Legal advice > Entrepreneurial activity > Tax consequences of an agreement for the assignment of the right to claim VAT

When engaged in entrepreneurial activity, any businessman in one way or another faces accounts receivable. These funds can be considered temporarily frozen or an asset that can be easily realized if necessary. In the article we will talk about the tax consequences of this sale, in particular about the calculation of VAT under an assignment agreement (assignment of the right of claim).

VAT on assignment agreements (assignment of claims)

The agreements under consideration are becoming increasingly relevant today. But the taxation procedure for such agreements is not sufficiently regulated at the legal level.

Because of this, many unclear points remain regarding the rate, taxes on non-VAT transactions, filling out invoices, and others.

According to Article 155 of the Tax Code of the Russian Federation, tax (VAT) must be paid for the transfer or sale of property rights. Moreover, within the framework of the article, different situations of the assignment agreement are considered. But let’s look at everything in order, and start with the definition of the concept of assignment of a right of claim.

Step-by-step instruction

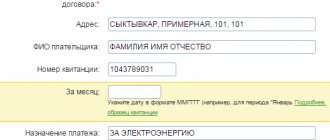

The organization delivered goods to the buyer Domostroy LLC (debtor) in the amount of 144,000 rubles. (including VAT 20%). The buyer did not pay the debt after the payment deadline.

On June 01, the Organization (assignor) entered into an agreement on the assignment of the right to claim this debt with Business Center LLC (assignee) for 120,000 rubles.

On June 10, the assignee transferred payment under the assignment agreement.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Exercise of the right to claim receivables | |||||||

| June 01 | 76.09 | 91.01 | 120 000 | 120 000 | 120 000 | Proceeds from the sale of the right of claim | Sales (act, invoice) - Services (act) |

| Drawing up the Federation Council | |||||||

| June 01 | — | — | 120 000 | — | — | Drawing up a Federation Code for the exercise of the right of claim | Invoice issued for sales |

| — | — | — | — | — | Reflection of VAT in the Sales Book | Sales book report | |

| Write-off of accounts receivable | |||||||

| June 01 | 91.02 | 62.01 | 144 000 | 144 000 | 144 000 | Write-off of accounts receivable | Debt adjustment - Debt write-off |

| Receipt of payment from the assignee | |||||||

| June 10th | 51 | 76.09 | 120 000 | 120 000 | 120 000 | Receipt of payment from the assignee | Receipt to the bank account - Payment from the buyer |

general information

The assignment of the right of claim is regulated by Art. 388, 389 and 390 of the Civil Code of the Russian Federation. These transactions are also called assignment agreements. Their essence lies in the transfer by the creditor of the right to claim the debt to another person.

The specific terminology of the parties is applied similarly to both the seller and the buyer in a purchase and sale transaction. The entity that originally owned the debt is the assignor, and the “buyer” is the assignee.

The reasons for the formation of debt are different. The subsequent calculation depends on this. The most common options include the following:

- The assignor is the supplier who shipped the goods or provided services with deferred payment.

- The debt formed after the transfer of an advance payment for subsequent delivery or provision of services is sold.

- The debt was created due to the transfer of credit.

Write-off of accounts receivable

Write off accounts receivable by documenting the Debt Adjustment type of transaction Debt Write-off (section Sales - Debt Adjustment - Create button).

Indicate in the header of the document:

- Write off - Buyer's debt ;

- Buyer (debtor) - the name of the debtor (debtor) under the agreement, selected from the Counterparties ;

Click the Fill in tabular part of the Buyer's debt (accounts receivable) to fill in the balances on mutual settlements with the buyer:

- Contract - an agreement with the original buyer from the Contracts ;

- A settlement document is a sales document on which a debt has arisen;

- Amount - the amount of debt in the accounting department (in our example - 144,000 rubles);

- Amount of NU - the amount of debt in NU (in our example - 144,000 rubles);

- Settlement amount - the amount of debt that is written off;

- Accounting account - an account in which the debt is recorded (in our example - 62.01 “Settlements with buyers and customers”).

Specify on the Write-off Account :

- Account - 91.02 “Other expenses”;

- Other income and expenses - an article from the directory Other income and expenses : Type of article - Realization of the right of claim after the payment deadline ;

Postings according to the document

The document generates the posting:

- Dt 91.02 Kt 62.01 - accounts receivable written off.

Tax calculation for partial repayment of debt

The debtor has the right to send money to the assignee not at once, but in separate parts, and even in different tax periods. This point is not really regulated in the Tax Code. Therefore, two approaches can be used:

- Use clause 2 of Article 155 of the Tax Code of the Russian Federation verbatim, and charge tax from the moment the amount exceeds the cost of obtaining the debt is received.

A similar situation will arise when the assignee purchased several debts and received only one of them in one tax period. But in this case, the application of the second approach is unlikely to please the regulatory authority, since the tax will be paid later.

