Additional payment for a temporarily absent employee: general provisions

Additional payment for temporarily absent employee

The right to an employee to receive additional payment for performing the work duties of another employee during the period of his absence is enshrined in Labor legislation. The surcharge is accrued if the following conditions are simultaneously met:

- one of the employees is temporarily absent from work due to vacation, illness, or other reasons, in connection with which his job duties are performed by another employee;

- an employee replacing a temporarily absent employee is not exempt from performing his own job duties as provided for in the job description.

Replacing a temporarily absent employee implies an expansion of the work responsibilities and area of responsibility of the replacement employee, without increasing the length of the working day (work shift).

Three things without which VRIO is impossible

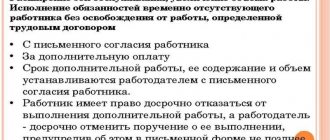

In order for the replacement of an employee to be legal, three conditions must be met simultaneously.

- Written agreement of the parties. Without the written consent of the employee (additional agreement), the employer cannot involve him in replacing another employee.

- Organizational order. Any replacement option must be formalized by order of the head of the institution, carried out in the usual manner.

- Assignment of additional payment for additional work. The temporary replacement must be paid in addition to the regular remuneration of the employed employee. The amount is not specified by law; it can be calculated in any way convenient for the employer and to which the employee agrees.

FOR YOUR INFORMATION! The employee’s signature confirming familiarization with the order does not constitute a legal basis for issuing a replacement. An additional document is also required that specifically formalizes the consent of both parties, that is, both clauses 1 and 2 must be available, without excluding or replacing each other.

The legislative framework

The procedure for determining the amount of additional payment to an employee when replacing an absent employee is enshrined in the Labor Code of the Russian Federation:

| No. | Regulatory document | Description |

| 1 | Art. 151 Labor Code of the Russian Federation | This provision of the Labor Code confirms the employee’s right to receive additional payment for a temporarily absent employee in the following cases:

The amount of additional payment for the replacement period is established by agreement of the parties and in accordance with the nature and volume of additional work. |

| 2 | Art. 60.2 Labor Code of the Russian Federation | The regulatory document defines the concept of additional work, for which an additional payment is charged in accordance with the established procedure. Also, this provision of the Labor Code of the Russian Federation describes the procedure for early refusal to perform additional work on the part of a replacement employee, as well as at the initiative of the employer. |

When working part time

It should be noted that an employee working as a part-time worker may insist on establishing a partial shift or day . This right is granted to him by Article 93 of the Labor Code.

Expert opinion

Kostenko Tamara Pavlovna

Lawyer with 10 years of experience. Author of numerous articles, teacher of Law

For example, if the amount of additional payment was established in the agreement at 10% of the salary, the calculation will be made using the following formula:

- the full salary is multiplied by the number of hours actually worked and divided by 160 hours (the number of working hours per month at full time);

- the resulting value (salary amount without additional payment) is multiplied by the amount of additional payment (10%) and divided by 100%;

- the salary for part-time work (the value obtained in the first action) is summed up with the amount of additional payment (the value obtained in the second action) - as a result, the accountant will receive the exact amount of the salary due to this employee.

To calculate an employee's salary you must:

As a result, the engineer’s salary will be the basic salary plus additional payment for part-time work.

How is additional payment calculated for a temporarily absent employee?

In accordance with the Labor Code of the Russian Federation, additional payment for a temporarily absent employee is accrued by agreement of the parties - the employer and the employee assigned to perform additional work. Thus, the amount of the surcharge and the procedure for its calculation can be fixed in:

- employment contract;

- collective agreement;

- The procedure for remuneration, or other documents regulating the mechanism for calculating and calculating wages and other monetary remunerations at the enterprise.

The amount of additional payment for performing the duties of a temporarily absent employee can be calculated either in a fixed form (the so-called “flat rate”) or as a percentage of the salary . Below we will look at the procedure for calculating surcharges for each method and look at an example.

Firm bet

At many enterprises, additional payment for a temporarily absent employee is calculated in a fixed form, namely in fixed monetary terms. In this case, the additional payment does not depend on the income of the absent or replacement employee, but is paid in the amount established by the employment/collective agreement.

In the case of an additional payment at a fixed rate, organizations use a gradational approach to determining the amount of payment in accordance with the complexity of the work performed, its volume, and level of responsibility. In other words, the amount of payment is set in different amounts, depending on the position of the replacing (absent) employee.

