Other means those not directly related to the main activities of the enterprise. These expenses and incomes are very important within the general business practice of the company; they cannot be avoided, despite the fact that they are auxiliary. Accountants often find it difficult to attribute financial results to the correct balance sheet item. Today we’ll look at other income and expenses.

Question: How to reflect the bank’s commission for issuing a loan in accounting, as well as in the financial statements of an organization? According to the accounting policy of the organization, for accounting purposes, additional costs for loans and credits are included in other expenses evenly over the term of the loan (credit). The commission amount was 12,000 rubles. (NDS is not appearing). The term of the loan provided to the organization to replenish working capital is nine months. Accounting statements are prepared as of the last day of each calendar month. Tax accounting uses the accrual method. Reporting periods for income tax are one month, two months, three months, and so on until the end of the calendar year. View answer

Which are included in other expenses?

The basic composition of other expenses of an organization in accounting is regulated by the third section of PBU 10/99.

Thus, other expenses are included in accounting (if these are not expenses for ordinary activities in accordance with clause 5 of PBU 10/99):

- expenses associated with the provision for a fee for temporary use (temporary possession and use) of the organization’s assets;

- costs associated with the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property;

- expenses associated with participation in the authorized capitals of other organizations;

- expenses associated with the sale, disposal and other write-off of fixed assets and other assets other than money (except foreign currency), goods, products;

- interest paid for the provision of funds (credits, borrowings) for use;

- expenses related to payment for services provided by credit institutions;

- contributions to valuation reserves created in accordance with accounting rules (reserves for doubtful debts, for depreciation of investments in securities, etc.), as well as reserves created in connection with the recognition of contingent facts of economic activity;

- fines, penalties, penalties for violation of contract terms;

- compensation for losses caused by the organization;

- losses of previous years recognized in the reporting year;

- amounts of receivables for which the statute of limitations has expired, and other debts that are unrealistic for collection;

- exchange differences;

- the amount of asset depreciation;

- transfer of funds (contributions, payments, etc.) to charity, expenses for sporting events, recreation, entertainment, cultural and educational events and other similar events;

- other expenses.

Please note that other expenses also include expenses arising as a consequence of emergency circumstances of economic activity - natural disaster, fire, accident, nationalization of property, etc.

Also see “How expenses are recognized in accounting.”

Read also

18.07.2019

Postings for accounting for other expenses

Transactions on other expenses are reflected in account 91 “Other income and expenses”, the debit of which records expenses, and the credit records income. Accounting is carried out using the following subaccounts:

- 91-1 “Other income”;

- 91-2 “Other expenses”;

- 91-9 “Balance of other income and expenses.”

Account 91 at the end of each month does not have a balance - debit and credit turnovers are calculated, their total balance is displayed and recorded on subaccount 91-9 in correspondence with account 99 “Profits and losses”.

The wiring will look like this:

- Dt 91-9 Kt 99 - profit made;

- Dt 99 Kt 91-9 - losses received.

It is recommended to keep analytical accounting of other expenses in account 91 separately for each of the operations in order to have before your eyes a complete picture of their impact on the results of the company’s work.

You can see examples of accounting entries in connection with the recognition of other expenses in ConsultantPlus. Trial access to the system is provided free of charge.

The total balance on account 91 on the last day of the month is zero, but debit and credit amounts have been accumulated on its subaccounts since the beginning of the year. At the end of December, amounts from subaccounts 91-1 and 91-2, collected for the year by internal postings, are transferred to subaccount 91-9:

- Dt 91-1 Kt 91-9 - transfer of the balance of other income.

- Dt 91-9 Kt 91-2 - transfer of the balance of other expenses.

In the financial statements, other expenses are indicated in the income statement on line 2350.

An example of filling out line 2350 can be found in the Guide to Accounting Reports by receiving a free trial access to ConsultantPlus.

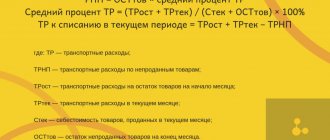

Information used to fill out line "2350"?

The information base for line 2350 of the financial document under consideration is the final turnover indicator. In this case, the following are not taken into account:

- accounts on which interest is payable

- value added tax invoices

- excise taxes

- other similar obligatory financial resources that the company receives from contractors and citizens

Data Search

The indicator for Dt 91-2 corresponds with the credit of various accounts: account. 01, count. 02, count. 10, count. 50, count. 52, count. 60, count. 62, count. 76.

In the financial report it is allowed not to make a detailed reflection of other expenses:

- If the accounting rules provide for or do not prohibit their reflection in this form.

- If the company’s income and the costs associated with them arose from one identical fact of entrepreneurial actions and are not particularly significant in the final parameter of the financial condition of the enterprise.

Program for checking PD&R accounting

The procedure for this type of audit is not too different from general audits. Most often, an audit of other income and expenses is structured according to the following scheme.

- Analysis of business transactions for other income and expenses from the point of view of their legality and correctness.

- Studying the reflection of these transactions in accounting accounts.

- Checking specific figures, comparing sources.

The audit plan is built on the principle “from specific to general”, that is, specific documents are first checked, on the basis of which a conclusion is drawn about compliance with the provisions of accounting policies and legal requirements. It may look like this:

- Recording the existence of contracts with persons bearing financial responsibility.

- Checking compliance with the provisions of internal regulations:

- comparison of the actual assessment of PD&R and their assessment according to the methodology of accepted internal accounting;

- the validity of classifying expenses and income as other;

- the methodology for determining PD&R, indicated in the accounting policy, in comparison with the one actually applied.

