Often citizens are faced with the need to correctly fill out the necessary details in pay slips, tax returns, fine receipts, and payment slips paying for the services of budgetary organizations. Difficulties are usually caused by the fields where it is necessary to enter the payer identifier (IP) and another identifier - UIN (aka UIP). How do you know what it is? Citizens usually know what a payer identification number is: on the tax return form it is usually indicated as a Taxpayer Identification Number (TIN).

What is UIN on a receipt and how to find it out in 2021

You can find out the UIN from the recipient of the payment - the ministry, department or their territorial body that administers the payment.

For example, the UIN for paying a traffic police fine can be found out from the resolution on bringing to administrative responsibility, the receipt for payment of the fine, or the details attached to the resolution. The UIN for transferring state duty can be found from the receipt received from the tax office or generated on the Federal Tax Service website.

The UIN for payment of property taxes of an individual is indicated in the receipt that the tax office sends to the citizen. These are receipts for payment of land tax, personal property tax, and transport tax. If a receipt is generated in your personal account on the Federal Tax Service website, it also contains the document index. This will be the UIN, it is located at the top of the receipt.

The legislation has not developed a specific classification of UIN, as well as a list of identifiers for organizations. This is why payers often have problems on this issue. Especially if you need to fill out a payment order for state duty.

First of all, it is necessary to check whether a unique identifier is indicated in the document that was issued/generated to the payer. If yes, then this is what needs to be indicated on the receipt.

If there is no UIN in its literal meaning, you should look for the “Document Index” column. In most cases, the number indicated in it will correspond to the UIN, which must be included in the payment for state duty.

The value of the “Document Index” is based on a similar principle as the identifier itself.

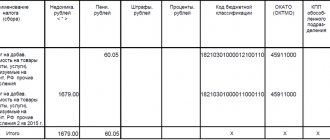

| Decoding the UIN code | |

| Number order | What does it mean |

| First 3 digits | Receipt Manager at the Treasury |

| Next single digit | Authority to whom the payment is addressed |

| One more number | Payment category (state duty) |

| Subsequent digits (except last) | Details of the document for payment |

| Last digit | Determines the uniqueness of the identifier |

Also see “Payment order for payment of state duty to the arbitration court: sample”.

Let us immediately note that the UIN when paying the state duty of the traffic police consists of 20 digits. To fill out the corresponding column, the payer must duplicate the identifier:

- from a receipt for payment of state duty;

- any other document provided by the traffic police.

If there is no information about a unique identifier, “0” should be entered in the corresponding column. This payment will go through like a regular one. The credit institution is obliged to accept it.

Please note that you absolutely cannot indicate a UIN that is intended for another type of payment. For example, a fine. In this case, payment of the state duty will not take place, and getting the funds back will be problematic.

Also see “UIN in payment orders: sample”.

Share with friends on social networks

A unique payment identifier is generated by the budgetary institution independently. It is necessary to carry out correct accounting of each transfer to a state budgetary authority, including: tax, customs authorities, preschool children's institutions, etc. What is a UIN in Sberbank Online in this case is the index of the document required to indicate when paying:

- In your personal account, enter payment information.

- Activate the "Information" field.

- Receive a check with a 20-digit “Payer Identifier” indicated.

- In Sberbank Online, when filling out payment data in the “UIN” field, indicate the payer’s ID from the check.

- For each payment you need to get your code by going through the whole process again.

- If taxes are transferred by an individual entrepreneur or a legal entity. These payers prescribe the KBK code. If you need to specify additional data for payment, then the following is written: “UIN0///. (necessary information for identification)".

- An individual pays property tax. The identifier is the document index.

- When paying for medical services. If there is no information on this matter on the official website of the medical institution, then in the “UIN” column of the payment document, simply put the number “0”.

- Non-cash payments sent by entrepreneurs. Here, too, in the field for entering this identifier, it is enough to enter “0”.

