At the moment, almost any enterprise is trying to receive advance payment from customers for upcoming deliveries of goods or services provided. This trend is due to the fact that the company seeks to protect itself from unscrupulous partners. In this regard, the seller receives funds that are not his property, since the provision of services/delivery of goods has not yet taken place. However, the contract for the purchase and sale of goods/provision of services may be terminated for any reason before such a fact occurs. As a result, the question arises: how to properly return the advance to the buyer?

What is an advance?

In pursuance of the agreements reached when drawing up the contract, one party often pays money for a product or service. The payment may be called an earnest money deposit, an advance payment, or an advance payment. The payer has the right to request the return of advance funds if the goods or services have not yet been provided to the recipient, or if the obligations undertaken under the contract have been partially fulfilled. In the first case, the payer is legally allowed to make a claim for payment of the advance in full. In the second scenario, it is possible to return a certain part of the advance payment, calculated with the deduction of work and services already performed. To do this, you need an advance invoice.

How to reflect the buyer's advance refund

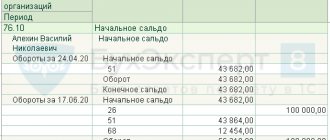

The buyer accounts for the amounts of advances issued to partners in a special subaccount to account 60 “Settlements for advances issued”, the debit of which reflects the occurrence of receivables, i.e. transfer of an advance, and for a loan - repayment of such debt.

If the seller is obliged to calculate and pay VAT on the amount of the advance received, then for the buyer the opposite is true. He may deduct the VAT included in the advance tax return received from the supplier, or he may not do so - this is his right. Depending on whether the buyer exercises this right or not, the algorithm of his actions when returning the advance payment depends.

The buyer can recover VAT if the contract provides for advance payments, and the basis for the deduction is the SF he has for the advance and the payment order for the transfer of the advance payment to the supplier. If a tax deduction was claimed, then when the advance payment is returned from the seller, the buyer will have to restore the tax. If VAT on the advance tax return was not claimed, then the tax will not have to be restored. Returning to the example discussed above, let us recall how the buyer will record in the accounting transactions the transfer of an advance payment and its return from the supplier in both of these situations:

Option 1

Let us assume that Lia LLC, upon receipt of an advance SF from Tsvet LLC on September 11, 2020, declared VAT deductible, and on September 26, 2020, the company’s account received a refund of the prepayment in the full amount - 600,000 rubles, which became the basis for the restoration of the previously refunded " advance tax. Postings:

| Contents of operation | D/t | K/t | Amount in rub. |

| 10.09.2020: | |||

| Prepayment under the supply agreement has been transferred | 60/AB | 51 | 600 000 |

| 11.09.2020 | |||

| VAT on advance payment taken into account | 19 | 60/AB | 100 000 |

| VAT deduction claimed | 68/2 | 19 | 100 000 |

| 26.09.2020: | |||

| Refund of advance taken into account | 51 | 60/AB | 600 000 |

| VAT restored | 60/AB | 68/2 | 100 000 |

Reverse situation

But the opposite situation is also possible, the amount of advance payments is lower than the cost of the work performed, in this case the customer reimburses the difference to the contractor. If the contractor wishes to terminate the contract, the other party requires him to pay the difference between the transferred advance payment and the cost of the work performed, as well as a penalty for improper fulfillment of contractual obligations. The amount of the penalty is determined by the terms of the agreement and the contract. ]

An advance cannot act as a guarantee of fulfillment of obligations. It is paid by the customer as an advance payment for future work and services provided by the contractor. It does not obligate the conclusion of a contract and can be returned at any time during the contract period. The Civil Code does not provide a clear definition of the concept of advance. Earlier legislation defined the term as partial advance payment. It is not paid as full payment under a contract or other agreement.

In what cases is it possible to return the advance upon termination of the contract?

Accounting

Judicial practice Situations related to the return of advance amounts often lead to conflicts between participants. Each participant in the transaction defends their rights, which is quite natural.

Important

What documents are needed to return money to the buyer? If the supplier returns the advance partially, then he has the right to accept VAT as a deduction in the amounts corresponding to the returned parts of the prepayment, provided that adjustment transactions due to changes in contractual relations and the return of the prepayment are reflected in the accounting records. The advance is returned by the tax agent. Does he have the right to deduct VAT? Right.

