What regulations should be followed when formalizing labor relations with part-time workers? What is the maximum working time for a part-time worker per day? How is a part-time employee paid? What benefits and compensations are external part-time workers entitled to? What is the procedure for granting them regular paid vacations?

Low wages in low-paid positions force workers to look for part-time work. An employee can perform additional work on a part-time basis, both external and internal. In the article we will consider issues related to payments that the institution makes in favor of part-time workers.

Part-time work is the performance by an employee of another regular paid job under the terms of an employment contract in his free time from his main job (Article 282 of the Labor Code of the Russian Federation). Article 60.1 of the Labor Code of the Russian Federation establishes two types of part-time work: internal and external. The provisions of this article allow the employer to use the labor of employees, both those working for him under an employment contract (internal part-time workers) and those who come from other organizations (institutions) (external part-time workers).

When formalizing labor relations with both internal and external part-time workers, the provisions of the Labor Code of the Russian Federation and other regulations in the field of labor legislation should be taken into account. For example, the specifics of regulating part-time work for certain categories of workers (teaching, medical and pharmaceutical workers, cultural workers), in addition to the Labor Code of the Russian Federation and other federal laws, can be established in the manner determined by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social labor relations.

Currently, such a document is Resolution of the Ministry of Labor of the Russian Federation dated June 30, 2003 No. 41 “On the peculiarities of part-time work for teaching, medical, pharmaceutical workers and cultural workers” (hereinafter referred to as Resolution of the Ministry of Labor of the Russian Federation No. 41).

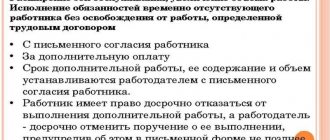

An important point in the part-time work of medical, pharmaceutical, pedagogical and cultural workers is that they have the right to carry out part-time work both in another and in a similar position, specialty, profession (clause “a”, paragraph 1 of Resolution of the Ministry of Labor of the Russian Federation No. 41 ). In other words, a doctor can work, for example, at 1.5 times the rate (the rate at the main place of work and 0.5 times the rate at a part-time job), and in this case an ordinary employee is given a job combination, an expansion of service areas or an increase in the volume of work (Article 60.2 of the Labor Code RF).

As part of the consideration of the material, we will dwell on the issues of remuneration for part-time workers, as well as the implementation of other payments in relation to these persons, guaranteed to them by the legislation of the Russian Federation.

What salary should be indicated in the employment contract of a part-time worker?

An employee’s salary is a remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed, includes both salary and incentives (bonuses, additional payments, allowances) and compensation payments (for overtime work, work in night time, for work with harmful and (or) dangerous and other special working conditions, for work in areas with special climatic conditions, etc.).

The monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (job duties) cannot be lower than the minimum wage (Article 133 of the Labor Code of the Russian Federation).

Salary is a fixed amount of remuneration for an employee for the performance of labor (official) duties of a certain complexity for a calendar month, excluding compensation, incentives and social payments (Part 4 of Article 129 of the Labor Code of the Russian Federation). Those. if the employee’s employment contract specifies a salary of 10,000 rubles, then this is the amount of money (minus 13% tax) that the employee should receive for a fully worked month, based on his work schedule and rest time. Most often, payment for a part-time worker or part-time employee is made in proportion to the time worked.

On the question of what exact salary amount to indicate in a part-time worker’s employment contract (full or proportional), several positions stand out:

1. The employment contract specifies the full salary in accordance with the staffing table. It is also stated that the employee is paid in proportion to the time worked.

2. The employment contract specifies part of the salary based on the employee’s current rate. For example, if a part-time worker is hired at 0.5 rates, then half the salary is indicated.

3. As in the second case, the part-time employee’s employment contract specifies part of the salary based on the employee’s occupied rate. But with a note that this is 50% of such and such salary for a full-time position. This is like a middle option, eliminating any ambiguity. As they say, “the wolves are fed and the sheep are safe.”

In all cases, in addition to the terms of remuneration, the employment contract must also specify in detail the working hours and rest periods of a part-time worker or part-time employee. Let's look at each option in more detail.

What is part-time work?

