When calculating benefits based on certificates of incapacity for work, the accountant first determines the average income.

According to the law on social insurance, when calculating, earnings for the 2 years preceding the year of illness are taken into account.

According to Part 1 of Art. 14 FZ-255, when calculating average income, it is possible to replace the years of the calculation period.

However, for this to happen certain conditions must be met.

Who is eligible for a replacement?

Women who received maternity leave, as well as persons who were on leave to care for a newborn, can change the years for calculating benefits.

If everything is clear with the first group of employees - only female employees - mothers of children - are included in it, then both women and men can be included in the second group. This is due to the fact that, according to the current legislation of the Russian Federation, a small child can be cared for by his mother, father or guardian (but only one).

What regulations govern sick pay in 2021?

In ch.

2 of the Law “On Compulsory Social Insurance...” dated December 29, 2006 No. 255-FZ, information is disclosed on cases when insured persons have the right to count on sickness benefits, as well as on the conditions and procedure for paying sick leave. We remind you! From 2021, new rules for paying money for sick leave will apply. For more details, see our memo.

Calculating sick leave after maternity leave in 2021 has certain features related to the lack of income in previous years. When calculating sickness benefits after maternity leave, in addition to the law dated December 29, 2006 No. 255-FZ, you should also take into account letters from the Social Insurance Fund dated November 30, 2015 No. 02-09-11/15-23247 and the Ministry of Labor of the Russian Federation dated August 3, 2015 No. 17 -1/OOG-1105. The main idea of these clarifications is that the insured persons should be compensated for their real earnings, but only that which was before the occurrence of the insured event, and not that which was many years ago. This means that the calculation period for calculating disability benefits cannot be any, but must be determined taking into account the established rules.

If you have access to ConsultantPlus, check whether you calculated the benefit correctly if the employee was on maternity leave during the billing period. If you don't have access, get a free trial of online legal access.

Read about the acceptable amounts of disability benefits in the material “Maximum amount of sick leave in 2021 - 2021” .

Why are these changes needed?

Russian legislation firmly guards the interests of employees. The transfer of years is one of the measures that follows this principle, since it is needed for the correct calculation of benefits for temporary disability, pregnancy and childbirth, and for caring for a child up to one and a half years of age.

By law, all these benefits are calculated taking into account the employee’s average earnings for the two years (according to the calendar) preceding the year in which the event covered by insurance occurred. Thus, if a person did not work for the reasons stated above, his insurance payment is significantly reduced, and recalculation with the replacement of years leads to a reasonable increase in the amount of benefits.

At the same time, the employer does not have the legal right to refuse an employee to receive an increased material payment, and if such a recalculation leads to its reduction, then this castling should not be carried out.

Calculation of insurance period for sick leave

The amount of benefits that an employee of an organization will receive in the near future depends on the length of insurance coverage:

- 100% of wages are taken into account for employees who have worked in total for at least 8 years, or even more;

- if a person worked for 5 to 8 years, 80% of earnings is taken as the basis;

- they are guided by the indicator of 60% of wages if a Russian citizen has worked for up to 5 years;

- if the length of service does not exceed six months, the benefit varies within the established minimum wage for 30 days. From January 1, 2021, the minimum wage was adopted at 7,500 rubles.

How is the insurance period recorded correctly? The main reference point is the date of occurrence of the insured event. The last day of the insurance period is the day preceding the onset of the disease, secured by a certificate of incapacity for work. Let’s say a worker fell ill on April 2, 2017, then the length of service is calculated as of April 1, 2017.

The insurance period includes the following components:

- period of work in accordance with a pre-drawn up agreement;

- periods when the employee was in the state civil service or municipal service;

- the time when military service or other type of official activity was carried out, specified in the law of 1993, registered under the number 4468-1;

- periods when the employee was engaged in other work activities, during which he still acted as an insured individual and made contributions in case of temporary disability or in connection with maternity.