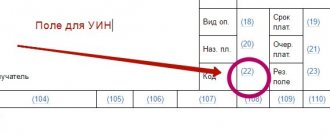

Finding out the UIN is easy - it should be provided to you by the budget organization to which you are sending the payment. In the vast majority of cases, personal application is not required - this information is available on the official website of the institution. This code can also be written in line 22 of the receipt issued to you.

Most banks require payers to provide a unique identifier on the relevant documents. Therefore, many people ask questions: what is a UIN, how to designate it? You need to know about this before making a payment, since if errors are made, the amount will be returned to the account without being credited. UIN means accrual identifier.

If you don't know the ID number combination, don't leave it blank! In this case, your payment may simply get lost and not reach the addressee. Therefore, if the UIN is unknown to you or you doubt its correctness, it would be most correct to put 0 (zero) in the line for the identifier.

It is interesting that from these figures it is easy to understand what tax is paid, which region’s budget goes to it, and who the payer is. And if a receipt was issued, for example, to pay a traffic fine, then the details are formed from information about the protocol on prosecution, the date of its preparation, and the code of the region where it was issued. In general, the state is doing everything so as not to lose the payer and the grounds for paying them money to the budget.

The UIN is formed by the relevant government agency, which is the recipient of the payment. It cannot be considered a constant value for a payment group. One UIN corresponds to a strictly defined accrual. Therefore, the main source of information about the UIN of a specific document is the government agency that established it.

For individuals

UIN is also used when transferring mandatory payments to the budget by ordinary citizens.

Taxes are calculated for them by the Federal Tax Service. These include land tax, transport tax, property tax, etc.

Every year, in due time, all payers who have a taxable object receive notifications that reflect in detail exactly how the tax was calculated, how much must be transferred to the budget, etc.

These letters are sent to individuals at their registered address. The UIN for them is the index of the received payment notification. Citizens just need to transfer it to the payment form.

Recently, the tax authorities, along with the notification, also send a receipt for payment of payments. Therefore, an individual must remember that if he uses a receipt prepared by the authority for payment, then the required UIN is already indicated in it.

If an individual has not received a notification, then he can look up the UIN in the taxpayer’s personal account.

Considering all the above information, you can understand why UIN is needed on receipts. The digital code helps to identify the payment, namely to determine:

- who made the payment;

- to whom it is intended;

- for what.

Having received a payment for which the UIN is specified, the payment administrator will send it to the direct recipient.

Since in 2021 all budget accruals are displayed in the GTS GMP system, determining the purpose of the payment allows you to immediately display the receipt of payment in a unified system.

When checking the payment in the GIS GMP, the authorized bodies see that the amount under a specific number has been paid to the budget.

How to obtain a new type of foreign passport through State Services, see the article:

registration of a new international passport through State Services

.

How to correctly fill out form P14001 when changing the director, read here.

UIN is the number required for making payments to budgets of various levels. In essence, this is a payment serial number that allows you to accurately identify the payer and the basis for payment. But you need to know where to indicate the UIN and when you can do without it.

Where is the code indicated?

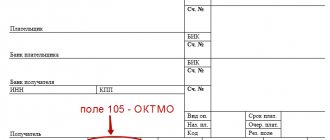

According to clause 1.21.1 of Bank of Russia Regulation No. 383 dated June 19, 2012, the UIN must be indicated in field “22” of the payment order intended for the transfer of contributions and taxes.

In the order, this field is called “Code”. The abbreviation and twenty digits of the code are entered in the required column, then the smash sign is written immediately after the digits.

In 2021, indicating the UIN in payment orders is mandatory. If funds are transferred to budgetary organizations.

But at the same time, the norm is valid only when a demand for payment is made. Since the code is generated simultaneously with the creation of the payment document, until this moment the UIN simply does not exist.

In such a situation, payment identification is carried out using other details. From March 28, 2016, individual payers who are not individual entrepreneurs, in the absence of a UIN, indicate the TIN (taxpayer identification number) in the payment order.

This amendment was introduced by Order of the Ministry of Finance No. 148n dated September 23, 2015.

