When filling out tax documentation and payment orders, including declarations, it is worth choosing the correct budget classification code.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Why is it needed, which tax code for 3-personal income tax to choose in a specific situation and what do the numbers in it mean?

How to find out the BCC tax for 3-NDFL for 2018?

In the 3-NDFL declaration, it is most difficult to fill out the sheets with income and deductions, and even section 2 requires concentration and calculations, and the title one requires the indication of numerous data. Section 1 sheet is the easiest and fastest to fill out; it only requires 3 values:

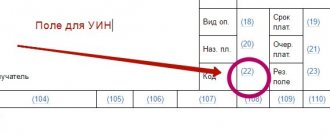

Line 020 in 3-NDFL is intended to indicate the BCC. Why is this code so important? The current budget system in Russia is divided into 3 levels - federal, regional and local, and each type of revenue has its own code. Such codes are necessary to organize and account for all income and expenses of the consolidated budget.

By indicating the KBK for filling out the 3-NDFL declaration, you identify the essence of your report - how all calculations are summarized: budget revenues or reimbursements from the budget. Depending on the code, the base of annual movements in the state treasury is formed.

Important! In order to correctly indicate the BCC in 3-NDFL for 2021, you need to rely on information from the Federal Tax Service of Russia, and also pay attention to what the result of your declaration is: income or expense of the country’s consolidated budget.

If you have questions or need help, please call Free Federal Legal Advice.

Budgetary accounting of funds received from the Social Insurance Fund

Outgoing account balances are transferred to the inter-reporting period, taking into account the compliance of the accounts of the Chart of Accounts of Budget Accounting, approved by Order No. 148n, with the accounts of the Unified Chart of Accounts and the Chart of Accounts of budgetary institutions:

Good afternoon We are a budgetary institution, the receivables were formed as part of the implementation of the FCD plan. Our financing is carried out by allocating a subsidy for the implementation of municipal tasks. Funds from the Social Insurance Fund were received into a personal account and immediately transferred to the budget revenue from which these expenses were financed. In my opinion, the funds were just passed through our personal account and should not have any impact on the relationship with the founder. And as a result of such transactions, a balance is formed either on account 303.05 or 401.10, which entails the founder’s receivables for the allocation of the 2021 subsidy in the form 0503769. It may be that there were letters from the Ministry of Finance of the Russian Federation dated December 22, 2021 N 02-06-07 /5236, No. 02-06-07/1546 dated 04/25/2021,

where it says: II. Implementation of legislative provisions on providing budgetary institutions with subsidies from the budget 4. When the founder makes a decision to provide a budgetary institution with a subsidy from January 1, 2021 from the relevant budget of the budgetary system of the Russian Federation in accordance with paragraph 1 of Article 78.1 of the Budget Code of the Russian Federation, the formation of opening balances on assets, liabilities and financial results are made as of January 1, 2021 in the following order. 4.1. During the inter-reporting period - upon the fact that the budgetary institution reflects on the budget accounting accounts of operations to close account indicators within the framework of the end of 2021 and before the reflection of the 2021 transactions on the accounts of the Unified Chart of Accounts, on the basis of the Certificate (f. 0504833), incoming account balances are formed The Unified Chart of Accounts and the Chart of Accounts for Accounting, approved by Order of the Ministry of Finance of Russia dated December 16, 2021 No. 174n “On approval of the Chart of Accounts for Budgetary Institutions and Instructions for its Application” (hereinafter referred to as the Chart of Accounts for Budgetary Institutions).

We recommend reading: Veteran Payments to Pensioners in 2021 in the Chelyabinsk Region

KBK for individuals in the 3-NDFL declaration

You can view the budget classification code in 3-NDFL for 2021 for individuals on the website of the Federal Tax Service of Russia. How to do it:

- Open the Federal Tax Service website and find the search box on the main page.

- In the search bar, enter “KBK”.

- In the output data, select the first line - codes.

- On the loaded page, click on the payer type.

- Select tax.

- A table with codes will open in front of you. Here you need to select the KBK in 3-NDFL that is suitable for your situation - tax payment, recalculation, penalties, etc.

Procedure for filling out an application

There is no official procedure for filling out the application, but it must include the following information:

- Name (code) of the tax authority to which the document is submitted.

- Reason for receiving benefits.

- Information about the deduction applicant (full name, TIN, passport details, place of registration).

- Information about the current account and the bank that opened it.

- Date and signature

When filling out the form recommended by the Federal Tax Service, pay attention to the tips given at the end of sheet 3.

KBK in 3-NDFL for individual entrepreneurs for 2021

Individual entrepreneurs submit a 3-NDFL declaration in 2 cases:

- they operate on a common taxation system;

- They work in a special regime, but in part of their income they are subject to income tax.