Part-time work is the performance by an employee of other paid regular work with the signing of an employment contract, during time free from work at the main place of employment.

This definition is very comprehensive and gives a clear idea of the conditions when work will not be considered part-time work.

Let's give examples.

| Example | Why is it not a part-time job? |

| 1. The girl officially works as a laboratory assistant at a research institute. On vacation he participates in the Greenpeace movement | For the second type of activity, the girl does not receive wages, and performing the second job on a paid basis is an indispensable condition. This is an example of volunteering |

| 2. The company’s accountant temporarily performs the functions of a cashier while the latter is on vacation | There is no regular nature of work. This is a combination |

| 3. An economist also performs the functions of a programmer within one eight-hour working day | The two jobs do not follow one another, but are performed in parallel. Here we are also talking about combining |

It is noteworthy that a part-time worker can have as many additional official jobs as he wishes. The law does not specify any limiting figure.

The only limiting factor is that there are only 24 hours in a day. The part-time worker is not obliged to notify the main employer about his subsequent employment. As for working hours, here, on the contrary, there is a limitation: the length of the working day at a non-main job must be within 4 hours daily.

Full salary for a part-time worker (according to the staffing table)

Is it possible for a part-time worker to get a full salary? Indicating in the employment contract of a part-time worker or part-time employee the full salary according to the staffing table is an option that suits many specialists. They appeal to the fact that in the Labor Code of the Russian Federation, and especially in Part 2 of Art. 57 of the Labor Code of the Russian Federation, it is written about the full salary, not about part of it. An employee is hired for a position according to the staffing table, according to which a certain salary is established.

The terms of remuneration (including the amount of the tariff rate or salary (official salary) of the employee, additional payments, allowances and incentive payments) are mandatory for inclusion in the employment contract (Article 57 of the Labor Code of the Russian Federation).

In addition to the full salary, in the employment contract of a part-time worker or part-time employee, it is necessary to specify that the employee’s payment is made in proportion to the time worked, and indicate the working hours and rest time (!), because it will clearly differ from the general rules established by the employer (Article 57 of the Labor Code of the Russian Federation).

Example wording:

“For the performance of duties stipulated by the terms of this employment contract and the job description, the Employee is given a salary of 10,000 (ten thousand) rubles per month. The Employee’s remuneration is made in proportion to the time worked.”

This position is also supported by Rostrud, although it also supports the opposite point of view, namely the indication of half the salary, which will also be noted below.

Unfortunately, it is the indication of the full salary in the employment contract of a part-time worker that very often leads to litigation, although by and large, judicial practice goes in favor of the employer, but there are still decisions in favor of the employee.

In fact, court decisions depend not only on all the evidence that each party presents (Article 56 of the Code of Civil Procedure of the Russian Federation), but also on the internal conviction of the judge (Article 67 of the Code of Civil Procedure of the Russian Federation). Moreover, if one court recognizes arrears of wages based on the full salary specified in the employment contract, despite the fact that the employee is a part-time worker, then another judge independently makes a conclusion about the amount of the part-time worker’s salary in accordance with his nature and mode of work, even if the full salary was also specified in the employment contract.

In favor of the employer

Quite an interesting appeal ruling of the Khanty-Mansiysk Autonomous Okrug - Ugra dated December 8, 2015, by a judicial panel, which literally saved the employer from unfair collection of arrears of wages in favor of a part-time worker, based on the full-time salary for the position specified in the employment contract (the first instance made a decision that was positive for the employee). It is significant that the employee, and therefore the plaintiff, was a personnel manager who independently drew up her employment contract, as is usually the case.

At the court hearing, the Plaintiff insisted on satisfying the claims in full and indicated that the salary of 10,000 rubles was provided for in the employment contract concluded with her, and not in the staffing schedule, which could not change the terms of the employment contract agreed upon with her. She drew up the employment contract herself. The director of the LLC, before signing an employment contract with her, spent a long time familiarizing himself with the contents of the contract, therefore, he agreed with the conditions included in it. The employer did not require her to bring the employment contract into compliance with the staffing table.

