Interest-free loan: basic provisions

The issuance of interest-free loans to employees is regulated by the Civil Code, namely the 1st paragraph of Chapter 42. The subject of the loan can be both money and things. In this case, an agreement must be concluded in writing between the employer and the employee (Article 808 of the Civil Code of the Russian Federation). The contract must state that the loan is interest-free. Otherwise, the default interest rate will be equal to the refinancing rate (Article 809 of the Civil Code of the Russian Federation). However, there are exceptions. If the agreement of the parties does not contain a word about interest, then the loan will be considered interest-free when:

- the agreement was concluded between citizens for an amount less than or equal to 50 minimum wages, not for business purposes;

- Things are given on loan.

In addition, the contract must specify the return period. If such a date is not specified, the borrower must be prepared to repay the debt within 30 days after receiving a request to do so. Also, at his discretion, an employee can repay an interest-free loan (hereinafter referred to as the LO) ahead of schedule.

Features of obtaining a loan

From the point of view of financial benefits and ease of registration, a cash loan from an organization is many times more attractive for an individual than the lengthy and complex process of obtaining a bank loan. Typically, the interest rate on such a loan is zero. In addition, there is no need to waste time collecting documentation.

In accounting, it is necessary to correctly reflect the allocation of a sum of money, the repayment by the borrower of obligations incurred and the tax consequences associated with this procedure.

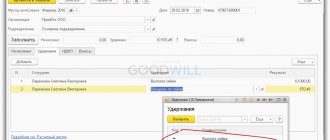

An interest-free loan was issued: accounting

Let's consider what entries an accountant should make for an interest-free loan to an employee. For settlements of loans to employees, the chart of accounts approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 200 No. 94n provides for account 73.

| Description | Dt | CT | Documentation |

| Posting for issuing an interest-free loan to an employee in cash | 73.1 | 50 (51) | Expenditure cash order (payment order, bank statement) |

| Posting for repayment of cash balance by employee | 50 (51) | 73.1 | Receipt cash order (payment order, bank statement) |

The financial investment account is not used in transactions for interest-free loans issued to employees; this is indicated in the instructions for the chart of accounts for account 58. It is also necessary to pay attention to the reflection of transactions for personal income tax, which must be paid if the employer does not charge interest on the loan. Read more about personal income tax in the following sections.

| Description | Dt | CT | Documentation |

| Personal income tax withheld from income from non-payment of interest on the loan | 70 | 68 | Tax registers |

| Personal income tax is transferred to the budget | 68 | 51 | Payment order, bank statement |

Debt write-off (forgiveness)

In a situation where the head of an organization decides to forgive the amount of debt to his employee, he will need to perform a number of actions established by law:

- First of all, the fact of debt forgiveness is documented in writing. This may be an agreement on donating funds to an employee of the organization, signed by the manager. Another documentation option is an official notification of forgiveness of the amount of borrowed funds.

- In the current situation, the amount of forgiven debt constitutes a certain material benefit. According to current legislation, a tax of 13% is charged on it. The date of accrual of income tax is the day when the corresponding document is signed.

- If the organization (or managers) decide not to withhold the debt from the employee, then the tax accrued on the amount of profit from the saved interest payments is withheld from the individual’s wages until full repayment.

As a result, the following are subject to taxation:

- amount of debt (forgiven);

- benefit from interest savings at the forgiveness date;

- income paid to an employee (personal income tax).

In this case, the total amount of taxes withheld cannot be more than half the monthly salary of an individual.

Taxation of material benefits

The MV amount is the tax base for personal income tax (Article 210 of the Tax Code of the Russian Federation). The tax is calculated at a rate of 35% for residents and 30% for non-residents (clauses 2–3 of Article 224 of the Tax Code of the Russian Federation). Thus, from the employee’s income, which the employer pays him monthly, the corresponding percentage of personal income tax from his MV from the BZ must be withheld. The amount of deduction cannot be more than 50% of income in cash, which is paid this month (clause 4 of article 226 of the Tax Code of the Russian Federation). If the withholding amount exceeds the maximum, the balance is carried over to the next month. If it was not possible to withhold personal income tax during the tax period, the employer must inform both the tax office and the employee about this by sending them a 2-NDFL certificate. The employer pays the withheld personal income tax on the day of payment of income or the next (clause 6 of Article 226 of the Tax Code of the Russian Federation); personal income tax cannot be paid in advance (clause 9 of Article 226 of the Tax Code of the Russian Federation).

An example of calculating personal income tax from the material benefit of saving on interest with an interest-free ruble loan from ConsultantPlus. On June 5, 2021, the employer issued the employee Romashkina V.V.