Since January 1, 2008, additions to paragraph 5 of Art. 171 of the Tax Code of the Russian Federation, introduced by Federal Law No. 85-FZ of May 17, 2007, according to which the above procedure for deducting VAT amounts applies to taxpayer buyers acting as a tax agent.

Info

II quarter of 2011, declarations submitted to the tax authority on 06/13/2013 and 06/07/2013, respectively). The agreement to terminate the contract, drawn up on September 10, 2013 (later than the deadline for submitting “clarifications” with the declared deductions - June 2013), did not save the situation: the company’s arguments that the right to deduct amounts of “advance” VAT arose only from the moment termination of the contract (from the date of drawing up the agreement) was not accepted by the cassation authority.

We suggest you read: How to cancel a loan

The court issued a verdict: by claiming deductions in June 2013, the company missed the deadline established by law for claiming these deductions. In general, it is worth keeping in mind that the Tax Code does not provide for such a condition for deducting “advance” VAT as the presence of documents confirming the change or termination of the contract. Therefore, the absence of these documents cannot be a basis for refusal of a tax deduction, which is confirmed by the judges’ findings.

Due to the lack of the required product in the assortment, the dispatch of the second batch has been delayed. In accounting, this operation will be accompanied by the following entries: Contents of transactions Debit Credit Amount, rub.

Info

January 2015 Received an advance for the upcoming delivery 51 62-2 1,180,000 “Advance” VAT accrued (RUB 1,180,000 x 18/118) 76-av. VAT 68-VAT 180,000 Until 25.04, 25.05, 25.06 {amp}lt;* Paid 1/3 of the amount of accrued “advance” VAT 68-VAT 51 60,000 May 2015

Goods shipped 62-1 90-1 472 000 VAT accrued on sales 90-3 68 72 000 “Advance” VAT accepted for deduction 68-VAT 76-av. VAT 72,000 The part of the advance payment attributable to the sale is credited 62-2 62-1,472,000 {amp}lt;* Payment of tax on transactions recognized as the object of taxation is made in equal shares no later than the 25th day of each of the three months following the expiration tax period (clause 1 of article 174 of the Tax Code of the Russian Federation).

In order to avoid misunderstandings, legal disputes and other troubles, it is necessary to take care of the correct drafting of the contract, the clauses of which will reflect all the nuances of the return of advance funds. But in practice, the services of a lawyer are most often resorted to when the problem has already matured and needs to be solved in one way or another.

Judicial practice in Russia is replete with cases of this kind, and its analysis allows us to draw the following conclusion. Refund of the advance upon termination of the contract is not always possible by agreement of the parties. This is a complex multi-level process that requires a thorough study of the tax and civil law norms of the legislation of the Russian Federation.

What reasons could there be?

Refund of the deposit or advance payment is possible if the following grounds exist:

- the party that received the advance did not fulfill its obligations;

- the work was performed poorly by the contractor;

- the contractor delayed the start of work and missed delivery deadlines.

We remind you that the customer has the right to refuse the services of the contractor during any period of the contract. However, in this case, the customer returns the advance minus the cost of the work performed based on the invoice for the advance payment.

Accounting for VAT from the buyer

Now let’s look at an example of how the buyer’s VAT accounting operations are reflected in the 1C: Accounting 8 version 3.0 program when returning the transferred advance payment.

Example 2

| Clothes and Shoes LLC (buyer) entered into an agreement for the supply of goods with Trading House LLC (seller) for a total amount of RUB 180,000.00. (including VAT 20% - RUB 30,000.00) on the terms of full advance payment. After the prepayment was transferred, the delivery contract was terminated and the prepayment amount was returned by the seller. The sequence of operations is given in Table 2. |

table 2

Payment to the supplier

To perform operation 1.1 “Registering an invoice for payment from a supplier,” you must create an Invoice from a supplier document (Purchases section - Purchases subsection) using the Create button.

To perform operation 1.2 “Drawing up a payment order for advance payment to a supplier,” a Payment order document is created (section Bank and cash desk - subsection Bank) using the Create button.

You can create a Payment order document based on the Invoice to buyer document.

Based on the Payment order document, the document Write-off from the current account is entered (operation 1.3 “Registration of prepayment”).

If payment orders are created in the Client-Bank program, then it is not necessary to create them in the 1C: Accounting 8 program. In this case, only the document Write-off from the current account is entered, which generates the necessary transactions. The document Write-off from a current account can be created manually or based on downloading from other external programs (for example, “Client-Bank”).