In its response to the claim, the defendant LLC ... indicated that the full name drew up the employment contract for itself. As a result, the full name provided and the employment contract signed by the director did not correspond to the true will of the employer. According to the staffing table, the salary for a full staff unit (full standard working hours) for the position of “leading HR manager” is 10,000 rubles. Meanwhile, the plaintiff performed the duties of the leading HR manager on a part-time basis. With her employment of 0.3 full-time units, her salary was 3,000 rubles. On a part-time basis, perform work for a full-time position and receive a salary of 10,000 rubles. The plaintiff could not...

The duration of the daily work of the full name was 2.88 hours. The plaintiff was not involved in overtime work, therefore, there were no grounds for recording the plaintiff’s part-time working hours based on the full working time standard of 7.2 hours, as well as for paying her wages in the amount of 10,000 rubles. The conditions for remuneration specified by the plaintiff in the employment contract did not correspond to the conditions of employment and payment approved by the employer in the company’s staffing table. In the appeal, the defendant asks to cancel the court decision regarding the recovery of wages and compensation for moral damage, and to make a new decision in the case to refuse to satisfy the claim

Having checked the case materials and discussed the arguments of the appeals, the judicial panel did not agree with the conclusions of the trial court, since the court incorrectly determined the circumstances relevant to the case.

The official salary system is used for managers, specialists and employees, whose labor is paid not according to tariff rates, but according to established monthly official salaries.

Official monthly salary is the absolute amount of wages established in accordance with the position held.

The staffing table in all organizations, enterprises and institutions is filled out using a single unified form No. T-3. In column 5 “Tariff rate (salary)” of the staffing table, the monthly salary is indicated in ruble terms at the tariff rate (salary), depending on the remuneration system adopted by the organization in accordance with the current legislation of the Russian Federation, collective agreements, employment contracts, agreements and local acts of the organization (Instructions No. 1). In column 9 “Total per month” of the staffing table, an amount equal to the product of column 4 and column 5 is indicated, which determines the amount of the part-time worker’s earnings, taking into account working hours. Thus, in the employment contract the salary must be indicated in accordance with the staffing table, that is, in full.

The court of first instance erroneously considered that the salary specified in the employment contract was established for her for part-time work. Meanwhile, as stated above, salary is the amount of wages established for the full rate for the position held. According to the staffing table of the LLC... the salary of the leading HR manager is 10,000 rubles, the staffing level is 0.3.

The appellate court, in connection with the incorrect determination by the trial court of significant circumstances in the case, requested the plaintiff’s timesheets and a detailed calculation of the payments made, indicating the date of actual receipt of the accrued amounts by the employee. From these documents it follows that the Plaintiff was hired at 0.3 rate with an official salary of 10,000 rubles, and therefore her earnings should be calculated from the amount of 3,000 rubles. In such circumstances, the decision of the court of first instance is subject to cancellation with the adoption of a new decision to refuse to satisfy the claims.

As you can see, in the text of the decision there is no reference to the terms of the employment contract regarding the payment of a part-time worker in proportion to the time worked (when indicating the full salary for a full-time unit). Taking into account that the employment contract was drawn up personally by the employee, this condition probably did not exist at all. Despite its absence, the court recognized the full salary clause in the part-time worker’s employment contract as relating to work for the entire working day, and not part of it. What can you say about the decision of the Noginsk City Court dated August 17, 2015?

In favor of the employee

So, Full Name was hired by the LLC as a part-time accountant with a salary of 10,000 rubles.

According to the representative of the defendant, the calculation of compensation for delayed payment of wages presented by the Plaintiff was drawn up incorrectly, since the plaintiff in the calculations was based on the size of the tariff rate (salary) for the position of an accountant in the amount of ... rubles, however, the Plaintiff was hired part-time, and by virtue of Art. . 284, 285 of the Labor Code of the Russian Federation, the duration of her working day should not exceed four hours a day, and remuneration should be made in proportion to the time worked. In fact, under normal conditions, remuneration for part-time work is half the tariff rate determined in the staffing table for his position for the main employee.

The court of first instance did not agree with these arguments. The objections of the defendant’s representative that ... rubles is a salary at the full rate, and the plaintiff, being a part-time employee, should have received 50% of ... rubles, the court considers unfounded, wages are an essential condition of the employment contract, evidence that after hiring the plaintiff to work, additional agreements were concluded with her that changed the terms of payment, the representative of the defendant was not presented to the court.

