Types of liability of accountants for incorrect payroll

Accounting errors, as well as deliberate violations in maintaining records, may entail liability for the person engaged in accounting. In this case, such liability may be:

- Administrative;

- Tax;

- Criminal;

- Material;

- Disciplinary;

- Civil law.

The level of responsibility is established depending on the immediate causes of the error and the severity of the resulting consequences. Moreover, in many cases, several types of liability may be applied simultaneously to an accountant who made a mistake in calculating wages. For example, administrative for the fact of an offense, disciplinary as a punishment from the employer, and material as compensation for damage caused by one’s actions.

Where to contact

Solving problems with incorrectly accrued wages almost always falls on the shoulders of the employee, especially in the case of understatement of wages.

For workers who seek to receive statutory benefits, there are several options for how to proceed:

- A peaceful way to resolve a conflict, in which an employee turns to the employer with a corresponding statement and a request to characterize the amount of payment received or to recalculate.

- A conflict method in which the solution to a problem is carried out with the involvement of additional bodies of influence and control.

Often, a conflictual way of solving problems with incorrect salary calculations entails the dismissal of a dissatisfied employee, since it becomes difficult to work in the previous team.

You can apply for protection of your rights to the following authorities:

- A labor inspectorate that directly protects the labor rights of workers.

- The prosecutor's office, whose responsibilities include checking and monitoring compliance with labor law standards in general and the legal freedoms of employees of any organization.

- Judicial authorities, allowing, through appropriate appeal, to recover underpaid amounts, as well as compensation for moral damage.

Wages are a mandatory attribute of labor relations; Lack of payments or insufficient transfers is a good reason to contact the authorized authorities to protect your rights.

Basic accounting errors when paying wages

The responsibility to ensure the payment and accounting of wages may lie either fully or partially directly with the accountant. At the same time, making calculations and the presence of errors in them can lead to various liability of such an employee both before the law and before the direct recipients of wages, the employer or the organization with which he cooperates under a civil contract. The most common errors related to payroll are:

Failure to comply with the requirements of labor legislation and the employment contract, including if the employment contract stipulates wage payment rules that do not comply with the law.- Payment of wages during business trips instead of average earnings or instead of vacation pay.

- Violation of the procedure for payments to dismissed employees.

- Failure to meet deadlines for payment of due salaries, advances and vacation pay.

- Lack of compensation payments for delayed wages.

- Failure to comply with the procedure for issuing settlement documentation to employees, violation of such procedure, as well as failure to comply with the established form of the sheet.

- Inaccurate or incorrect calculation of average earnings.

- Incorrect implementation of required deductions from wages.

- Overpayment of wages beyond what is required.

Each of these cases should be considered in more detail.

The legislative framework

Adjustments to previously entered salary-related data are a fairly common practice in any company. The reasons for carrying out such manipulation are varied and among them are:

- The sick leave came to the accounting department after the period was closed;

- Personnel changes in the company followed;

- Arithmetic, that is, counting errors in calculations;

- Salary indexation.

Pay attention to the results of the inventory of calculations. Often the bulk of errors are discovered precisely based on its results.

Failure to comply with labor legislation and non-compliance of wages with the employment contract

If, when an accountant calculates wages, certain provisions of the employment contract are not taken into account, then the accountant may be held liable. The most common violations in this case are:

- Non-payment of overtime for overtime recorded in the time sheet;

- Failure to pay bonuses stipulated by the employment contract;

- Violation of the procedure for paying bonuses and other allowances.

More common cases are when an accountant acts in accordance with an employment contract, but contrary to labor laws. From the point of view of the law, the clauses and conditions of a collective or personal agreement with an employee are considered void if they contradict the provisions of the Labor Code. However, the following errors are often common:

- Failure to indicate in the employment contract the tariff rate of salary and a note that payment is regulated by the staffing table or other internal regulations of the enterprise;

- The difference in wages of employees in the same positions and with the same qualifications is considered unacceptable, even if the employee is on a probationary period;

- Failure to pay bonuses to employees working part-time or under fixed-term employment contracts for a similar amount of work in similar positions.

Important fact

If such a payment procedure was established directly by the manager, the accountant is obliged to independently write a statement in his name about the presence of errors in the calculations, and if the manager refuses to keep accounts in accordance with labor legislation, the accountant should require written orders from management for each specific case of payroll or bonuses.

How to prove the counting nature of the error made in the calculation

When going to court, the company must provide documentary evidence of the calculation error made by the performers and describe in detail the algorithm for the calculation performed.

If an error is detected in the calculation program used by the organization, the information technology department specialist must register the program failure and indicate in the prepared report what problems resulted in the operations for calculating the indicators being incorrect.

In addition to the IIT report, the court should be provided with an explanation from the accountant with mathematical calculations demonstrating the fragment that caused the inaccuracy of the final value.

If a clerical error or typo is discovered by the accountant (for example, in the form of 10,000 rubles instead of 1,000 rubles), the organization has a chance to recover the amount of the overpayment. But a software failure or double payment of wages will be classified as technical or mathematical violations that do not fall within the scope of the law.

