Types of postings for salaries and taxes

The total employee payroll for the month is displayed on the last day of that month. At the same time, the amounts for calculated tax (personal income tax) and accrued insurance premiums are formed.

In some cases, accrual occurs at other times. We are talking about payments when granting vacation, upon dismissal of an employee and other settlement cases.

Wages are generated using account 70. Accounting is kept separately for each employee. The cost account is determined depending on the employee’s employment in one of the structural divisions, on the specifics of the organization, for example:

- Dt 20 Kt 70 - wages accrued to employees of the main production;

- Dt 26 Kt 70 - salary of the management staff;

- Dt 44 Kt 70 - wages for employees of a trading enterprise.

The formation of wages and other payments is accompanied by the withholding of personal income tax and the calculation of insurance premiums. Income tax is withheld from the calculated amounts to employees, while the responsibility for transferring personal income tax falls on organizations as tax agents. Insurance premiums are calculated entirely at the expense of the employer.

To generate income tax data, a subaccount 68.1 is opened for account 68. When making records of insurance deductions, the following subaccounts are used:

- 69.1 - contributions to the Social Insurance Fund;

- 69.2 - insurance contributions to the Pension Fund;

- 69.3 - amounts in the Federal Compulsory Medical Insurance Fund;

- 69.11—accruals to the Social Insurance Fund for injuries.

Transactions on tax withholding and assessment of contributions are reflected in the following transactions:

- Dt 70 Kt 68.1 - personal income tax is withheld from accrued earnings;

- Dt 20 (23, 25, 26, 44) Kt 69 - insurance premiums have been charged.

General provisions of the PBU

All tax obligations, with the exception of insurance premiums, should be reflected in a special accounting account 68 “Calculations for taxes and fees”.

To ensure that the amounts of calculated tax payments are not confused, the company must detail the accounting data. To do this, you need to open subaccounts separately by type of obligation. It is necessary to write in the accounting policy which subaccounts a specific economic entity will use. All possible values are provided for in Order No. 69n on the approval of the Unified Chart of Accounts.

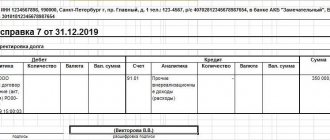

Please note that the company needs to carry out systematic reconciliations of mutual settlements with the Federal Tax Service. Self-control will allow you to avoid accrual of penalties, fines and penalties for late or incorrectly credited payments. To carry out the reconciliation, you will have to order a special certificate from the Federal Tax Service. For information on how to organize a check of calculations for fiscal payments, read the article “How to reconcile with the tax office.”

Typical payroll entries

In addition to the withholding tax, other withholdings may be necessary when calculating wages. For example, for loans:

This includes amounts for alimony and compensation for damage caused. Deductions are made after taxation of earnings:

- Dt 70 Kt 76 - amounts on writs of execution are withheld;

- Dt 70 Kt 73 - reflects other deductions from the employee’s income.

If the employee was on sick leave, the employer should calculate payments for the period of illness upon presentation of a certificate of incapacity for work. Based on the results of calculations, the following transactions can be generated:

- Dt 20 (23, 25, 26, 44) Kt 70 - sick pay is accrued at the expense of the employing organization;

- Dt 20 (23, 25, 26, 44) Kt 69.1 - sick leave at the expense of the Social Insurance Fund.

Collection procedure

Forcible collection occurs if the debtor refuses to pay them voluntarily.

The creditor himself does not have the right to take coercive measures against the debtor. This is done exclusively through the court.

You cannot go straight to the judiciary. You must first try to solve the problem out of court. To do this, the debtor is first sent a demand for voluntary payment of the debt, which includes the accrued penalty. The requirement is drawn up in the prescribed form. It is sent within 3 months from the date the debt arose. The demand is delivered in person. It can also be sent by registered mail. The document must indicate the following points:

- The time frame within which the arrears must be covered.

- The reasons on which the debt arose.

- The consequences that will be applied to the debtor if he does not pay the debt.

- Information from relevant laws.

The requirement may also not indicate deadlines. In this case, the debtor needs to repay the debt within 10 days.

If the debtor does not make any payments, the creditor has the right to go to court. After receiving the writ of execution, the production process begins. In the process, coercive measures are implemented:

- Write-off of funds from bank accounts in the amount of debt.

- Seizure of property.

- Ban on traveling abroad.

If a debt is not paid for a long time, it is considered uncollectible and is cancelled.

Features of calculating penalties

The penalty is calculated daily. Its size is determined as a percentage of the debt. For example, a person’s debt to the tax office is 1000 rubles. The penalty is set at 0.1%. The delay was 10 days. That is, the penalty will be 10 rubles. The arrears are determined based on the current Central Bank refinancing rate.