At the same time, with the appropriate attitude, the taxpayer may well defend his position in court. Moreover, in judicial practice there were cases when assignees won the case, and the court recognized their ability to pay the tax once, regardless of how many debtors paid off their obligations.

Receipt of payment from the assignee

Reflect the receipt of payment from the assignee with the document Receipt to the current account transaction type Payment from the buyer (section Bank and cash desk - Bank statements - Receipt button).

Please indicate:

- Counterparty - the name of the counterparty who purchased the debt (assignee), selected from the Counterparties ;

- Contract - the name of the contract with the counterparty, selected from the Contracts ;

- Settlement account and Advance account - 76.09 “Other settlements with various debtors and creditors”;

- Income item is a predefined item from the Cash Flow Items Payment from Customers .

Sale of debt by buyer

The buyer's receivables are formed when he makes an advance payment. Basically, they sell the right to return it, for example, if the contract is terminated. The refund of this payment is not subject to tax. Therefore, transactions under an assignment agreement should also not be subject to taxation.

But this is only in the case of the 1st sale. If the assignee wishes to resell the debt, he will have to pay tax for such an operation, in accordance with clause 2 of Article 155 of the Tax Code of the Russian Federation. The same will happen with subsequent operations on the resale of the corresponding obligation. This position was adhered to by the Supreme Arbitration Court of the Russian Federation in its Resolution No. 33 in 2014.

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

The exercise of the right to demand delivery is rare, since it will require finding a person who requires the same goods or services. But formally we are talking about property rights by agreement.

Therefore, tax authorities sometimes seek to charge tax on the full amount of the transaction based on clause 2 of Article 153 of the Tax Code of the Russian Federation. At the same time, when such cases came to trial, the courts generally did not support the tax authorities.

OSNO and UTII

The acquisition of the right to claim under an assignment agreement is a separate operation, which is subject to the rules of Chapter 25 of the Tax Code of the Russian Federation. The organization does not have to pay UTII from such a transaction, even if it conducts activities subject to this tax. For more information about this, see: Does the assignee need to pay income tax and VAT when the debtor repays the acquired right of claim. The debtor repaid his debt, which the organization (assignee) acquired under an assignment agreement. The organization (assignee) is the payer of UTII. Therefore, operations for the acquisition of the right of claim and its repayment by the debtor are taken into account when calculating taxes in the same manner as organizations on the general taxation system.

The right of claim acquired under an assignment agreement can be assigned by the assignee (i.e., sold to another person). For information on how to reflect income and expenses in this case, see How the assignee should reflect the assignment of the right of claim in accounting.

Assignment of loan debt

In accordance with paragraph 26, paragraph 3 of Art. 149 of the Tax Code of the Russian Federation, the sale of debts under these agreements is not taxed.

Although the article talks about both assignment and reassignment, tax authorities sometimes argue that the benefit applies only to the initial sale of debts.

It must be borne in mind that this provision applies only to loans that were issued in cash. If the loan was provided, for example, in goods, then tax will be levied on both the loan and the assignment agreement.

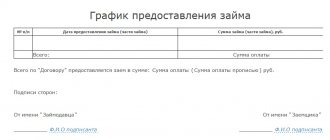

Documents for assignment

The documentary basis for the assignment is a written agreement. The document is drawn up taking into account certain requirements, including significant conditions, and the choice of a specific type of assignment agreement is determined on an individual basis.

The agreement is accompanied by the attachment of documents confirming the legality of the transaction. The annexes to the agreement are:

- an initial agreement that gave one of the parties the right to demand, and the other party the obligation to fulfill the agreement. The documentary basis is often loan agreements, or purchase and sale or supply agreements;

- act of mutual settlements (reconciliation);

- receipts, expenditure orders indicating the existence of obligations.

In a separate document, an annex to the assignment agreement, the parties have the right to include additional provisions on the procedure.

Contract options

Depending on the circumstances of the transaction, the assignor-assignee parties choose one of the contract options:

- By number of sides. A regular contract is a bilateral agreement, with mandatory notification to the debtor of changes that have occurred. A tripartite agreement will allow you to speed up the re-registration procedure, but it presupposes the consent of the debtor himself. Unlike a two-sided document, it is signed by three parties, i.e. there must be three signatures at the end.

- Based on the principle of compensation. The assignment can be paid or gratuitous. If the right of claim is transferred with the payment of a certain amount, then a paid assignment agreement is signed. Sometimes assignment is a forced measure that would allow the funds issued to the debtor to be returned, at least partially. When a bank contacts a collection agency and agrees to transfer the right of collection, most often the collectors buy the debt for an amount much less than what was paid to the borrower. After the transfer of rights, the new creditor does not have the right to change the object of the claim, the amount, or the conditions. When the parties agree on a gratuitous assignment, the right is transferred to the new claimant without payment of compensation.

- Free/paid, depending on the conditions for changing the debtor.

