This article is devoted to how to reflect a contract, that is, transactions under an assignment agreement in 1C using the example of the 1C: Accounting 8.3 configuration.

An assignment agreement is an assignment of the right to claim receivables, that is, simply put, the sale of such debt to another person. Typically, the debt is sold at a discount, resulting in a loss for the original creditor.

Legislative accounting of the assignment agreement is determined by:

- Civil Code of the Russian Federation - Articles 382-389 (refers to Chapter 24 - Change of persons in an obligation);

- PBU 9/99 – Income of the organization;

- PBU 19/02 – Financial investments – clause 8, clause 9;

- Tax Code of the Russian Federation - Art. 146, 155, 164, 268, 271, 279. When making a transaction between related parties, additional nuances are possible.

Let's consider an example: Organization A sold goods or provided services to organization B in the amount of 120,000 rubles, incl. VAT 20,000 rub. Not receiving payment when due, A sold this debt to organization C for RUB 110,000.

Terminology within the framework of a transaction under an assignment agreement:

- Organization A (original creditor) – Assignor ;

- Organization B (debtor) – Debtor ;

- Organization C (new creditor) – Assignee.

BU at the assignor

Dt 62 (balance according to B) 120000. Postings under the assignment agreement:

| Dt | CT | Sum | Operation |

| 76(C) | 91.01 | 110000 | Proceeds from the sale of the right to claim a debt |

| 91.02 | 62(B) | 120000 | Expenses for the debt sale operation |

| 51 | 76(C) | 110000 | Received a payment from the assignee on the account |

The loss on the operation will be 10,000 rubles.

If the assignor sold the debt for more than the original amount, then VAT would have to be charged on the excess amount, entry 91.02 - 68.02 VAT.

Note: VAT can only be charged on the sale of debt for VAT-taxable transactions. If the subject of the transaction is a loan agreement, VAT does not need to be charged even if the amount of the agreement exceeds the actual debt.

Filling examples

Even knowing what to write in the purpose of payment when making a transfer, you should be extremely careful when indicating the names and numbers of documents that are the basis for performing financial transactions. An error in even one letter or number when filling out financial orders can become an obstacle to making a bank payment. For our part, we will give you several examples of how to fill out the field discussed in the article:

- Payment for housing and communal services in the period from 10.10.2017 to 10.11.2017

- Private, non-commercial translation. NDS is not appearing.

- Transfer to a private person for services provided.

- Advance payment for the supply of equipment in accordance with Agreement No. 32/1 dated 08/09/2017, including VAT.

- Refund of funds transferred under payment order No. 18/34 dated 06/03/2017 in accordance with the requirements of letter No. 3/1 dated 09/12/2017

- Refund of erroneously received funds under agreement No. 107/12 dated 02/02/2016, terminated under agreement No. 10/2 dated 05/27/2017.

There is no need to copy these examples exactly. They are only a sample, not a direct guide to action. Remember that when filling out payment orders, the number of characters entered in the field is limited. When deciding what to write in the “payment purpose” column, try to present the information as briefly as possible. Got it? Then you can fill out the receipt and sign.

Sberbank clients have long appreciated all the conveniences and advantages of remote servicing through the Sberbank Online system. It allows you to make different types of payments from your home computer and without the help of an operator or cashier. However, in some cases difficulties arise when working with the system. For example, the question of what to write in the “Purpose of payment” field in Sberbank Online causes difficulties. Let's try to figure it out.

NU at the assignor

The loss on the operation is 10,000 rubles.

If the payment deadline has already arrived, the loss is recognized in full. If the payment deadline has not arrived, the loss cannot be taken into account in full in tax accounting. Here you should be guided by the provisions of Art. 279 of the Tax Code of the Russian Federation and the accounting policies of the organization.

It should be noted that the specifics of reflecting losses in such a situation are specially allocated several lines in the income tax return.

In our example, the payment deadline has arrived, so we will take into account the entire amount of the loss in the NU.

Between legal entities

Unfortunately, such relationships between organizations are not uncommon. Often the agreement is drawn up to pay off a debt. In fact, this is tantamount to bankruptcy or a critical financial situation of the organization. Two legal entities draw up a separate agreement where the debt of one company is assigned to the other.

Please note that all deductions and money transfers must be officially processed through the accounting department. In addition, VAT is paid separately. In some cases, given the circumstances described, it is not at all advisable to repurchase the debt.

The agreement specifies the details of the parties, the grounds for the transfer of rights and any nuances. For the most part, these are bilateral remunerative relationships. Fraudulent actions are prosecuted under the law of the Russian Federation.

Sample 2021

You can download and view a free sample agreement between legal entities here.

BU with the assignee

| Dt | CT | Sum | Operation |

| 58 | 76(A) | 110000 | Purchasing the right to claim a debt (financial investment) |

| 76(A) | 51 | 110000 | Payment to the assignor from the account |

| 51 | 76(B) | 120000 | Received a payment from the debtor |

| 76(B) | 91.01 | 120000 | Revenue reflected |

| 91.02 | 58 | 110000 | Costs reflected |

| 91.02 | 68.02 VAT | 1666,67 | VAT charged on the transaction (10000*20/120) |

BU at the debtor

| Dt | CT | Sum | Operation |

| 60(76)A | 60(76)С | 120000 | Transfer of debt to another counterparty |

| 60(76)С | 51 | 120000 | Payment of debt from the account |

The assignment agreement has no tax consequences for the debtor.

Purpose of payment: examples and description

In accordance with clause 1.7.2 of the Bank of Russia Regulation No. 385-P dated July 16, 2012, the owner of a bank account is required to indicate the purpose of the payment in his payment orders. All payment documents must disclose the essence of the transaction being carried out, and correctly filled in field 24 (payment purpose) will help to do this.

