Today, an invoice is a common document that serves as the basis for agreeing with management on payment by bank transfer/cash.

It indicates the seller or performer of a certain work (as a legal entity or individual entrepreneur), current account number and bank details, address, list of goods or services that are subject to payment. Quantity, price and, if applicable, VAT must be indicated. The date and number are needed only for internal document flow. It can be sent by fax, by mail, sent by courier, delivered in person, or electronically.

In what situations is an invoice issued?

Before the start of any cooperation, counterparties, as a rule, enter into agreements that stipulate payment terms, amounts and other terms of transactions.

In addition, our legislation does not require transactions without contracts. If the terms of the contract do not stipulate that the seller must issue an invoice for payment, there is no need to do this. In this case, the buyer must pay for the service or product only on the basis of an agreement.

But there are situations when you can’t do without an account. In the event that the terms of the contract do not specify the amount that the buyer must transfer, the seller must issue an invoice without fail.

This may be the case, for example, when paying for communication services: in contracts of this kind, the amount, as a rule, is not specified in advance. An invoice is issued when an organization carries out transactions subject to VAT, and in other cases established by law.

Such an invoice should be issued to the customer (or buyer):

- an organization exempt from VAT (Article 145 of the Tax Code of the Russian Federation);

- an organization that sells goods or services under an agency agreement on its own behalf, subject to the application of the general taxation system, clause 1 of Art. 169 Tax Code of the Russian Federation;

- an organization that has received an advance/partial payment towards the upcoming sale of goods from the customer (Article 168 of the Tax Code of the Russian Federation).

Payment of an individual entrepreneur's bill by an individual

An individual entrepreneur often provides services or sells goods to individuals. In such a situation, he also issues invoices for payment. An individual has the option to either use this account to transfer funds via bank transfer or pay in cash. However, it should be taken into account that an individual entrepreneur has the right to accept cash only in three cases:

- using a cash register;

- using strict reporting forms provided for by law;

- if the individual entrepreneur acts as a payer of UTII.

Why do you need an account?

Apart from issuing an invoice, there is no other way to speed up settlement between the parties . The invoice acts as a preliminary agreement, when the seller sets prices for his goods, and the buyer makes payment on its basis (without the actual existence of an agreement), the remaining documents are drawn up upon receipt of the goods. In this case, the invoice is usually issued in one copy.

In the financial industry, issuing an invoice is considered a serious business document. It is used mainly by legal entities and individual entrepreneurs who pay VAT.

Such an invoice may be issued by the seller (or performer) after the sale of goods or services. It is used to confirm payment of VAT and excise duty. In addition, it can inform about the country of origin of the goods and contains information about the customs declaration number (if the goods are imported). It is issued in a strictly established form and is considered the basis for deducting VAT amounts from the buyer. Issued in two copies.

Fines

The bank is obliged to report all suspicious deductions in favor of an individual to the Central Bank or the Federal Tax Service. The transaction will be subject to verification. If it turns out that a citizen received income from a legal entity, but neither party made the appropriate mandatory payments, a fine of 20% of the amount of unpaid taxes .

Important: in such situations, you yourself must prove that the funds received on the card were not income.

If intentional non-payment of tax is proven, the fine may reach 40% of the unpaid amount. In addition, penalties will be charged - 9% per annum.

In cases where legal entities illegally cash out funds by transferring them to the cards of ordinary citizens, the company may be subject to criminal liability, which will entail either a fine of up to 300 thousand rubles or imprisonment for 6 months.

Can I issue an invoice from an individual?

Since individuals who are not registered as individual entrepreneurs do not pay VAT, and an invoice can only be issued by an organization or individual entrepreneur with VAT, this function is not directly available to them .

Any serious company will not pay an invoice issued by an individual, exposing itself to taxes. Or you will have to register as an individual entrepreneur/closed joint stock company/LLC in order to be able to issue invoices, or draw up an agreement with an organization for the provision of a certain type of service, and it makes payment as an individual for the work performed. So, from a legal point of view, an individual and invoicing are incompatible concepts.

Information on how to obtain a copy of an individual’s TIN via the Internet is contained in this article. If you are wondering whether notification of the opening of a current account to the tax office or other authorities is required, find out about it here.

Commissions

The size of the commission for a transfer to an individual from a legal entity depends on the bank through which the transfer takes place. The percentage can vary from 0.5 to 10% of the total amount.

Important: the maximum commission amount is not limited

For example, at Sberbank the transfer fee is 1.1% of the amount, but not less than 115 rubles per transaction. The commission fee does not apply to the payment of wages, as well as to social and insurance contributions.

At VTB24 , the commission depends on the transfer amount. So, if you send up to 6 million rubles per month, the bank will take 1% of the transaction. Transfers over this amount are subject to a 10% commission.

Important: if an enterprise has concluded an agreement with VTB on a salary project, then the transfer of wages to employees is not subject to a commission.

Additionally, for any transfer to a card that the tax office may accept as undeclared income of an individual, you need to make 13% deductions.

