Individual entrepreneur sells an apartment or car

Let's start with the amendments dedicated to entrepreneurs on the main tax system who sell their residential house, apartment, room, cottage, garden house or shares in them, as well as a vehicle.

Starting from 2021, they will not have to pay personal income tax if the specified real estate was in their ownership for at least the minimum maximum period of ownership (in general, it is five years), and the car - for three years or more. This rule will apply even if the housing, garden house or car was used in business activities (subclause 17.1 of Article 217 of the Tax Code of the Russian Federation as amended by Federal Law No. 425-FZ dated November 27, 2018; see “Individual entrepreneurs will no longer pay Personal income tax on the sale of apartments and cars that were used in business activities”). If the individual entrepreneur owned the listed property for a shorter time, he, as before, will have to pay personal income tax. But in this case, the entrepreneur has the right to apply a property deduction. With the adoption of the commented Law No. 424-FZ, the procedure for calculating the deduction amount has changed. The innovations will affect the situation when the costs associated with the purchase of housing, a summer house or a car were taken into account within the framework of the simplified tax system, Unified Agricultural Tax, or as part of a professional deduction under the OSNO. Under such circumstances, it will be possible to include in the property deduction the actual costs of acquiring the specified object minus the previously taken into account costs of its purchase or the amount of the professional deduction (new edition of subclause 2, clause 2, article 220 of the Tax Code of the Russian Federation).

We would like to add that no changes are provided for individual entrepreneurs on the simplified taxation system. When selling real estate that was rented out, they must pay a single “simplified” tax in accordance with the conclusions made in the ruling of the RF Armed Forces dated December 2, 2014 No. 309-KG14-5023.

Calculate contributions “for yourself”, tax according to the simplified tax system, fill out payments in the web service Fill out for free

What will change in personal income tax from 2021

The main changes from 2021 related to personal income tax relate to certificates in form 2-NDFL and tax returns in form 3-NDFL.

Let's take a closer look at these changes. The main innovation associated with 2-NDFL certificates is that from January 2021 there are two certificates (and not one, as before) - a certificate for employees and a certificate for the tax office. Therefore, starting from 2021, employers issue different certificates to employees and submit them to the tax authorities.

The certificates that were issued to employees until 2021 were briefly called “certificates in form 2-NDFL.” As of 2021, this certificate does not have a short name. There is only the full name - “Certificate of income and tax amounts of an individual.” Form 2-NDFL for the tax office retained the old abbreviated name - 2-NDFL.

Let's talk about certificates for employees. This certificate remains practically the same as it was before 2021. There are changes, but they are very minor. Several fields have disappeared. The procedure for filling out this certificate is not described separately anywhere. It must be completed in the same way as the previous 2-NDFL certificate was issued.

The new 2-NDFL certificate, which is intended for tax purposes, has changed quite a lot. Compared to the old certificate, it has a different structure. Instead of five sections, it now has three sections and one application.

Information about the organization that is the tax agent, such as TIN, KPP and name of the organization, is indicated at the top of the new form.

A breakdown of information about income and deductions by month must be included in a separate appendix to the certificate.

There is no need to indicate the TIN of the individual in the country of citizenship - there is no such field in the new certificate. The following fields are also missing:

- “Notification confirming the right to a property tax deduction”;

- “Notification confirming the right to a social tax deduction”;

- “Notice Confirming Eligibility for Tax Reduction on Fixed Advance Payments.”

The notification type is now reflected in encoded form in the new “Notification Type Code” field.

New certificates came into force on January 1, 2021. For 2018, you will need to use a new 2-NDFL certificate and a new certificate for employees.

The new 3-NDFL declaration form has become significantly smaller. It contains only 13 sheets instead of 20. The new form has redistributed the information that needs to be included in the declaration and removed some lines. In addition, new barcodes and line numbering have been introduced.

Dividends upon exit from the company or its liquidation

From January 1, 2021, the concept of dividends of an individual - participant (shareholder) of a Russian or foreign company will be expanded. From this date, dividends, among other things, will recognize the excess of income received by such a person upon leaving the organization or upon its liquidation over his contribution.

In other words, the size of dividends is the difference between two values. The first value is the amount of money or the value of property (property rights) transferred to a participant or shareholder at the time of leaving the organization or in the process of its liquidation. The second is the cost of purchasing shares or shares of a given company. If the first value is greater than the second, the participant (shareholder) receives taxable income in the form of dividends. If the first value is less than or equal to the second, taxable income is zero. This follows their new editions of subparagraph 1 of paragraph 1 and subparagraph 1 of paragraph 3 of Article 208 of the Tax Code of the Russian Federation.

If, upon leaving the company or upon its liquidation, a former participant (shareholder) receives property rights, their value should be determined at the market price in accordance with Article 105.3 of the Tax Code of the Russian Federation (new sub-clause 1.1, clause 2, Article 211 of the Tax Code of the Russian Federation).

Check the financial condition of your organization and its counterparties

Change No. 5: A ban on the use of UTII and patents is introduced

No changes!