Other work activities mean:

- Work related to the provision of notary services, registered privately, the position of a private detective or private security guard, if the work was carried out before January 1, 2001 and after January 1, 2003, but only if social insurance contributions were paid at that time.

- Work in a law office, which was accompanied by timely payment of contributions to state social insurance funds, after January 1, 2003 and before January 1, 2001.

- Activities on a collective farm or cooperative, during which deductions from wages continued to be made to the accounts of state insurance funds, in accordance with the norms of current legislation, before January 1, 2001 and after January 1, 2003.

- Other work activities also include the time when the employee was registered and performed the duties of a deputy of the State Duma.

- Periods of work as a clergyman who regularly sent transfers to social insurance funds.

- Time of activity of the convicted person after November 1, 2001.

Periods that can be used when replacing years

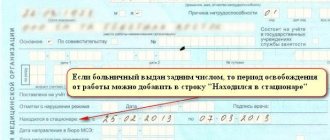

As already mentioned, the replacement of years should not occur more than two years before the insured event occurs.

An employee of an organization can request either a replacement of one year taken for calculation, or two years at once (even if the second year included only a couple of days from the above-mentioned vacations).

Moreover, if leave for pregnancy and the birth of a baby or to care for a newborn fell on only one of them, it is impossible to ask for the replacement of both years for recalculation.

To complete the picture, let's give an example.

Let’s assume that an employee of the organization was on official maternity leave in 2015 and 2021, and she fell ill in 2021. Then the years 2015 and 2021 are not considered, and the years 2013-2014 are taken into account.

When can I choose a calculation period for temporary disability benefits?

Some working citizens have the right to request in writing to change the years of the calculation period when calculating benefits for sick leave, as well as leave related to pregnancy or caring for a child up to one and a half years old.

Art. 14 of the Social Insurance Law specifically stipulates the conditions for replacing years necessary to calculate average income when calculating benefits:

- During the billing period, the insured person was on maternity leave or childcare leave.

- Changing years is really beneficial to the employee - the payment for temporary disability increases when choosing a different billing period.

Only the woman who is the mother of the baby has the right to take maternity leave. As for parental leave, even men, as well as grandmothers or other relatives, take it.

When changing periods, you need to pay attention to the income limits established for the corresponding years.

For example, in 2021 the law established a limit of 815 thousand rubles, in 2017 – 755 thousand rubles.

Income above this indicator is not subject to insurance contributions, including the social insurance fund, and therefore is not taken into account in calculating average income.

You can replace both years at once, or just one. Therefore, the calculation period may include years that are not consecutive.

For example, an employee provided sick leave in 2021, had maternity leave with a child in 2021 and 2017, and for benefits in 2021 he has the right to choose 2016 instead of 2017. Then, the accountant will take into account 2021 and 2018 non-consecutive years.

We offer to calculate sick leave benefits using an online calculator for free.

What documents are needed?

In order for the accountant to change the years when calculating sick leave benefits, the employee must fill out a special application -.

It is recommended to fill it out in two copies:

- one remains for the employer;

- on the second, the accountant will mark the acceptance and give it to the applicant.

Additionally, the employer does not require any documentation to replace years.

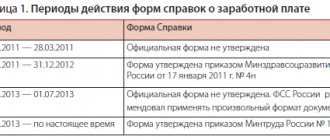

When an employee worked during a “beneficial” period for him with another employer, in order to transfer, he will need to request a certificate 182-N from his previous place of work.

It contains the earnings amounts needed to calculate benefits.

Also, if at that time he worked for several employers, it is necessary to obtain certificates from each of them - the procedure for paying sick leave when working part-time.

After maternity leave

If an employee goes on sick leave in 2021 due to his illness and has been on maternity leave for the last two years, then as a general rule, to calculate benefits, the calculator must take the employee’s income for 2017-2018.