- A writ of execution implies the registration of an assignment after applying to arbitration. Upon consideration of the claim, the judge decides on a partial transfer of obligations.

Contract details

When drawing up a contract, the parties include significant conditions according to the preliminary agreement that has arisen. The document assumes the following information:

- Detailed information about the creditor and recipient of claims. The information must be comprehensive, allowing identification of the individual and establishing the competence to sign the contract.

- Amount of obligations, the right to collect which is transferred to a new person:

- balance of outstanding debt;

- total value of liabilities;

- information about the document giving the right to claim;

- obligations that arose in addition to the payment of debt, but are directly related to them.

- The settlement scheme for compensated transactions, and in case of gratuitous transfer, this is indicated in a separate paragraph.

- Time limit for transfer of rights, fulfillment of obligations by the assignor and assignee.

Do I need to register?

It is not necessary to specifically register a document between the new and former creditor, except in cases where the right of claim to real estate is transferred under an assignment agreement. The assignment of rights to real estate requires mandatory registration with Rosreestr. In the absence of registration, the document loses legal force.

In addition to the main documents, Rosreestr must submit a share participation agreement and papers confirming the authority of the primary creditor for registration. Legal entities also present constituent documentation (Unified State Register of Legal Entities certificate, extract, charter, power of attorney for an employee authorized to carry out registration, and an order for an official).

How to fill out an invoice

This document is drawn up with specific features, depending on the party to the contract who is involved in this.

The invoice is issued by the assignor regardless of the sales amount. In case of loss or sale at par value, VAT will be equal to 0.

When making a profit, the corresponding amount must be reflected, both the tax base (in column 5) and the calculated VAT (in column 7). An exception is the situation of selling a loan of money or a credit obligation.

Then the invoice will not be needed at all, since it is not needed when exempt from the tax burden. This is stated in paragraph 1, paragraph 3, Article 169 of the Tax Code of the Russian Federation.

The assignee's tax base appears when the debt is repaid. Then they are given an invoice indicating the difference between the funds received from the debtor and the costs of purchasing the debt (in column 7). The amount of the tax fee is indicated in column 8. It is calculated in the same way as for the assignor.

Is it necessary to indicate VAT in the assignment agreement?

The legislation does not directly say that the tax must be indicated in the agreement. Article 389 of the Civil Code of the Russian Federation only states that the form of the agreement must be similar to the form of the main obligation. At the same time, in order to avoid disputes with the inspection authority, nothing prevents you from indicating this provision in the agreement.

If the debt is sold at a loss or at par value, then the text may contain the wording “VAT – 0 rubles”. But when the assignor receives a profit, he will have to pay a tax fee. Accordingly, it is advisable to specify in the agreement the tax amount, which is determined by calculation based on the amount of profit.

Consider the following example.

Company No. 1 sells to Company No. 2 a debt in the amount of 660,000 rubles, the nominal value of which is 600,000 rubles. The income of company No. 2 will be 60,000 rubles. Then the calculation will be like this: 60/120/20=10. VAT will be 10,000 rubles.

How to take into account all the details when calculating tax and avoid problems with the tax authorities

VAT is one of the main fees, with the help of which a large part of the state budget is formed. But it is a significant burden for taxpayers. Naturally, businessmen strive in different ways to reduce the size of payments under it. Moreover, the methods used are not always legal.

A significant part of the violations that are detected by the tax authorities relate specifically to VAT. VAT declarations are subject to special scrutiny.

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

It is rare that desk audits pass without any complaints for a taxpayer. Basically, a businessman has to give a lot of explanations and provide a lot of documents until the tax authorities “calm down.”

Any transactions of an unusual nature will certainly arouse increased interest among tax authorities during an audit. These include assignment agreements, especially for an amount that is an order of magnitude lower than the nominal value.

Therefore, the best opportunity to pass the audit painlessly is to pay the tax at full cost and use only legal methods to reduce its base.

Controlling authorities are constantly evolving, so schemes to reduce the VAT base are constantly being reduced. In this regard, the tax authorities are assisted by banking organizations, which are guided by Federal Law No. 115, as well as explanatory notes by the Central Bank of the Russian Federation.

There are legal methods to reduce the tax burden, but this should be done by specialists who are well versed in this issue. Otherwise, it will most likely not be possible to avoid problems during the check.

The agreement in question represents the resale of receivables formed for various reasons. Such a debt can be formed after the shipment of goods, after the transfer of an advance payment, or after the issuance of a loan.

VAT is calculated differently depending on the type of debt, as well as the profit or lack thereof resulting from the relevant transaction.

For advice on assignment of claims, watch this video:

The right of claim arises from the contract for the sale of goods, which are subject to VAT at a rate of 10%. Is it necessary to indicate the value of the assigned right, including VAT, in the assignment agreement? If so, at what rate should VAT be charged on the assignment of the right of claim by the original creditor? On what amount is VAT charged by the assignor: on the entire amount of proceeds from the assignment of the right of claim or on the amount of income?