As a result of posting the document Write-off from the current account, the following accounting entry will be generated:

Debit 60.02 Credit 51 - for the amount of advance payment transferred to the seller, which is 180,000.00 rubles.

In accordance with paragraph 1 of Article 168 of the Tax Code of the Russian Federation, the buyer of goods who has transferred the prepayment amount must be issued an invoice no later than 5 calendar days, counting from the date of receipt of the prepayment by the seller. This invoice is the basis for the buyer, who has transferred the prepayment, to accept for deduction the amounts of tax calculated and presented by the seller, in the presence of documents confirming the actual transfer of the prepayment amounts, and an agreement providing for the transfer of these amounts (clause 2 of article 169, clause 12 Article 171, paragraph 9 Article 172 of the Tax Code of the Russian Federation).

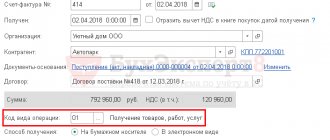

To claim a deduction by the buyer based on an invoice received from the seller (operations 1.4 “Registration of a received invoice for prepayment”, 1.5 “Deduction of VAT from the transferred prepayment”), it is necessary to create the document Invoice received

using the

Create on base

(see Fig. 4).

Rice. 4. Prepayment invoice received by the buyer

In the new Invoice document received, most of the fields are filled in automatically.

This will also automatically install:

- in the Invoice type field – the value For advance;

- in the Transaction type code field - code 02, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ).

In addition, in the new Invoice document received, you should additionally indicate:

- in the Invoice No. and from fields - the number and date of the invoice received from the seller;

- in the Received field - the date of actual receipt of the invoice, which by default is entered similar to the invoice date specified in the from field.

To automatically reflect the deduction of VAT from the transferred prepayment in accordance with paragraph 12 of Article 171 and paragraph 9 of Article 172 of the Tax Code of the Russian Federation, it is necessary to check the presence of the flag in the line Reflect VAT deduction in the purchase book (Fig. 4).

As a result of posting the Invoice document received, an accounting entry will be made in the accounting register:

Debit 68.02 Credit 76.VA - for the amount of input VAT in the amount of RUB 30,000.00. (RUB 180,000.00 x 20/120), claimed for tax deduction.

From 01/01/2015, taxpayers who are not intermediaries (forwarders, developers) do not keep a log of received and issued invoices. However, after posting the document Invoice received in the Invoice Journal register, an entry is also made to store the necessary information about the received invoice.

To register the received advance invoice in the purchase book, an entry will be made in the Purchase VAT accumulation register with the transaction type code 02, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights ( Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ).

Based on the entries in the VAT Purchases register, a purchase book is formed for the first quarter of 2021 (section Reports - VAT subsection), fig. 5.

Rice. 5. Purchase book for the first quarter of 2021 from the buyer

The amount of VAT claimed for deduction from the transferred prepayment is reflected on line 130 of Section 3 of the VAT tax return for the first quarter of 2021 (approved by order of the Ministry of Finance of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] ) (section Reports - subsection 1C-Reporting - hyperlink Regulated reports).

The difference between the concepts of advance, deposit and prepayment

All relationships between the customer and the contractor are determined by the civil code. A clearly defined description of the deposit is contained in Art. 380 Civil Code of the Russian Federation. It states that the agreement on the issuance of a deposit must be drawn up in writing, and its exact amount is indicated. The deposit is considered a kind of security for the guarantee of the contract. Thus, if the service contract is terminated by the customer, the deposit remains with the contractor. But upon termination, the executor pays double the amount. You cannot make a deposit in the form of securities.

With an advance, as we said above, the situation is more complicated. The legislator does not disclose this concept, so it happens that an advance and a deposit are often confused. However, this is a mistake, since advance, prepayment and deposit mean different types of payments. The advance payment can always be returned to the buyer in full if the transaction does not take place.

VAT accounting for the supplier

Let's consider an example of how the 1C:Accounting 8 program, edition 3.0, reflects operations for accounting for VAT from a supplier when returning advances received to the buyer.

Please note that in accordance with Federal Law No. 303-FZ dated 08/03/2018, VAT tax rates changed from 01/01/2019: from 18% to 20%; from 18/118 to 20/120 and from 15.25% to 16.67%.