The UIN is formed by the organization to which the accruals are made. If the payment is made to the traffic police, the UIN can be generated by a bank employee. Each payer has its own unique code for each individual payment. If the payer does not know which UIN should be entered, the value 0 must be indicated in the corresponding column of the receipt.

If an individual prefers to make a money transfer in person, without a document from the tax service, he should generate the payment himself. This can be done using the electronic service on the website of the Russian Tax Service. In this situation, the index will be assigned automatically. When filling out a notice in form No. PD-4sb (tax), the UIN is not indicated.

Payment guarantees

By paying for government services using your UIN number on the “Payment for government services” portal, you can be sure that the information will immediately enter the GIS GMP and be processed by the system. Thanks to this, you will not need to present documents confirming the fact of making the payment.

Collapse text

https://www.youtube.com/watch?v=wvMEwlriZxc

Fill in the form

In order to pay for any service, you must indicate the UIN number, consisting of 20 or 25 digits (it is indicated in the notice, receipt, or issued when ordering the service on one of the state portals) and click the “Search” button. If the specified accrual is found in the GIS GMP, then all the necessary details will be entered automatically.

Payment, for example, of a fine by UIN number online is available regardless of the region where the service is received and ordered or the accrual is paid. You can pay off debts or make any other payments throughout Russia, including in the following regions:

- Moscow and Moscow region,

- St. Petersburg and Leningrad region,

- Krasnodar region,

- Novosibirsk region,

- Ekaterinburg and Sverdlovsk region,

- Sevastopol and the Republic of Crimea.

Unique accrual identifier (UIN): new details for payment orders

Another case is the payment of property taxes by individuals. If the tax is paid on the basis of a tax notice generated by the tax authority, a UIN is not needed. In such a situation, the notification, as well as the payment document attached to it, are generated by the tax authorities. The index of the payment document is used as an identifier for the payment.

Most Russians, faced with the need to fill out documents to pay state fees, are wondering where to get the UIN for a payment order? Such code cannot be found in any reference books. As mentioned above, it is formed only by the tax authorities and the traffic police. Other budget recipients, as a rule, do not assign a code to completed payment transactions. That is why zero values are usually entered in the UIN field of the payment slip.

It is worth noting that payers do not have the opportunity to come up with a UIN on their own. This code has its own generation algorithm. Therefore, an incorrectly specified identifier may result in an error when checking documents. It is also prohibited to indicate the same UIN for different payments.

It should also be noted that in payment orders the UIN code is called “Payment Purpose”. This code consists of 20 characters. Before specifying these characters, you must write the word UIN. Therefore, the “Purpose of payment” field must contain 23 characters.

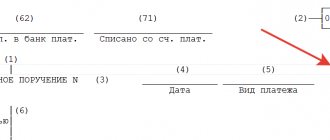

Since February 4, 2014, new rules for filling out payment orders for a number of transfers to the budget of the Russian Federation have been in effect. In particular, in accordance with the order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013, a new requisite is being introduced - UIN. UIN stands for “unique accrual identifier” and is a sequence of 20 digits that ends with the value “///”. The UIN must be indicated in the “Code” field of the payment order when filling out a payment order to transfer payments to the budget system of the Russian Federation.

Since March 31, 2014, bank orders for payment of funds to the budget have a new requisite - a unique accrual identifier (UIN). Now, when making tax calculations, organizations must indicate the number by which the payment will be identified in the state information system. In what cases is the UIN required when transferring taxes, and how can the payer obtain it?

Initially, the UIN is located on the top of the receipt, and is called the “document index”. If payment is made regularly, the code will be saved. It is better to use the service option and create a standard template.

The second option for obtaining the necessary details is to perform the following actions:

- Log in to your Sberbank Online account.

- Go to the “Transfers and Payments” category.

- Click on the “Information” button, where you can find information about checks for payments made. There you can find out the 20-digit identifier.

If the system displays a “search error,” then the data is missing, which means that you do not need to write the UIN, but simply enter “0” in the code cell.