And for income not related to individual entrepreneurship, such persons are ordinary citizens - individuals, and enter the same BCC for the payment of personal income tax of an individual for 3-personal income tax.

How to find codes for individual entrepreneurs:

- When choosing a payer, go to entrepreneurs.

- Here you can also select income tax.

- The table will contain all the codes you need.

Reimbursement of benefits from the Social Insurance Fund

As supporting documents that are submitted with the application and the calculation certificate, the organization must submit copies of certificates of incapacity for work, birth certificates and other documents. Such documents need to be submitted in two situations:

- Write an application for a refund and submit this application to the Social Insurance Fund.

- Prepare a statement of calculation, as well as the necessary supporting documents and attach them to the application.

- Wait for the FSS check.

- After the FSS checks and approves the reimbursement, it will transfer the funds to the organization’s account.

CBC for personal income tax refund for treatment

Tax refunds for treatment expenses, etc. relate to deductions - property, social, standard or special. Refunds in such cases may vary:

- full refund of tax paid for the past calendar year (one and the last 3 years; data for one year is filled out in one declaration);

- receiving a deduction at your place of work - submitting a request to your employer to stop collecting income taxes on your salary; there is no refund here, but it does stop you from being taxed for the time being.

Most often, the first option is used for treatment. In this case, the BCC in 3-NDFL when registering a deduction will be the same as when paying, but instead of the number 3, the number 1 is used in the code:

What is this code and why is it needed?

KBK was invented with the aim of being able to track expenses and profits with clarification of financing methods, and to control finances using certain codes. Using special codes, various coefficients contained in the budget are compared. Such codes help in the correct grouping of financial use. This will also have an impact in determining the misuse of income. The classification of the budget is carried out in order to significantly simplify the control of financial condition. Classification codes are divided into separate groups. This is done to simplify the search process in the future. Profitable items of the current budget are classified according to the corresponding income resources. Expense items, in turn, can show vectors whose directions coordinate the use of funds.

The importance of using codes is very high. It is with the help of codes that the state manages financial flows. If for some reason the code was displayed incorrectly or the code value contained an incorrect value, the corresponding payment will not be able to be sent to the specified address, which in turn will provoke the emergence of new difficulties. Alternatively, such an error may mean that a particular taxpayer will not receive a penalty for late payment that he or she currently has. To correct the situation, you need to contact the tax service. If they make appropriate clarifications on this payment, the penalty will be corrected correctly. In order to provide the tax authorities with such information, it is necessary to draw up an application for the offset of the corresponding tax from one cbk to another. To do this, you can view previous samples and use the most relevant one. At the same time, in 2021 there were slightly different rules. The relevance of the required codes must be double-checked.

KBK in 3-NDFL when selling a car

The sale of a car is an operation that generates income for the seller, subject to personal income tax. Even if you used a deduction or submitted expenses for the purchase of a car and reduced the tax base to zero, you need to fill out the declaration and submit it on time.

Even if the amount is zero, in section 1 you note the absence of payment to the budget, and in the amount column you indicate “0”, while the BCC from the sale of a car in 3-NDFL will be as follows:

KBK in 3-NDFL when buying and selling an apartment

The sale of an apartment is reflected in the report in the same way as the sale of a car. And the purchase of real estate gives the buyer the right to exercise the right to reimbursement of 13% of the costs of the apartment, i.e. there is a refund from the budget. The BCC for 3-NDFL in 2021 for property deduction is as follows:

.

Important!

If you receive a deduction from your employer, you also fill out a declaration and you need both the BCC and other details.

KBK fine for late submission of tax returns in 2021

Penalties are not indicated in the declaration; these reports are intended solely to reflect taxes - payable or refundable. But if you committed a tax violation and were fined, you need to pay it by the due date specified in the tax notice or demand.

The Federal Tax Service always attaches receipts with details for the correct transaction to the letter. If you lose them, you can easily pay the tax yourself - for example, from a card or electronic wallet, knowing the BCC and other details.

You can also view the BCC for fines on the Federal Tax Service website in the specified section of budget classification codes:

Free legal assistance

The BCC for personal income tax in 2021 is also an important value when filling out. Therefore, an entrepreneur should familiarize himself with the provisions that will be relevant for the preparation of documentation in 2021. The budget qualifier is a digital code.

If an individual entrepreneur pays tax on his income on the OSN, then in field 104 of the payment slip he must indicate 182 1 0100 110. In some situations, an ordinary individual (not an individual entrepreneur) has to pay personal income tax (PIT) on his own. For example, when selling real estate, the period of ownership of which does not provide exemption from personal income tax (,).