In addition, in large companies and large manufacturing enterprises with a complex and branched organizational structure, the amount of additional payment is fixed separately for each structural unit.

The essence of the problem

The provision of human resources is a problem in all areas of activity.

Not only is it difficult to find a decent specialist, but also the main employee may be absent for a long time. For example, in the summer, when the busy holiday season begins, the enterprise begins to have widespread holidays and business becomes difficult. In addition, any employee can get sick. It's good if the cold ends in one or two weeks. But situations are different. There are many reasons for employees being absent from work. But the company's activities should not suffer. Therefore, it is important for the employer to take care of the duties of absentees. It is not enough to arbitrarily assign responsibilities to a subordinate; you need to pay for the work above the norm.

How to apply for additional payment for performing the duties of a temporarily absent employee

Below are step-by-step instructions for registering and calculating additional payments to an employee for performing the duties of a temporarily absent employee:

Step 1. Obtaining verbal consent from the employee

Before starting paperwork, you should obtain verbal consent from the employee to perform the duties of another employee during his absence. As a rule, at the initial stage, the employee’s immediate supervisor conducts a conversation with the subordinate, informing him of the need for a replacement (vacation, illness of another employee, other reasons) and obtaining consent or a reasoned refusal from the employee.

We emphasize that the manager does not have the right to force an employee to perform the duties of an absent employee. This decision is made solely by agreement of both parties - the employee and the company (represented by the manager).

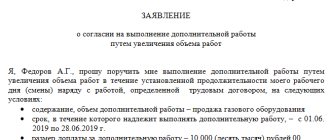

Step-2. Drawing up an application

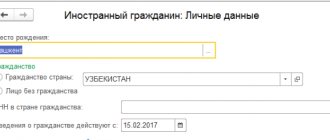

If the employee agrees to perform the duties of the absent employee, the manager invites him to fill out a corresponding application. There is no legally established form on which this application must be filled out, so the document can be drawn up in free form, indicating the required details:

- name of the organization;

- Full name, position of the absent and replacement employee;

- period of replacement of duties;

- reason for replacement (vacation, illness, other reasons);

- date of application, signature of the applicant.

A sample application can be downloaded here ⇒ Application to replace a temporarily absent employee (sample).

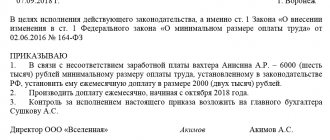

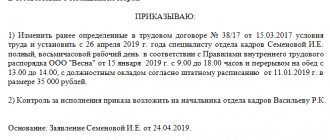

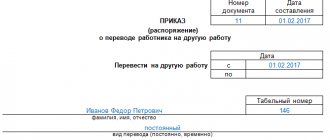

Step-3. Issuance of an order

A statement drawn up by the replacement employee and agreed upon by the manager is the basis for issuing the corresponding order. A sample order can be downloaded here ⇒Order to replace a temporarily absent employee (sample) .

Step-4. Accrual of surcharge

Based on the order, additional payments are calculated and accrued for the period of replacement of the absent employee and the performance of his job duties by the replacement employee.

Calculation of additional payments and payment of funds is carried out in accordance with the procedure and in the amount approved by the labor/collective agreement and internal regulations. As a rule, the employee is paid based on the results of the reporting month - along with the salary, the employee receives an additional payment for replacement.

Documenting

Sequence of several stages:

- Consent is obtained from the employee. First verbally, then in writing.

- The employee writes a written statement if he agrees to be replaced. In practice, the manager calls the employee to his place. He explains why substitution was needed and under what conditions the process takes place. As a rule, employees agree and write a statement in any form. The document reflects:

- information about the enterprise;

- information about the parties;

- reason for replacement;

- day of compilation;

- signature.

- The leader issues an order.

- An additional charge will apply for combinations. The basis for the calculation is an order. The amount of additional payment is established by agreements and employment contracts. According to the rules, the employee receives payment at the end of the reporting month.

Early refusal to perform the work of a temporarily absent employee

The current legislation enshrines the right of an employee to early refuse to replace an absent employee. To do this, the replacement should fill out a corresponding application and submit it to the manager no later than 3 days before the date of refusal to replace. For example, an employee who submitted an application on 06/18/18 may not perform absentee duties three days later, from 06/21/18.

A similar right is granted to the employer, who can notify the employee 3 days in advance of the early termination of replacement functions.

If the employee did not work all working days

If an employee did not work all working days in the current month, the additional payment is also calculated based on the hours actually worked. For example:

- The size of the basic salary is determined - 127 hours multiplied by 225 rubles.