On this issue we take the following position:

In this situation, VAT should not be charged.

However, given the position of the regulatory authorities, it is possible that you will have to prove your case in court.

If an organization decides to pay VAT, then the amount of tax should be calculated from the entire value of the transferred property right at a rate of 18% and highlighted in the assignment agreement.

In accordance with civil legislation, property rights (including the right to claim) are the object of civil rights along with things, money, securities and other property (Article 128 of the Civil Code of the Russian Federation).

According to paragraph 1 of Art. 382 of the Civil Code of the Russian Federation, the right (claim) belonging to the creditor (assignor) on the basis of an obligation may be transferred by him to another person (assignee) under a transaction (assignment of the claim) or transferred to another person on the basis of law.

According to paragraphs. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, the object of VAT taxation is transactions on the sale of goods (work, services) on the territory of the Russian Federation, including the sale of collateral and the transfer of goods (results of work performed, provision of services) under an agreement on the provision of compensation or novation, as well as the transfer of property rights .

The specifics of calculating VAT when transferring property rights are given in Art. 155 Tax Code of the Russian Federation.

Clause 1 of Art. 155 of the Tax Code of the Russian Federation establishes that when assigning a monetary claim arising from a contract for the sale of goods (works, services), transactions for the sale of which are subject to taxation, or when transferring the specified claim to another person on the basis of law, the tax base for transactions for the sale of these goods (works, services) services) is determined in the manner provided for in Art.

154 Tax Code of the Russian Federation.

Based on the established judicial practice, we can conclude that until recently the tax authorities were of the view that if clause 1 of Art.

155 of the Tax Code of the Russian Federation contains a reference norm to Art. 154 of the Tax Code of the Russian Federation, and p.

1 tbsp. 154 of the Tax Code of the Russian Federation, in turn, establishes that the tax base when a taxpayer sells goods (work, services) is determined as the cost of these goods (work, services), calculated based on the price specified by the parties to the transaction, then upon the initial assignment of the right to claim VAT should be calculated from the entire value of the transferred property right.

See also letter of the Federal Tax Service of Russia for Moscow dated 08/04/2009 N 16-15/079709.

In paragraph 2 of Art. 155 of the Tax Code of the Russian Federation we are talking about the procedure for determining the tax base by a new creditor when independently collecting a debt from a debtor (buyer of goods, works, services) or when assigning this claim to the next creditor, that is, clause 2 of Art.

155 of the Tax Code of the Russian Federation applies only to subsequent, and not primary assignment of a monetary claim. It is in this case that the tax base is determined as the difference between the amount of income received by the new creditor upon the subsequent assignment of the claim and the amount of expenses for the acquisition of the specified claim.

In the situation under consideration, your organization makes the initial assignment of the right of claim, therefore it has no right to calculate the tax base in this way (from the difference).

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Clauses 3, 4 and 5 of Art. 155, requirements also do not apply to transactions involving the primary assignment of rights. It turns out that Art. 155 of the Tax Code of the Russian Federation, the procedure for determining the tax base for VAT upon the initial assignment of the right of claim is not established.

In other words, the tax legislation does not contain a specific rule approving the procedure for determining the tax base for VAT upon assignment of a monetary claim by the original creditor. In this regard, we believe that during the initial assignment of the right to claim a debt for goods supplied, the VAT tax base in relation to the transaction for the initial assignment of the right of claim is not determined, therefore VAT on such a transaction is not charged by the original creditor and is not presented to the new creditor.

The amount of VAT on goods sold as of the date of assignment of the right of claim (work, services) has already been calculated and paid to the budget (clause 1 of Art.

155, paragraph 1, art.

167 of the Tax Code of the Russian Federation), therefore, the assignor, when assigning the right to claim his receivables, should not re-charge the same tax.

The interpretation of the provisions of Article 153 of the Tax Code of the Russian Federation proposed by the tax authority is unacceptable, since in accordance with paragraph 7 of Art. 3 of the Tax Code of the Russian Federation, all irremovable doubts, contradictions and ambiguities in acts of legislation on taxes and fees are interpreted in favor of the taxpayer.

Thus, at present, it is not possible to unambiguously answer the question: is it necessary to calculate VAT upon the initial assignment of the right of claim. In our opinion, in such a situation the tax base for VAT is not determined.

However, taking into account the opposite position of the regulatory authorities, we do not rule out that if the organization does not charge VAT when assigning the right of claim, this decision may become the subject of legal proceedings.

If an organization decides to follow the position of the regulatory authorities and charge VAT when assigning the right of claim, then the tax must be calculated at a rate of 18% (clause 3 of Article 164 of the Tax Code of the Russian Federation).

