Settlement procedure

The basic conditions for mutual offset are contained in the Civil Code of the Russian Federation. These include:

- Presence of counterclaims. Offsetting is carried out in the presence of at least 2 agreements, so that both organizations are simultaneously a debtor and a creditor. It is impossible to offset if only one company has debt.

- Uniformity of requirements. This refers to a uniform method of repaying debt, for example, in cash, despite the fact that the organization actually pays by supplying goods or providing services.

- Validity and indisputability of requirements. Settlement is not possible in case of assignment of claims to third parties and disputes regarding the fulfillment of obligations.

- Legality of requirements. Art. 411 of the Civil Code of the Russian Federation contains an open list of grounds on which it is unacceptable to carry out offsets. There should also be no restrictions or prohibitions in concluded agreements.

- Written registration of mutual settlement. The Civil Code does not contain instructions on how to fill out the netting act; therefore, it is drawn up taking into account the requirements for primary accounting documentation. This means that it must necessarily reflect the following: the parties, the grounds for offset (numbers of contracts, work completion certificates, etc.), the amount of offset and the date of final write-off of mutual claims.

- The deadline for fulfilling obligations has arrived. Settlement is possible only for those contracts where the performance period has already arrived or is not defined. In case of different deadlines, the offset is carried out after the later one. Settlement cannot be carried out against future deliveries of goods or provision of services.

If these conditions are met, in order to carry out mutual offset, it is necessary to draw up a corresponding act (agreement) and provide the other party with a copy of it.

A sample settlement agreement can be found on our website.

A detailed algorithm of actions for unilateral and bilateral offset is described in detail in the Ready-made solution from ConsultantPlus, which you can view by getting free access.

According to clause 4 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 29, 2001 No. 65, a document notifying about the test must be received. The act (agreement) of offset must be signed by persons authorized to sign documents by power of attorney or order. If the document is signed by persons who do not have these powers, transactions on mutual offsets may be considered void.

The date of offset is considered to be the date of signing the act or the date specified in the document. It is this that is subsequently reflected in accounting and affects taxation. Situations not prescribed by law or contract are resolved in accordance with business customs.

Read about the nuances of preparing primary documents in the article “Primary document: requirements for the form and the consequences of violating it.”

Mechanism for refund or offset of overpayment

The tax office does not automatically refund overpaid amounts. This happens only at the request of the taxpayer. For your convenience, we have prepared a detailed scheme for carrying out a tax offset or refund of an overpayment.

Stage 1. Conduct a reconciliation with the tax office

Submit an application to the Federal Tax Service at the place of registration regarding the need to carry out a reconciliation. Such an application can be brought in person or sent by mail or through Kontur.Extern. Within 5 working days, the tax office will send you a reconciliation report, check it.

Request the Federal Tax Service Inspectorate for a reconciliation of the status of settlements with the budget through Kontur.Extern

If everything is correct, sign the document and submit it to the tax office. If errors or discrepancies are found, indicate at the end of Section 1 of the act that “the act was signed with discrepancies.”

Stage 2. Prepare an application for offset or refund of overpayment

Submit an application for offset or refund to the tax office at the place of registration or location of the taxpayer. The application can be submitted in any form or on the form recommended in Appendix 9 to the order of the Federal Tax Service dated February 14, 2017 No. ММВ-7-8 / [email protected] Attach payment orders and documents confirming the overpayment to the application. If the overpayment arose due to errors in the tax return, submit an updated calculation.

Stage 3. Wait for the tax inspector’s decision

Within 10 working days, but not earlier than the day the desk audit on the updated declaration is completed, the inspector will make a decision on whether to carry out a tax offset or refund the money.

The period for returning the overpayment is 1 month from the date of filing the application or from the date of completion of the desk audit of the updated declaration (Clause 6 of Article of the Tax Code of the Russian Federation).