Example 1

| Trading House LLC (seller) entered into an agreement for the supply of goods with Clothes and Shoes LLC (buyer) for a total amount of RUB 180,000.00. (including VAT 20% - RUB 30,000.00) on the terms of full advance payment. After receiving the advance payment, the supply contract was terminated and the advance payment amount was returned to the buyer. The sequence of operations is given in Table 1. |

Table 1

Issuing an invoice for payment to the buyer

To perform operation 1.1 “Issuing an invoice to the buyer” (section Sales - subsection Sales), you need to use the Create button to create a new document Invoice to the buyer.

Receiving preliminary payment from the buyer

To perform operation 2.1 “Receiving advance payment from the buyer”, you need to create a document Receipt to the current account based on the document Invoice to buyer by clicking the Create based button.

The indicators of the document Receipt to the current account are filled in automatically based on the information in the document Invoice to the buyer.

In addition, in the document Receipt to the current account you must indicate:

- in the fields According to document No. and from - the number and date of the buyer’s payment order;

- in the Amount field - the actual amount of the prepayment received.

As a result of posting the document Receipt to the current account, the following accounting entry is generated:

Debit 51 Credit 62.02 - for the amount of money received by the seller from the buyer.

In accordance with paragraphs 1, 3 of Article 168 of the Tax Code of the Russian Federation, the buyer of goods who has transferred the prepayment amount must be issued an invoice no later than 5 calendar days, counting from the date of receipt of the prepayment.

An invoice for the received prepayment amount (operations 2.2 “Creating an invoice for the amount of prepayment”, 2.3 “Calculation of VAT on the received prepayment”) in the program is generated on the basis of the document Receipt to the current account using the Create based button. Automatic generation of invoices for advances received from customers can also be done using the processing Registration of invoices for advance payments (section Banks and cash desk - subsection Registration of invoices).

In the new document Invoice issued

basic information will be filled in automatically according to the base document:

- in the from field - the date of preparation of the invoice, which by default is set to the same date as the date of generation of the document Receipt to the current account;

- in the Counterparty, Payment document No. and from fields - the relevant information from the basis document;

- in the Invoice type field – the value For advance;

- in the tabular part of the document - the amount of the received prepayment in the amount of 180,000.00 rubles, the VAT rate in the amount of 20/120 and the amount of VAT in the amount of 30,000.00 rubles.

In addition, the following will be automatically entered:

- in the Transaction type code field - value 02, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] );

- the Compiled switch is moved to the position On paper, if there is no valid agreement on the exchange of electronic invoices, or In electronic form, if such an agreement has been concluded;

- flag Issued (transferred to the counterparty) indicating the date - if the invoice is transferred to the buyer and is subject to registration. If there is an agreement on the exchange of electronic invoices before receiving confirmation from the EDI operator, the checkbox and date of issue will be absent. If the date of transfer of a paper invoice to the buyer is different from the date of preparation, then it must be adjusted;

- The Manager and Chief Accountant fields are data from the Responsible Persons information register. If the document is signed by other responsible persons, for example, on the basis of a power of attorney, then it is necessary to enter the relevant information from the directory Individuals.

For the correct preparation of an invoice, as well as the correct reflection of the document in the accounting system, it is necessary that in the Nomenclature field of the tabular part of the document the name (or generic name) of the goods supplied is indicated in accordance with the terms of the contract with the buyer.

This information is filled in automatically indicating:

- names of specific product items from the document Invoice to the buyer, if such an invoice was previously issued;

- a generic name, if such a generic name was defined in the agreement with the buyer.

By clicking the Print document Invoice issued button, you can go to view the invoice form and then print it in two copies (Fig. 1).

Rice. 1. Invoice for prepayment issued to the seller

The invoice for the prepayment amount received shall indicate:

- in line 5 - details (number and date of preparation) of the payment and settlement document (clause “h” of clause 1 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in column 1 - the name of the goods supplied (description of work, services), property rights (clause “a”, clause 2 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in column 8 - the amount of tax calculated on the basis of the tax rate determined in accordance with paragraph 4 of Article 164 of the Tax Code of the Russian Federation (clause “z” of paragraph 2 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in column 9 - the amount of advance payment received (clauses “and” clause 2 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in lines 3 and 4 and columns 2–6, 10–11 - dashes (clause 4 of the Rules for filling out an invoice, approved by Resolution No. 1137).