A technical violation may occur due to:

- incorrect setting of the coefficient when calculating wages;

- payment for one billing period for several (different) reasons;

- incorrect entry into the program of initial parameters for calculation;

- application of tax benefits that are not related to a specific employee.

If the organization cannot prove an indirect connection between the counting error and the software failure, the court will not support the claim for a refund.

For your information! If the organization makes a refund without the consent of the employee, the latter has the right to file a statement of violation of his rights in court. According to a court decision, the employer will be obliged to return the collected amount and compensate for moral damage caused to the employee, even if the company had grounds for demanding the return of the excess amount.

Payment of salary during a business trip or vacation pay

At some enterprises, vacation and travel allowances are tied to wages, which is a violation of the procedure established by law. These types of payments are tied to average daily earnings and calculated accordingly, and payment during such pay periods is a violation of accounting, and possibly the rights of the employee.

The application of such accounting rules is regulated by Art. 114 and art. 167 Labor Code of the Russian Federation. It should be remembered that the average daily earnings in this way can either exceed the established salary or be lower than it, which can cause certain types of financial liability.

You should take into account separate rules for paying for days off on business trips, as well as days of departure, travel and arrival from them. Thus, the days of travel, departure and arrival from a business trip must be paid. If a posted employee does not perform work duties on weekends, they are not included in the payment. Weekends falling on vacation are subject to payment, and holidays do not count towards the amount of vacation.

Underpayment for sick leave

The specifics of calculating sick leave payments depend on several factors that directly affect not only the volume of transfers, but also the specifics of their collection from certain authorities.

Thus, temporary disability benefits are paid:

- from the budget of the insurer, if the sick leave is issued for a period of less than three days;

- from the budget of the Social Insurance Fund (FSS), if sick leave is issued for a period of more than three days, starting from the fourth.

In some cases, the Social Insurance Fund begins payments from its own fund from the first day of temporary disability. The period for payment of benefits is limited to the sick leave period for the entire time specified in the sick leave certificate, which is provided at the place of work.

The amount of payments is determined within the framework of Federal Law No. 255-F3. Thus, a temporarily disabled employee will be able to count on:

- 60% of average earnings, if his insurance period is less than five years;

- 80% of average earnings if the experience is from five to eight years;

- 100% of earnings if the experience is more than eight years.

The amount of benefits taken into account includes not only the length of service from the last place of work, but also for previous years of work in other organizations. Average earnings are calculated based on data from the previous two calendar years, excluding the current year.

If an employee has discovered an underpayment, he can contact the employer to obtain a payslip for sick pay and to receive an explanation of its contents.

A complaint about the employer’s actions must be sent to the Social Insurance Fund, which will check the employer’s actions and, if necessary, initiate additional payment to the employee. When filing a complaint against an employer, the following documents are submitted to the Social Insurance Fund:

- A statement indicating the basis for filing a complaint.

- Sick leave or a copy thereof.

- Statement of insurance record, if any. In case of its absence, the Social Insurance Fund can independently check the employee’s length of service based on his personal data.

- A copy of the employment contract and other documents that have anything to do with the assignment of payments.

Violation of the procedure for payments to dismissed employees

Upon dismissal for any reason, each employee must be paid compensation for all days of unused vacation in accordance with the time they worked. In this case, the accounting of time worked is rounded up to a full month - up or down, depending on the total number of days worked in an incomplete month.

In addition, labor legislation requires the payment of severance pay within specified periods and amounts for certain reasons for dismissal. It should be remembered that it is inadmissible to deduct any funds from severance pay and vacation compensation in favor of the employer, regardless of the presence of debt obligations on the part of the employee.

Important fact

No circumstance can prevent the employee from paying compensation for vacation and wages for all days worked.

Failure to meet deadlines for payment of due wages, advances and vacation pay

Art. 136 of the Labor Code of the Russian Federation clearly establishes the terms during which the accounting department or the management of the company are obliged to pay the employee his wages, as well as vacation pay. Most often, the accounting department violates the procedure for issuing vacation pay, which the employee must receive no later than three days before the start of his planned vacation according to the vacation schedule or application.

In addition, based on the provisions of the above-mentioned article, wages must be paid at least twice a month, except in cases where their payment and accrual cannot be ensured due to holidays or weekends. Accordingly, the practice established at some enterprises of paying advances in violation of such deadlines (when the maximum interval of 15 days is not observed) is illegal. It is also illegal to reduce the amount of the advance below the salary actually earned during working days by the employee.

Important fact

The presence of a personal statement written by an employee with a requirement to pay him a one-time salary in full is not legally significant. The accounting department is obliged to ensure the accrual of earned funds at least twice a month. It is permissible to formalize an employee’s refusal to receive wages, but only if such wages are available in the enterprise’s reporting.

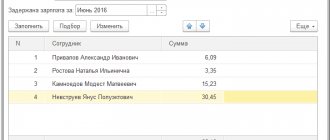

Lack of compensation for delayed wages

Each day of delay in the payment of wages, vacation pay or other required payments due to an employee allows the employee to demand compensation. However, if an audit of the financial statements reveals a violation of the payment procedure and the presence of any delays, such funds may be recovered in favor of the employee even in the absence of a trial and a statement from the injured employee himself.