When filling out this column, you should keep in mind that the maximum number of characters is set for it - 210. Such information is contained in Appendix 11 to Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds.”

It is very important to use the correct wording in payments, since Banks can block a questionable (in their opinion) transaction or even refuse to service the company and blacklist it.

If the Bank terminates an agreement with an organization, it transfers data about this company to the Central Bank, which, in turn, blacklists it and does not recommend other credit organizations to cooperate with it. As a result, the company cannot open a current account, work with counterparties by bank transfer, or work in general, since the legislation of the Russian Federation obliges LLCs to have a settlement account.

Buyers from such an organization bear their own risk: when working with an organization on the Central Bank’s blacklist, be prepared to prove your expenses and legal deductions to the tax authorities.

What should I write in the payment instructions?

In the “Purpose of payment” column, you must indicate the payer’s basic information about the purpose of the money transfer.

It is advisable to include more information in the purpose of payment. It is not prohibited by law to provide any additional information. It is highly undesirable to write the purpose in one word, for example Advance, Tax, For materials.

Such information may include:

- Accountable funds.

- Name and payment of work, service, product.

- Date and number of the agreement, contract, agreement, etc.

- More information about value added tax.

- Renting real estate, transport, etc.

Assignment in 1C BP

There are no special documents to reflect assignment operations in the program. Sometimes in this case they use the “Operation” document, where the user manually fills out the necessary transactions. This option has many disadvantages. Firstly, in order to obtain correct reports and fill out regulated reporting, it is often not the postings that are important, but the register entries, which are not generated when using the “Transactions” document. Secondly, there are restrictions on the choice of printing forms.

Based on this, we will try to reflect the assignment agreement in 1C using standard documents, which is easiest to do in this situation by showing the operations of the debtor organization. Let's start with this.

Types of assignment

All assignment transactions can be divided into two main types: when the object belongs to an individual and when the object belongs to a legal entity.

In both cases, we are talking about assignment under the DDU, since assignment as a transaction is possible before taking ownership; after that it will be a regular purchase and sale.

Let's consider the first option. In this situation, a person who bought an apartment in a building under construction puts it up for sale when the house is almost ready. Most often we are talking about investing: the cost of an apartment at the excavation stage and at the final stage of construction (several months before the project is commissioned) will differ significantly.

The peculiarity of this type of transaction is that when the documents are drawn up, the validity of the first DDU does not terminate - only the shareholder in it changes. This means that if the agreement previously concluded between the developer and the current seller does not suit the current buyer, then he will either have to refuse the purchase or agree to what is available. You won't be able to make edits. The good news is that all the developer’s responsibilities reflected in the initial contract will be “inherited” by the newly-minted participant in shared construction (work deadlines, apartment price, warranty period, etc.).

“Sometimes there are proposals for assignment under a preliminary DDU, but it is better to beware of such options, because this is not a full agreement, but in fact only a paper about the intention to buy an apartment. Such agreements are not subject to state registration, which means fraud and double sales are possible. Only the DDU and assignment under the DDU are subject to mandatory state registration,” notes Irina Gorskaya, legal advisor at the Inkom-Real Estate legal service.

7 signs of new buildings worth investing in

5 tips for those who invest in new buildings today

But there is a second option - in this case, the assignment agreement is concluded not with an individual, but with a legal entity. This can be either a contractor that carries out construction and installation work on site, or an investor in a real estate project under construction. Globally, such a transaction is no different from a transaction between two individuals: the original contract and payment under it must also be carefully checked. Payment under such an agreement is possible only in non-cash form and after state registration of the agreement. Checking the legal purity of the transaction is the main part of acquiring real estate under an assignment agreement.

Assignment agreement in 1C 8.3 from the debtor

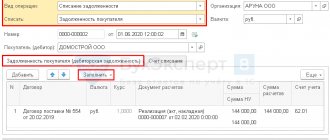

Automation of accounting at the debtor's enterprise implies the following actions: having received notification of a change of creditor, the debtor must transfer the amount of debt from one counterparty to another. To do this, use the “Debt Adjustment” document, which can be located in the “Purchases” and “Sales” sections.

Fig. 1 Purchases - Debt adjustment

Fig.2 Sales-Debt Adjustment

Create a new document Debt adjustment. In the document:

Type of operation – Transfer of debt; Transfer – Debt to the supplier.

We fill in the data on the creditor and the new supplier from the counterparties directory.

By clicking the “Fill” button, you can automatically generate a tabular part, and, if necessary, later adding the necessary parameters (in our case, these are a New Agreement and a New Account).

Fig.3 Fill in

Let's look at the entries in the document.

Fig.4 We look at the postings according to the document

Sometimes there is a need to reformat a document, but an error occurs - it is suggested that you first unapprove it. Here you can use the menu option using the “More” button.

Fig.5 Unconfirm

Sample contract for the assignment of the right to claim a debt

| Moscow | January 21, 2021 |

Limited Liability Company Private Security Organization "Alpha" (LLC Private Security Organization "Alpha"), hereinafter referred to as "Assignor", represented by General Director Ivanov Vyacheslav Nikolaevich, acting on the basis of the Charter, and

Joint Stock Company "Omega", hereinafter referred to as "Assignee" ", represented by Denis Anatolyevich Golovanko, acting on the basis of the Charter, collectively referred to as the "Parties", have entered into this agreement (hereinafter referred to as the Agreement) as follows:

Assignment agreement in 1C 8.3 with the assignor

The transfer of debt to the Assignee will be reflected in the sales document.

Fig.6 The transfer of debt to the Assignee will be reflected in the sales document

We create a new document for the sale of services, having two options for the input form to choose from.

Fig.7 Creating a new document for the sale of services

We fill out the document.

Fig.8 Filling