Confirmation of income of an individual entrepreneur: when necessary

There are plenty of situations when an individual entrepreneur is obliged to provide information about his income. These may be the following cases:

- An individual entrepreneur applies for a loan from a bank;

- An individual entrepreneur needs to receive an allowance, subsidy, benefit, etc.;

- in some cases when traveling abroad.

Moreover, if people who work for hire can apply for a certificate confirming their income to their employer, where the issue is resolved quickly and competently, then individual entrepreneurs in this case have a problem - quite often entrepreneurs do not know how to correctly confirm their level of income for all kinds of authorities

Does the bank have the right to write off increased interest if it suspended the issuance of the loan before increasing it? If at the time of concluding the loan agreement the bank’s tariffs did not provide for a commission for early repayment, does the bank have the right to write it off after changing the tariffs? What circumstances do courts evaluate when considering cases of writing off fees for early loan repayment? View answers

What income will need to be verified?

Depending on the chosen taxation system, slightly different funds are legally recognized as income. If necessary, you need to confirm various forms of income:

- actual - to entrepreneurs working on the general taxation system, as well as the simplified taxation system and the unified agricultural tax (Chapter 23 of the Tax Code of the Russian Federation, clause 1 and clause 2 of Article 248 of the Tax Code of the Russian Federation);

- imputed - individual entrepreneur working on UTII (Article 346.29 of the Tax Code of the Russian Federation);

- possible – for patent entrepreneurs (Article 346.48 of the Tax Code of the Russian Federation).

NOTE! If an individual entrepreneur combines his taxation system with UTII or PSN, that is, combines forms of income, then the imputed or possible income will be included in the total actual amount.

Each type of income has its own characteristics in reflection and documentary evidence.

What is the procedure for assessing personal income tax on the income of an individual entrepreneur when renting out premises ?

Regions will decide for themselves what types of activities a patent can be used for

Now in st. 346.43 of the Tax Code of the Russian Federation specifies a closed list of 63 types of activities under a patent; regions have the right to supplement it with household services.

From January 1, 2021, the list will be expanded to 80 types of activities and it will become recommended, and regions will independently determine the types of activities under a patent. This means that in a particular region there may be more of them than in NK, or maybe less. In addition, local authorities may introduce additional restrictions on the physical indicators of a business: the area of sales floors, the number of vehicles, and others.

To determine if the patent system is right for you, check the law in your region or simply open a calculator.

Due to the fact that amendments to the Tax Code were adopted only at the end of November, not all regions had time to make changes to their laws. For the same reason, the calculator for calculating the cost of a patent has not yet been updated. Even if a new law does not appear in your region until the end of the year, the tax will be calculated according to the 2021 rules and the patent will still be issued.

Article: how to find out the cost of a patent in your region and where to find local law

Individual entrepreneur on OSNO: confirmation of income

The procedure for confirming income by individual entrepreneurs is clearly defined by law. If hired employees must provide state bodies and other organizations that require information about income with certificates in Form 2 of personal income tax, then individual entrepreneurs applying the general taxation regime are required to file a declaration in Form 3 of personal income tax. If you already have a declaration and it contains a mark of acceptance by a tax specialist, then it is advisable to obtain copies of it - they may also come in handy. In most cases, the individual entrepreneur will no longer need any additional documents or certificates.

Important! Photocopies of the declaration in Form 3 of personal income tax must also have the original marks of the tax authorities. Otherwise, the interested party may refuse to accept them due to invalidity.

For your information. Institutions that require proof of income sometimes have a very different approach in this regard regarding individual entrepreneurs. In particular, sometimes, in addition to the standard 3 personal income tax declaration, they may ask to provide a declaration for the last reporting tax period, according to the tax regime used by the entrepreneur.

To summarize the above

In 2021, individual entrepreneurs will be able, in the same manner, to independently draw up certificates or confirm income with other accounting documents, and submit requests to the Federal Tax Service inspectorate. The individual entrepreneur will be able to choose an option that is convenient for himself and acceptable to the requesting organization.

The main thing is that the certificate reflects information that corresponds to the facts (true information). After all, for documents containing incorrect data, the creditor may incur criminal liability under the Criminal Code of the Russian Federation. The culprit can be fined 120 thousand rubles, sent to perform labor service, and imprisoned for up to 2 years.

Therefore, it is better not to “play hide and seek” with creditors or government agencies, but to provide real indicators of your business activities through tax reporting and other government registers.

USN: confirmation of individual entrepreneur’s income

As for those individual entrepreneurs who use OSNO, for “simplified” people the 3rd personal income tax declaration serves as proof of income. But in addition to this, they can provide another important document as proof of the amount of income.

