Hello, dear reader!

Today we will talk about how wisely invested capital will not allow inflation to devalue savings, but will preserve and increase them. It doesn’t matter here whether the investor is willing to take risks to quickly receive dividends or has chosen a small but constant income.

Since it is not easy to withdraw invested funds from circulation, it is important to plan the management of investments. I will help you understand the aspects of additional sources of financing, as well as the most profitable ways of investing.

What is investment in fixed capital

Investments in fixed capital are understood (section II of Rosstat order No. 746 dated November 25, 2016):

- costs of creation, reconstruction (modernization) of facilities, purchase of machinery, equipment, inventory, classified from an accounting point of view as non-current assets;

- investments in intellectual property;

- investments in biological resources.

Investments in fixed capital can be made both at the expense of one’s own funds and at the expense of borrowed (or received as assistance) funds, within the framework of exchange agreements and equity participation agreements.

Investments in fixed capital do not include the cost of acquiring assets whose price is less than 40,000 rubles, except for cases when these assets are reflected in accounting as fixed assets.

The following are not recognized as investments in the fixed capital of an organization:

- purchase of fixed assets that were previously on the balance sheet of third-party organizations;

- costs of purchasing apartments in multi-apartment residential buildings;

- purchase of land plots, environmental management facilities;

- concluding lease agreements, purchasing licenses, purchasing goodwill, marketing connections (related to non-produced assets in accordance with the system of national accounts).

A synonym for the concept of “investment in fixed capital” is “capital investments” (Article 1 of the Law “On Investment Activities” dated February 25, 1999 No. 39-FZ).

It should be noted that investments in fixed assets (as opposed to, in fact, fixed capital) are outside the jurisdiction of the main sources of law governing the accounting of fixed assets - Order of the Ministry of Finance dated October 13, 2003 No. 91n, as well as PBU 6/01. What rules of law should be considered as guiding principles when accounting for capital investments?

Formula

To calculate the amount of invested capital, two alternative approaches can be used, leading to the same result: financial and operational.

The so-called financial approach involves the use of the following formula.

The formula used in the operational approach is as follows.

At the same time, the use of both approaches implies that some adjustments must be made to the amount of assets, liabilities and equity disclosed in the balance sheet. For example, assets under a finance lease are shown on the lessee's balance sheet, while assets under an operating lease are shown on the lessor's balance sheet. In other words, this item will be off-balance sheet for the lessee. Therefore, it must be taken into account when calculating invested capital.

Current Liabilities ( NIBCLs)

) are also excluded from the amount of invested capital. Common examples of such articles are:

- accounts payable;

- accrued liabilities;

- accrued expenses;

- accrued taxes payable;

- advances received;

- deferred income;

- other accounts payable;

- debt to staff.

Accounting for investments in fixed assets: basic regulatory standards

The legislator's main attention is paid to accounting for the results of investments - directly the fixed capital listed on the organization's balance sheet. As soon as fixed capital is formed and reflected in accounting at its original cost, it already falls under the jurisdiction of the specified rules of law - order No. 91n and PBU 6/01.

Until the moment an object of fixed assets is registered, an accountant can legally be guided by only one source of law - Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, which introduces charts of accounts used by private enterprises.

Key indicators of capital analysis

Analysis of a company's capital is carried out on the basis of absolute and relative indicators. Absolute characterize an increase or loss expressed in natural units - rubles, millions of rubles, etc., and relative ones show an increase or decrease expressed in %.

To fully build a picture of the development of the enterprise, absolute and relative indicators are considered in dynamics over several years. This allows you to track the stability of development and predict the further dynamics of the company - which, of course, will not necessarily follow the forecast based on its historical data. But still.

In addition to absolute and relative indicators, various coefficients are also calculated to complete the picture:

profitability

turnover

financial leverage

non-current assets coverage ratio

autonomy

Information about the capital of an enterprise can be taken from the consolidated statement of financial position, in the section “capital and liabilities”. Let's analyze the listed indicators based on the reporting of PJSC Rosseti for 2021. But before calculating the above coefficients, let's analyze the overall dynamics of the company's capital.