As a result of posting the document Invoice issued, an accounting entry is generated:

Debit 76.AB Credit 68.02 - for the amount of VAT calculated on the amount of advance payment received from the buyer in the amount of RUB 30,000.00. (RUB 180,000.00 x 20/120).

Based on the issued Invoice document, an entry is made in the information register of the Invoice Log.

Despite the fact that since 01/01/2015, taxpayers who are not intermediaries (forwarders, developers) do not keep a log of received and issued invoices, register entries in the Invoice Log are used to store the necessary information about the issued invoice.

Based on the document Invoice issued, a registration entry is made in the Sales VAT

.

Based on the entries in the VAT Sales register, a sales book is generated for the first quarter of 2021 (section Reports - VAT subsection), fig. 2.

Rice. 2. Sales book for the first quarter of 2021 from the seller

The amount of VAT accrued from the prepayment received is reflected in line 070 of Section 3 of the VAT tax return for the first quarter of 2019 (approved by order of the Ministry of Finance of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] as amended by the order of the Federal Tax Service of Russia dated December 28, 2014 .2018 No. CA-7-3/ [email protected] ) (section Reports - subsection 1C-Reporting - hyperlink Regulated reports).

Refund of received advance payment

To perform operation 3.1 “Return of advance payment to the buyer”, you must create a document Write-off from the current account.

You can create this document based on the document Receipt to current account by clicking the Create based on button.

The document Write-off from a current account can also be created based on downloading from other external programs (for example, “Client-Bank”). If payment orders are created in the Client-Bank program, then it is not necessary to create them in the 1C: Accounting 8 program. In this case, only the document Write-off from the current account is entered, which generates the necessary transactions.

As a result of posting the document Write-off from the current account, the following accounting entry will be generated:

Debit 62.02 Credit 51 - for the amount of advance payment returned to the buyer in connection with termination of the supply agreement.

Amounts of VAT calculated by the seller and paid to the budget from payment amounts, partial payment for upcoming deliveries of goods (work, provision of services) sold in the Russian Federation are accepted for tax deduction in the event of a change in conditions or termination of the contract and the return of the corresponding amounts of advance payments (Clause 5 of Article 171 of the Tax Code of the Russian Federation).

Deductions of VAT amounts are made in full after the corresponding adjustment operations in connection with the return of goods or refusal of goods (work, services) are reflected in the accounting records, but no later than one year from the date of return or refusal (clause 4 of Article 172 of the Tax Code of the Russian Federation) .

Submitting for tax deduction the amount of VAT calculated on the received advance payment (operation 3.2 “Deduction of VAT calculated on the received advance payment”) is carried out using the document Generating purchase ledger entries (section Operations - subsection Closing the period - hyperlink Regular VAT operations) using the Create command .

Data for the purchase book on tax amounts to be deducted in the current tax period are reflected on the Advances received tab.

To fill out a document using accounting system data, it is advisable to use the Fill command.

As a result of posting the document Formation of purchase ledger entries, an accounting entry is generated:

Debit 68.02 Credit 76.AB - for the amount of VAT claimed for tax deduction in connection with the termination of the supply agreement and the return of advance payment.

To create a purchase book, an entry is made in the Purchase VAT accumulation register.

Based on the entries in the VAT Purchases register, a purchase book is generated for the tax period in which the contract was terminated and the amount of advance payment was returned to the buyer, i.e. for the second quarter of 2021 (section Reports - VAT subsection), fig. 3.

Rice. 3. Purchase book for the second quarter of 2021 from the seller

When registering the advance invoice in the purchase book, the following will be indicated:

- in column 2 - transaction type code 22, which corresponds to the operation for the return of advance payments in the cases listed in paragraph 2 of paragraph 5 of Article 171 of the Tax Code of the Russian Federation (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3 / [email protected] );

- in column 7 - details of the document confirming the return of the advance payment to the buyer (clause “k”, clause 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137);

- in column 15 - the entire amount of the invoice from column 9 on the line “Total payable” (clause “t”, paragraph 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137);

- in column 16 - the amount of VAT that the seller claims for tax deduction (clause “y” of clause 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137).

The amount of the tax deduction will be reflected on line 120 of Section 3 of the VAT return for the second quarter of 2021 (approved by order of the Ministry of Finance of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] as amended by order of the Federal Tax Service of Russia dated December 28, 2018 No. SA-7-3/ [email protected] ) (section Reports - subsection 1C-Reporting - hyperlink Regulated reports).