Invoice for payment from an individual entrepreneur or LLC

Today there is no form approving the type of account or suggesting its standard . It is not even considered an accounting document. An invoice is issued and issued for payment electronically or in paper form. Be sure to indicate the following:

- details of an individual entrepreneur or legal entity (identification code, name of the organization, its legal form and legal address);

- details of the servicing bank (name, address, current and correspondent accounts, BIC);

- codes (OKPO, OKONH).

Blank form and example of filling out an invoice for payment

After the individual entrepreneur has indicated his and the buyer’s details, the invoice number and the date of its formation are entered and the presence or absence of VAT is indicated. At the end of the individual entrepreneur’s document, you must indicate your last name, initials and sign. It is not necessary to put a stamp.

Most often, an invoice is created in a standard office program, Excel or Word: there you need to create a template into which data will be entered in the future.

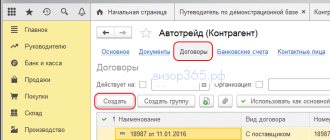

It’s even better to use a special program that generates invoices. In addition, it will automatically keep records of all completed transactions, significantly simplifying accounting reporting. It will also allow you to track the payment of bills, eliminating the occurrence of errors, for example, transferring money to another account.

The following video shows issuing an invoice in the 1C 8.2 program:

How much does the money cost?

After the sending company generates payment registers and submits a transfer order, the bank will begin to process the payment. This can take from one to several days, depending on what time the documents are submitted and how correctly they are completed.

All settlement transactions are carried out during the banking day, which most often ends at 16:00.

Important: the exact time depends on the bank branch, region and currency in which the transfer is made.

We issue invoices in English

An invoice in English - invoice - is often used in Russia without translation. This document, first of all, must contain the word invoice (in Russian and English).

According to the recommendations of experts, any invoice issued in English must include the following information:

- outgoing and incoming own number;

- name, contact details of the seller;

- information and contact details of the buyer or customer;

- discharge date;

- company and tax information;

- date of dispatch/delivery/purchase/services rendered;

- order number or other number by which the customer can track the progress of delivery;

- total amount;

- payment terms;

- and other information, for example, special conditions, information about taxes, penalties for late delivery, late payment or refunds in case of damage to the order.

Since when issuing an invoice in English, as a rule, we are talking about cooperation with a foreign partner, and the laws in his country may differ from ours, it is important to describe everything in detail in the invoices. The data specified in contracts and invoices must be identical to the information in the delivery notes.

Possible errors when drawing up a document

If we analyze the problems that arise when preparing invoices, we can identify the following common mistakes:

- Lack of decoding of signatures of authorized persons (in electronic invoices such an error is eliminated: an electronic signature is placed on the document, which already contains information about the signatory).

- Violation of the five-day deadline for issuing an invoice - in this case, the problem is the different understanding of the terms “date of preparation” of the invoice and “date of issue”. In paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, these concepts are not deciphered; it simply states that an invoice must be issued no later than 5 days from the date of shipment of goods. In addition, the details of the standard invoice form provide only one date, which is both the date of preparation and the date of issue.

- The invoice was not received in the tax period for which VAT was claimed for deduction (the Ministry of Finance recommends declaring the deduction in the same tax period in which the invoice was received). To eliminate this problem, organizations store envelopes, receipts, and keep logs of incoming mail.

- The seller's and buyer's copies of the invoice have different dates; as a rule, this is due to corrections (different copies of the same invoice are not evidence of the transaction).

- The presence of the signatures of the chief accountant and the manager on the invoice (according to the tax authorities, we are talking about using a facsimile signature, and on the basis of this you may be denied a deduction).

- Errors in the preparation of the invoice header (the name of the seller or buyer, their tax identification number or checkpoint, addresses, etc. are incorrectly indicated).

When an error is detected in the invoice, it is corrected in accordance with the established procedure (clause 29 of the Rules). If an invoice is corrected, the incorrect indicators are crossed out and the correct ones are entered, then the date of the corrections is indicated. Changes are certified by the signature of the manager and the seal of the enterprise. Please note that only the organization that issued this document can make corrections to the invoice.

Invoice form

An invoice for payment is not a mandatory primary document; it is drawn up at the request of the parties. Despite the fact that a unified form of invoice for payment has not been approved, there is a certain set of details that should be included in it. The account consists of several sections:

- The name of the document and its date.

- Banking and other details of the recipient. This is the name of the bank, BIC, correspondent account, recipient's account number, as well as its name, INN and KPP.

- Information about the supplier and buyer - their names, all main codes, addresses and telephone numbers.

- Information about goods and services. As a rule, this is a tabular part in which goods and/or services are listed line by line, quantity, units of measurement, price and cost are indicated. At the end, the total amount for the account is summed up.

- Section for signature and seal (if applicable).

If necessary, additional information for the buyer can be added to the invoice. For example, the period within which payment must be made. Or a warning that after transferring money, the buyer must notify the seller.

On behalf of the organization, the document is signed by the director and chief accountant. How to issue an invoice from an individual entrepreneur? Everything is simple here - the entrepreneur himself is indicated as a signatory. This is the only difference between the payment invoice for an individual entrepreneur and the one issued by the company.

.