Dynamics of enterprise capital

Dynamics is an absolute indicator that reflects the increase/decrease of the analyzed balance line over time. To calculate, you need to subtract the value of the previous year from the current period line value. Data are indicated in millions of rubles.

| Line name | 2019 | 2018 | Dynamics |

| Capital ( K ) | 1 584 105 | 1 494 962 | 89 143 |

| Long-term liabilities ( LO ) | 650 464 | 625 267 | 25 197 |

| Short-term liabilities ( KO ) | 415 010 | 398 403 | 16 607 |

| Total capital and liabilities ( ICO ) | 2 649 579 | 2 518 632 | 130 947 |

Rosseti PJSC experienced an increase in all liability indicators. Capital increased by 89,143 million rubles, subsidiary by 25,197 million rubles, KO – 16,607 million rubles. The total increase amounted to 130,947 million rubles. The largest increase in equity capital has increased, which characterizes the company positively. Nevertheless, the main feature of a business is the ability to generate profit.

For a more detailed study of the company’s capital, you can consider the dynamics for each line of the balance sheet separately, and not for the final indicators. This will allow us to assess what exactly caused the increase in the total amount of capital.

Enterprise structure analysis

Analysis of the company's structure allows us to determine the share of each position in the total capital. This share is determined by dividing each number by the total balance sheet liability amount multiplied by 100%. Nothing complicated:

| Name | 2019 | Share | 2018 | Share |

| Capital | 1 584 105 | 59,8% | 1 494 962 | 59,4% |

| long term duties | 650 464 | 24,5% | 625 267 | 24,8% |

| Short-term liabilities | 415 010 | 15,7% | 398 403 | 15,8% |

| Total capital and liabilities | 2 649 579 | 100% | 2 518 632 | 100% |

In the liabilities side of the balance sheet of Rosseti PJSC, the share of equity capital is almost 60%, while there is an increase in capital in 2019 compared to 2021 by 0.4%. We can assume that it has remained constant.

The KO section has the least impact on the liability structure of Rosseti PJSC, since it has the smallest share of less than 16%. At the same time, there is a decrease in the share of its influence in 2021 by 0.1%. This means that the company operates primarily with its own money and has little dependence on short-term loans or receivables with a maturity of less than a year.

How to account for investments in fixed capital according to Order No. 94n (on accounting accounts)

The order in question introduces account 08 “Investments in non-current assets”, which can be legally used to reflect investments on the balance sheet of an enterprise as accounting objects. But as soon as the result of these investments is the manufacture or acquisition of a fixed asset, its accounting is kept in another account - 01 “Fixed Assets”, and this accounting is regulated, as we noted above, by the norms of Order No. 91n and PBU 6/01.

Account 08 “Investments in non-current assets” can reflect costs incurred from any sources of financing:

- own;

- borrowed;

- allocated from the budget.

Account 08 reflects the costs of creating, modernizing, as well as maintaining the enterprise’s capacities, purchasing equipment, machinery and other production and non-production fixed assets.

This is evidenced by the provisions of clause 1.2.1 of the Recommendations for accounting in agricultural cooperatives, approved by the Ministry of Agriculture of Russia on January 25, 2001. Based on the principle of legal analogy, due to the absence of other industry norms, this formulation can also be applied to enterprises in other areas not related to agriculture.

An enterprise, when accounting for investments in fixed assets, can open various sub-accounts to account 08 if necessary. For example, if capital investments are made in the independent production of an asset, then subaccount 08.03 “Construction of fixed assets” can be used. If an asset is purchased, subaccount 08.04 “Purchase of fixed assets” is used.

Account 08 of the Chart of Accounts is rightfully classified as active. That is, its debit reflects directly investments in working capital, and its credit reflects the write-off of the enterprise’s costs in the process of capitalizing certain assets. The entries in this account reflect the monetary value of business transactions on an accrual basis from the beginning of the reporting year.

In what cases are investments in non-current assets subject to property tax, ConsultantPlus experts explained. Get trial access to the K+ system and go to the Tax Guide for free.

Let us now study the nuances of accounting for investments in fixed assets using the specified account and its subaccounts in more detail.

Investments in OS can be made in the form of:

- investments in independent production of funds;

- investments in the production of funds using contractors;

- purchases of ready-made funds.

Example of calculating invested capital

GFK-X's balance sheet is as follows.

in thousand USD

Some of the equipment used in the company's operations was obtained as a result of an operating lease agreement that will be valid for the next 5 years. Expected lease payments are as follows:

- at the end of the 1st year 2,350 thousand.

- at the end of the 2nd year 2,550 thousand.

- at the end of the 3rd year 2,600 thousand.

- at the end of the 4th year 2,800 thousand.

- at the end of the 5th year 2,750 thousand.

GFK-X's weighted average cost of capital (WACC) is 15%.

An operational approach will be used to calculate the amount of invested capital.

The company's balance sheet contains items that relate to current non-interest-bearing liabilities, namely: accounts payable, accrued liabilities, advances received and accrued taxes payable.