In particular, entrepreneurs who use a simplified tax regime in their work with an income minus expenses of 15% must keep a Book of Income and Expenses, which allows them to determine the tax base for calculating taxes. And if so, it means that this document contains all the necessary information about the income of the individual entrepreneur. That is, if necessary, a copy of the Book of Income and Expenses certified by a notary can be provided to any authority as a document confirming income.

Attention! By law, all entries made in the Income and Expense Book, including those related to income, must also have their confirmation, for example, bank statements, contracts, payment receipts, etc. These papers must be kept, since they may also need to be attached to this Book to prove income. In addition, individual entrepreneurs may need them in the event of a tax audit.

Certificate for social protection authorities

Social security authorities ask to provide income data when it is necessary to assess the financial situation of a family and decide on local or federal benefits for its members. Current examples: receiving compensation for utility bills for low-income families, applying for guardianship benefits, and the like.

The law provides that income from business activities for the months of the calculated period is obtained by dividing the total amount of income for the period by the number of months.

In fact, the law allows the use of data from various reporting documents of an entrepreneur, be it declarations or accounting registers, to apply for benefits. However, regional social authorities often prefer to accept income certificates to provide benefits. The rules for their design are practically no different from those indicated in the sample above.

However, the period is usually three months; the document must indicate the amount of “dirty” income before taxes are deducted from them. Sometimes social security departments require you to indicate income by month in the form of a table; they may ask you to calculate the average income per month, so it is better to clarify the form of the requested form in advance.

Otherwise, the certificate is no different from those provided in other places. That is, in this case, the individual entrepreneur can make a certificate on his own. The main thing to remember is that you need to submit information for the three months preceding registration; you cannot take the current one.

How to confirm the income of an individual entrepreneur on UTII

Unlike other types of taxation, individual entrepreneurs located on UTII, if it is necessary to confirm income, find themselves in a slightly more difficult situation.

The thing is that to calculate taxation, it is not income that is used here, but types of activity. At the same time, the tax amount for each type of activity has a fixed value, based on their level of expected profitability, physical indicator and adjusting federal and regional coefficients. That is, the actual income that an individual entrepreneur receives on UTII actually, in any case, differs from what is assumed when calculating this tax. Moreover, the state does not in any way oblige entrepreneurs working on UTII to monitor and record their income.

What to do in this case?

Option two:

- regardless of the will of legislators, still keep records of income in a simplified form;

- prove profitability by presenting primary documents.

Here the first option requires some explanation. Almost all individual entrepreneurs who are “imputed” still control the level of their income in one way or another. Which, in general, is logical: every individual entrepreneur wants to be sure that his business is profitable and profitable, and also to clearly understand exactly how much income he has. However, the main question here arises not in the fact of accounting itself, but in what form it is carried out. For example, if these are ordinary magazines or notebooks filled out by hand, then of course they will not have any evidentiary value. It is important that income records are kept in documentary form, with official status assigned to internal accounting documents. This is possible if each such document has the appropriate details.

The law clearly defines the information that must be contained in the details confirming income on the “imputation”:

- Name;

- date and place of compilation;

- Full name IP;

- IP INN;

- individual entrepreneur registration number;

- signature and seal (if any) of the individual entrepreneur.

In addition, this document must include:

- the name of the business transaction performed;

- a specific amount of income or expense, if accounting is also carried out for expenses.

All accounting documents must be kept in chronological order, including all information about costs and profits without exception.

Attention! Since, according to UTII, the reporting tax period is one quarter, it is necessary to summarize the internal accounting of expenses and income once every three months. Based on the results of the year, it is necessary to display separate annual results.

How to fill out a certificate

Filling out the document involves entering information about:

- employee personal data;

- employer details;

- the amount of an individual’s earnings by month;

- applicable tax deductions indicating codes;

- signature of the manager and chief accountant (if there is one).

When the certificate contains data on a person’s income and personal income tax, the number 1 is entered in the “Attribute” section. When tax collection is not withheld, 2 is also noted here. In the “Adjustment number” section, you usually need to enter 00.

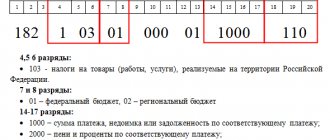

The header of the document must contain the date of formation, number and year for which the document is issued. Information to be entered into the IFTS and OKTMO code fields should be clarified with the tax authorities or on the Federal Tax Service website.

When an organization acts as a tax agent, its details are entered in the first section: checkpoint, tax identification number, name, contact information. Entrepreneurs write my full name instead of the checkpoint.

In the section about the recipient the following is written:

- FULL NAME.

- Date of Birth.

- Status (1 - for residents of the country, 2 - for non-residents).

- TIN.

- Citizenship (for Russians - 643).

- Place of residence.

- Passport details (enter 21 in the required field).

Important! It is allowed to use a permanent address, but not a temporary one.