Accounting for penalties

How to record a penalty in accounting? There is no need to take into account the penalty in expenses, since it is unreasonable. Postings are used to reflect penalties in documents. To track penalties, you can create auxiliary subaccounts “Peni”. The amount of penalties is indicated in the “Losses” account.

When paying a penalty, two payment orders are issued. The documents are marked with different budget classification codes. These codes include 12 characters.

Example of accounting entries for wages

Let’s assume that employee K.V. Ivanov received a salary for September in the amount of 36,000 rubles. In addition, he has a writ of execution for the payment of alimony. Withholding percentage is 25% after tax.

What amounts for wages and contributions will be accrued, withheld, as well as postings for wages and taxes are presented in the table:

| Sch Dt | Sch Kt | the name of the operation | Amount, rub. | A document base |

| 26 | 70 | Salary accrued | 36 000 | Salary calculation |

| 70 | 68.1 | Personal income tax withheld | 4 680 | Salary calculation |

| 70 | 76 | The amount under the writ of execution was withheld | 7 830 | Salary calculation |

| 26 | 69.1 | Contributions to the Social Insurance Fund have been accrued | 1 044 | Salary calculation |

| 26 | 69.2 | Pension Fund contributions | 7 920 | Salary calculation |

| 26 | 69.3 | Contributions to the FFOMS | 1 836 | Salary calculation |

| 26 | 69.11 | Insurance premiums for injuries to the Social Insurance Fund | 72 | Salary calculation |

| 70 | 50 | Salary issued through the cash register after deductions | 23 490 | Payroll |

| 68.1 | 51 | Personal income tax listed | 4 680 | Payment order |

| 76 | 51 | Alimony payments listed | 7 830 | Payment order |

| 69.1 | 51 | Contributions to the Social Insurance Fund have been paid | 1 044 | Payment order |

| 69.2 | 51 | Pension Fund contributions | 7 920 | Payment order |

| 69.3 | 51 | Contributions to the FFOMS | 1 836 | Payment order |

| 69.11 | 51 | Contributions for injuries | 72 | Payment order |

We take into account penalties and fines in tax accounting and prepare entries

Fines and penalties are what determine financial liability for failure to fulfill obligations. There are two types of liability that are different from each other. One of them relates to the contractual sphere and is regulated by civil law, and the second by tax law.

When reflecting penalties and fines in tax accounting, as in accounting, you need to clearly understand what type of sanctions we are talking about - contractual or tax. This affects both postings and recognition as expenses when calculating income taxes.

Next you will learn about these differences, but first you need to understand how the Civil and Tax Codes interpret the concepts of “Fine” and “Penalty”.

The content of the article:

1. Penalty in the Civil Code of the Russian Federation

2. Fines and penalties in the Tax Code of the Russian Federation

3. Postings for accrual and payment of fines in accounting

4. Tax accounting of penalties under the contract

5. Do I have to pay VAT on the fine received?

6. Reflection of fines and penalties for taxes in accounting

7. Reflection of tax penalties in accounting

8. Tax sanctions - penalties and fines in tax accounting

9. Postings for calculating fines and penalties in 1C 8.3

Now we will cover each of these points in detail.

Penalty in the Civil Code of the Russian Federation

The Civil Code of the Russian Federation does not define fines and penalties, but there is such a thing as “Forfeit” (Article 330 of the Civil Code of the Russian Federation).

Almost all contracts have a liability clause, which usually stipulates the conditions under which a penalty arises and its amount. If this is a fixed value, then it is usually called a fine, and the penalty, which is obtained by calculation, is a penalty.

Usually, to calculate penalties, the percentage for each day of violation of the terms of the contract and the indicator from which the penalties are calculated are determined.

Fines and penalties in the Tax Code of the Russian Federation

From the point of view of the tax code, a fine is a type of tax sanction - a measure of responsibility for a tax offense committed (Article 114 of the Tax Code of the Russian Federation). The amounts of fines are determined in the Tax Code. They primarily depend on what tax law requirement was violated.

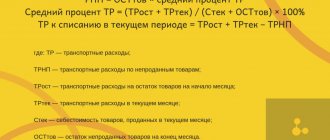

Penalty (Article 75) ─ the amount of money that the taxpayer pays in case of delay in paying taxes, contributions, and fees. Its value depends on:

- unpaid amount of mandatory payment

- duration of delay

- refinancing rate established by the Central Bank on the date of calculation of the penalty

If, in the event of a violation of contractual obligations, the violating party pays a fixed fine or an estimated amount of penalties, then in case of non-payment of taxes (contributions, fees) or parts thereof, the tax authorities will oblige the taxpayer to pay both the arrears, the fine, and the penalty.