What does the law say?

Law on the protection of rights on the side of consumer interests. Payment is made in full, and this rule works “by default” with rare exceptions. Such exceptions include situations where it was previously provided for the execution of a preliminary purchase and sale agreement or another document certifying and fixing the terms of the transaction even before its completion. This is what they do, for example, when making a large purchase. Like, for example, an advance payment when buying an apartment. If an agreement was drawn up that clearly stated the circumstances under which the prepayment may be withheld, then their violation leads to the fact that the prepayment may be withheld in full or in full.

In the second, most common case, in which the prepayment or part of it is usually not returned, when the goods are ordered through the store. In this case, the advance payment represents compensation for losses that the seller may incur. At the same time, the conditions under which the advance payment is not refunded are usually specified in the operating rules of the trade organization, about which the buyer must be warned.

Well, the last most common case when the prepayment is not returned exactly is when ordering services. If the contractor purchased materials and tools to complete your order, then the money is unlikely to be returned to you. But at the same time, you need to remember a very important thing: they can withhold the advance payment only if you were warned about this in advance.

Let's designate the questions

As is known, when receiving an advance payment, a supplier applying the general taxation system is obliged to calculate VAT (subclause 2, clause 1, article 167 of the Tax Code of the Russian Federation). Then, when delivering goods (providing services, performing work) on account of this advance, the organization accepts the previously calculated VAT for deduction (clause 6 of Article 172 of the Tax Code of the Russian Federation). But if the shipment did not occur, what about the previously calculated tax?

Questions are asked not only by sellers, but also by buyers who accept VAT from the advance payment as a deduction. If the transaction was completed, the buyers would have restored this tax. But what to do in case of a failed shipment?

Difficulties may also arise when calculating income tax or single tax if one of the parties uses a simplified taxation system. Let's look at these and other questions in more detail.

The procedure for returning the advance upon termination of the contract

The customer submits a written claim, which clearly states the demand for the return of the advance amount and the reasons why he made this decision. If the return is justified and confirmed by the terms of the contract, the advance payment must be paid to the customer within the terms established by the agreement, unless it contains clauses indicating other conditions. The contract can be terminated if there is consent of both parties or as a result of the demands of one party, but if there is a judicial act. If there is a unilateral termination of the contract, then in court the applicant presents relevant evidence confirming the fact of non-fulfillment of the conditions.

The first way to return an advance is to transfer (withdraw from the cash register) funds

So, all the issues regarding the return of the advance payment have been resolved and now all that remains is to directly return the previously received funds to the buyer.

Important! To avoid misunderstandings on the part of tax inspectors, in the document for transfer of advance payment refund, in the “Purpose of payment” field, write down not only the basis for the operation - return of the prepayment, but also indicate the details of the supply agreement .

If possible, also refer to the details of the agreement on termination of the contract (date and number), and if there is none, to the buyer’s written statement in which he refuses to carry out the transaction.

Repayment of the advance can also be made by issuing funds from the company's cash desk. However, the amount of such issuance cannot exceed 100,000 rubles, since this is the maximum limit for cash payments. In this case, when filling out a cash receipt order, fill out the “Base” line in the same way as filling out the “Purpose of payment” field on the payment slip.

Deal Breakers

Violations of the transaction are considered significant if they entailed significant damage to the other party. Such a case is considered suitable for termination of the contract by one of the parties. Often the problem appears before the work begins, this allows the advance to be paid in full, and the contract is terminated. However, when concluding an agreement, the parties can make a reservation that upon termination of contractual obligations, the advance payment cannot be returned under any circumstances. This, of course, only benefits the performer and partly frees the hands of unscrupulous citizens. But the customer may well lose his funds paid in the form of an advance. In this case, even the court will be on the side of the performer. Refunds to third parties are issued if such a clause is indicated in the contract.

Deadlines

In case of unilateral termination of the contract, the contractor returns the advance amount on the day when the contract actually ceased to be valid. If the case was heard in court, then on the day the decision was made. If there is a refusal to pay advance amounts, then from the moment the agreement is terminated, interest will be accrued on this amount for the use of someone else's funds. The customer has the opportunity to insure his money by contacting the bank for an advance guarantee. It serves as a guarantor of coverage of expected risks in case of violation of the contract by the contractor. Insurance is issued for the period of validity of the contract, that is, until all obligations are fully fulfilled by the parties. In this case, the guarantor who issued the insurance controls the timely implementation of the contract and all the conditions specified in it.