By virtue of Art. 285 of the Labor Code of the Russian Federation, remuneration for persons working part-time is made in proportion to the time worked, depending on output or on other conditions determined by the employment contract.

Thus, when working part-time, the terms of the contract may provide for a salary of more than 50 percent of the salary for the position held, since setting the employee’s wages falls within the exclusive powers of the employer, and therefore the court comes to the conclusion that the calculation of the defendant’s wage debt to the plaintiff the payment should be made on the basis that the salary established for the plaintiff is ... rubles per month.

The employer tried to appeal the court's decision in the appellate instance, but this also failed.

The panel of judges finds the argument of the defendant’s appeal about the court’s unlawful calculation of arrears of wages based on the plaintiff’s official salary in the amount of 10,000 rubles to be unfounded, since this argument is refuted by the copy of the order in the case ... on the plaintiff’s employment as an accountant on a part-time basis with a salary in the amount of 10,000 rubles, certified by the defendant in the prescribed manner. This argument of the defendant was carefully examined by the court; the court decision contains comprehensive conclusions on it, with which the panel of judges agrees. Based on the specified salary, the court calculated the arrears of wages when resolving a previous similar dispute between the parties for the previous period, while the court’s absentee decision dated ... 2013 was not challenged by the defendant.

To be fair, I note that this particular employee was lucky. Most likely, the role played not only by the fact that the employer for the first time did not challenge the decision of the court in absentia on a similar dispute (which was the focus of the appeal), but also, apparently, by the absence in the order of employment and the employment contract of the wording “remuneration in proportion to time worked,” although there may have been one, it’s just that no one focused on it. Other plaintiffs were not so lucky.

In favor of the employer

In February 2015, the Basmanny District Court of Moscow rejected in full the plaintiff’s claims for the collection of arrears of wages, compensation for unused vacation, compensation for delayed payments, and compensation for moral damage.

In 2010, Full Name was hired by the LLC as a part-time office manager. In accordance with clause 1.4 of the specified employment contract, the employee has an 8-hour working week with a flexible start and end time of the working day. The employee has a five-day work week from Monday to Friday, with two days off (Saturday and Sunday). Working hours during the working week are at least 8 hours.

In accordance with amendments No. ... dated April 1, 2013 to the employment contract, full name, an official salary is established in the amount of ... kopecks before payment of personal income tax in proportion to the time worked.

Please note that the text of the decision notes that the additional agreement to the employee’s employment contract indicated the official salary with a note indicating proportionality to the time worked. Further in the text it is clear that the salary was indicated at the full rate.

The final decision was made by the court in its entirety, based on the submitted timesheets, payslips, payment orders, as well as the nature of the labor relationship between the employee and the employer, i.e. the nature of the combination.

According to the staffing table of the LLC as of April 1, 2013, the full-time salary of an office manager was 105,208 rubles 25 kopecks.

Meanwhile, during the consideration of the case, the representative of the LLC presented documents, including pay slips, payment orders and registers for them for the disputed period, from which it is clear that the plaintiff was accrued and paid wages based on the information available in the time sheet, for hours actually worked, and therefore there is no reason to believe that the defendant has arrears to the plaintiff for wages and compensation for unused vacation upon dismissal.

The court finds the plaintiff’s representative’s argument that the extracts from the time sheet submitted by the defendant are unacceptable evidence to be untenable, since time sheets and pay slips are not normative acts, but only record the employer’s activities in monitoring the performance of labor functions by employees and the performance they are responsible for paying remuneration for their work.

The defendant’s indication in amendments No. ... dated ... 2013 to the employment contract of the amount of the plaintiff’s official salary at the full rate ... is not a circumstance legally significant for the consideration of the dispute, since the labor relations that developed between the full name and the LLC were of a part-time nature, which was not disputed by the plaintiff in during the consideration of the case.

At the same time, the plaintiff, receiving monthly wages, did not make any claims regarding wages during the employment relationship against the employer. The plaintiff’s demands for payment of her wages and compensation for unused vacation, based on her official salary in the amount of ..., that is, exceeding her actual contribution to the defendant’s activities, contradict the principles set out in Art. 129 of the Labor Code of the Russian Federation, in connection with which the court comes to the conclusion that the LLC has no debt to the Plaintiff...