If a refund is refused, you can appeal the refusal to a higher tax authority within one year (Articles 137, 138 of the Tax Code of the Russian Federation). When the appeal does not help, return the overpayment through the court. The statute of limitations for filing an application is 3 years.

Reflection of offsets in accounting

The offset procedure does not depend on the taxation system and is shown in the same way in accounting. The differences lie in how it is reflected in tax accounting.

So, in accounting, the offset of claims is reflected in subaccounts containing information about accounts payable and receivable. Most often these are accounts 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 76 “Settlements with various debtors and creditors”.

However, claims are rarely equivalent in monetary terms, so offsets are often carried out to partially write off obligations, and the remaining amount of debt is repaid with separate documents or money.

The posting reflecting the offset is generated on the day of signing the act or on the date specified in the document and has the form: Dt 60 (62, 76) – Kt 62 (60, 76) - partial (full) repayment of the counter obligation by offsetting mutual claims.

See also: “Dt 60 and Kt 60, 50, 51, 76, 62 in accounting (nuances).”

Features of the document and general points

An application for a tax offset from one BCC to another can be written either in free form or according to an established unified template. Regardless of which method is chosen, you need to refer to Article 78 of the Tax Code of the Russian Federation. We will take the standard form as an example, since it contains all the necessary lines, is convenient and easy to fill out.

First of all, let’s say that you can enter information into the form either on the computer or by hand. If the second option is chosen, then you need to ensure that the document does not contain inaccuracies, errors or edits. If they do happen, you should fill out another form.

The application must be signed by the applicant or his legal representative - the head of the organization or another person authorized to act on his behalf.

It is necessary to certify a document using a stamp or seal only when such a condition is stated in the accounting documents of the enterprise.

The form must be completed in two identical copies,

- one of which must be handed over to the tax inspector,

- the second, after putting a mark on it to accept the copy, keep it for yourself.

This approach in the future will allow you to avoid controversial situations with the tax service regarding the availability of an application or the timing of its submission.

Offsetting under the simplified tax system and tax accounting

With the object “income”, this operation is reflected in the book of income and expenses as receipt of revenue. The date indicated is the moment of repayment of obligations, that is, either the date provided for in the act (agreement) on netting (this will be the basis for the operation), or the date of signing this act (agreement). This conclusion is confirmed by the letter of the Ministry of Finance dated December 28, 2011 No. 03-11-06/2/185, as well as the current judicial practice.

The obligation to accept the offset for accounting also arises if there is no act. Then the document confirming this business transaction will be a reconciliation act or any other suitable primary accounting document.

If the income from the operation was not taken into account, then it is highly advisable to submit an updated declaration under the simplified tax system and make an additional payment, otherwise the organization will face sanctions under Art. 122 Tax Code of the Russian Federation .

The act of offset in itself documents only the write-off of mutual claims and does not lead to the emergence of income or expenses. However, according to Art. 346.17 of the Tax Code of the Russian Federation, the income of enterprises under special tax regimes can be recognized not only as the receipt of funds, but also as the repayment of receivables in alternative ways, for example, by terminating a counter-obligation. Thus, in the book of income and expenses, writing off claims in any form will be reflected as income of the enterprise.

You can find out how simplifier expenses are taken into account when offsetting in the Ready-made solution from K+, having received trial access to the system.

Read more about income simplification in the article “STS-income in 2019-2020 (6 percent): what you need to know?”

What are the dangers of errors in KBK?

When making payments to the budget, accountants of enterprises and organizations, indicating the BCC, sometimes make mistakes. They can be caused by simple inattention, but most often they still occur simply out of ignorance. The fact is that BCCs change quite often and employees of commercial companies do not always have time to track these changes in time.

Responsibility for errors in the KBK lies entirely on the shoulders of taxpayers.

