Simplified and assignment agreement: understanding the concepts

A simplifier is a taxpayer who has chosen a special regime for tax calculations, which allows him not to pay a number of mandatory taxes (income, VAT, with some exceptions, etc.).

You will find a detailed list of taxes that become optional when applying the simplified tax system in the material “Single Tax under the Simplified Taxation System (STS).”

When applying this mode, the simplifier must follow several rules:

- monitor compliance with the restrictions established for the simplified tax system by law (on income, residual value of fixed assets, etc.);

For information about increased limits for simplified people, see the message posted on our website “The “income” limits under the simplified tax system have increased even more.”

- control expenses (for the simplified person, there is a special closed list of expenses by which he can reduce income when calculating the simplified tax).

You will get acquainted with the list of expenses for simplified people in the material “List of expenses under the simplified tax system “income minus expenses””.

In the course of its activities, a simplifier has the right to enter into all types of contracts not prohibited by law, including an assignment agreement (AC) - an agreement under which one can sell (purchase) the right of claim against the debtor. Such agreements have recently become very common, and simplifiers in this case are no exception.

A simplifier may decide to conclude a DC if the following circumstances coincide simultaneously (for example):

- he acts as a creditor;

- he does not have the opportunity to wait for the debt to be repaid;

- he does not have the opportunity to force the debtor to fulfill the obligation;

- an entity was found who was ready to repurchase this debt and collect it from the counterparty who was unwilling to pay.

We will tell you more about DC in the next section.

The procedure for assigning a right of claim is often accompanied by questions. On our forum you can get an answer to any of them. So, in this thread we discuss how VAT should be calculated during the assignment of the right to claim the supply of goods.

Documenting

The transfer of rights to the assignee must be reflected in the agreement. It is concluded in the same form as the original agreement. It must be received in writing, if the contract was first certified by a notary, the secondary contract is also certified by a notary.

It is necessary to register the contract if the original transaction was subject to registration. This is stated in Article 389 of the Civil Code. Documents confirming the right to demand payment of the debt are attached to the agreement. These can be invoices - invoices, acts, etc.

The assignment agreement shows on what basis the right arose, what obligations the debtor has, what documents certify the right of claim. Other information relevant to the assignment must also be present.

The need to allocate VAT is not provided for in the assignment agreement. Article 389 of the Tax Code states that the form of the contract must be consistent with the form of the main obligation. To avoid some problems with inspectors, sometimes it makes sense to enter data on VAT amounts.

If the debt is sold at a loss or at par, the wording “incl. VAT – 0 rub.” If the assignor makes a profit from the transaction, the assignment will be taxed. The contract then specifies the amount of the fee, which is calculated based on the amount of profit.

Features of the assignment agreement

DC is regulated by separate norms of civil legislation - Art. 382–390 Civil Code of the Russian Federation.

DC Features:

- the presence of 2 parties to the agreement: the transferor of rights (assignor) and the recipient of rights after their assignment (assignee);

- double responsibility of the assignor (for the authenticity of documents and the validity of transferred rights);

- the optionality of obtaining the debtor's consent to the assignment, provided that written notification of this procedure is absolutely necessary;

- other features (impossibility of regressive claims against the assignor if the debtor evades fulfillment of his duties, etc.).

DC cannot be concluded in relation to rights that are inextricably linked with the identity of the creditor (Article 383 of the Civil Code of the Russian Federation), for example:

- rights to claim alimony;

- compensation for harm caused to life or health.

You will get acquainted with various agreements using the materials posted on our website:

- “Agreement on full individual financial responsibility”;

- “Agreement without VAT: controversial issues and settlements”;

- “Contract agreement and insurance premiums: nuances of taxation”.

Related documents

- Debt forgiveness agreement

- Loan agreement (microloan)

- Loan agreement (interest-free) with an employee

- Interest-free loan agreement

- Sample. Commercial loan agreement

- Sample. Trade credit agreement

- Letter of guarantee

- Letter of guarantee (form)

- Agreement on the temporary use of foreign currency (annex to the Moscow government decree No. 962 dated October 19, 1993)

- Targeted loan agreement. Agreement on a targeted loan to a customer of scientific and technical products

- Targeted loan agreement. Agreement with the contractor on a targeted loan for scientific and technical products

- Additional agreement to the loan agreement between a legal entity and the institution of a savings bank of the Russian Federation

- Agreement on the bank's participation in the authorized funds

- Foreign currency loan agreement (with collateral in rubles)

- Agreement on credit financing of leasing

- Inter-farm loan agreement

- Agreement on a targeted loan to a customer of scientific and technical products

- Agreement with the contractor on a targeted loan for the supply of scientific and technical products

- Financing (investment) agreement

- Application from an individual borrower for a loan

- Executive inscription

- Loan agreement

- Loan agreement (without collateral)

- Loan agreement (with collateral in foreign currency)

What tax consequences arise for a simplifier under an assignment agreement?

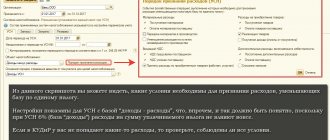

When concluding a transaction contract, the simplifier needs to pay attention to 2 important points:

- For the amount of income from DC. Funds received under an agreement for the assignment of a claim to a third party are income from the sale of property rights. For the simplifier, the specified income is taken into account in the amount actually received from the assignee.

