Composition of general business expenses

Order of the Ministry of Finance No. 94n clearly establishes that account 26 in accounting is used to reflect general business expenses (OHR).

Such expenses of an enterprise include some types of expenses that cannot be attributed to the main production, but without which the implementation of the main activities would become impossible or problematic. The following types of costs are attributed to accounting account 26 (for dummies):

- Remuneration of management personnel, as well as taxes and insurance premiums accrued on the salaries of administrative and managerial personnel.

- Fixed assets, intangible assets, which are used to ensure the work of the enterprise administration. As well as depreciation charges for such property.

- Material supplies (stationery, fuels and lubricants, spare parts) that are purchased for management, ensuring the operation of the farm and the AUP.

- Payment of rental and leasing payments for property purchased directly for the needs of the company administration. For example, renting office space.

- Information, consulting, legal and other support services of third-party organizations and firms that are used in the company’s activities as auxiliary.

For exceptional types of activities, account 26 can include not only general business expenses, but also expenses for core activities. For example, the activities of brokerage companies. Such features should be described in detail in the accounting policies.

Analytical monitoring

Expenses of the enterprise, information about which is collected on the account. 26, are an integral part of production costs and influence the formation of the cost of products manufactured and services provided. Analytics is carried out by departments for which funds are allocated, as well as by cost items.

Example: purchasing an antivirus program for computers

Dt 26

Subconto 1: Information Technology Department

Subconto 2: material costs.

The chart of accounts does not provide for the opening of subaccounts 26 of the accounting account.

Structure of OCR in the table

A complete list of expenses for general business needs with examples:

| Main categories | Compound | Examples |

| Administrative and management expenses | Salaries of management personnel, secretariat, accounting, personnel department and legal department. Insurance premiums and other charges on the earnings of the AUP. Representation expenses of the organization. Expenses for business trips and business trips. Payment for postal services, telephony, internet, communications, etc. Security services. | The official salary and bonus of the director of the organization, insurance premiums for the reporting month. Payment for postage stamps for sending business correspondence. |

| Repair and depreciation | Costs of an economic entity for the repair of non-production equipment. Depreciation charges for fixed assets and intangible assets not involved in the production cycle. | Repair of the CEO's company car. Depreciation for office premises of the AUP and accounting department. |

| Material support | Acquisition of inventory and intangible assets to meet general economic needs. | Purchasing computers for the secretary. Purchasing specialized software for accounting. |

| Rent | Payment of rent for AUP. | Calculations of monthly rental payments for the office of the organization's directorate. |

| Budget payments | Taxes, fees, contributions. | Payment of fiscal payments to the budget of the Russian Federation. |

| Other | Consulting, information, audit services. | Payment for external audit control. |

Features and characteristics of 26 accounts

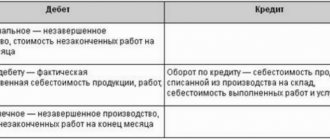

General business expenses are subject to reflection on active accounting account 26. Debit turnover accumulates the cost of all expenses incurred, and credit turnover reflects the closure of account 26.

Account 26 is considered a transaction account. This means that this accounting account is not reflected in the annual balance sheet, or as part of other reporting forms. Consequently, the account at the end of the reporting period cannot have a closing balance. All turnover must be distributed to the appropriate accounting accounts.

The current standards of PBU require the organization of analytical accounting for account 26. Provide detail in the context of cost items, according to the approved cost estimate. Conduct additional analytics by structural divisions - places where costs arise, by intended purposes and other accounting features.

IMPORTANT!

Account 26 cannot have a final balance at the end of the reporting period. This means that the account is subject to monthly closure.

Closing cost accounts: 20, 23, 25, 26

First of all, it should be noted that there are standards for the write-off of fuel and lubricants established by the Russian Ministry of Transport. But the use of these standards is not necessary; the Tax Code of the Russian Federation allows you to develop your own standards for the consumption of fuel and lubricants and use them for write-off. Everything is clear with the standards approved by the Ministry of Transport; take the established standard for writing off fuel and other related materials for your type of transport and write it off. If you want to develop your own standards, then read below.

Postings for recording general business expenses

All typical accounting entries for accounting are collected in the table:

| Operation description | Debit | Credit |

| Depreciation was accrued for fixed assets and intangible assets used for the administration of the enterprise | 26 | 02 - fixed assets 05 - intangible assets |

| Salaries and insurance contributions were accrued to the director of the organization and his deputies | 70 - salary 69 – contributions | |

| Materials, equipment, special clothing and personal protective equipment used in work for general business needs of the company have been written off. | 10 | |

| Part of the finished products is sent for chemical and chemical work | 43 | |

| Services of third-party organizations are included in the OCR | 60 76 | |

| The deviation in the cost of written-off materials and raw materials for industrial maintenance is reflected | 16 | |

| Semi-finished products are assigned to our own general facilities. company needs | 21 | |

| Part of the costs of main production (goods, works, services) is written off for own needs | 20 | |

| Auxiliary production costs are written off for maintenance | 23 | |

| Costs of servicing production shops are allocated to administrative needs | 29 | |

| Shortages and thefts were written off without identifying the perpetrators. Except for natural disasters | 94 | |

| OHR are included in the reserve for future expenses and payments | 96 | |

| The share of deferred costs is allocated to maintenance and repair | 97 |

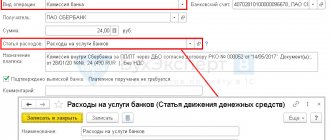

Accounting for costs of fuels and lubricants (part 3): accounting

The waybill can be used to write off fuel as an expense, and the act can be used to write off other lubricants. Samples of waybill: Posting for acceptance of fuel and lubricants for accounting is carried out on the basis of an advance report and a document confirming the fact of payment, for example, a check (for cash payments) or a delivery note, invoice and documents confirming payment (for non-cash payments).