If the organization’s accountant incorrectly indicated the KBK in the payment documents, this means only one thing: the payment will not be used for its intended purpose. That is, in fact, money will go to the budget, but it will be impossible to distribute it correctly, so it will be considered that the state has not received these funds. In this regard, tax specialists will formalize this as an arrears under the corresponding item of revenue (even if an overpayment is formed under another item due to such confusion), which means that in the future this will entail the imposition of penalties and fines on the taxpayer.

An example of netting using the simplified tax system

Let's look at the reflection of offsets in accounting and tax accounting using an example.

Yasen LLC applies a simplified “income” taxation system. From April 5, it leased the production premises to Lipa LLC for a period of 11 months. And on April 10, an agreement was concluded that Lipa LLC would provide transport services for the period until December 31 of the current year.

In June, the enterprises decided to offset mutual claims and found out that, according to the agreements, the accounts payable of Yasen LLC amounted to 42,000 rubles. (under the contract for the provision of transport - 58,000 rubles (under the lease agreement). On June 15, an act of offset was signed in the amount of 42,000 rubles.

For 3 months (April, May, June), the accountant of Yasen LLC did the following for each wiring transportation service:

Dt 44–Kt 76/2 - transport costs are reflected.

As a result, as of June 15, Yasen LLC accumulated accounts payable to Lipa LLC on account 76.

As well as Yasen LLC revenue was recognized:

Dt 62/3–Kt 90/1 (revenue from renting out production premises) - 58,000 rubles.

After signing the netting act, the accountant of Yasen LLC made the following entry:

Dt 76/2–Kt 62/3 (offset of claims in accordance with the act dated June 15, 2018) - 42,000 rubles.

Since the company “Yasen” LLC is on the simplified tax system “income”, when filling out the book of income and expenses, the accountant reflected in the income the revenue in the amount of partial write-off of mutual claims.

After Lipa LLC deposited the balance of the debt into the settlement account, the accountant of Yasen LLC reflected it in his accounting with the entry: Dt 51–Kt 62/3 - 16,000 rubles, and also included it in income when calculating the single tax under the simplified tax system.

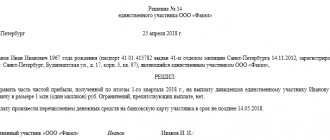

Sample act of mutual settlement.

Act No.__

on carrying out mutual settlement between Yasen LLC and Lipa LLC.

Ulyanovsk June 15, 2021

As of the date of drawing up this act, there are mutual obligations between the parties:

- LLC "Lipa" (tenant) has before LLC "Yasen" (lessor) under agreement dated 04/05/2020 No. __ (act of acceptance and transfer of production premises dated 04/05/2020 No. __) in the amount of 58,000 rubles.

- Yasen LLC (customer) has before Lipa LLC (contractor) under contract dated 04/10/2020 No. __ (Acceptance and transfer certificates for services rendered dated 04/15/2020 No. __, dated 05/15/2020 No. __, dated 06/15/2020 No. __) in the amount of 42,000 rubles.

The parties agreed to mutually offset the debt in the amount of 42,000 rubles, thereby fully repaying the obligations of Yasen LLC to Lipa LLC.

Yasen LLC Lipa LLC

_______________ _____________

M.P. M.P.

The article “Which object under the simplified tax system is more profitable - “income” or “income minus expenses”?” will help you make the right choice of taxation system under the simplified tax system.

Sample application for offset of overpaid tax

Form the offset document in the unified form KND 1150057. Please note that individual entrepreneurs and organizations fill out only the first page of the document; the second part is provided for applications from individuals who are not individual entrepreneurs.

KND form 1150057

Let's look at how to fill out the form correctly, using a specific example: Vesna LLC, when transferring insurance premiums for September 2017, made a mistake on October 10, 2017: the payment for compulsory health insurance was sent to pension insurance in the amount of 150,000 rubles. The accountant began filling out an application to offset the resulting overpayment under compulsory medical insurance against the debt under compulsory medical insurance:

- We fill in the TIN, KPP and the full name of the organization. We indicate the application number and the code of the territorial office of the tax office to which the application is submitted. If the application is made by an individual entrepreneur, his last name, first name and patronymic (if any) should be indicated. Place dashes in empty cells.

