Posted on Sep 2nd, 2019 by Olya Categories: Addictions From the second half of 2021

When starting a business, every businessman must choose a taxation scheme. Currently available as

A number of professions are closely related to the need for employees to perform their labor functions out of place

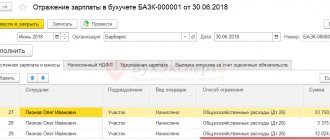

Employers must withhold personal income tax (PIT) from their employees' paychecks. That's why,

Strict reporting forms are now used by many individual entrepreneurs and organizations to process cash payments.

Starting from 2021, VAT will be paid directly to the budget, bypassing the supplier. Now none

An individual entrepreneur sells an apartment or a car. Let's start with the amendments dedicated to entrepreneurs on the main tax system,

Income tax Once a quarter, advance payments for income tax are transferred

The Social Insurance Fund may not accept benefits for credit. An entrepreneur cannot ignore this decision of the authorities.

There are often situations when an employee goes on sick leave due to illness. At the same time, the employer