In addition to the above, accounting for fuels and lubricants at an enterprise also includes conducting periodic inventories (daily, weekly, monthly - at the discretion of the organization itself). In order to check the remaining fuel with the accounting data, you can go in two ways. Add gasoline or other used fuel into the car tank until the tank is full, then subtract the added volume from the volume of the full tank, then check the resulting value with the data in account 10.3.

Closing an account and writing off expenses in accounting

It is important to understand how account 26 is closed and what transactions are made. Writing off expenses, that is, closing account 26, is done in several ways:

- Costs are included in the cost of production using production accounts. The method can be used in the production of products.

- Costs are charged to cost of sales. For example, if an economic entity provides services or performs work.

- Expenses are written off as current expenses of the reporting period using the direct costing system.

It is not enough to simply choose a method for writing off OCR. The choice and distribution standards must be fixed in the accounting policies. And the chosen method must be justified.

Typical transactions on how to close account 26:

| Operation | Debit | Credit | Note |

| Write-off reflected at actual cost | 20 23 29 | 26 | If the production activities of an enterprise include auxiliary and service production (shops), then costs should be distributed between the corresponding accounting accounts. Provide information about the distribution method in your accounting policies. |

| Reflected write-off using the direct costing system | 90-2 | 26 | If a company uses the method of forming a reduced cost, or direct costing, then the cost and equipment are written off immediately to the account. 90-2 “Cost of sales”. Fix this decision, how and to what account account 26 is closed, in the accounting policy. |

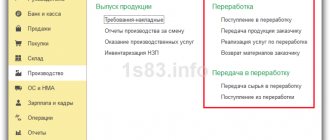

Basic business operations

- Calculation of depreciation of general business equipment

- Write-off of purchased inventory and business equipment for servicing business departments (for example, purchasing office supplies)

- Carrying out payroll calculations for business units and administrative departments

Dt 26 Kr 70 – employee wages;Dt 26 Kr 69 – calculation of mandatory contributions to social funds from the amounts of accrued wages

- Display of accounts payable to service providers

- Tax calculation

- Write-off of deferred expenses

- Closing the month and writing off costs based on the results of work performed

7.1 Inclusion in cost when distributed between productionsDt 23 Kr 26 – auxiliary production;

Dt 20 Kr 26 – basic

Dt 29 Kr 26 – service production

Attention! Expenses are written off in DT accounts 23 and 29 in cases where additional production facilities performed work or manufactured products for third parties.

7.2 Direct inclusion in total cost

Dt 90 Kr 26 – at semi-fixed costs

Victor Stepanov, 2017-01-11

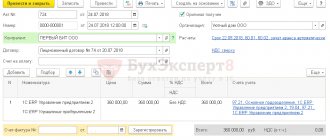

Accounting example for account 26

Let's look at the rules for closing account 26 using an example. NPO “Good Day” produces scissors and rulers. Products are produced at planned cost. In the organization, it is customary to reflect the main costs on account 20, and reflect indirect costs on account 26.

The accounting policy of the NPO “Good Day” reflects:

- General business expenses are written off to the cost of production;

- distribution of costs between types of products should be made according to the volume of material costs.

In March 2021, direct production costs amounted to 220,000 rubles:

- for the production of scissors - 150,000 rubles, including material costs - 80,000 rubles;

- for the production of rulers - 70,000 rubles, including material costs - 40,000 rubles.

Structure of indirect expenses—RUB 140,200:

- salary of management personnel - 100,000 rubles;

- insurance premiums - 30,200 rubles;

- rental of premises - 10,000 rubles.

1. We distribute indirect costs according to the volume of material costs using the formula:

Amount of indirect expenses for the production of scissors: 140,200 × 80,000 / 120,000 = 93,467 rubles.

The amount of indirect costs for the production of rulers: 140,200 × 40,000 / 120,000 = 46,733 rubles.

2. Close account 26, distributing indirect costs:

| Operation | Debit | Credit | Sum |

| Indirect costs for the production of scissors were written off | 20 | 26 | 93 467 |

| Indirect costs for the production of lines are written off to the main production | 20 | 26 | 46 733 |

Correcting errors in accounting

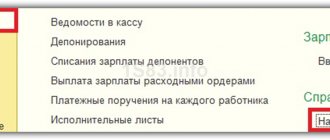

The use of automated accounting greatly simplifies accounting. Errors are not uncommon in specialized accounting programs. Why account 26 is not closed:

- Check the accounting policy settings in the software product. Follow the prompts that the program gives, or contact the developers.

- Check that transactions are recorded correctly in the special program. In most cases, errors lie in misgrading (for example, an accountant made a mistake in the details or nomenclature).

- Check the dates of registration of transactions. For example, in the 1C software, the dates of registration of a business transaction play a key role in the formation of accounting data.

To avoid mistakes, systematically create the turnover sheet and check the accounting card 26.