1, Article 10 of Law No. 255-FZ):

- 140 days (in general);

- 194 days (with multiple pregnancies);

- 156 days (for complicated births).

How much pay

The minimum and maximum amount for calculating sick leave in 2021 is established by law, taking into account the employee’s earnings. The calculation period is the two previous years. In 2021, the years 2021 and 2021 are used to calculate the benefit amount.

The minimum size is determined based on the current minimum wage. From January 1, 2020, the minimum wage is 12,130 rubles. According to the rules, the minimum average daily earnings for calculating sick leave in 2021 is calculated as follows: 12,130 × 24 months / 730 days = 398.79 rubles.

The lower limit is applied in cases where the employee’s calculation base for the previous two reporting periods is unknown or his income is too small. If necessary, the minimum average daily wage is adjusted as a percentage by the employee’s length of service.

The maximum amount of average daily earnings in 2020 is calculated as follows:

The established limit on insurance premiums for VNiM: (865,000 + 815,000) / 730 days = 2,301.37 rubles.

The maximum amount of payment for sick leave in 2020 is 69,041.10 rubles per month. This value is calculated by multiplying the maximum number of days in a month (30) by the maximum possible average daily earnings.

Answers to common questions

1.Question No. 1:

What does a pilot project mean for paying for sick leave?

Answer:

The pilot project is envisaged in many regions of our country. It allows you to reduce paperwork and reduce the number of unnecessary printouts. An accountant, working in the 1C program, goes to the registers tab for the social insurance fund, selects the required benefit for accrual, fills out all the data on the employee, calculates the average daily earnings, then generates an application, prints it for the employee to sign and sends the register to the fund. In case of any shortcomings, the fund sends by e-mail a table with comments that need to be corrected. The accountant makes corrections and sends again. It is very comfortable. And it pays much faster than without a pilot project.

2.Question No. 2:

Does the amount of sick pay depend on the minimum wage?

Answer:

If your salary is low and the average daily earnings are below the minimum, namely 370.85 rubles, then you will be awarded a minimum amount of sick leave benefits based on the current minimum wage, having previously calculated your average daily earnings and compared it with the minimum.

3.Question No. 3:

How long after the certificate of incapacity for work is provided must it be paid?

Answer:

After you have been sick, you are required to submit sick leave. The accountant, in turn, must complete it within ten days, that is, if it is on paper, then enter the data in 1C and transfer it to the Social Insurance Fund; in the case of an electronic version, go to your personal account and enter the necessary calculations there. The FSS charges you quite quickly if there are no comments, but if there are, then this delays the process.

Maternity benefit

Maternity compensation is calculated taking into account a number of features.

SDZ is calculated according to the formula given in Part 3.1 of Art. 14 No. 255-FZ:

SDZ = income of the woman in labor for the billing period / (number of calendar days in the billing period - periods excluded from the calculation).

The number of calendar days, as a general rule, is 730. But how many days to take to calculate sick leave if the year is a leap year: 731 or 732 days. In 2021, the base is 2021 and 2021, they are not leap years, therefore, 730 days are taken as the basis for calculation.

The excluded periods include (Part 3.1 of Article 14 No. 255-FZ):

- illnesses and other cases of temporary disability;

- maternity leave;

- Holiday to care for the child;

- release of an employee with full or partial retention of salary, during which maternity contributions were not accrued.

Maternity compensation is paid in full - 100% of the amount on the temporary disability certificate. The benefit is calculated as follows:

Daily allowance = SDZ × 100%;

Total amount = daily allowance × number of vacation days.

The minimum limit for paying maternity leave in 2020 is:

12,130 rubles × 24 months / 730 days = 398.79.

398.79 × 140 days = 55,830.60.

By analogy, the amount of payments for a complicated pregnancy (156 days) is equal to 62,211.24 rubles, and for a multiple pregnancy (194 days) - 77,365.26 rubles.

Maximum limit on sick leave payment in 2020 (payment in rubles):

(865,000 + 815,000) / 730 days = 2,301.37.

RUB 2,301.37 × 140 days = 322,191.80.

For complicated pregnancy: RUB 2,301.37. × 156 = 359,013.72.

For multiple pregnancy: RUB 2,301.37. × 194 = 446,465.78.

IMPORTANT!

If a woman in labor does not have an insurance base for the two previous financial years (she had no salary), then the employee has the right to write an application to postpone the billing period for calculating maternity benefits, provided that this will lead to an increase in the amount of compensation (Part 1 of Art. 14 No. 255-FZ).