Answer prepared by: Expert of the Legal Consulting Service GARANT Lazukova Ekaterina

Response quality control: Reviewer of the Legal Consulting Service GARANT Monaco Olga

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

Features of assignment between legal entities

Unlike individuals, assignments between organizations are quite common. For example, the creditor considers the return of the borrowed amount impossible and is looking for ways to return the borrowed funds, at least partially.

In addition to banks and other financial organizations, other legal entities can transfer debts to a third party. This provision of the law appeared at the end of 2015 and allowed enterprises faced with debt to get rid of non-recoverable (in the opinion of the legal entity) debt by selling it for the full amount of the outstanding balance, or at a reduced cost.

When a company goes through a reorganization stage, the name of the debtor changes, while in fact the organization remains the same. This happens when, at the time of organization, the balance (remainder) remains not zeroed. According to the concluded agreement and the signed reconciliation report on mutual settlements, the counterparty is changed in the accounting program.

A feature of an assignment agreement between legal entities is the permissibility of a transaction between affiliated parties.

An important requirement when signing an agreement between enterprises is to reflect the change of parties in the accounting entries. In addition, the issue of taxation in relation to the transaction is resolved, taking into account tax obligations for VAT. If it is established that a transaction has been deliberately undervalued, representatives of the Federal Tax Service are authorized to carry out additional tax assessments.

Obligation to pay VAT

The only exceptions are transactions for the assignment (assignment, acquisition) of the rights (claims) of the creditor under obligations arising from agreements for the provision of loans in cash and (or) credit agreements, as well as for the fulfillment by the borrower of obligations to each new creditor under the original agreement underlying the basis of the assignment agreement. According to paragraphs.

26 clause 3 art.

149 of the Tax Code of the Russian Federation, these transactions are not subject to taxation (exempt from taxation).

In accordance with paragraph 2 of Article 155 of the Tax Code of the Russian Federation, when the debtor repays his obligation, the tax base of the assignee is determined as the difference between the amount of income received from the debtor and the amount spent on the acquisition of a monetary claim (if this difference is negative or equal to zero, the tax is not paid).

On the date of repayment by the debtor of the monetary obligation in 2021, the tax is calculated at the rate of 18/118 (clause 4 of article 164, clause 8 of art.

167 Tax Code of the Russian Federation

).

For example, a monetary claim in the amount of 100 rubles. purchased for 30 rubles. The debtor transferred 100 rubles. to the assignee's account. Accordingly, the tax base for VAT will be 70 rubles. and VAT - 10.68 (70*18/118)

In a situation where the debt is repaid in installments, the procedure for determining the tax base for VAT is not established by the norms of the Tax Code of the Russian Federation.

We were unable to find official explanations from the Ministry of Finance and the Federal Tax Service of the Russian Federation on this issue. However, in practice, the tax authorities insist that the tax base for VAT should be determined as the excess of the amount of income in the form of a partial payment received from the debtor over the amount of expenses for the acquisition of a monetary claim in a part proportional to the amount of this income.

Considering that the norms of clause 2 of Article 155 of the Tax Code of the Russian Federation are similar to the norms of clause 3 of Art. 279, ch. 25 of the Tax Code of the Russian Federation, the tax base for VAT in the event of partial repayment by the debtor of its obligations can be determined in the same manner as is applied for profit tax purposes when applying the accrual method.

If you follow the official position, then VAT should be calculated as follows. For example, a monetary claim in the amount of 100 rubles. purchased for 30 rubles. The debtor transferred 20 rubles. to the assignee's account. Accordingly, the tax base for VAT will be 14 rubles. ( (100-30)*(20/100) or 20 - (30*20/100)), and VAT - 2.14 (14*18/118).

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

There is an opinion that as long as the debtor’s payment does not exceed the cost of acquiring the right of claim, the assignee does not have a VAT tax base. Then in our example, upon receipt of partial payment in the amount of 20 rubles.

There is no tax base (20 rubles - 30 rubles). But this point of view will most likely have to be defended in court.

An invoice issued “for yourself” should be registered in the sales book (clause 3 of the Rules for maintaining the sales book).

Transaction code - 14. Note that KVO 14 is used to reflect transactions on the transfer of property rights listed in subparagraphs 1 - 4 of Article 155 of the Tax Code of the Russian Federation, i.e.

formally, incl. when calculating the tax base when extinguishing the right of claim.

But the Federal Tax Service of the Russian Federation explains that when recording an invoice entry with KVO 14 in the sales book, the following must be indicated: invoice number, invoice date, name and INN/KPP of the buyer , the value of property rights on the invoice with VAT and excluding VAT, VAT amount (See commentary to code 14 in Letter of the Federal Tax Service of Russia dated September 20, 2016 N SD-4-3/ [email protected] “On sending information for use in work”).

To fulfill this requirement, in our opinion, you can indicate the details of your organization as the buyer’s details. At the same time, if there are no buyer details in the sales book, you can specify transaction code 26; this code is indicated when selling goods (work, services) to VAT evaders in the event that invoices are not issued to them.

