How to draw up a balance sheet - reporting requirements

Before asking yourself how to draw up a balance sheet, you need to familiarize yourself with the basic requirements for this form of reporting. The legislation establishes the following basic requirements:

- reflection of only reliable and complete information about property and liabilities;

- generation of data based on the rules established by accounting legislation;

- presentation of neutral information in relation to users, that is, they should not infringe on the rights of some users in the interests of others;

- providing data for at least two reporting periods - current and previous;

- drawing up a balance sheet in Russian and in Russian currency;

- signing of the balance sheet by the head of the company.

Procedure for submitting financial statements

Starting with reporting for 2021, the following rules for the preparation and submission of accounting reports apply (see laws dated November 28, 2018 No. 444-FZ, dated November 28, 2018 No. 447-FZ):

- Accounting statements can be prepared on paper or in the form of an electronic document signed with an electronic signature. A paper copy must be made for interested parties or government agencies if required by law or contract.

- Most companies only have to submit annual reports to the tax office; they are not required to be submitted to Rosstat. This continues to be done only by organizations whose reports contain information classified as state secrets, as well as organizations in cases established by the Government of the Russian Federation.

- Tax authorities accept reporting exclusively in electronic form using the TKS. Some relief has been made for small and medium-sized enterprises: for 2021 they will still be able to report on paper, but from reporting for 2021 they will also have to switch to electronic submission. The audit report (in case of a mandatory audit) must also be submitted in the form of an electronic document.

- When preparing reports for the Federal Tax Service, you must use an electronic format and follow the submission procedure approved by the Federal Tax Service.

- The reporting deadline remained the same: no later than three months after the end of the reporting period. The auditor's report must be submitted along with the financial statements or within 10 business days from the day following the date of the audit report, but no later than December 31 of the year following the reporting year.

- The Federal Tax Service must maintain a special state information resource for accounting. Interested parties will be able to obtain information from it for a fee.

Balance sheet structure

The balance sheet of an enterprise characterizes the financial position of an economic entity as of a specific reporting date and is a table with certain columns. Since it reflects assets and liabilities, the table is divided into two large sections:

- Asset – to reflect the property and assets of the organization,

- Liability – to reflect the obligations of the organization.

Each section of the balance sheet is divided into groups that have individual lines with a specific name. The current form of the balance sheet can be taken from the order of the Ministry of Finance of the Russian Federation “On the forms of financial statements of organizations” dated July 2, 2010 No. 66n. Note that you cannot delete any lines from it, but you can add columns if necessary.

Line-by-line information is collected from synthetic accounting accounts or taken from the balance sheet for a specific period.

Online program to facilitate the analysis process

Modern information processing tools can significantly simplify the process of comprehensive analysis of the balance sheet. Calculations are carried out both using standard computer programs (for example, using Excel, where you can carry out calculations, create tables and charts), and using specialized programs that allow you to conduct financial analysis online - via the Internet.

The use of specialized software not only saves time, but also significantly expands the types of analysis. They allow you to analyze market stability, business activity, score assessment of financial stability, etc. In addition, developers of specialized programs provide the possibility of adapting and changing the program depending on the goals and objectives of the analysis, taking into account the specifics of a particular enterprise.

Analysis of balance sheet indicators is a voluminous and multi-stage process. Its results make it possible to identify potential risks, develop the financial policy of the enterprise and contribute to effective management decisions. The analysis process can be facilitated by using specialized programs.

How to make a balance sheet - example (step by step instructions)

The procedure for drawing up the balance sheet is based on filling out the corresponding lines according to the balance sheet data for the reporting period, taking into account the requirements of PBU 4/99. To fill out the balance sheet, indicators are taken from the “turnover” in the form of an expanded balance for all accounting accounts. Fixed assets and intangible assets are reflected in the balance sheet minus depreciation. If the company's work results in a loss, its amount is reflected in parentheses as a negative number.

Each column of the balance sheet has a special encoding specified in Appendix No. 4 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. Based on the line names, you can understand how to fill out the balance sheet.

Example of a balance sheet form

Let's look at an example of how to fill out the balance sheet of an enterprise created in 2021.