The procedure for accounting and calculating compensation is regulated by the provisions of Art. 236 of the Labor Code of the Russian Federation, and provides for the daily accrual of additional interest. Their size is calculated at one three hundredth of the established financing rate of the Central Bank, of the volume of unpaid amounts.

Failure to comply with the procedure for issuing settlement documentation

The payslip must be drawn up in accordance with the provisions of Art. 136 of the Labor Code of the Russian Federation and have the general form established by the employer. In addition, this form is in accordance with Art. 372 of the Labor Code of the Russian Federation must necessarily be agreed upon with the trade union body.

The pay slip must contain information about the number of days worked, all deductions from wages, bonuses and other allowances. At the same time, the pay slip must be present for all types of payments, and not issued only once a month - such an action is considered a violation of accounting standards and can serve as a reason for bringing the accountant to justice.

Operation Settings

The operation itself is performed in the “Payroll” document. You can change the setting to perform it in a separate document through “Settings-Payroll”.

Fig.2 Setting-Salary Calculation

Check the appropriate box.

Fig.3 Setting up a recalculation document

When calculating salaries, the program will warn you about the need for recalculation, but it will not be reflected in the document.

Incorrect deductions from wages

The amount of deductions from wages cannot exceed 70% of the employee’s total regulated earnings. At the same time, at the initiative of the employer, without a writ of execution, it is permissible to collect from the salary as compensation no more than 20% of his salary. With a writ of execution, in accordance with its provisions, it is permissible to withdraw amounts from an employee’s salary up to 50% of its amount.

The procedure for carrying out any deductions is regulated by Art. 137 Labor Code of the Russian Federation. A common mistake is to withhold funds from an employee’s earnings for overpaid wages for a long period of time, when the law directly allows for the possibility of returning overpayments only within one month before they are discovered.

Important fact

The obligation to withhold alimony, fines and other payments to third parties from an employee by court decision lies with his employer and, accordingly, the accounting department of such an enterprise. Violation of the deadlines for making such payments can also serve as a reason for holding the accountant accountable.

How to recalculate

There is no single procedure for recalculation - all situations are individual. Here are the key rules and recommendations:

- Corrections can be made manually. Or use specialized accounting programs for calculations.

- Make adjustments to calculations only on the basis of administrative documentation.

- If you need to make a deduction from earnings, be sure to obtain the employee’s consent.

- Follow the deadlines for recalculations when errors are identified. It is possible to correct an accounting deficiency in the accrual only within a calendar month.

IMPORTANT!

It is impossible to withhold wages without the written consent of a subordinate, regardless of the types of payments and the reasons for the transfer. An employee can challenge any actions of the employer in court.

Overpayment of wages beyond what is required

If, due to any errors, the accountant accrued excessive wages to the employee, then it can be withheld from the employee’s salary. However, such retention is permissible only in cases specified by law and is carried out for a period of no more than one month.

At the same time , an accountant who overpaid may be held liable for the entire time when the employee was provided with an inflated payment that did not correspond to his due earnings.

The procedure for applying and types of penalties for incorrect calculation of wages

The legislation does not address individual situations of accountant liability for incorrect calculation of wages. However, the general rules used to regulate all aspects of accounting activities in an enterprise apply to such cases.

- Disciplinary liability may be imposed by the employer on the accountant for any of the errors at his discretion. In this case, the accountant is obliged to provide an explanatory note, and he is subject to all labor legislation standards, as well as in relation to other employees. In general, the employer may subject the accountant to one of the disciplinary sanctions in the form of a reprimand, reprimand or dismissal.

Important fact

An accountant working under a civil contract cannot be subject to disciplinary liability. However, such an accountant may still be liable for errors, both in accordance with the provisions of the concluded agreement itself, and from the point of view of tax and civil law.

- The accountant's financial liability for incorrect calculation of wages begins if his actions led to a loss for both the organization and the employee. At the same time, the employer has the right to mention in the employment contract the full financial responsibility of the accountant, but in itself it is not provided for by law. Partial financial liability allows the accountant's employer to compensate for the damage incurred in an amount not exceeding the average monthly earnings of such an employee.

Important fact

Full financial liability occurs in any case if the damage was caused by conscious actions of the accountant for selfish reasons, or committed for personal purposes. At the same time, if the damage was caused due to extraordinary circumstances, liability may not arise at all.

- Administrative liability is the most common punishment for incorrect payroll calculations by an accountant. Such liability is regulated by separate articles of Chapter. 15 of the Code of Administrative Offenses of the Russian Federation and may imply as punishment both deprivation of the right to hold certain positions, a fine and even administrative arrest or compulsory labor.

- Criminal liability for an accountant for incorrect calculation of wages occurs only in exceptional cases. These include non-payment of taxes related to payroll, in particular personal income tax, which is regulated by Art. 199 of the Criminal Code of the Russian Federation. Also, such crimes include deliberate long-term delay of wages for more than two months - Art. 145.1 of the Criminal Code of the Russian Federation.