Returning goods: let's get to the bottom of it

The supply of products or goods is carried out on the basis of an agreement or contract. These documents reflect the key delivery terms and requirements. If the supplier violates the agreement, then, according to the provisions of the Civil Code of the Russian Federation, the buyer has the right to refuse the purchase.

The acquirer requires under Art. 475 Civil Code:

- price reduction;

- replacement of low-quality products;

- free elimination of defects;

- additional packaging and shipment;

- or other things.

In most cases, you will have to return products that have already been shipped. To do this, draw up a return invoice to the supplier, a letter of claim and a statement of discrepancy.

IMPORTANT!

If the buyer refuses a product that does not comply with the terms of the supply agreement, he is still obliged to ensure the safety of the supplied goods and materials until return. The requirement is enshrined in Part 1 of Art. 511 of the Civil Code of the Russian Federation.

Results

The buyer has the right to return goods by law (when a low-quality or incomplete product is returned) or under the terms of the contract (for example, when returning goods that were not sold before the expiration date). If deficiencies are identified during the acceptance process, then in order to return it is enough to issue a report on discrepancies in quantity and quality.

When returning goods that have been capitalized, a delivery note is issued. Particular importance is attached to documents justifying the return. They will be referenced in the return invoice, and they will also serve as an attachment to this invoice. The information about the product in these documents is identical to that received upon delivery.

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Grounds for returning inventory items

It is not always possible to return goods legally. For example, if the delivery requirements are fully met and the supplier refuses to enter into an additional agreement. But there are specific situations when the return of goods and materials is legal and necessary. Let us indicate the situations when you will have to prepare a return invoice for goods and materials:

| Situation | Comments | Link to legal acts |

| Inconsistency with quality | The buyer has a choice:

| Clause 2 Art. 475 Civil Code of the Russian Federation |

| Discrepancy in scope of supply | If an undelivered part of the inventory is identified, the purchaser returns the entire shipment. If the counterparty has shipped a larger volume of goods and materials, then the excess must be returned. | Art. 466 Civil Code of the Russian Federation |

| Incomplete supplied | You require the counterparty to supply the missing parts, parts and components, or you return the entire shipment. | Art. 480 Civil Code of the Russian Federation |

| Assortment mismatch | The recipient refuses the entire shipment. However, you can only return non-conforming items and request a replacement. | Art. 468 Civil Code of the Russian Federation |

| Failure to meet delivery deadlines | The supplier violates the terms of delivery of the goods, refuse the shipment altogether. But there are exceptions for goods with a limited shelf life. | Art. 511 Civil Code of the Russian Federation |

It is not necessary to go to extreme measures and terminate the supply contract. First, require the supplier to eliminate the identified deficiencies and discrepancies. If complaints do not yield results, proceed with countermeasures.

The buyer also refuses quality goods delivered on time and in full. But for this you will have to negotiate with the supplier. In this situation, you will have to conclude an additional agreement, which will reflect the new terms of cooperation or severance of business relations.

Accompanying documents

Return invoices may be accompanied by supporting documentation such as:

- written complaints;

- acts on the identification of hidden defects;

- acts of non-compliance;

- examination results;

- defective statements.

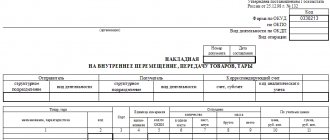

Which form to use

The unified form of the TORG-12 invoice was approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132. But the use of uniform forms is not necessary. The organization has the right to use its own return invoice forms. Approve the self-developed form in your accounting policy. Read on for detailed instructions on how to fill it out. Or use a unified form.

There is no need to establish the structure and rules for filling out the TORG-12 invoice form in the accounting policy of the institution. It is enough to make a link that TORG-12 is used to process the return.

IMPORTANT!

State employees use special invoice forms to reflect returns. This is an act of acceptance and transfer of objects of non-financial assets (f. 0504101) and an invoice for the release of materials (material assets) to the outside (f. 0504205). Instructions for filling out are fixed by Order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n (as amended on November 17, 2017).

Filling out the invoice

Let's look at how to make a return invoice and what needs to be taken into account when filling out individual lines. The sequence of actions will be as follows:

- First you need to fill out the introductory part. Here you indicate information about the sending organization (name, address, bank details, telephone, fax, OKPO and OKDP code). An important point: in the top line “shipper organization” you should enter the buyer’s data.

- Below are lines in which you need to indicate information about the Consignee, Supplier, and Payer. When returning, the supplier and consignor are considered to be the buyer, and the consignee is the seller. The “Payer” line is filled out if the buyer must receive funds upon return, otherwise it is left empty.

- Next, you need to indicate the reason for returning the product. Details of all invoices, contracts and other documents are listed here.

- It is necessary to indicate the bill of lading number and the date of its preparation.

- Below is a tabular section that displays data about the products being shipped: name, characteristics, quantity, price and other information. The information specified in the table must completely coincide with the data on the delivery note drawn up upon acceptance of the goods. The data may not match if only part of the received inventory items is returned.

- Return invoice TORG-12 (download below) is signed by the head of the company or his deputy, the chief accountant and the official who returned the goods. Signatures must be accompanied by a transcript.

Responsible persons must ensure that all fields of the document are filled out properly and sealed by the parties. This is important, because otherwise, the Federal Tax Service may question the buyer’s right to display their expenses for purchasing products and receive a VAT deduction.

Sample of filling out the return invoice (TORG-12).