NIBCLs = 5,680 + 1,890 + 1,770 + 1,230 = 10,570 thousand.

To estimate the value of off-balance sheet assets, we calculate the present value (PV) of future operating lease obligations using the weighted average cost of capital as the discount rate.

And finally, it is necessary to make the last adjustment, namely, subtracting deferred tax liabilities in the amount of CU 40 thousand.

Invested capital = 13,100-10,570+36,850+8,649.33-40 = 48,061.08 thousand.

Accounting for capital investments on account 08: OS production

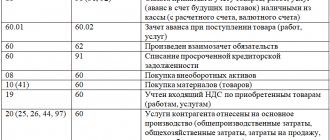

Accounting for funds produced by an enterprise independently in an economic way is carried out during the following business transactions:

1. Payment of wages to employees involved in the production of fixed assets. This payment is made by posting:

Dt 08.03 Kt 70 - the accrual of the actual salary is reflected;

Dt 08.03 Kt 69.01 (02, 03, 04) - the accrual of contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund, and the Federal Compulsory Medical Insurance Fund is reflected on wages.

2. Acceptance of equipment into the production workshop for the purpose of installing it on the fixed asset facility being created. This operation is reflected in the register using the following entries:

Dt 08.03 Ct 07.

3. Acceptance of materials into the production workshop for the purpose of their use in the creation of fixed assets. The following correspondence applies here:

Dt 08.03 Kt 10.

4. Implementation of other expenses not classified within the above operations, but directly related to the creation of an item of fixed assets, which characterize the corresponding operations. For example, these may be costs associated with paying for the services of transport companies. They are reflected in the registers by posting:

Dt 03/08 Kt 60.

Thus, the main accounting objects within the framework of investing in fixed assets will be:

- expenses for labor, equipment, materials;

- expenses for third party services.

In turn, if an enterprise, investing in the production of fixed assets, attracts contractors, then the cost of work performed by these contractors (excluding VAT) is reflected in the debit of account 08 and the credit of account 60. VAT is reflected in the debit of account 19.01.

Another way to invest in OS is to purchase ready-made assets.

What it is

Invested capital refers to those funds that have been invested in the enterprise throughout its existence.

This includes both funds from owners and investors, as well as credit. Why define it? To evaluate the effectiveness of business activities using indicators such as free cash flow, return on invested capital, economic value added.

Who can invest funds

The source of invested capital for the operation of the enterprise can be:

- individual;

- entity;

- state.

They can be the founders of the project, act as lenders or investors. Investments involve the investment of funds or material assets in the development of an enterprise with the aim of generating profit in the future.

Areas of activity for investment

If you have free funds that you want to invest somewhere, you should pay attention to investment methods that can give a positive result:

- investing capital in your own business. The method is not for lovers of passive income, but rather for those who want not only to benefit, but also to work hard on creating and promoting a business. But there is one significant advantage: you do not need to share profits with other investors, because the enterprise is completely yours;

- purchasing a franchise – the right to open a business with a ready-made brand. Advantages: no need to spend money on advertising; franchise owners help in opening a business and its further management; the invested funds quickly pay for themselves, because you acquire a known successful enterprise model with a ready-made name and reputation. The downside is the lack of opportunity to create something according to your vision; you cannot make changes to the brand;

- investing in startup development. Investors of new developments, as a rule, receive about 80% of the profit, since the startupers themselves rarely have their own invested capital to implement the idea. If you choose the right project, the invested capital will quickly pay off and bring considerable profit. But a startup can also bankrupt the investor;

- capital invested in shares of a company. A share is a security that gives the right to own a certain share of a company. The owner of the shares will receive a profit equivalent to the percentage of shares he owns. Before purchasing securities on the stock exchange, you need to study the financial activities of the enterprise. Otherwise, there is a risk of buying shares of an unprofitable company and receiving a percentage of zero profit;

- purchase of bonds. Capital invested in bonds can be considered funds lent to an enterprise. It, in turn, gives you a security - a bond. According to it, the company undertakes to pay you a certain amount;

- investing in production work. You can't go wrong by choosing to invest in a plant that produces well-known mass-produced goods;

- capital invested in small businesses. It will pay off only if you choose the investment object wisely;

- purchasing a share in an investment fund (UIF). A mutual fund is an organization to which you provide your capital, and it already manages its investment.

Forms of investment

Forms of investment are methods of selling available funds. These methods can be used by both an entrepreneur (individual) and a legal entity.