(tax resident of the Russian Federation) interest-free loan in the amount of 130,000 rubles. until August 1, 2021. The employee transferred the entire loan amount to the organization’s account on July 31, 2021. The refinancing rate of the Bank of Russia during this period is 7.5% (conditionally). The employer calculated personal income tax on material benefits as follows. You can view the entire example in K+ by getting free trial access.

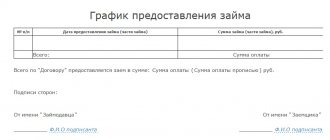

Loan agreement without interest

Any transaction in this case is recorded in writing. In the agreement on issuing a loan on a gratuitous basis, this fact must be reflected. The absence of a clause on the gratuitous nature of financial assistance entails automatic accrual of interest.

The agreement must indicate:

- loan amount;

- repayment period;

- special purpose.

The agreement contains the following information:

- place and date of issuance of borrowed funds;

- name of the organization and full name of the head;

- personal information about the borrower;

- repayment scheme and terms, possibility of early repayment;

- ways to resolve disputes;

- document confidentiality clause;

- options for force majeure situations that release the parties to the transaction from their obligations under this agreement.

If the loan period is extended or other changes occur, this is stated in the additional agreement. The additional agreement document becomes part of the main loan agreement.

Interest-free loan for home purchase

Taxation of personal income tax for MV has exceptions specified in subsection. 1 clause 1 art. 212 of the Tax Code of the Russian Federation. One of them is that if the purpose of the BP is defined as the construction or acquisition of housing in our country, as well as land for its construction, then the MV for such BP is not recognized as income. In this case, the employee to whom such a work permit was issued must have the right to a property deduction. This deduction must be confirmed by a special notice issued by the tax authority, the form of which was approved by order of the Federal Tax Service of the Russian Federation dated January 14, 2015 No. ММВ-7-11/ [email protected]

Thus, until the employee brings the specified notice, the accountant withholds personal income tax from him every month from the MV according to the BZ. After confirmation of the right to a property deduction, personal income tax is not accrued, however, the employer cannot return previously withheld personal income tax amounts, since they are not considered excessively withheld in accordance with clause 1 of Art. 231 Tax Code of the Russian Federation. You can return personal income tax amounts that were withheld before the notification was provided yourself at the tax office at your place of residence. Such clarifications are given in the letter of the Ministry of Finance of the Russian Federation dated March 21, 2013 No. 03-04-06/8790.

NOTE! Starting from 2021, financial benefits arising during mortgage holidays are not subject to personal income tax.

When is it not permissible to enter into a contract?

An interest-free loan cannot be issued to an employee under the following conditions:

- the employer signs the agreement under threats or blackmail;

- any participant in the transaction is in a state of intoxication, which may be narcotic or alcoholic;

- Many companies do not provide non-targeted loans, so money is offered only on the condition that it will be used for significant purposes, for example, buying a home, paying for children’s education, or treating an employee and his close relatives.

If the above requirements are violated, the signed agreement is easily invalidated. This leads to the fact that the employee will have to return all funds received ahead of schedule. Additionally, he will be held accountable if he blackmailed or forced the employer to give out a sum of money.

Interest-free loan in kind: taxation

An employee’s knowledge book can be issued to the company’s goods, materials, fixed assets, etc. The things transferred must be defined by generic characteristics, that is, they cannot be unique with specific characteristics that only they have. A non-monetary loan can be repaid in money or the same things. The main qualities of the transferred items should be indicated in the contract (name, grade, quantity, size, etc.) so that the borrower returns the corresponding property.

When issuing this type of work permit, the employer must take into account some taxation nuances. As for income tax, the transfer of money or things as a loan is not considered an expense (clause 12 of Article 270 of the Tax Code of the Russian Federation), and repayment of the loan is not considered income (clause 10 of Article 251 of the Tax Code of the Russian Federation). Cash loans are not subject to VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation). Under a non-monetary loan agreement, the employer's property becomes the property of the employee. In paragraph 1 of Art. 39 of the Tax Code of the Russian Federation, the sale is equated to the transfer of ownership of things, and, according to subparagraph. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, the sale is called an object for VAT. Therefore, the transfer of things under the BZ agreement is subject to VAT. The price of the transferred property is determined as the current market price. When calculating such VAT, the employer has the right to deduct the corresponding input VAT that he paid when purchasing valuables transferred under the BZ.

Example 2

01/01/2020 V. A. Sokolov received ceramic tiles produced at the Voskhod LLC enterprise, where he works, as a BZ. The cost of the tiles was 135,000 rubles. without VAT. The loan term is 1 year. The employer must pay VAT to the budget in the amount of 135,000 rubles. × 20% = 27,000 rub.

How to apply for a cash loan?