The third section is intended to display the rate and payment amount by month and code. All tax rates must comply with the accrual parameters. Amounts are entered in rubles and kopecks, but the rounding rule applies to the tax amount. Values below 50 kopecks are discarded, values above are rounded to the nearest ruble.

The following are indicated:

- Month of payment accrual (01, 02, etc.).

- Payment code (2000 for wages, 2012 for vacation pay, 2300 for sick leave benefits, 2760 for financial assistance).

- Payment amounts.

- Code and amount of deduction (if any).

Most often, 503 is indicated - the code for non-taxable financial assistance, which amounts to 4,000 rubles per year.

The fourth section describes all types of deductions: investment, standard or social type. For each, a code is indicated, the amount of the annual reduction. For these purposes, codes 114 are used for the first child, 115 for the second, 311 for property return. All codes are specified in the corresponding order of the Federal Tax Service. For property and social compensation, notification from the tax authorities will be required.

The fifth section contains information about the total amount of payment, the tax base, as well as taxes - calculated, withheld, and transferred. If payments are provided at different rates, sections 3-5 are filled out separately for each such rate.

The validity period of the document is not limited by law. However, a number of institutions and organizations set their own deadlines. For example, a bank certificate will be valid for 10-30 days.

Sample

In order not to make mistakes when filling out the certificate and not to waste time making adjustments, it is worth using a sample of such a document. It is worth making sure that the sample is up to date, since various changes occur in legislation from time to time.

PDF file

How to confirm income on PSN

Entrepreneurs working on the patent system, as well as on imputation, may not receive the same income as expected. So which one should be confirmed for various authorities - the real one or the one that was supposed?

Entrepreneurs on PSN have two documents to record and confirm income receipts:

- a patent that states the possible amount of income;

- an income book that reflects actual receipts.

To confirm the real income of an individual entrepreneur on the PSN, the above-mentioned book should be bound, its pages numbered, and preferably certified with the seal of the individual entrepreneur. Next, one copy of the book must be transferred to the tax office, then it will put its stamp on it, which will be a legal confirmation of the income of the entrepreneur on the patent.

Certificate of income of individual entrepreneurs in any form

Sometimes, beginning, inexperienced individual entrepreneurs think that to confirm their income they only need to write a certificate in any form and submit it at the place of request. This is wrong. Individual entrepreneurs cannot provide information about income to government agencies in the form of arbitrary certificates, even sealed and signed. Such papers will not be considered legal documents, and, therefore, will not have the slightest significance.

But! In some, very rare cases, such a certificate is still sufficient, although it must be accompanied by a certificate from the territorial tax office on the registration of individual entrepreneurs, a copy of the declaration for the last tax period with the tax stamp and either the Book of Income and Expenses, or some other or other internal documents confirming the profitability of the individual entrepreneur.

Help 3-NDFL

If the client decides to take out a rather impressive amount of money or a mortgage loan, it would not be superfluous to provide a 3-NDFL certificate, which will help confirm additional income, for example, from:

- renting out existing real estate under a contract

- vehicle rental

- investment profit and much more

To confirm the rental of real estate, you will also need to provide documents confirming ownership of the property and a lease agreement concluded with the tenants. The most important thing that bank employees pay attention to is the amount of all taxes paid for the reporting period.

Confirmation of income of individual entrepreneurs in the tax office

Not a single law or regulation states that territorial tax authorities are required to issue any supporting documents about the income of individual entrepreneurs. However, the practice already established in some regions shows that if individual entrepreneurs contact the local tax service with a similar request, specialists issue such certificates. To do this you need:

- contact the district tax inspectorate;

- write an application in any form with a request to issue a certificate of income.

Within 30 days, the tax office will make a decision and either provide the required document or deny the request. It is worth noting that if the local tax service has refused to provide a certificate, there is no point in challenging it.

Validity period of the certificate confirming income

Different authorities have different requirements for the validity period of certificates confirming the profitability of individual entrepreneurs. But, as a rule, all documents confirming the income of an entrepreneur are suitable for presentation to various government and other structures during the period following the last tax reporting period. In any case, it is necessary to clarify the maximum limitation period for such documents in the institution where they are required to be presented.

As the above material shows, the main document confirming the income of an individual entrepreneur is the 3rd personal income tax declaration. However, it may additionally require other evidentiary documents, and different ones, depending on the tax system that the individual entrepreneur uses. In any case, entrepreneurs should keep separate records of all income with the collection and storage of all receipts.

Recommendations from experts

In most cases, the only way to justify the amount of earnings declared by an entrepreneur is to refer to internal accounting. Lawyers advise all business representatives to record cash and in-kind receipts, regardless of the tax regime.

Before compiling a package of documents, it is also recommended to familiarize yourself with the internal rules of the institutions. The key to success remains completeness and transparency of financial transactions. It is also important to support the certificate with primary reporting.