What to do with VAT

The rules for processing documents involved in the calculation of value added tax have changed. Now the buyer who returned the goods and materials does not issue an invoice. But the supplier who accepted the return issues an adjustment invoice taking into account the actual delivery values. Then he registers the adjustment invoice in the sales book (clause 3 of article 168, clause 10 of article 172 of the Tax Code of the Russian Federation, clause 12 of the Rules for maintaining a purchase ledger, clause 1.4 of the Federal Tax Service Letter No. SD-4-3/ dated October 23, 2018) [email protected] , Letter of the Ministry of Finance dated 02/04/2019 No. 03-07-11/6171).

The buyer, if he has accepted VAT for deduction, restores the tax on the basis of the received adjustment invoice. And registers transactions in the purchase book (clause 4, clause 3, article 170 of the Tax Code of the Russian Federation, clause 1.4 of the Federal Tax Service Letter No. SD-4-3 of October 23, 2018 / [email protected] ).

Forms TORG-2 and TORG-12

There is no current sample of an invoice for the return of goods and products. And only because of that. Whether products and goods of improper type or quality are accepted for registration, or whether a defect was identified at the time of acceptance of the consignment of goods, various forms are used. Namely:

- TORG-12;

- TORG-2 (filled out for domestic goods) or TORG-3 (filled out for imported goods).

In a decision, when the product or delivered goods has already been registered with the customer or buyer’s company and the discrepancy was discovered during a detailed examination of the documentation or examination of a single batch. Then a form will be issued in accordance with TORG-12.

Consignment note (form TORG-12) form

Otherwise, when a violation of the quality or quantity of the supplied products was detected during the acceptance itself. Then there will be no need to fill out a form in the TORG-12 form and it will not be drawn up. You will need to write a report on the identified and established discrepancies in inadequate quantity and quality.

Then, when accepting all delivered goods and products, you will need an invoice in the TORG-2 form. It is used for domestic goods and products. In the case of using imported types of products and goods, either TORG-3 is used. In this case, the receiver will have to complete the marks in the invoice issued by the supplier.

In the process of filling out these acts, it is important to accurately indicate all the criteria and the amount of damage or existing shortages.

Accounting, storage and transfer from paper to electronic system

Accounting for invoices is maintained in the accounting department

. into a single case, formed by periods. The enterprise independently determines the order of systematization of data, simplifying search if necessary.

Shelf life

primary accounting documents in accounting – 5 years. Paper documents are submitted for tax control during audits. Data from suppliers can be entered into electronic databases and used to clarify accounting indicators.

Completely electronic invoices, unlike paper documents, have a convenient form of storage in their original form. Any party to the transaction can print the document and present it to the control authorities.

To transfer document flow into electronic format

necessary:

- coordinate actions with a partner;

- develop a procedure for filling out the form;

- changing information, returning goods.

Each party to a commercial transaction will need to purchase digital signature sets and register the right to sign officials.

Facebook

Accounting

The rules for recording this document are not established by law, therefore the organization has the right to approve the rules for transportation and storage of invoices independently.

In most cases, a commodity report is generated at the warehouse, which is a document on the basis of which the report reflects data on the sale of objects and their cost.

Invoices are attached to the report. They are arranged in chronological order. When accounting for objects, records are kept in a journal or computer database, reflecting changes in the condition of the products that are taken into account. These entries are called entries.

Postings for receiving goods:

- Dt 41 Kt 60 – receipt of products.

- Dt 19 Kt 60 – reflection of incoming VAT.

- Dt 68-VAT Kt 19 – VAT accepted for crediting.

- Dt 44-TZR Kt 60 – cost of services of third-party companies.

- Dt 60 Kt 51 – transfer of prepayment.

- Dt 41 Kt 42 - reflection of the value of the trade margin.

- Dt 15 Kt 60 – a reflection of the actual cost of materials.

Postings for shipment of goods:

- In case payment is made later.

- Dt 90.02 Kt 43, 41 – shipment of finished delivered objects.

- Dt 62.01 Kt 90.01 – reflection of revenue including VAT.

- Dt 90.03 Kt 68.2 – the amount of VAT.

- Dt 51 Kt 62.01 - reflection of the repayment of debt for shipment.

- If prepayment has been made

- Dt 51 Kt 62.02 – crediting of prepayment.

- Dt 76.AV Kt 68.02 – VAT calculation.

- Dt 90.2 Kt 43.41 – shipment of products.

- Dt 62.01 Kt 90.1 – revenue including VAT.

- Dt 62.02 Kt 62.01 – crediting the advance to the shipment account.

- Dt 68.02 Kt 76.AB – the amount of VAT is credited from the prepayment that was made earlier.

Postings for sales of products (wholesale):

- Dt 51 Kt 62.02 – payment is credited.

- Dt 76.AV Kt 68.02 – preparation of an invoice for advance payment.

- Dt 62.01 Kt 90.01.1 – accounting for revenue from the sale of products.

- Dt 90.03 Kt 68.02 – VAT calculation.

- Dt 90.02.1 Kt 41.01 – write-off of sold units.

- Dt 62.02 Kt 62.01 – crediting the advance.

- Dt 68.02 Kt 76.AV – deduction of advance VAT.

Postings for the supply of products:

- Dt 90.2 Kt 41 – reflection of disposal of goods.

- Dt 62.01 Kt 90.1 – reflection of revenue on the sale price of objects including VAT.

- Dt 90.3 Kt 68.2 – reflection of the amount of VAT.

Read about the important rules for filling out TORG-12 with and without VAT here, and from this article you will learn how to correctly fill out a bill of lading for an individual entrepreneur.