To do this, we will need input data based on the indicators of the balance sheet of Iskra LLC for 2017:

| № | Name | Balance line | Amount, thousand rubles |

| 1 | Fuel | Reserves | 2720 |

| 2 | Production equipment in workshops | Fixed assets | 9000 |

| 3 | Items for resale | Reserves | 734 |

| 4 | Tara | Reserves | 215 |

| 5 | Buyers' debt | Accounts receivable | 7 |

| 6 | Cash register | Cash | 70 |

| 7 | VAT on purchases | VAT on purchased assets | 1700 |

| 8 | Production materials | Reserves | 2200 |

| 9 | Securities | Financial investments | 113 |

| 10 | Computer programs | Intangible assets | 750 |

| 11 | Money in the current account | Cash | 4000 |

| 12 | Advance issued to employees for reporting purposes | Accounts receivable | 12 |

| 13 | Transfers on the way | Cash | 112 |

| 14 | Debt to suppliers | Accounts payable | 1250 |

| 15 | Tax debt | Accounts payable | 1600 |

| 16 | Wage arrears | Accounts payable | 1000 |

| 17 | Obtained a long-term bank loan | Long-term borrowed funds | 120 |

| 18 | Authorized capital | Authorized capital | 10 123 |

| 19 | Reserve capital | Reserve capital | 5800 |

| 20 | revenue of the future periods | revenue of the future periods | 340 |

| 21 | Profit received in the reporting year | retained earnings | 1400 |

How to fill out the balance sheet in this case: the indicators need to be posted on the corresponding lines of the balance sheet form and the totals must be summed up.

How to prepare documents?

Reporting is provided for the current and reporting period - intermediate and final results. The first type is submitted to the inspection at the end of the quarter or month, the second - no later than 90 days from the beginning of the new year.

Marks must be objective and show the real state of assets and liabilities, liabilities, expenses and income. In the event that data from previous reporting periods cannot be compared with current ones, they require adjustments or an explanatory note to the reporting, which is submitted to the regulatory authority.

Things to remember when writing:

- It is mandatory to indicate the line code in accordance with Order No. 66.

- Reporting is described in only one unit of measurement - thousand rubles.

- “OKVED” must be written in the header.

- In Form 1, it is necessary to indicate information about the auditor if the organization is subject to mandatory audit.

- Indicators are indicated either as of the reporting date or as of December 31 of the current/previous period.

- Indicators with a “-” sign are written in brackets.

The nuances of correctly filling out the

forms can be found on the website of the Federal Tax Service of the Russian Federation in the section on tax reporting. There you can download them blank and immediately start filling them out.

Line by line transcript

For error-free filling of documents, below are explanations for filling out lines of Form 1 (balance sheet) and Form 2 (results report).

The balance sheet of an enterprise has 2 main sections - assets and liabilities, each of which contains separate items about the existing types of property and liabilities. More details about them:

- Non-current assets is a line about all fixed assets (FP), intangible assets (IMA), long-term investments, intangible and tangible exploration assets, as well as non-current assets.

- Current assets are property that can be quickly sold, i.e. any company inventory, accounts receivable up to 12 months, cash and short-term investments. Capital and reserves - this section should display all data on the organization’s existing capital, be it reserve, authorized or additional. All retained earnings are recorded here, i.e. a loss that was not covered by profit.

- Long-Term Liabilities - This line should include all of the company's financial liabilities that have a maturity of more than 12 months.

- Current liabilities are also financial obligations of an organization whose maturities are less than 1 year.

Important ! As a result, the annual balance sheet must fully reflect the company's funds, its property, loans and any monetary obligations.

The income statement exceeds the balance sheet in terms of volume of data, since it is necessary for a detailed presentation of the settlement transactions that were carried out during the reporting period. The breakdown of the report lines is given below:

- Revenue is the income that an organization received by performing its activities in the market.

- Cost - finances that were used in the production of services and goods.

- Gross profit is profit before taxes and production costs.

- Commercial expenses are expenses that accompany the sale of goods. This includes renting store premises, salaries of salespeople, marketing, etc.

- Management expenses are money that was spent to implement the management of the company.

- Profit (loss) from sales - that is, income or expense from ordinary activities.

- Income from participation is indicated if the enterprise is a member of any association. In this case, the profit from this activity should be reported here.

- Interest received - if the organization invests or has securities, this line records the total amount of payments on them.

- Interest paid - finances that were used to repay credit loans.