No changes!

The bill prohibits working on UTII and patents when selling goods subject to mandatory labeling. Thus, in relation to trade in labeled goods, it is proposed to prohibit the use of these special tax regimes. Let us remind you that cigarette labeling has been introduced since March 1.

The government, by order No. 792-r dated April 28, 2018, determined which products to label starting this year: from March 1 - cigarettes; from July 1 - shoes; from December 1 - perfumes and eau de toilette, most light industrial goods, cameras and tires.

Don’t forget to reconfigure the cash register for labeled goods. Instructions below.

In addition, it is proposed to give regions the opportunity to set restrictions on the use of patents by the total number of vehicles, by the total area of leased facilities, as well as by the total number of retail chain facilities and public catering facilities.

Deduction upon receipt of dividends (withdrawal from the company or its liquidation)

As mentioned above, a participant (shareholder), to whom property (money, property rights) was transferred upon liquidation of the company or upon leaving it, receives taxable income. This income is exempt from personal income tax on the basis of subclause 17.2 of Article 217 of the Tax Code of the Russian Federation, provided that at the time the income was received, the individual owned these shares or interests for more than five years (for more details, see “How to calculate personal income tax when a participant leaves an LLC: dealing with complex issues”) .

If the founder received property (property rights) upon leaving the company or upon its liquidation before November 27, 2021 (the date of entry into force of the commented Law No. 424-FZ), then in order to be exempt from personal income tax, one more condition must be met. Namely: shares or shares of the company must be acquired after December 31, 2010. If income is received on November 27 or later, then it is not subject to personal income tax, regardless of the date of acquisition of shares and interests.

If the above conditions for exemption from personal income tax are not met, the former participant (shareholder) is obliged to pay personal income tax. At the same time, he has the right to apply a property deduction if he is a tax resident of the Russian Federation. The amount of the deduction is equal to the amount of expenses for the acquisition of shares and the acquired company.

How to determine the amount of such expenses is specified in the new edition of subclause 2 of clause 2 of Article 220 of the Tax Code of the Russian Federation. If an individual paid for shares or shares in cash, everything is simple: acquisition costs are equal to the amount transferred to the authorized capital or spent on the purchase of shares or shares.

If shares or shares were paid for with property (property rights), then expenses are determined as follows. If, at the time of transfer to the authorized capital or to third parties, the full value of the property was included in the taxable income of an individual, such property is taken into account as expenses at the market price. The same rule also applies in a situation where the specified income was exempt from taxation on the basis of Article 217 of the Tax Code of the Russian Federation.

If the cost of the property with which the shares or shares were paid was not included in the taxable income of an individual, or was only partially included, then the costs consist of three components. The first is the documented costs of purchasing this property. The second is a material benefit attributed to the taxable income of an individual as a result of the purchase of this property. The third is the partial value of the property, classified as taxable income when transferring it to the authorized capital or to third parties.

If a tax resident of the Russian Federation is unable to confirm expenses for the purchase of stocks and shares, for example, due to the loss of primary documents, he has the right to apply a deduction in the amount of 250,000 rubles. (Subclause 1, Clause 2, Article 220 of the Tax Code of the Russian Federation). As for tax non-residents, under no circumstances can they use the property deduction.

We would like to add that the commented amendments raised certain doubts among experts that they would be implemented.

Alexey Krainev, tax lawyer at Accounting Online:

— Taking into account the amendments, the following picture is obtained. A shareholder or participant who left the organization or received property in connection with its liquidation received income in the form of dividends. To find the amount of dividends, you need to subtract the costs of purchasing stocks, shares and shares from the amount of money received or the value of property. Then, if the specified income is not exempt from taxation under Article 217 of the Tax Code of the Russian Federation, a tax resident of the Russian Federation can apply a deduction. This deduction is equal to the costs of purchasing stocks, shares and shares.

It turns out that a resident has the right to reduce his income twice by the amount of the same expenses. The first time is at the time of determining the amount of dividends. The second time is at the time of applying the property deduction. However, such a “double” reduction in expenses looks dubious. It is possible that further amendments will soon appear that will correct this accounting algorithm.

Keep personal income tax records in the web service, generate and submit 6‑personal income tax and 2‑personal income tax via the Internet

Current income tax rates

The standard personal income tax rate is 13

%, which is taxed on the majority of income of the working population of the Russian Federation (residents). In some cases, non-residents are also subject to this rate:

- foreign highly specialized workers;

- foreigners working for individuals under a patent;

- participants of the State Program, under which they voluntarily move from abroad to Russia for permanent residence;

- foreign refugees;

- crew members of ships operating under the State flag of the Russian Federation.

For some types of revenue that are not remuneration for labor activity (winnings or prizes worth more than 4 thousand rubles received at any competitions), the tax code provides for a rate of 35%.

In other cases, the following tax rates are provided - 9, 15 and 30% (for more details, see Article 224 of the Tax Code).