- The audit of the PD&R itself (separately for other income and other expenses) is carried out using primary documentation and accounting registers.

- Checking the PD&R inventory.

Sources of data when accounting for PD&R

Information for verification is taken from the following documents:

- local regulations of the company;

- financial statements;

- results of past similar inspections;

- data from conversations with company representatives and (sometimes) third parties;

- information from the internal audit of the enterprise.

NOTE! The direct verification of PD&R accounting should be preceded by an analysis of the internal control system operating in the organization. Its results will become a factor in the reliability and reliability of subsequent data obtained.

FOR EXAMPLE

In September 2012, Leto LLC entered into an agreement with an auditing organization to conduct an initiative audit of the financial statements for 2012. The total cost of audit services is RUB 708,000. (including VAT - 108,000 rubles). According to the terms of the agreement, the audit is carried out in 2 stages.

- Stage 1 - inspection of 9 months of 2012 - was carried out from November 5 to 16, 2012, the cost of services for stage 1 was 531,000 rubles. (including VAT - 81,000 rubles), upon completion of the inspection, a certificate of services rendered for stage 1 dated November 16, 2012 and an invoice dated November 16, 2012 were issued.

- Stage 2 - inspection of the 4th quarter of 2012 - was carried out from March 11 to March 15, 2013, the cost of services for stage 2 was 177,000 rubles. (including VAT - 27,000 rubles), upon completion of the inspection, a certificate of services rendered for stage 2 dated March 15, 2013, an invoice dated March 15, 2013, and an audit report for 2012 were issued.

Under the terms of the agreement, in September 2012, the customer transferred to the contractor an advance in the amount of 60% of the total cost of services in the amount of 424,800 rubles. (including VAT - 64,800 rubles). The audit organization issued an invoice dated September 30, 2012 for the amount of the advance.

The final payment is made after the submission of the audit report and the signing of the act on the provision of audit services for stage 2. The amount is 283,200 rubles. (including VAT - 43,200 rubles) the customer transferred on March 18, 2013.

In accordance with the accounting policy of the organization, for tax purposes, the date of incurring other expenses is the date of the act of rendering services.

Tax Code: other expenses for taxation

In order to correctly form the profit received for calculating tax, you must be guided by a special list of non-operating expenses, which contains Art. 265 Tax Code of the Russian Federation. This list includes:

- costs of maintaining the leased property;

- interest paid on loans taken;

- negative exchange rate differences;

- expenses for disposal of fixed assets;

- court fees and charges;

- maintenance of unused property;

- fines for violation of contractual terms.

Non-operating expenses also include losses from natural disasters, bad debts, damage to material assets in the absence of the culprit, etc.

The list of such expenses is open. It may include other expenses of the enterprise that are not related to production and sales. The main thing is that it is necessary to comply with the condition specified in paragraph 1 of Art. 252 of the Tax Code, - expenses are necessary for the full-fledged activities of the organization and must be documented properly and with all the necessary details.

The moment of recognizing an expense for calculating taxes is also stipulated in the Tax Code of the Russian Federation. If, according to the accounting policy of the organization, the accrual method is used, then you need to use the instructions of clause 7 of Art. 272 of the Tax Code of the Russian Federation. When using the cash method, to write off non-operating expenses, you must be guided by clause 3 of Art. 273 Tax Code of the Russian Federation.

You will learn what the Tax Code says about non-operating expenses from the article “Art. 265 of the Tax Code of the Russian Federation: questions and answers.”

Results

Reliable reflection of other expenses in accounting and tax accounting helps not only to rid the company of claims from controllers, but also to obtain information for making strategic decisions.

Therefore, it is important for an accountant to correctly identify an expense business transaction, using the norms of accounting and tax legislation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Negative factor

If the indicator decreases

Positive factor

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- Other income 2340 Definition Other income 2340 is the other income of an organization that is not income from core activities, that is, revenue: receipts associated with the provision for a fee...

- Cost of sales 2120 Definition Cost of sales 2120 is part of the expenses for ordinary activities and includes expenses associated with the manufacture of products and the sale of products, the acquisition and sale of goods, ...

- Revenue 2110 Definition Revenue 2110 is income from ordinary activities - revenue from the sale of products and goods, income related to the performance of work, provision of services. IN…

- Administrative expenses 2220 Definition Administrative expenses 2220 are a separately allocated part of the cost of sales of an enterprise in the form of general business expenses. Administrative expenses may include the following expenses: administrative and management expenses; on the…

- Income from participation in other organizations 2310 Definition Income from participation in other organizations 2310 is income from participation in the authorized capitals of other organizations: income associated with participation in the authorized capitals...

- Other non-current assets 1190 Definition Other non-current assets 1190 are assets whose circulation period exceeds 12 months and which are not reflected in other lines of Section I of the balance sheet. To them…

- Selling Expenses 2210 Definition Selling Expenses 2210 is a separately allocated portion of a business's cost of sales in the form of selling expenses. Organizations conducting production activities reflect on this line...

- Financial investments 1170 Definition Financial investments 1170 are financial investments of an organization, the circulation (repayment) period of which exceeds 12 months from the moment on which the reporting was prepared (from the reporting date): state ...

- Profitable investments in material assets 1160 Definition Profitable investments in material assets 1160 - investments of an organization in property, buildings, premises, equipment and other material assets provided by the organization for a fee for a temporary...

- Profit (loss) before tax 2300 Definition Profit (loss) before tax 2300 is the difference between all the organization’s income (from core activities and from other activities) and all its expenses, but...