The employee tried to appeal the court’s decision directly to the cassation court, bypassing the appellate court, but of course this did not work out for him, the case was sent back without consideration on the merits, and then it seemed to have stalled.

In favor of the employer

In favor of the employer, you can also see the appeal ruling of the Krasnoyarsk Regional Court dated August 3, 2015, which left the decision of the first instance court unchanged.

Only now the employee was hired as a clerk on a part-time basis for 4 hours a day (0.5 rate). The employment contract and the hiring order established a salary for a full day of work, as provided for in the staffing table. The court decision also does not contain information about the provision in the employment contract of proportionality to the time worked.

The employee considered that the full salary in the employment contract was established for working part-time, i.e. “half the rate”, with which the court did not agree. Based on the work time sheets, pay slips, and the plaintiff’s working hours, the court refused to satisfy the employee’s demands.

Conclusion:

As I already wrote, most court decisions on full salary in the employment contract of a part-time worker or part-time employee are mostly positive for employers, because courts pay attention not only to the nature of the employee’s work and working hours, but also to supporting documents (record sheets, pay slips, payment orders, etc.). Although there are still exceptions.

Apparently, the presence in the employment contract and in the hiring order of the condition on proportionality to the time worked does not matter, probably due to the fact that this is stated directly in the Labor Code of the Russian Federation (see 285, Article 93).

In principle, indicating the full salary according to the staffing table for an employee hired at 0.5 rate (or any other) has the right to life, but only with a greater likelihood of an individual labor dispute with the employee, this is worth remembering.

I would also like to note one more court decision; I left it for last, so to speak, for reflection.

In favor of the employee

The Omsk Regional Court, by appeal ruling dated July 09, 2014, decided in favor of the employee, citing the literal interpretation of the employment contract, which stated the full salary for the position.

The employer insisted that the full salary was indicated in accordance with the staffing table, to which the court responded that the employee was not familiar with the staffing table, i.e. actually equated the ShR to local regulations, which should be familiarized to employees. The “counting error” of the employer who calculated and paid the employee’s wages for one and a half months based on the full salary for the position also played a role.

As follows from the case materials, an employment contract was concluded between the Plaintiff and the LLC.

According to clause 1.5 of the employment contract, the Plaintiff has a five-day working week, the duration of working hours is hours per week, the duration of daily work (shift) is an hour, the start and end time of work is - .

In his job application, the Plaintiff asked to be hired for the position ..., with a five-day work week, from hours to hours, without a lunch break. The above indicates that the parties to the employment contract have agreed on the duration of the employee’s working hours.

Section 1 “General Provisions” of the employment contract, which specifies the profession, position for which the employee is hired, his term, start of work, duration of working hours per week, hours in a working day, does not reflect that the salary for this position is a certain amount.

At the same time, in section 4 “Working conditions” (clause 4.1.) it is stated that for the fulfillment of the duties assigned to the employee by this employment contract, job description (work) instructions, local regulations of the employer, the employer is obliged to pay timely and in full employee salary rub. per month.

According to the provisions of Art. 431 of the Civil Code of the Russian Federation, when interpreting the terms of a contract, the court takes into account the literal meaning of the words and expressions contained in it. The literal meaning of a contract term, if it is unclear, is established by comparison with other terms and the meaning of the contract as a whole.

From the overall interpretation of the terms of the employment contract, it follows that the salary is RUB. established for monthly wages for an hour-long workweek with a shift duration of an hour per day.

The defendant’s reference to the order from the Plaintiff’s employment, which indicates the amount of the salary in rubles, cannot be taken into account, since from this order, which clearly indicates the Plaintiff’s work time, it does not clearly follow that his salary will be paid in the amount of the salary indicated above.

The defendant’s arguments that the contract specifies the salary in accordance with the organization’s staffing table (it names a salary of rubles per rate for the plaintiff’s position) are untenable, since the employee was not familiar with this staffing table.

The employee is hired for the position established in the employment contract, with the official salary established therein, and all doubts must be interpreted in favor of the employee.