The Tax Code of the Russian Federation does not provide for liability for incorrect indication of transaction codes.

In column 3 of section 9 of the VAT return, lines 010 - 220 reflect the data indicated, respectively, in columns 2 - 8, 10 - 19 of the sales book. Indicators on lines 010 - 220 are filled in in an order similar to the order in which indicators are filled out in columns 2 - 8, 10 - 19 of the sales book (p.

47.4 Procedure for filling out a tax return for value added tax, approved. By order of the Federal Tax Service of Russia dated October 29, 2014 N ММВ-7-3/ [email protected] ).

- in line 200 - the amount of VAT on the invoice at a rate of 18% from column 17 of the sales book - 1525 rubles. (VAT).

Changes to clause 3 of Article 164 of the Tax Code of the Russian Federation (increase in VAT by 2%, i.e. from 18% to 20%) come into force on January 1, 2021 (clause 3 of Article 5 of the Federal Law of 08/03/2018 N And when calculating VAT on the date of repayment of the debt, the assignee must calculate VAT at a rate inverse to the rate specified in clause 3 of Article 164 of the Tax Code of the Russian Federation (clause 4 of Article 164 of the Tax Code of the Russian Federation).

Thus, in our opinion, if the VAT tax base arises on the debt repayment date after 01/01/2020, the assignee (your organization) should apply the VAT rate of 20/120

Accounting

If the actual costs of acquiring the right to claim debt (accounts receivable) under the assignment agreement are less than the debt itself, then the acquired right of claim is a financial investment for the assignee, which is accounted for in account 58 “Financial investments” (clause 3 of PBU 19/02).

In the debit of account 58, reflect the acquired right of claim at the actual costs of its acquisition. The composition of such costs is formed from the following:

- amounts paid in accordance with the agreement to the seller (assignor);

- other expenses directly related to the acquisition (for example, consulting services, intermediary fees).

This is stated in paragraphs 8 and 9 of PBU 19/02.

On the date of signing the assignment agreement, make the following entry in accounting:

Debit 58 Credit 76 – reflects the cost of the right of claim acquired under the assignment agreement.

Repay the debt to the assignor by posting:

Debit 76 Credit 51 (50) – the debt to the assignor under the assignment agreement was repaid on the date of settlement under the terms of the agreement.

In the credit of account 58, reflect the write-off of the right of claim (when the debtor repays his obligations). Consider the cost of the right of claim as part of other expenses, and the amount received from the debtor as part of other income (clause 11 of PBU 10/99, clause 7 of PBU 9/99). When you receive funds from the debtor to repay the debt, make the following entries:

Debit 51 (50) Credit 76 – debt received from the debtor;

Debit 76 Credit 91-1 – the amount of repaid debt is taken into account as income;

Debit 91-2 Credit 58 – the cost of the acquired right of claim is taken into account as expenses.

This procedure follows from the Instructions for the chart of accounts (accounts 58, 76, 91).

Situation: how to reflect in accounting the acquisition of the right to claim debt at face value?

Report as cash equivalent.

The right to claim a debt acquired at par value is not capable of generating income for the organization in the future and cannot be considered as a financial investment (clause 2 of PBU 19/02). Therefore, such an asset should be classified as cash equivalents. This is explained by the fact that the right to claim a debt is a highly liquid asset that can be presented for payment, sold or transferred as payment. This qualification of the right to claim debt does not contradict the position of the Ministry of Finance of Russia given in paragraph 5 of the information message dated December 21, 2009.

The Chart of Accounts does not provide for a special account to reflect the movement of such cash equivalents. An organization can take into account such a requirement, for example, on account 76 “Settlements with other debtors and creditors” by opening a separate sub-account “Cash equivalents that are not financial investments.” In the balance sheet, as well as in the cash flow statement, take into account the acquisition of the right to claim debt at par value as part of cash equivalents, having previously established this procedure in the accounting policy.

When acquiring the right to claim a debt at par value under an assignment agreement, make the following entries in accounting:

Debit 76 subaccount “Cash equivalents that are not financial investments” Credit 76 “Settlements with the assignor” - reflects the cost of the right of claim acquired under the assignment agreement;

Debit 76 subaccount “Settlements with the assignor” Credit 51 – payment was made under the agreement of assignment of the right of claim.

When you receive funds from the debtor to repay the debt, make the following entry:

Debit 51 (50) Credit 76 “Cash equivalents that are not financial investments” - debt received from the debtor.

Situation: how to reflect in accounting the acquisition of the right to claim a debt if, under the terms of the contract, the right to claim is transferred to the assignee after full payment of its obligations?

Until the final settlement with the assignor, reflect the transferred amounts as advances.