Postings for accrual and payment of fines in accounting

Let's at accounting for a contractual penalty in the form of a fine using an example. According to the agreement, Osen LLC was supposed to supply Leto LLC with goods worth 50,000 rubles. Deadline ─ 06/15/2018. In case of violation of the deadlines, Osen LLC must pay a penalty in the amount of 3,000 rubles. The goods were delivered on 06/20/2018.

Documenting. If the contract does not specify the procedure for filing a penalty, then the injured party can file a claim and send it to the debtor. The claim must be accompanied by a calculation of the amount of the penalty.

According to clause 7 of PBU 9/99 “Income of the organization” and clause 11 of PBU 10/99 “Expenses of the organization”, fines and penalties are classified as other expenses.

Entries in accounting for fines - accrual:

From Leto LLC: Dt 76-2 ─ Kt 91-1 ─ 3000 rub.

From Osen LLC: Dt 91-2 ─ Kt 76-2 ─ 3000 rub.

Postings for paying a fine and receiving it:

From Leto LLC: Dt 51 ─ Kt 76-2 ─ 3000 rub.

For Osen LLC: Dt 76-2 ─ Kt 51 ─ 3000 rub.

Read on to see how penalties and fines are reflected in tax accounting.

Tax accounting of penalties under a contract

OSN

An organization or individual entrepreneur on the OSN ─ the injured party ─ must include fines and penalties received from the counterparty as non-operating income if they are recognized as a debtor or there is a court decision imposing a penalty that has entered into force (Clause 3 of Article 250 of the Tax Code of the Russian Federation) .

A company on the OSN that has violated the terms of the contract, after recognizing the penalty or in the event of a court decision, can recognize it when calculating income tax as part of non-operating expenses (clause 13, clause 1, article 265 of the Tax Code of the Russian Federation).

simplified tax system

Like companies on the simplified tax system, organizations and individual entrepreneurs on the simplified tax system must include penalties recognized by the debtor or by a court decision as part of non-operating income.

But a company that has violated the terms of the contract cannot recognize fines and penalties as part of its expenses, since they are not in the closed list of expenses of the simplified tax system (Article 346.16 of the Tax Code of the Russian Federation).

Please note that the fine recognized by the debtor and the fine paid by him are not the same thing. The penalty must be taken into account in income or expenses at the time it is recognized by the debtor.

Documents that can be used to confirm recognition of the fine:

- agreement with relevant conditions

- bilateral act

- letter from the debtor, by which he acknowledges the fact and amount of the penalty

Having such documents is extremely important when you reflect penalties and interest in tax accounting. This becomes especially important at the turn of tax periods. For example, the debtor recognized the penalty in 2018, but paid only in 2021. The amount of the penalty must be included in the 2021 tax return.

To avoid late payments to counterparties, do not forget to conduct regular reconciliations with them. How to do this correctly, read the article .

Do I have to pay VAT on the fine received?

Until recently, tax authorities, the Ministry of Finance and the courts did not have a clearly developed position regarding the inclusion of received fines in the VAT tax base.

Tax officials referred to paragraph 2 of paragraph 1 of Article 162 of the Tax Code, which states that the VAT tax base must include all amounts “related to payment for goods sold (work, services).” And since the receipt of fines and penalties from counterparties is, one way or another, related to sales, they must be subject to VAT.

But later, a different practice developed for assessing received fines from a VAT point of view.

There are penalties that the buyer receives from the seller , for example, for untimely delivery of goods. Such fines and penalties are in no way related to the sale of products and services, and they definitely should not be included in the VAT tax base. This is confirmed by the letter of the Ministry of Finance of the Russian Federation dated 06/08/2015 No. 03-07-11/33051.

In the opposite situation, when the seller receives a penalty from the buyer for late payment for goods, the courts and tax authorities could not reach a consensus for a long time. The courts believed that such a penalty does not apply to payment for goods (work, services) within the meaning of Article 162 of the Tax Code of the Russian Federation. Moreover, the SAC expressed its opinion back in 2008 ─ Resolution of the Presidium of the SAC dated 02/05/2008 No. 11144/07.

And letters from the Ministry of Finance (for example, dated August 17, 2012 No. 03-07-11/311) contained the opposite opinion.

As a result, in 2013, the Ministry of Finance, in letter dated 03/04/2013 No. 03-07-15/6333, agreed that penalties received by the seller from the buyer for late payment do not need to be included in the VAT tax base. In 2021, the Ministry of Finance, in a letter dated October 5, 2016 No. 03-07-11/57924, once again confirmed the same opinion.

Reflection of fines and penalties for taxes in accounting

Chapter 16 of the Tax Code of the Russian Federation lists possible types of tax offenses and liability for them. In each case, the tax office makes a decision, which is the basis for paying a fine.