- Other income is finance received by the organization and not previously indicated.

- Initial profit is gross profit from which selling and management expenses are subtracted. Income received before taxes are paid.

- A tax is a standard payment to the government for the normal activities of a company.

- Other is all additional information about the parameters that affected net profit.

- Net profit is the income of a business, excluding the total amount of losses.

For all organizations that exist according to accounting standards, it is mandatory to indicate:

- Ongoing commitments;

- Changes in deferred liabilities and assets;

All expenses and expenses (as well as gross profit, if it was negative) are indicated in parentheses, since they will be deducted in the final calculations.

Examples

Filling out the balance sheet of an enterprise will not take much time if all documentation at the enterprise is filled out correctly and in a timely manner. Otherwise, you will need to check and double-check the numbers.

Sample of correct balance filling part 1

The completed “Results Report” is submitted to the regulatory authorities.

Sample of correct balance filling part 2

In addition, it reflects the real financial situation of the company, therefore it becomes the document that investors and shareholders study before investing or buying shares of this organization.

An example of compiling a “Results Report”

Accounting documentation is the key to correct business analysis. Filling out forms 1 and 2 of the financial statements makes it possible to analyze strengths and weaknesses, as well as take steps to improve and develop the business.

primer_balansa_str_2.png

It should be noted: the structure of the balance sheet is such that the totals of assets and liabilities should always be equal. This is explained by the use of the double entry method in accounting, in which the same transaction is reflected in the debit and credit of accounts simultaneously. If there is no equality between assets and liabilities, then the balance sheet is drawn up incorrectly.

In our example balance sheet, only 2017 is presented, but it must also contain information from at least one previous period. Organizations newly created in 2021 fill out only one balance sheet column - as of December 31, 2017.

Specifics of analyzing the balance sheet of individual companies using the example of a bank balance sheet (Form 1)

Banks, although they are commercial companies and are created to make a profit, have specific features. They are subject to special legislation, maintain a special chart of accounts and build a different methodology for accounting processes.

At the same time, the main approaches to analyzing a bank’s balance sheet are in many ways similar to analyzing the balance sheet of an ordinary commercial company. For the bank balance sheet, the main stages of analysis also remain relevant:

- preliminary (reading the balance sheet, structuring its items, etc.),

- analytical (description of calculated indicators of structure, dynamics, relationship between balance sheet indicators);

- final (evaluation of analysis results).

In the process of analyzing the bank’s balance sheet, special coefficients are also calculated, but their types differ from those discussed earlier:

- bank reliability coefficient (capital adequacy ratio),

- return on assets ratio (shows the efficiency of using assets and quality based on their profitability),

- leverage ratio (interbank loans), etc.

To learn how banks analyze the creditworthiness of their clients, read the material “Methods for assessing the creditworthiness of commercial bank clients.”

Brief summary

The presented sample balance sheet for 2021 is the most simplified form, since it contains information only on the main accounting accounts. In practice, accountants justifiably have a question about how to draw up a balance sheet, since the company carries out a wide variety of operations.

The most important! Competently maintain operational accounting and timely reflect all actions on the appropriate analytical and synthetic accounts so that the data from them is correctly distributed among the lines of the organization’s balance sheet.

***

Compiling reports over 3 years makes them more informative for users, but it is necessary to adjust the figures to ensure their comparability.

Similar articles

- Explanatory note to the balance sheet 2018 sample

- Rules for filling out form No. 3 for the balance sheet

- Basic rules for evaluating balance sheet items

- We draw up a balance sheet for an enterprise in the form of an LLC

- Accounting calendar for 2021 - reporting

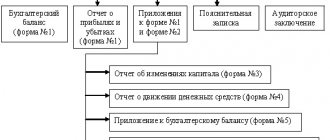

Rules for preparing financial reports

All information on the form can be entered either handwritten or printed. The main condition is that it contains the original signature of the head of the enterprise or an employee authorized to act on his behalf.

Starting from 2021, it is not necessary to put a stamp on the report, since legal entities are legally exempt from the need to endorse their documents using seals and stamps.

The financial results report is prepared in two copies :

- one is transferred to the tax office,

- the second remains in the organization.

After losing its relevance, this document is transferred for storage to the archive of the enterprise, where it is kept for the entire period established for this type of paper.