Under such circumstances, having correctly established the factual circumstances relevant to the case, and having given them a proper legal assessment in accordance with the norms of substantive law, having checked the arguments of the parties, the court of first instance came to a reasonable conclusion about the recovery of arrears of wages in favor of the plaintiff, according to the literal interpretation terms of the employment contract.

In addition, as evidence of the conclusion of the contract on the terms named by the plaintiff, the court correctly took into account the fact that the calculation and payment by the defendant to the plaintiff of wages for and bonus for were carried out on the basis of a salary in the amount of rubles. The references in the LLC's complaint that the payment of wages to the plaintiff in and in, based on the amount of rubles, is a calculation error are not confirmed. There were no claims against the Plaintiff regarding overpaid amounts; thus, the plaintiff’s arguments about incomplete payment of wages were confirmed by the evidence presented during the consideration of the case, which was assessed by the court according to the rules of Art. 67 of the Civil Procedure Code of the Russian Federation.

Therefore, be careful when drawing up an employment contract and do not allow any inaccuracies or mistakes, especially when it comes to part-time work. This solution is not the only one of its kind; reducing risks for the employer is the direct responsibility of the HR specialist.

Salary when combining positions

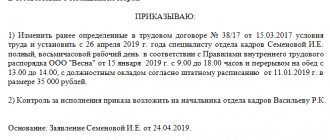

The organization enters into an additional agreement to the contract with its employee Mashuk K.V. on combining the position of a seamstress with the position of a cutter in connection with the improvement of cutting techniques.

For expanding duties, an additional payment is established - 20,000 rubles.

On June 1, Mashuk wrote a statement and an order for transfer to a new position was issued.

On June 30, her salary was accrued.

See the beginning of the example Combining positions

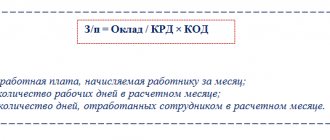

Payroll

Calculate the salary of an employee combining positions using the Payroll document (Salaries and personnel - All accruals).

All accruals specified in the Personnel Transfer will be reflected and calculated automatically.

See also:

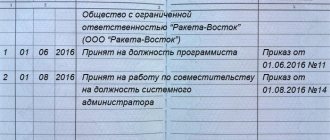

- Hiring a part-time worker

- Salary settings: 1C

- Main types of charges

- Document Payroll

- Payroll

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Payment of dividends to founders: individuals and legal entities Let's consider the features of reflecting the accrual and payment of dividends in 1C...

- The method of reflecting salaries in accounting 1C 8.3 Accounting 3.0 Reflecting salaries in the accounting of an organization can be different. So that everyone...

- Test No. 24. Error: incorrect salary payment amount in the statement...

- Rounding taxes and other liabilities and assets...

Proportional salary for part-time worker

An indication in the employment contract of a part-time worker or part-time employee of the real salary that he will receive per month based on his work schedule and rest time. Those. if the salary for a position is 10,000 rubles, then an employee hired at 0.5 rate is given a salary of 5,000 rubles, despite the fact that this is actually part of the salary. This way, the employee will initially know what salary he can expect for his work schedule, and he will not be misled.

Example wording:

“For the performance of duties stipulated by the terms of this employment contract and the job description, the Employee is given a salary of 5,000 (five thousand) rubles per month.”

You can also add, for example,

“For the performance of duties stipulated by the terms of this employment contract and the job description, taking into account the nature and mode of work, the Employee is paid a salary of 5,000 (five thousand) rubles per month.”

Rostrud also supports this point of view (i.e. contradicts itself).

I did not find any judicial practice regarding the indication of half the salary in the employment contract of a part-time worker, instead of the full salary in accordance with the staffing table.