Payment of penalties can be made by the taxpayer voluntarily. For example, a company drew up an updated declaration, paid additional tax, after which it calculated the amount of penalties and transferred it to the budget.

If the tax was assessed additionally by inspectors as a result of inspections, then the company will be charged with the arrears and will be required to pay a fine and penalties.

of tax fines

Dt 99 ─ Kt 68 ─ for the amount of the established fine

If you made a mistake in previous periods, you may have to correct it. How to do this, read the article about fixing errors .

Reflection of tax penalties in accounting

As for penalties , the regulations do not provide clear guidance on how to reflect them in accounting.

The instructions for using the chart of accounts establish that on account 99 it is necessary to take into account the “amounts of tax penalties due.” And penalties, according to the Tax Code of the Russian Federation, do not refer to tax sanctions (Chapter 15), but to methods of ensuring the fulfillment of obligations to pay taxes, fees, and insurance premiums (Chapter 11).

Therefore, there are two options for accounting for penalties.

First option . Take into account penalties on account 91-2 “Other expenses”. Although the article “Penalties paid on obligatory payments” is not in the list of other expenses in PBU 10/99, there is an item “other expenses” there.

Dt 91-2 ─ Kt 68 ─ for the amount of the penalty

The second option for accounting for penalties is to still use account 99. According to clause 6 of PBU 1/08 “Accounting Policy”, when reflecting the facts of economic activity, the priority of content must be observed over form. And in their meaning, penalties for late payment of taxes are close to fines, and therefore to tax sanctions.

The accounting entries for accrual of penalties in this case are the same as for fines:

Dt 99 ─ Kt 68 ─ for the amount of the penalty

In both options, you need to document the calculation of the amount of the penalty using an accounting certificate.

And since there are different ways to reflect penalties in accounting, it is better to consolidate the chosen option in the accounting policy.

Postings for payment of fines and penalties . The transfer of fines and penalties is reflected in accounting in the same way:

Dt 68 ─ Kt 51 ─ for the amounts of the listed fines or penalties

Tax sanctions - penalties and fines in tax accounting

Clause 2 of Article 270 of the Tax Code of the Russian Federation stipulates that all penalties and interest that were transferred to the budget for non-payment or late payment of taxes, contributions, and fees are not taken into account in expenses when calculating income tax.

This means that when a fine or penalty on taxes is paid, a permanent tax liability (PNO) appears in the organization’s tax records, which increases the amount of tax payable.

Do I need to make postings to take into account PNO?

If fines and penalties were accrued on the debit of account 99 and the credit of account 68, then in this case additional entries are not needed. The fact is that account 99 does not participate in the formation of the tax base for income tax.

In the case where penalties were taken into account in accounting on account 91-2 as other expenses, it is necessary to additionally accrue PNO:

Dt 99 ─ Kt 68 ─ by 20% (income tax rate) of the amount of penalties

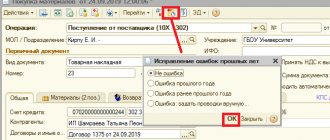

Postings for calculating fines and penalties in 1C 8.3

How to make entries for calculating fines and penalties in 1C 8.3, see this video.

There are no particular difficulties in accounting and tax accounting for fines and penalties. The main thing is to understand that there is a big difference between the consequences of failure to fulfill the terms of the contract and liability for violations of tax laws.

This is what influences how to reflect penalties and fines in tax accounting, whether to accept them or not for profit taxation, and which accounts will be included in accounting entries. Leave your questions about accounting for fines and penalties in the comments.

We take into account penalties and fines in tax accounting and prepare entries

Summary

Arrears are debts formed due to the fact that the enterprise does not make tax deductions, contributions to insurance funds, and the Pension Fund of the Russian Federation. Arrears are discovered during checks and errors in payment documents are discovered by the head of the company himself. Subject to recovery in court. First, the creditor sends a demand for payment to the debtor. If the debtor does not respond to the demands, the creditor has the right to appeal to a judicial authority. Collection occurs through withdrawal of funds from bank accounts and seizure of property.

How permanent tax assets and liabilities are accounted for

The difference between permanent differences (PD) and temporary ones is that they are not repaid over time, that is, they reduce or increase profits once and for all.

PR - those incomes (expenses) that are reflected in the accounting accounts, but are not taken into account when calculating the tax base (NB). Permanent negative differences form a permanent tax asset (PTA), permanent positive differences form a permanent tax liability (PTA).

Formula for determining PNA and PNO:

Postings for accrual of PNO and PNA

Accounting for permanent negative and positive differences is carried out on the active-passive 99 account. The accrued permanent liability is reflected in the postings:

| Dt | CT | Operation description |

| 68 | 99 | Accrual of PNA from a constant negative difference |

| 99 | 68 | PNO accrued from a constant positive difference |