Do I need to recalculate benefits up to 1.5 years?

The answer to this question is unequivocal - no. The general rule is: child care benefits up to 1.5 years old are assigned once and only on the start date of the vacation.

The benefit will need to be recalculated if, after February 1, 2021, the employee returned from maternity leave for at least one day and then went on vacation again. This time she will leave with a new calculation.

Plans to increase child care benefits

From 2021, the amount of childcare benefits for children aged 1.5 to 3 years will be significantly increased. At least, Prime Minister Dmitry Medvedev announced such intentions. Now women on maternity leave, after the child reaches 1.5 years of age, receive a monthly payment of 50 rubles.

Officials believe that the benefit should not just be increased - it should be targeted, that is, paid to those who need it.

Also, according to Medvedev, the issue of increasing the period of maternity leave counted towards length of service from 1.5 to 3 years needs additional discussion. First of all, we need to weigh both the financial and social aspects of this idea, he noted.

How is sick leave paid for a domestic injury?

How sick leave is paid for a domestic injury is influenced by the person’s compliance with the treatment regimen and the cause of the injury.

So, if an accident or illness occurred when a citizen was drunk or under the influence of drugs or toxic substances, the certificate of incapacity for work is considered according to the minimum wage. A similar procedure is provided if injury or illness is a consequence of actions committed while intoxicated.

Failure to comply with the treatment regimen requires payment of sick leave according to the minimum wage from the date of the violation. A similar penalty is established if the patient fails to appear on the day of examination or medical and social examination.

Benefit payment terms

Sick leave accruals are paid by the enterprise's accounting department on the day the salary is issued. The benefit is taxed at 13%. You can file a complaint against an employer who violates the procedure for paying sick leave to the Labor Inspectorate or other competent authorities. The employee draws up a complaint and indicates his claims against the employer. Evidence confirming a violation of the labor legislation of the Russian Federation is attached to the application. Evidence may include:

- A photocopy of the certificate of incapacity for work;

- Employment contract;

- Calculation provided by the organization’s accountant;

- Bank statement (if benefits are transferred to a plastic card);

- Payment statement.

What is the maximum size

The maximum size of the bulletin is subject to change every year, as the minimum wage indicators and the critical values of the base for calculating insurance premiums from the wages of individuals are updated.

Payment transactions and calculation of benefits are carried out on the basis of a certificate of incapacity for work. Moreover, it applies exclusively to those citizens who have entered into an official employment contract with their employers.

Calculation of temporary disability benefits takes into account the employee’s income subject to insurance contributions for an accounting period of 2 years. These years precede the one in which the ballot is taken. For 2021, respectively, the calculation periods are 2021 and 2021. In some cases, they can be changed, for example, if the employee was on maternity leave during this period.

- In 2021, the maximum base for insurance contributions is 755 thousand rubles;

- as a result of re-indexing the permissible values of the insurance deduction base in 2021, this amount amounted to 815 thousand rubles.

Once the average salary is calculated, it is compared with the minimum and maximum values adopted for the current year. When the amount received exceeds the maximum allowable value, the benefit is calculated based on the larger figure. When the amount is below the minimum limit, then the minimum specified in the legislation (from the minimum wage) is paid.

Temporary disability certificate in 2021

Officially employed employees can receive sick leave in the event of their temporary incapacity for work due to the development of a disease (infection, exacerbation of chronic pathology, etc.) or during pregnancy and upcoming childbirth. The sheet is issued in a public hospital or private clinic, which has the appropriate licensing and the right to work with such documents. The document is drawn up when a person seeks medical help from an appropriate specialist in a medical institution. It can also be applied for online. The first and last days of illness are determined by the attending physician based on the diagnosis and condition of the patient.

A “closed” sheet with the doctor’s signature and the seal of the medical institution is provided by the employee to the manager or employee of the human resources (accounting) department no later than 6 months after the date of recovery (discharge from the hospital). Payments are usually made within a month.

The period of temporary disability is paid to the employee depending on the level of his salary and length of service. The first three days of illness of the general period are paid from the funds of the employer (enterprise), and the remaining days - from the Social Insurance Fund. The fund receives funds from the employer, who contributes the corresponding percentage of the employee’s income to the Social Insurance Fund. Thus, in essence, employees provide themselves with the opportunity to receive this benefit.