In this case, the employee has every right to choose a different pay period - to write an application to replace the years from 2017-2018 to 2015-2016, if there was earnings during that period and the benefit amount will increase. It is possible to replace only one of the years in which the maternity leave falls.

For example, in this case, the employee can choose:

- 2015 and 2016;

- 2016 and 2017;

- 2016 and 2018;

- leave 2021 and 2021.

It is important that the employer is not obliged to offer the employee any options. The initiative must come from the employee.

If he wants to choose other years, he has the right to do so by declaring in writing.

The replacement is carried out only if the employee benefits from it, that is, the temporary disability payment will increase.

If choosing a different period would result in a reduction in benefits, the employer should not make the change.

In accordance with the law, the accountant’s task, after receiving an application from the employee, is to calculate the sick pay with and without replacement, then you need to choose the option that is more profitable for the employee.

Read more about paying sick leave after maternity leave here.

When is it not profitable to change?

One of the points for replacing years is the profitability of the procedure.

If the choice of years in the calculation period does not lead to an increase in the average daily earnings, and, accordingly, the amount of disability benefits, then the period cannot be changed.

For the employee, the replacement will not be beneficial if the person loses some amount of benefits from this action. This is possible if earnings were higher in the years before maternity leave.

Before writing an application and choosing other years, you need to figure out whether it is profitable or not.

It is recommended that you contact a payroll specialist with this question.

After all, in the calculations you also need to take into account what amounts can be taken according to the law. There are also periods excluded from such calculations.

It is difficult for a simple working person to figure out which amounts to take for calculation and which not.

Example for 2021

Let’s look at a specific example of what “replacing years is not profitable” means.

Initial data:

Ivanova Alevtina Konstantinovna falls ill in April 2021 and goes on sick leave for ten days.

She has 10 years of experience.

She was on maternity leave throughout 2021 and 2021.

Her earnings during these periods were only in the form of child care benefits. Such payments are not taken into account in calculating average earnings.

Therefore, the accountant will calculate the sick leave benefits for an employee from the minimum wage (from January 1, 2021, it is equal to 11,280 rubles).

In 2015 and 2021, the employee worked and had a total income of 200 thousand rubles.

Is it necessary to change the age of this employee?

Calculation:

Let's calculate the benefit based on 2 indicators in the form of a comparative table:

| When replacing (calculation for 2017-2018) | Without replacement (calculation for 2015-2016) | |

| Average daily earnings | 11280 * 24 / 730 = 370,85 | 200000 / 730 = 273,97 |

| Benefit | 370,85 * 100% * 10 = 3708,50 | 273,97 * 100% * 10 = 2739,70 |

| Amount in hand minus personal income tax | 3708,50 – 3708,50 * 13% = 3226,95 | 2739,70 – 2739,70*13% = 2383,54 |

Comparing the obtained indicators, it becomes clear that choosing earlier years for calculating benefits will not be profitable. The employee will receive a smaller amount of benefits than the minimum for 2021.

Therefore, it makes no sense for her to write an application for changing the billing period.

Also, for example, it is not profitable to make a choice if during the billing period the average daily earnings were 450 rubles, and in 2015 and 2016 it was 440 rubles.

Features of the document, general points

If you are faced with the task of drawing up an application for replacement years to calculate temporary disability benefits, read the recommendations below - they will give you an accurate idea of the document. Please also take a look at the application example below - you can easily draw up your own form based on it.

Let's start with general information. Today, there is no generally applicable, unified sample of such an application, so you can write it in free form, based on your own vision of this document or, if the employer provides your application template, according to its type.

When creating a form, it is important to ensure that its composition and content meet certain standards of business documentation. This means that the document must include three parts:

- the beginning contains information about the employing company and the applicant;

- the main section is the actual request to change the years;

- the conclusion contains a list of attached documents (if any), a signature and date.