It is also used when making payments to federal and city authorities. There are situations when you do not need to specify a twenty-digit code:

- Individuals pay property taxes. But before this, a special notification comes from the fiscal service. Your payment ID is also used here.

- Individual entrepreneurs and organizations calculate the tax themselves, based on their own completed fiscal declarations. In this case, a different payment ID is used. It is listed in column 104. In simple terms, if you have not received any notifications requiring you to transfer money, you should not enter the identifier.

On a note!

Even if according to the rules the number is not required to be written down, this field should not be empty. Instead of a twenty-digit code, enter the number zero (“O”).

The “Code” line should not be left blank. A unique identifier is not a set of random numbers.

- Receive a letter with notification and a completed notice in form No. PD (tax). This is a ready-made receipt in which all the necessary details have already been entered, including the document index. Funds can be transferred through any bank that accepts budget payments.

- Register in your taxpayer’s personal account and generate a “payment” through the electronic service on the Federal Tax Service website. It will also be indexed. You can pay through a bank or by bank transfer.

This is usually how individuals pay off their property taxes. In order to “pay and sleep in peace,” they wait for a mail notification from the Federal Tax Service or print out the necessary receipts through their personal account on the department’s website. Since these documents are generated by the budget recipient, the UIN is assigned to them automatically.

Why is it needed?

First of all, it should be noted that the unique identifier is generated by the organization itself, which accepts transfers and payments. They are primarily needed for the convenience of accounting for each income received by a budget institution. As mentioned earlier, you need to enter details when paying taxes, fines from the traffic police, kindergartens and other municipal institutions.

Many people ask the question where to enter the UIN in a payment order. This code should be indicated in the “Purpose of payment” line. You need to write it as follows: first “UIN”, then a 20-digit number without spaces. Thus, the line must contain only 23 characters. If you pay the receipt through Sberbank Online, then when filling out the details you will find a separate UIN line; here you only need to indicate the number.

By the way, it should be noted that some parents pay for kindergartens through Sberbank Online. And, accordingly, they have a question about where to get a unique number. Let's try to figure out what a UIN is in Sberbank Online Kindergarten. As mentioned earlier, it will be impossible to send payment without this information. Therefore, if you plan to pay for kindergarten services through Sberbank Online, you need to contact the accounting department of a budgetary educational institution directly and inquire about this data. Moreover, it is enough to find out the unique identifier number once and enter it regularly when paying. That is, this value is constant.

Please note that the bank does not provide information on the UIN; this information should be clarified with the organization to which you are paying.

By the way, if you, for example, pay payments on a receipt to the traffic police or the Tax Inspectorate, then finding the identifier will be quite simple for you: take a printed receipt and in the top line find the phrase “Document Index”. In the Sberbank remote service, enter this value in the UIN line.

In what case is it indicated

Using a UIN code assumes that this identifier has already been set. Therefore, the UIN is indicated in payments generated on the basis of documents received from the authorities.

They can be claims, receipts, etc.:

- When an organization or individual entrepreneur generates payments for current tax payments, the UIN is not defined for them. These entities transfer taxes according to the deadline to certain details, indicating their TIN.

- The current rules provide that in field 22 in this case it is necessary to display “0” instead of the 20-digit code. In this case, quotation marks do not need to be indicated in the order itself.

- When making a payment for medical services, the UIN code, unless provided for by the contract, does not need to be indicated. In this case, "0" is also supplied.

Attention! In addition, for budget-funded enterprises it is required to indicate the UIN in the application for cash payment, on the basis of which a payment order is subsequently generated by the treasury.

The unique identifier is not indicated in payment documents when transferring tax fees by individual entrepreneurs and legal entities. Instead, the code KBK is used. In the event that it is necessary to indicate additional information about the purpose of the payment, “UIN0///” is entered in the corresponding column, and additional identification data is written after the separating sign. Payment of property taxes by individuals also does not require an identifier. Instead of UIN in this case, the document index is used.