Menu

In commercial activities, it is not uncommon for a transaction under a concluded supply or service agreement to fail. The seller is faced with such a procedure as returning the advance payment to the buyer.

Let's consider the algorithm of actions when returning advance payments. Contents:1. Termination of the contract and return of the advance payment2.

Advance refund procedure3. Refund of advance payment upon termination of the contract: consequences for the seller Termination of the contract and return of the advance payment Advance payment is an advance payment made by the buyer as part of the execution of the contract before the start of work or transfer of goods. Typically, the contractor uses this amount to purchase the materials necessary to execute the transaction. We are talking about the return of the advance upon termination of the contract. Both parties can initiate it.

- Buyer. He must inform the seller of his intentions. Termination can only be made in writing.

If the case was heard in court, then on the day the decision was made. Refund of advance payment Then, when you received an advance payment, you had to include it in income.

Attention

What to do when the advance is returned? When an organization returns an advance to the simplified tax system, the income of the period when the money was transferred back is reduced by the amount of the return (clause 1 of Article 346.17 of the Tax Code). In column 4 of Section I of KUDiR, on the date of return, the amount of money transferred is recorded with a minus sign. The advance can be returned either within the same reporting (tax) period or in different ones.

We invite you to familiarize yourself with: Act on the destruction of powers of attorney form. Document destruction act. Disposal methods and procedures

However, regardless of the time of return, the obligation to submit an updated declaration and recalculate tax amounts (advance payments) for previous periods does not arise.

Types of terminated transactions

“Money in the morning, chairs in the evening”! This is not only Ostap Bender’s favorite motto. All sellers prefer to work this way. But even an advance payment does not always guarantee the seller that the client will buy these “chairs” from him. No seller is immune from situations where an advance has to be returned. The trouble with the return is aggravated by the VAT paid on the advance. In this case, you can take the tax paid as a deduction, following certain rules. First, it is necessary to terminate the contract, return the advance to the buyer and reflect this operation in accounting. All these operations must be carried out within a period not exceeding one year from the moment the failure occurred.

Advance payments in the Tax Code

Speaking about VAT and advance payments, it is necessary to take into account the provisions of a number of articles of the Tax Code of the Russian Federation. Article 168, paragraph 1, declares the seller’s obligation to present VAT to the buyer for payment on amounts of prepayment, partial prepayment for goods, works, services, property rights. The tax is calculated according to the rules of Art. 164 clause 4, by calculation method at a rate of 20/120 (in some cases 10/110).

Within five days from the date of receipt of the money, the buyer who has made an advance payment is presented with an invoice (Article 168, paragraph 3). The buyer has the right to accept the amounts presented by the seller for deduction (Article 171, paragraph 12).

If the delivery does not take place: the contract between the parties is terminated or its terms have changed, the advance payment is returned:

- The seller can deduct VAT from partial or full prepayment (Article 171, paragraph 5);

- the buyer is obliged to restore the full amount of the “advance” VAT accepted for deduction in the tax period when the advance was returned from the seller (Article 170, paragraph 3-3).

Real estate transactions

Separately, it is necessary to stipulate the return of the advance when the real estate purchase and sale agreement is terminated. The process of buying or selling real estate is itself labor-intensive, requiring a lot of time and effort from all parties involved. An advance payment is often made when purchasing an apartment.

Therefore, termination of the contract in this case causes quite serious damage to both the buyer and the seller. But life makes its own adjustments, often our plans change for reasons that do not depend on us, and we are forced to submit to circumstances.

Work agreement

Next, we will consider the advance payment under the contract.

In a situation where the contract is terminated, a refund of the advance payment is also possible. If the situation is obvious: the contractor has not started work, the advance payment is subject to full refund. In practice, the contract is usually terminated when the customer has already paid the advance and the contractor has already completed part of the work (the quality of this work is often the reason for termination of the contract). As in the cases indicated above, the customer does not have the right to demand advance payment in full.

If the contractor is to blame for the termination of the contract, then the customer has the right to demand, in addition to the return of the advance payment, payment of a penalty for violation of contractual obligations. In this case, the contractor is obliged to pay all amounts previously received under the contract minus the cost of the work actually performed and documented by the acceptance certificates of the work performed. The deadline for repayment of the advance must be met.