Depending on the investment object, the following forms of investment are distinguished:

- purchase of securities (shares, bonds) – financial investments;

- use of monetary instruments (bank deposit, etc.). Allows you to preserve invested capital, but will not help to significantly increase it;

- direct investment - investing in production activities;

- investments in authorized capital (technical equipment of production, infrastructure development, etc.).

Risks

Capital invested in various types of enterprises cannot be considered protected. Investing money always involves risks. This is important to remember when choosing an area and a specific investment object.

Types of investment risks:

- direct losses – the risk of losing invested funds;

- indirect losses - they are characterized by the safety of invested funds, but at the same time they depreciate (when purchasing currencies or gold bars);

- loss of profitability - invested funds are saved, but do not bring profit;

- lost profit - failure to receive the amount of profit that could be received.

Diversification helps to significantly reduce these risks - distributing available funds into different areas of business. If we are talking about purchasing securities, buy shares of several companies.

So, if one of them is unprofitable, then the profit from the others will compensate for this problem. Using the same principle, it is recommended to invest in other areas of business.

Formula

To make a decision on investment, it is necessary to analyze several indicators:

- the amount of funds required for investment = one-time investments + ongoing expenses (for rent, salaries, etc.);

- return on investment = expected profit/amount of investment; if the indicator is more than 1, the investment is profitable, if less - not;

- net investment = invested capital - amount of capital depreciation; a good value will be positive – with a + sign.

Such an analysis will help you decide whether it’s worth investing in this project or whether it’s better to find another one.

Accounting for capital investments: purchasing OS

Business transactions that characterize this option for investing in fixed assets are reflected on almost the same principle as in the case of registration of transactions involving the services of contractors during the construction of fixed assets. That is, provided:

- reflecting expenses for the purchase of fixed assets in the debit of account 08 and the credit of account 60;

- when accounting for VAT on the debit of account 19.01.

In addition, if additional spare parts and tools are supplied to fixed assets, their cost can be reflected in the debit of account 10.05. If necessary, other subaccounts of account 10 can be used. For example, subaccount 10.03, if gasoline is supplied along with the fixed asset represented by a car. Or - subaccount 10.09, if the main asset, for example represented by a tractor, is also supplied with agricultural implements (mowers, winnowers).

Fixed assets are accepted for operation at the generated initial cost, and the corresponding business transaction is reflected by posting Dt 01 KT 08. After this, the enterprise accounts for the fixed asset accepted on the balance sheet according to the standards established by the above federal regulations.

You can learn more about the features of accounting using postings to account 08 in the article “08 accounting account (nuances)” .

Adjustments

The reason for the differences between the book value and market value of the company is the inability to value many intangible assets in monetary terms:

- business connections;

- reputation;

- experience and skills of employees.

Therefore, various methods are used to analyze the return on invested capital. In addition, adjustments are made:

- the accrued value of funds taking into account the inflation index;

- predicted exchange rates;

- rising prices over time, as well as tax rates, fees and duties;

- taking into account the contents of off-balance sheet accounts.

After receiving a profit from the invested capital, taxpayers adjust the figures for the difference between income and expenses. The amount is calculated taking into account the participation in the activities of financing companies.

Various calculation methods cause errors in the indicators of organizations. Therefore, enterprises that do not use the classic formula add the definition “adjusted” to the name, for example: adjusted EBIT, EBITDA, OIBDA.

Off-balance sheet reserves

Accounting for debts and assets that do not belong to the company is carried out on off-balance sheet accounts. The following objects are reflected here:

- leased fixed assets, installation equipment;

- property accepted for safekeeping;

- materials in processing and on commission;

- written off overdue debt;

- received for use under contracts.

Invested property guarantees the fulfillment of obligations under transactions with counterparties, but is taken into account outside the balance sheet.

Off-balance sheet assets

Any property that acts as collateral - transport, real estate, equipment or bank guarantees - is classified as off-balance sheet assets. This category includes:

- production equipment allocated by the customer for use by the contractor;

- funds received by the broker for investing in securities or money received from their sale;

- guarantees of payment of debts of other companies or individuals.

Large investors provide financial consulting based on various schemes using balance sheet and off-balance sheet accounts.

Assets held for sale

Properties held for sale are expected to be sold in the near future. The carrying amount of this property is recovered after the transaction, not during use. International standards IFRS 5 suggest that intangible or financial assets can also be classified in this category.

The results of the revaluation of property and its transfer from one category to the category “Intended for sale” are reflected in the profit or loss of the current period.

The following conditions must be met in relation to these objects:

- readiness for immediate sale in current condition;

- high probability of a quick transaction;

- An active search for a buyer and implementation of the sales plan have begun.