At the same time, at the time of concluding the agreement, no entries are required in the assignee’s accounting records. Indeed, in relation to the debtor, he will become a creditor only after he has finally settled with the seller of the debt (assignor). This procedure follows from paragraph 2 of Article 389.1 of the Civil Code of the Russian Federation and paragraph 8 of Article 3 of the Law of December 6, 2011 No. 402-FZ.

What if the assignee pays the assignor in installments? Then reflect the paid amounts in accounting as an advance payment:

Debit 76 subaccount “Settlements with the assignor” Credit 51 – an advance payment was transferred for payment under the assignment agreement.

This follows from paragraphs 3, 16 of PBU 10/99.

Having finally paid off, reflect the transfer of the right to claim the debt in the following order.

If the actual costs of acquiring the right to claim the debt under the assignment agreement are less than the debt itself, then reflect the acquired right of claim on account 58 “Financial investments”:

Debit 58 Credit 76 subaccount “Settlements with the assignor” - reflects the value of the right of claim acquired under the assignment agreement as a financial investment.

Having purchased the right to claim a debt at face value, make the following entries in accounting:

Debit 76 subaccount “Cash equivalents that are not financial investments” Credit 76 “Settlements with the assignor” - reflects the value of the right to claim debt acquired under an assignment agreement at par value.

VAT in the purpose of payment when paying off a debt

Debtors pay off their obligations to your organization in the manner prescribed in the agreement with the original creditor

Those. if debtors pay a fee for services that were subject to VAT from the original creditor, then in the purpose of payment they will indicate, incl.

the amount of VAT that they transfer as part of the payment. But this information is not reflected in the calculation of VAT for the assignee who acquired the right of claim against the debtor.

VAT is calculated in the manner provided above.

So, according to paragraph 1 of Art.

382 of the Civil Code of the Russian Federation, the right (claim) belonging to the creditor (assignor) on the basis of an obligation may be transferred by him to another person (assignee) under a transaction (assignment of the claim) or transferred to another person on the basis of law. At the same time, Art.

384 of the Civil Code of the Russian Federation establishes that, unless otherwise provided by law or agreement, the right of the original creditor passes to the new creditor to the extent and on the conditions that existed at the time of transfer of the right.

Thus, the new creditor receives the claim in the form in which it existed at the time of its transfer, including VAT.

The conclusion of an agreement for the assignment of the right of claim does not lead to the termination of the contract under which the right of claim has been assigned.

Therefore, the agreement for the assignment of the right of claim concerns the debtor only in terms of changing one creditor to another (the composition of the obligation does not change).

The Civil Code allows any company with receivables to transfer the right to collect it to third parties. In conditions of financial instability and non-payments, an increasing number of companies are using this right. In such cases, the accountant is concerned about the tax consequences of selling the debt.

UTII

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, the acquisition of receivables under an assignment of claim agreement does not affect the calculation of the single tax.

Situation: does the assignee of UTII need to pay income tax and VAT when the debtor repays the acquired right of claim? The debtor repaid the debt acquired by the assignee under the assignment agreement.

Yes need.

Upon receipt of payment from the debtor to repay the acquired right of claim, the assignee receives income from the sale of financial services (clause 3 of Article 279 of the Tax Code of the Russian Federation). Operations related to the implementation of property rights are regulated by Article 279 of the Tax Code of the Russian Federation and go beyond the scope of activities subject to UTII.

This means that the organization (assignee) - payer of UTII, upon receipt of receivables from the debtor to repay the obligation, has an obligation to pay taxes according to the general taxation system (income tax and VAT) (clauses 1 and 7 of Article 346.26 of the Tax Code of the Russian Federation).

In addition, due to the emergence of an additional type of activity that is not subject to UTII, the organization has a need to distribute expenses associated with both types of activities (for example, the salary of the head of the organization) (clause 9 of article 274, clause 7 of article 346.26 of the Tax Code RF).

Debtor's taxes

For the debtor, it does not matter what kind of debt he has to the creditor (arising from the sale or from the loan). In any case, the transfer by the creditor of the right to claim this debt to another person does not oblige the debtor to restore VAT (if it was presented).

After all, the list of grounds for tax restoration is closed and there is no such item as the conclusion of an assignment agreement (clause 3 of Art.

170 of the Tax Code of the Russian Federation). Note that when assigning the right of claim under a loan agreement, the issue of VAT does not arise at all, because

the operation of providing a loan is not subject to VAT, which means that the tax is not presented to the debtor and is not accepted for deduction (clause 15, clause 3, article 149 of the Tax Code of the Russian Federation).

The picture is similar with income tax. The transfer to a new creditor of the right to claim payment for property acquired by the debtor does not entail any consequences.

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Indeed, with the accrual method, expenses are taken into account for tax purposes regardless of actual payment (Article 253, Article 272 of the Tax Code of the Russian Federation). And the loan amount, when repaid, is not taken into account at all in expenses (clause

12 tbsp. 270 of the Tax Code of the Russian Federation).

And this rule does not depend on who the loan is returned to: the original creditor, or a new one who has received such a right to claim under the assignment agreement.