- The amount of additional payment is determined - 127 hours multiplied by 332 rubles, and then multiplied by 0.5 (50%);

- The total amount is established - the two values obtained as a result of calculations are added.

You will find out the length of service for retirement in Russia under the new law in our article.

In 2021, Russian military pensions will be increased! Find out more about this event in the article.

There are some changes to unemployment benefits in 2021. Our material has all the information you need.

Video on the topic:

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

According to the current legislation of the Russian Federation, every employee has the right to vacation. During the rest period, the performance of his work duties is assigned to another employee.

To do this, the employee, according to regulatory requirements, needs to write an application to fill a position during vacation. To prepare the paper, it is recommended that you familiarize yourself with the rules for drawing up the document and the sample.

What is combination and how does it differ from part-time work?

Combination means that an employee, at the request of management, performs duties additional to his main job during his working day. This situation usually arises when it is necessary to perform the work of an employee who is absent for various reasons in parallel with the performance of his main job. This employee's work schedule becomes busier.

The need for combination usually arises in the following cases:

- the replaced employee goes on vacation;

- during the employee’s sick leave;

- absence of an employee for family reasons;

- under other circumstances.

Sometimes the concepts of part-time and combination are confused, thinking that these are synonyms of the same concept. In reality they have different meanings.

Expert commentary

Kamensky Yuri

Lawyer

Part-time workers work additionally in another company or organization outside of their main job, time. According to the law, the duration of a part-time worker’s work cannot last more than 4 hours, while part-time work does not imply regulation of the time for performing additional work. The main thing here is the result of its implementation in parallel with the main work. In this case, combination is possible if this does not affect the quality of performance of the main job responsibilities, for example, the quantity and quality characteristics of labor. Usually, in order to prevent additional workload from affecting the performance of the main work process, the organization’s management finds a way out by offering to replace the employee with an employee who knows his functional responsibilities.

Answers to frequently asked questions

Question No. 1: The employer assigned his employee to perform one more duties (new job). The parties reached certain agreements, but there was no formalization. Can an employee, under these circumstances, demand payment for combining?

This is important to know: What water meter readings need to be transmitted and how to do it

Maybe, and by all available legal means. But if the case goes to court, then the person in question will need to prove that he actually combined work, provide documentary evidence, etc. In the absence of any evidence, it will be very difficult for the employee to achieve a positive decision.

Question No. 2: Are there additional days off for combined work? And are they paid?

No. The Labor Code of the Russian Federation does not provide for additional rest in such cases. But when calculating vacation pay for the main paid vacation, an additional payment for combined work is included in the calculation base.

Employer's liability for lack of payments

The employer, unless otherwise provided by law, is obliged to pay additional payments to employees. If he does not do this, he can be brought to administrative responsibility. In particular, the employer is issued a fine in the amount of 1,000-5,000 rubles. The amount of the fine is established by Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

How to hold an employer accountable? You can contact the labor inspectorate. Upon the employee's application, the company is checked. An alternative option is to file a claim in court. The second option is more preferable. When contacting the labor inspectorate, you need to understand that the inspection will not be carried out immediately. As a rule, it is carried out within a month. During this period, the conflict that has arisen may no longer be relevant. Moreover, it is quite difficult to detect an offense during an audit.

Calculation procedure

Additional payment can be set in two ways: a fixed amount or a percentage of the salary for the position being filled.

When choosing compensation that is a certain percentage of salary, you must first calculate the amount based on the established percentage.

Example: for combining a position, a person receives 50% of 20 thousand rubles. This amounts to 10 thousand rubles. The employee's salary is 30 thousand rubles. Thus, wages are calculated as (30,000 + 10,000) – 13% personal income tax = 34,800 rubles.

It is important to remember that compensation is calculated in proportion to the time worked if the month was not fully worked.

Combination restrictions

The code does not contain information about restrictions on combining positions. Almost any employee in an organization can be assigned this type of work. There are two important factors to consider:

Any combination must be included in working hours, and not in excess of its norm.

It is advisable to combine positions of similar professions or employee qualifications. This is due to more competent performance of duties without wasting time on training.

However, we should not forget about the privileged category of citizens: pregnant women, disabled people, minor employees and mothers with children under three years of age. Although the law does not prohibit them from increasing the load, it is better to insure against unpleasant consequences.

This is important to know: Administrative arrest: the period to whom it cannot be applied

To do this, you can discuss all working conditions, assess their applicability to these individuals and sign all the necessary documents.