If the criteria are not met, the property is not included in the For Sale category.

Other comprehensive income (loss)

Items of income and expense that are not included in profit or loss are included in other comprehensive income.

Write-off of assets

IFRS 10 states that investors should review their control criteria for investees annually. Assets that do not meet these parameters are subject to write-off.

Deferred compensation payments

When calculating invested capital, the following expenses are excluded from the total cash flow:

- payments of loans, loans and interest on them;

- dividend payments;

- monetary compensation related to the nature of the work performed.

These payments are taken into account when assessing the return on invested capital.

Deferred tax assets and liabilities

Different rules for recognizing identical business transactions in accounting and tax accounting are the cause of discrepancies in the calculation of profit. This is called a deferred tax asset. The accounting method is used to accurately calculate deferred taxes.

Results

Investing in fixed assets (making capital investments) refers to the process in which an enterprise invests capital in the creation, modernization or purchase of fixed assets. Before this object is accepted on the balance sheet, account 08 is used to account for investment in it. Afterwards, accounting for the fixed assets object is carried out using account 01 (in accordance with the norms of PBU 06/01 and corresponding sources of law).

You can get acquainted with other facts about the capital investments of the enterprise in the articles:

- “Capital investments in accounting are...”;

- “Formula for calculating specific capital investments (nuances)”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Definition

Invested Capital

) is the total amount of money invested in the company since the beginning of its activities.

In other words, it is the capital provided by all investors, both the owners of the business and its creditors. This indicator is one of the central indicators in value-oriented management, and is also used in calculating such performance indicators as return on invested capital (ROIC

), Economic Value Added (

EVA

) and free cash flow (

eng. Free Cash Flow, FCF

).

Financial leverage

The degree of dependence of a company on borrowed capital can be assessed using the financial leverage indicator. It is also called financial or credit leverage. It shows the ratio of equity and debt capital in the enterprise and is calculated using the formula:

✅ Kfl=Io/K

CFL 2021 = 1,065,474/1,584,105 = 0.67

CFL 2021 = 1,023,670/1,494,962 = 0.68

A value equal to 1 is considered normal for Russian enterprises. This means that the company’s equity capital is equal to its borrowed capital and the enterprise is not too dependent on creditors. The higher this indicator, the more dependent the company becomes.

PJSC Rosseti has a financial leverage ratio of less than 1, and during the reporting period there was a slight decrease. This means that the company largely covers its expenses with its own money and is less dependent on creditors.

Coverage ratio of non-current assets

To determine the company's solvency in the long term, the coverage ratio of non-current assets is calculated. Non-current assets form the fundamental basis for the production and development of the company. Therefore, if an enterprise does not provide their value using its own funds and long-term loans, this indicates the possibility of an insolvency crisis in the near future.

The coverage ratio is calculated using the formula:

✅ Kpv=(K+Do)/VA , where

VA - non-current assets

The amount of non-current assets of the company for 2021 is 2,328,087 million rubles, and for 2021 – 2,144,809 million.

Kpv 2021 = (1,584,105 + 650,464)/2,328,087 = 0.96

Kpv 2021 = (1,494,962 + 625,267)/2,144,809 = 0.99

An indicator around one is considered normal. If the coefficient is less than 0.8, this indicates a financial crisis in the enterprise. PJSC Rosseti's ratio fluctuates around the normal level, which indicates a stable financial position.

Optimal amount of equity capital

Dear colleague, do you know that VTB Bank allows legal entities to conduct transactions directly from the accounting program and pay bills until 23:00?

This increases the company's riskiness, but reduces its weighted average cost of capital. The company's invested capital decreased by 5.6% during the analyzed period, which indicates a slight slowdown in business and is associated with a decrease in the company's working capital. The results of calculating the company's profit indicators are presented in Table 2.

The resulting difference is written off against the company's income. This leads to a decrease in the amount of invested capital, so that if there was a write-off of assets during the reporting period, its after-tax value should be added back.

If we take the current form of the balance sheet (OKUD 071001, taking into account the latest edition dated 04/06/2015), then the indicator of the amount of equity capital can be found in the final line of Section III “Capital and Reserves”. According to this, equity will be equal to the sum of the lines in this section.

If the CI is more than 1, the enterprise is considered solvent; if the CI is less than 1, there are not enough own funds. The traditional method is characterized by increased simplicity, and therefore it is popular in calculations. Let us recall that within the framework of this method, equity capital is identical to the size of net assets. To determine it, just look at the value of line 1300.