- We indicate the number of the article of the Tax Code of the Russian Federation, which is the basis for a written application for offset, and the amount of overpayment in figures. The following values of the basis articles are acceptable: Art. 78 - to offset excess funds for insurance premiums, fees, penalties, fines.

- Art. 79 - for offsetting excessively withheld (collected) amounts in favor of the Federal Tax Service.

- Art. 176 - to dispose of overpayment of VAT.

- Art. 203 - for offsetting excise tax surpluses.

- Art. 333.40 - for the return of overpayments on state duties.

- We fill out the tax period, OKTMO and KBK.

For a tax period, we set the value of the settlement (reporting) period established for a specific tax or fee. The field contains 8 cells, the first two of which have a letter designation: “MS” - month, “QV” - quarter, “PL” - half-year, “GD” - year. In the remaining cells we indicate the numerical indicator of the billing period. For example, September 2021 - “MS.09.2017”. It is also acceptable to indicate a specific date of payment or declaration without a letter designation - “10.10.2017”. In our example, the reporting period for insurance premiums is the third quarter of 2021 - “Q.03.2017”.

We indicate the BCC on the basis of Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. You can view OKTMO and KBK in the payment order for the transfer of tax liability.

We write down the code of the tax authority in which the overpayment is listed.

- We indicate the code indicating the taxpayer’s decision on how to manage the money overpaid to the budget. To offset against other payments, indicate “1”, against future periods – “2”. Now write down the tax period, OKTMO and KBK tax to which you plan to transfer the overpayment. We write down the code of the tax authority in which the debt is registered.

- We indicate the number of completed application pages, the number of application sheets, information about the manager and contact phone number. We set the date of preparation and have the finished document certified by the manager.

Filled-in form

Results

Mutual obligations to each other in business are not uncommon. Mutual offset allows organizations to pay each other, while saving time and money on bank commissions. Accounting for offset transactions is the same for all tax regimes. For a company using simplified taxation system (STS) income, offset means the receipt of revenue, which must be taken into account for tax purposes.

Sources:

- Tax Code of the Russian Federation

- Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to draw up and submit an application to offset tax overpayments

Traditionally, the TIN and KPP should be indicated at the very top.

The individual entrepreneur’s identification number consists of 12 digits, so there should be no free cells left. Organizations enter only 10 numbers in the appropriate fields, and put dashes in the remaining two.

When filling out the line intended for the checkpoint, applicants must act in the same way: if there are numbers, enter them, if not, put dashes.

Step 2. Enter the request number. Here they put down the number of times in the current year they applied for the test. Don’t forget about dashes if the number of numbers to be entered is less than the number of cells.

Step 3. Enter the code of the tax authority where the application will be sent. This should be an inspection of the Federal Tax Service at the place of registration of the individual entrepreneur or organization.

In a consolidated group of taxpayers, the responsible member of this group must request a credit for the overpayment of income tax. Step 4.

Application for crediting the amount of overpaid tax: how to fill out,

You can find out about this if you periodically request reconciliations and certificates of mutual settlements for taxes from the tax office.

It is possible to offset overpaid taxes when both the Federal Tax Service and the taxpayer themselves are aware of the current situation. If the inspector was the first to discover this, he sends a notice to the company and asks him to make a decision on return or credit.

This choice must be made by the taxpayer. However, if the company has any arrears, then it will not be able to refund the overpaid tax.

In this case, the inspector will independently, without the consent of the organization, carry out the offset. The legislation provides only for his obligation to notify the company about the offset. A situation may arise that the arrears are less than the overpayments.

Then a credit is applied to part of the arrears, and a notice is sent to the business entity about the need to make a decision regarding the overpaid amount of tax.