When part-time work is prohibited

The law describes situations in which a person cannot have a second official job at the same time as the first:

- Minor age. This limitation is natural, because the law prescribes restrictions on the workload of persons under 18 years of age;

- Harmful or dangerous working conditions - at both jobs. For example, a man cannot work half a day as a fireman and half a day as a miner;

- Drivers of vehicles. The logic is that drivers are responsible for people's lives, and lack of rest will reduce the overall level of safety;

- Deputies of the State Duma of the Russian Federation cannot officially engage in work other than lawmaking. Exceptions: teaching or scientific activities;

- Heads of companies cannot simultaneously be members of internal control bodies. For example, the general director is also prohibited from serving on the audit committee;

- Managers cannot be part-time workers in other companies, unless they have received written consent from the owner of the enterprise;

- Employees of law enforcement agencies, employees of the Bank of Russia.

Proportional salary for part-time worker (with clarification)

An indication in the employment contract of a part-time worker or part-time employee of the real salary that he will receive per month based on his work schedule and rest time. But with a note that this salary is 0.5 rates (or 50%) of the full salary for the position. Those. this is like a middle option, eliminating any ambiguity.

Example wording: “For the performance of duties stipulated by the terms of this employment contract and the job description, taking into account the nature and mode of work, the Employee is given a salary of 5,000 (five thousand) rubles per month, which is 0.5 times the salary of 10,000 (ten thousand ) rubles per month."

You can add:

“For the performance of duties stipulated by the terms of this employment contract and the job description, taking into account the nature and mode of work, the Employee is given a salary of 5,000 (five thousand) rubles per month, which is 0.5 times the salary of 10,000 (ten thousand) rubles per month. month established by ... (job title) with a working time standard of 40 hours per week.”

Rostrud also supports this option.

I also did not find any judicial practice.

For my part, I would like to note that, in my opinion, it is better to indicate in the part-time worker’s employment contract the amount of salary that he will receive after working the required working hours. It is possible even with clarifications, as in the third option. This will not only eliminate any ambiguity in the provisions of the employment contract, but may also completely eliminate all possible misunderstandings in the future.

In fact, there is not and will not be a single position; even the State Transport Inspectorate cannot decide on this issue, let alone personnel specialists. Each personnel officer decides independently how to specify the salary amount in the employment contract for a part-time worker or a part-time employee, of course, after weighing all the pros and cons.

It can be said that in case of litigation, everything will depend on the evidence on both sides and the competence of the judge. The labor inspectorate does not have the right to issue an order in the event of an inspection, because resolving individual labor disputes (and that is the size of the salary) is not part of her job.

That's all. Until next time.

Related Posts

- Changes in labor legislation from 2021! Well, the salads have been eaten, the gifts have been given, we’ve eaten too much candy, it’s time to mentally prepare for the new work...

- Error or typo in the employment contract Errors in the employment contract. How to correct a mistake in an employment contract? Arbitrage practice.

- Personnel notes. Issue 1 Monthly personnel notes

- Personnel notes. Issue 2 Monthly personnel notes. News.

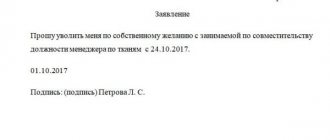

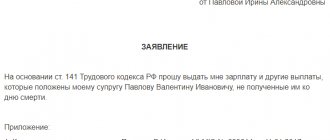

Procedure for calculating compensation

The accounting department of the enterprise in which the person was on staff deals with the calculation of payments due to a dismissed part-time worker. The process begins with sending an application for termination of the employment agreement at the initiative of the employee to the manager.

Next, a corresponding order is issued for the enterprise, and the citizen’s data is sent to the accounting department from the human resources department. Here the final amount of compensation is fixed, which is subsequently handed over to the former employee along with the work book. However, the latter remains with the employer if we are talking about the dismissal of an internal part-time worker while maintaining his main position.

Payment deadline

Regardless of the grounds for which an employee is dismissed, his/her payment must take place on the day of actual dismissal (Article 140 of the Labor Code of the Russian Federation). Namely, on the date specified in the relevant order.

Article 140 of the Labor Code of the Russian Federation - Payment terms upon dismissal

Upon termination of the employment contract, payment of all amounts due to the employee from the employer is made on the day the employee is dismissed.

If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed employee submits a request for payment. In the event of a dispute about the amount of amounts due to the employee upon dismissal, the employer is obliged to pay the amount not disputed by him within the period specified in this article. If for some reason a person is absent, then compensation is paid upon his first request. Or on the day following the day when the desire to receive funds was voiced.