- Date of recognition of income from DC. It is necessary to recognize income on the day of receipt of money from the assignee to the bank account or cash desk of the assignor (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

Find out about the structure of simplified income from the material “What income is recognized (accounted for) under the simplified tax system?”

For tax purposes, income from DC is recognized according to the rules of the cash method of accounting. For the “income minus expenses” and “income” modes they are identical.

The material “What is the procedure (conditions) for recognizing income and expenses using the cash method?” will tell you about the features of the cash method of accounting for income and expenses.

The absence of payment received from the buyer for the goods (work, services) sold to him for the simplified means the absence of revenue. As a result of the sale of the buyer's debt, the simplifier-assignor receives income in the amount received from the assignee under the DC, and expenses include the cost of goods (work, services) sold to the buyer.

If, as a result of the DC, the assignor receives a loss, the simplified assignor does not have the right to take it into account in expenses due to the absence of this type of expense in the closed list when applying the simplified tax system.

The assignee may not be in a better position if he applies the simplified tax system “income minus expenses”: he also cannot include the amount he paid to the assignor under DC as expenses for the same reason.

Is it possible for a simplifier to take into account advertising and entertainment expenses? For the answer, see the material “Acceptable expenses under the simplified tax system in 2015-2016.”

The above accounting scheme is typical for the assignment of debt under a supply agreement and does not apply in the case of DC under a loan obligation.

Find out how to easily determine your tax obligations under DC associated with borrowed obligations in the next section.

Assignment of the right of claim: what accounting entries must the assignee make?

Thus, organization “B”, the assignee, has an obligation to calculate VAT on the date of fulfillment of obligations by the debtor (the date of receipt of money from him) or on the date of subsequent assignment of the received right of claim. In this case, the amount of VAT is determined by the calculation method (clause 4 of Article 164 of the Tax Code of the Russian Federation).

Based on clause 8 of PBU 19/02, financial investments are accepted for accounting at their original cost. The initial cost of financial investments acquired for a fee is recognized as the amount of the organization's actual costs for their acquisition, with the exception of VAT and other refundable taxes (except for cases provided for by the legislation of the Russian Federation on taxes and fees) (clause 9 of PBU 19/02).

We recommend reading: How much does an Extract from the Unified State Register cost in 2021 for individuals in the MFC

Nuances of calculating the simplified tax system under an assignment agreement for borrowed obligations

If the simplifier (income minus expenses) has fulfilled the requirement arising from the loan agreement, then his income from the DC is determined based on the following:

- as a result of DC, the claim on the loan is acquired by the assignee (new creditor);

- the payment received by the assignor (the original creditor) under the DC is the proceeds from the sale of property rights, and not the repayment of the loan;

- The assignor receives taxable income.

Read about the intricacies of accounting for borrowed obligations in the material “Accounting for loans and borrowings in accounting.”

The new creditor’s accounting scheme for the DC is somewhat different (we are talking about the repayment of the loan by the debtor to the new creditor):

- income from the DC is recognized only as the amount of interest on the loan and amounts received in excess of borrowed funds;

- the amount received to repay the loan is not taken into account when calculating the single simplified tax (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation).

The material “Art. 251 Tax Code of the Russian Federation (2015): questions and answers.”

Assignment of debt between a legal entity and an individual

The fact is that the list of costs that can be recognized in tax accounting under simplified taxation is limited by Article 346.16 of the Tax Code of the Russian Federation.

A creditor who has acquired a monetary claim as a result of an assignment (assignee) also has the right to assign it to another person or present it to the debtor for payment.

The Chart of Accounts does not provide for a special account to reflect the movement of such cash equivalents. An organization can take into account such a requirement, for example, on account 76 “Settlements with other debtors and creditors” by opening a separate sub-account “Cash equivalents that are not financial investments.”

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated February 17, 2010 No. 03-07-08/40.

Results

A simplifier can act under an assignment agreement as a assignor or as an assignee. For each party to the contract, the tax consequences depend on the type of the original obligation (whether it was related to a sale or a loan).

Find out what awaits simplifiers in the near future from the message “Rates under the simplified tax system may be halved” posted on our website.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Cancellation of simplification from January 1, 2021

Based on the results of their activities, individual entrepreneurs and organizations are required to report to the tax office. For a certain circle of entrepreneurs, the good news will be the abolition of reporting under the simplified taxation system, which is expected from 2021, since reporting involves additional costs for an accountant, since not everyone has the time and knowledge to independently prepare and submit reports.

In addition to Medvedev’s instructions, conclusions about the high probability of introducing changes can be drawn on the basis of the text of the address published on the official website of the President, with which V.V. Putin traditionally addressed the Federal Assembly. It also mentions the need to simplify business operations and reporting as much as possible for entrepreneurs who work using online cash registers. In particular, the President considers it necessary to provide support for citizens who start doing business and use digital services and cash register equipment for this.

We recommend reading: How many Migrants are in Russia 2020