There are no special requirements for the design of the document, just like for its text, i.e. The application can be written in your own hand or typed on a computer. For a printed document, an ordinary blank sheet of paper of any convenient format (A4 or A5 are mainly used) and the company’s letterhead (if such a condition is stated by the employer) are suitable.

The application must be written in two copies , one of which should be given to the employer, the second should be kept with you, having previously secured a mark on it that a copy was received by a representative of the organization.

Results

Sick leave after maternity leave in the absence of income in the previous 2 years is calculated according to special rules. At the request of the insured person, the periods of earnings used to calculate benefits can be replaced, but only for the years preceding the insured event. As a result of such a replacement, the employee should be in a more advantageous position. It must be remembered that the possibility of changing the billing period is only the right of the insured person, therefore it is unacceptable to change the period without a corresponding application.

Sources: Federal Law of December 29, 2006 No. 255-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sample application for replacing years when calculating sick leave

At the top of the document (right or left - it doesn’t matter) the position, full name of the manager, and the name of the company - employer are indicated. Then information about the applicant is entered in the same way: his position and full name are indicated. Below in the middle of the form, write the word “Application” and put a dot.

The main part of the application contains the actual request to change the years. Here you need to indicate the articles of the legislation of the Russian Federation justifying the replacement of years, as well as the years that are subject to replacement. If necessary, the application can be supplemented with other information (depending on individual circumstances).

Finally, the document is signed and dated.

How to correctly carry out the procedure?

At the first stage, the employee is required to draw up a statement indicating the reason for the replacement and the year(s) that should be taken into account. The accountant is not obliged to pre-calculate possible options for the employee; changing the accounting years is a personal initiative of the employee who has the status of an insured person. If in the specified year (years) the employee is employed at another enterprise (organization), then it is necessary to make a request for earnings. Next, salary (average) calculations are made for the new period, taking into account the maximum earnings limits.

Calculation example

Samokhina A.’s sick leave was closed in the second ten days of June 2021 (10-day sick leave, 12 years of experience).

The employee asked to replace her 2016-2017 income. for the 2014-2015 salary, since the payments received in the traditional pay period are not used when calculating sick leave. The average salary for the new period is 300,000 rubles. According to the law, Samokhin A. has the right to replace the years, but the employer, before accruing payments, is obliged to find out which period is financially beneficial to the employee and pay a larger amount. If the traditional one is used, then the compensation is equal to 3,670 rubles, since the average daily earnings are taken based on the minimum wage of 11,163 rubles. When replacing, the compensation is 4,110 rubles, which is 440 rubles more. Changing years is justified and a larger amount is paid. In some cases, the current minimum wage for 2021 may exceed earnings in 2014-2015, then the replacement of years is not made, since the final payment is not beneficial to the recipient. If the average wage per day in the alternative period is less than 367 rubles, then replacing years is not practical. The salary during the alternative period should not be higher than the maximum limit established by law at that time.

How to write an application

The employer must not transfer anything on his own initiative. Even if it will be very beneficial for the employee. The worker must take care of this himself and write an application for changing years when calculating sick leave. The form of the document is arbitrary, but an example form can be used. After filling it out (can be on a computer, or by hand), it is submitted to the employer along with a request for payment of benefits.

Procedure for submitting an application

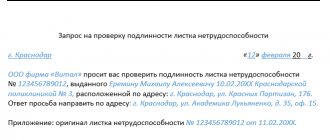

An employee can submit an application to change the years for calculating sick leave to the accounting department in one of the following ways:

- Hand it personally to a company employee;

- Send by registered post with acknowledgment of receipt;

- Give it to a company employee through your representative. According to the rules, to perform this operation, the authorized person must have a notarized power of attorney with the right to transfer papers. In practice, this requirement is usually neglected.

The employee can also send an application or a scan of it via email. However, in this case, the law establishes that such letters must be signed with an electronic digital signature (EDS), which could uniquely identify the sender. In addition, the personnel officer himself may refuse to accept such an application, justifying this by the need for a living signature of the originator on the document.