The application procedure is not complicated. The employee submits a written application addressed to the head of the organization. The manager reviews the appeal and makes a decision.

If the outcome of the case is positive, the organization issues a corresponding notification (instruction, order). The issuance of funds is carried out on the basis of a loan agreement. It contains the details of the parties and the conditions for issuing and repaying the loan.

The following can be used as a source of financing in such a situation:

- personal funds of the manager (or individual entrepreneur);

- part of the authorized, reserve or other fund of the organization;

- retained earnings.

In exceptional cases, when allocating a large sum for specific purposes stated in the application, the manager has the right to request an apartment plan, an agreement of intent for the purchase of real estate, a medical report, and so on.

Interest-free loan in kind: accounting

The accounting value of the transferred assets may or may not correspond to their assessment in the business contract. If a difference exists, it will be reflected in other income or expenses. In accounting, transactions on business history are reflected as follows:

| Description | Dt | CT | Documentation |

| The book value of the property was written off when issuing a business license | 73.1 | 41 (01, 10…) | Transfer and acceptance certificate (invoice) |

| Income is reflected if the contract value is higher than the book value | 73.1 | 91.1 | Transfer and acceptance certificate (invoice) |

| An expense is reflected if the contract price is lower than the book value | 91.2 | 73.1 | Transfer and acceptance certificate (invoice) |

| VAT is charged on the amount of the loan issued by the property | 73.1 | 68 subaccount “VAT” | Invoice |

| Repayment of debt in kind with property or money | 41 (01, 10, 50, 51…) | 73.1 | Acceptance certificate (invoice), payment order, bank statement |

Example 2 (continued)

The book value of the tiles was 105,000 rubles. Let's assume that the refinancing rate did not change throughout the year and amounted to 9% (conditionally). Then the personal income tax amount will be equal to: 35% × 2/3 × 9% × 159,300 = 3,345 rubles. The accountant recorded the following entries:

| Description | Dt | CT | Sum |

| The book value of the property was written off when issuing a business license | 73.1 | 41 | 105 000 |

| The excess of the contract value over the book value is reflected | 73.1 | 91.1 | 30 000 |

| VAT is charged on the amount of the loan issued by the property | 73.1 | 68 subaccount “VAT” | 24 300 |

| BZ extinguished | 41 | 73.1 | 159 300 |

| Personal income tax withheld from MV according to BZ | 70 | 68 subaccount “NDFL” | 3 345 |

| Personal income tax is transferred to the budget | 68 subaccount “NDFL” | 51 | 3 345 |

Debt repayment methods

In the process of drawing up an agreement on the basis of which an interest-free loan is provided to an employee, the nuances of the return of funds by the hired specialist are discussed. To do this, the following actions can be performed:

- the debt can be fully or partially transferred to the company’s current account, for which the employee receives the details of this account from the employer in advance;

- money is deposited in cash into the company's cash desk;

- a certain part of the citizen’s salary is withheld monthly, as a result of which the debt is gradually repaid.

The specific method of repaying the debt is specified directly in the drawn up agreement. If such information is not available, the company may require the employee to use a method convenient for it.

Most often, information is included in the contract that a large debt is repaid by the employee by monthly transfer of a small amount of funds. It can be transferred to the company’s account or deposited in the company’s cash desk. If, for various reasons, the loan recipient systematically violates the terms of repayment of the debt, then the company can make a unilateral decision to withhold the required amount from the debtor’s salary. Under such conditions, changes may even be made to the contract; for this purpose, an additional agreement is drawn up.

Results

Currently, organizations are finding various ways to motivate employees; one of the options may be issuing a work permit. However, we must not forget that, despite the absence of interest, the employee will still incur associated expenses in the form of personal income tax with MV. And the responsibility for calculating and paying this tax to the budget lies with the employer.

Read about the BC for organizations in our article “Is an interest-free loan subject to income tax?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Organizational requirements for employees

Each organization has its own rules and procedure for lending to its employees, since there is no clear regulation in the law.

In some companies, the allocation of borrowed funds to an employee is possible subject to a certain length of service. Other employers incentivize workers with small short-term loans almost from the first month (or even day) of employment or after the expiration of an agreed probationary period.

One of the important conditions for an organization to issue loans to its employees is a stable financial position.

When considering a request for borrowed funds, the following shall be taken into account:

- work experience and personal characteristics of the applicant (employee qualities, responsibility, benefit to the company);

- average monthly salary;

- availability of existing loans and debts in relevant institutions;

- the purpose for which the employee required the loan.

Considering that the potential borrower works in this organization, documents confirming the identity and income of an individual are not required to apply for a loan. All information about the borrower is already available in the organization’s accounting department and human resources department.