Keep records and submit income tax and VAT reports online

But if the debtor applies the cash method when taxing profits or is on the simplified tax system, then the purchased goods (work, services), the right to claim payment for which has been assigned, will be considered paid at the time of repayment of the debt to the new creditor (clause 3 of article 273 of the Tax Code of the Russian Federation, Clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

simplified tax system

Regardless of the chosen object of taxation, a simplified organization must take into account income in accordance with the requirements of Article 346.15 of the Tax Code of the Russian Federation.

Situation: when calculating the single tax, does the assignee need to include in income the value of property (including money) received from the debtor under the assignment agreement? The organization applies simplification.

The answer to this question depends on the type of claim under the assignment agreement and the procedure for repaying the debt.

Money received by the assignee from the debtor to repay the debt (i.e., the amount of receivables that was acquired as part of the assignment of the right of claim from the original creditor (assignor)) is recognized as income from the sale of financial services (clause 1 of Article 346.15, clause 1 of article 249, clause 3 of article 279 of the Tax Code of the Russian Federation). Therefore, when calculating the single tax, take it into account as part of income from sales (clause 1 of Article 346.15, Article 249 of the Tax Code of the Russian Federation). At the same time, include income in the calculation of the taxable base on the date the debtor repays his debt (for example, on the date of crediting funds to the current account) (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). Such clarifications are contained in letters of the Ministry of Finance of Russia dated August 1, 2011 No. 03-11-06/2/112, Federal Tax Service of Russia for Moscow dated January 18, 2005 No. 18-09/01679.

Under an assignment agreement, a new creditor may acquire the right to claim the debt in the form of an advance paid by the assignor for the delivery of goods. As a result, the debtor may receive goods to repay the debt. Then, when calculating the single tax, the income of the assignee is determined as follows. If the value of the goods does not exceed the price paid to the assignor, then the assignee will not have any income. If the cost of the goods exceeds the price paid to the assignor, then the difference between the cost of the goods received and the amount paid to the assignor should be taken into account by the assignee as part of non-operating income. This conclusion follows from the letter of the Ministry of Finance of Russia dated January 30, 2012 No. 03-11-11/14.

When assigning the right of claim under a loan (credit) agreement, the organization applying the simplification (assignee) should not take into account the amount of the loan returned by the debtor as part of its income. This is explained by the fact that the assignment agreement concluded between the assignor and the assignee follows from the loan agreement. In turn, the original creditor, when returning the amounts of issued loans, does not take them into account as income when calculating income tax (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation). Consequently, if the assignment agreement follows from the loan agreement, the assignee should also not include in income when calculating the single tax the amount of debt repayment received from the debtor (subclause 1, clause 1.1, article 346.15, subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation ). This position is set out in letters of the Ministry of Finance of Russia dated February 7, 2011 No. 03-11-06/2/14, dated December 22, 2010 No. 03-11-06/2/192, dated January 22, 2007 No. 03- 11-05/5 and the Federal Tax Service of Russia dated May 3, 2011 No. KE-4-3/7204. If the assignee received from the debtor an amount exceeding the price paid to the assignor, the difference must be included in income (letter of the Ministry of Finance of Russia dated November 2, 2011 No. 03-11-06/2/151).

If an organization pays a single tax on the difference between income and expenses, it will not be able to take into account the cost of acquiring the right of claim (property right) as expenses. This is explained by the fact that this type of expense is not included in the closed list given in Article 346.16 of the Tax Code of the Russian Federation. A similar position is taken by the Russian Ministry of Finance in letter dated July 24, 2012 No. 03-11-06/2/93.

Object of taxation

Tax legislation does not define the concept of realization of property rights.

Article 39 of the Tax Code of the Russian Federation provides a definition only for the sale of goods, works, and services. However, property rights do not belong to any of these categories (Article 38 of the Tax Code of the Russian Federation). Civil legislation recognizes property rights as an object of civil circulation (Articles 128 and 129 of the Civil Code of the Russian Federation). This means that organizations and citizens can freely alienate, acquire or exchange their property rights. Thus, for the purposes of VAT, the implementation of property rights should be recognized as their transfer from one person to another.

Article 155 of the Tax Code of the Russian Federation establishes the specifics of calculating VAT on the implementation of specific property rights. They need to be taken into account:

- upon assignment of a monetary claim arising from a contract for the sale of goods (works, services) (clauses 1 and 2 of Article 155 of the Tax Code of the Russian Federation);

- when transferring rights to residential buildings and premises, garages or parking spaces (clause 3 of Article 155 of the Tax Code of the Russian Federation);

- when transferring a monetary claim acquired from third parties (clause 4 of Article 155 of the Tax Code of the Russian Federation);

- when transferring rental rights and rights related to the conclusion of an agreement (clause 5 of Article 155 of the Tax Code of the Russian Federation).