For comparison, it is worth considering the amount of income tax in other countries:

| A country | Annual income, dollars | Income tax, % |

| Australia |

|

|

| Austria |

|

|

| Belarus | For any income | 13% |

| Bulgaria | For any income | 10% |

| Brazil |

|

|

| Great Britain |

|

|

| Germany |

|

|

| Spain |

|

|

| Italy |

|

|

| Canada |

|

|

| China |

|

|

| Mexico |

|

|

| USA |

|

|

| Ukraine | For any income | 18% |

| France |

|

|

| Sweden |

|

|

| Norway |

|

|

Sale of property received upon exit from the company or its liquidation

What will be the tax base if a former participant (shareholder), who received property (property rights) upon leaving a Russian company or during its liquidation, sold it? The amendments introduced by the commented Law No. 424-FZ provide an answer to this question.

If we are talking about securities or derivative financial instruments, then upon their sale, disposal or redemption, income is reduced by their full value, which was subject to accounting when determining taxable income at the time of leaving the company or in connection with its liquidation (new clause 13.4 of Art. 214.1 Tax Code of the Russian Federation).

If a former participant (shareholder) sells other property or property rights, then he has the right to apply a tax deduction. Its size is equal to the documented full value of the sold property or property rights, which was subject to taxation at the time of their receipt upon leaving the company or upon its liquidation (new sub-clause 2.4, clause 2, article 220 of the Tax Code of the Russian Federation).

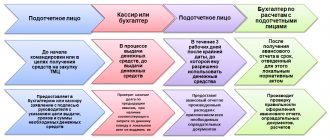

By whom, how and when is the payroll paid?

Payment of income tax to the state treasury can be carried out in two ways:

- without first filing a declaration;

- with its compilation.

People whose income consists only of monthly wages do not need to take any action themselves. The employer calculates and transfers the tax for them, since he is considered a tax agent. This also applies to dividends paid to the founders.

The amount of tax withheld should not exceed 50% of the total salary payment to the employee.

Who must prepare and submit an income tax return to the tax service:

- Individual entrepreneurs and citizens engaged in private labor activities;

- persons selling and leasing any property;

- citizens who won the lottery;

- residents receiving income from abroad;

- people gifted with something by private individuals (not registered as individual entrepreneurs), with the exception of gifts from relatives.

As a standard , personal income tax is transferred every month, no later than the date following the day the earned funds are issued to the employee

. An exception will be vacation pay and subsidies for temporary disability of an employee or for caring for a sick child. Then the tax is paid until the end of the month in which it was assessed.

Private entrepreneurs transfer personal income tax advances three times a year:

- until July 15;

- until October 15;

- until January 15th.

The basis for transferring PN will be a notification from the Federal Tax Service. Tax authorities calculate specific amounts themselves, based on the submitted declaration.

Citizens who are not listed as individual entrepreneurs and do not conduct private practice pay personal income tax once - no later than July 15 of the following year.

Sale of property by non-residents

The current version of subclause 17.1 of Article 217 of the Tax Code of the Russian Federation states that individuals who have sold their real estate or a share in it are exempt from personal income tax. But not always, but provided that the sold object was owned by the seller for the minimum maximum period of ownership or longer (Article 217.1 of the Tax Code of the Russian Federation). There is one more restriction: only tax residents of the Russian Federation are exempt from personal income tax when selling real estate. A person who is a tax non-resident of the Russian Federation (for example, lost his resident status because he was abroad for more than 183 days over the next 12 consecutive months) is required to pay tax when selling real estate, regardless of the period of ownership of the property.

Starting from 2021, this restriction for non-residents will be lifted. This means that a non-resident will be able not to pay personal income tax if the sold property was in his ownership for the minimum maximum period of ownership or longer (new editions of subclause 17.1 of article 217 and clause 1 of article 217.1 of the Tax Code of the Russian Federation).

Change No. 8: The rules on trade fees will be clarified

The bill clarifies the procedure for paying the trade tax when trading through the facilities of a stationary retail network and when trading from warehouses. It is proposed to establish a procedure for the payer of the trade fee to notify the tax authority upon termination of use of the object of trade, as well as about changes in the indicators of the object of trade, which entails a change in the amount of the trade fee.

In addition, the authorities want to establish the specifics of calculating and paying the trade fee under a simple partnership agreement (agreement on joint activities), a commission agreement, an agency agreement, an agency agreement, and a trust management agreement.

Tax reform

Many party factions have developed specific projects for reforming the current flat tax system for individuals. The need to reform the taxation of individuals is long overdue.

A number of official opposition parties – the LDPR and the Communist Party of the Russian Federation – have long advocated the introduction of a progressive scale. Representatives of United Russia did not want to introduce progressive taxation, implying an increase in taxes on wealthy citizens, since this, in their opinion, would lead to a significant part of the economy going into the shadows.

The lack of sources of financial revenue forced the liberal part of the Russian government, primarily its financial sector, to put forward proposals to increase personal income tax for all citizens by 2%.