When paying for medical services, the receipt also contains the “Unique identifier” column. However, in most cases, paid medical services do not require the use of a unique code when making payments. To transfer money you need to put “0” in the UIN column. In each medical institution, this information is published on the official website. Information about this code can also be obtained from the medical center where this receipt was issued.

Can the field with code 22 be left blank?

Filling out the field with code 22 in the payment order is mandatory when transferring funds to the budget.

The value of column 22 can take the following meaning:

- Digital multi-digit UIN code - in case of filling out a payment slip based on the requirement of the Federal Tax Service for repayment of arrears, payment of fines and penalties.

- 0 – in other payments to the budget.

- Not to be filled in for other payments not to the state budget.

Empty field 22 when paying money to the budget is equivalent to a zero value, however, in accordance with the rules for filling out payment orders, it is necessary to put 0 in this field if there is no UIN, without leaving the column empty.

Payment orders in which field 22 is not filled in may not be accepted by the bank and the tax authority.

If the subject makes a payment to the account of an individual, legal entity or individual entrepreneur who is not related to government agencies, then the field is not filled in.

How is the column filled in when paying taxes?

If an organization, individual or individual entrepreneur pays taxes on time or pays off the debt on its own initiative, and not at the written request of the Federal Tax Service, then 0 must be entered in field 22.

To identify such tax payments in the payment slip, you need to fill out the KBK correctly; it is from this that the Federal Tax Service learns about the purpose of the received amount.

If a subject fills out a payment order for the payment of arrears of taxes, a fine or penalty imposed in connection with the debt, and has received a written notification from the tax office with a requirement to repay the debt, then in field 22 the UIN specified in the tax notice is filled in.

The UIN identifier is expressed digitally and can have up to 25 digits. When filling out field 22 in a payment order, you must accurately rewrite the entire code without making mistakes.

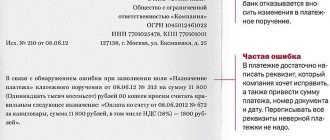

Errors in the UIN will lead to the payment not being accepted, since the purpose of the amount cannot be identified correctly.

If the payment order is filled out with an error in the UIN, the payer will face the following problems:

- the tax debt will not be repaid or will be received late;

- Penalties will continue to accrue for each additional day overdue.

Filling samples

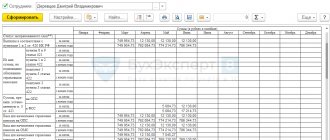

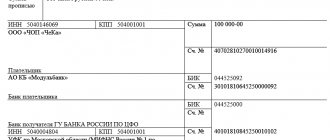

Sample of filling out field 22 of a payment order when paying tax:

A sample of filling out the UIN in field 22 of a payment slip when paying tax arrears based on the requirements of the Federal Tax Service:

UIN when paying state duty to the traffic police

- Protocol serial number.

- Date of execution of the protocol or corresponding order.

In this case, each digit of the identifier has its own meaning. The first three indicate the code assigned to the manager. In the traffic police, the first three digits of the code are 188. The fourth digit means the organization that accepts the payment. In this case it is "1". The fifth digit is the purpose of payment. If we are talking about a fine, then the fifth digit in the code is “1”.

Tax authorities and investigators have agreed who can be considered “tax criminals”

The Investigative Committee and the Tax Service have developed methodological recommendations for establishing facts of deliberate non-payment of taxes and forming an evidence base.

Pension Fund branches do not have the right to demand zero SZV-M from companies

Recently, the Altai branch of the Pension Fund of the Russian Federation issued an ambiguous information message regarding the rules for submitting SZV-M. The information stated that “even if there are no employees, the employer still submits information, but only without indicating the list of insured persons.”

Changes have been made to PBU “Accounting Policies”

As of August 6, 2017, amendments to PBU 1/2008 “Accounting Policies of Organizations” come into force. Thus, in particular, it has been established that in cases where federal standards do not provide for a method of accounting for a specific issue, a company can develop its own method.

Unscrupulous taxpayers may be refused to accept reports

Khabarovsk tax officials reported that territorial inspectorates have the right not to accept declarations from organizations that have signs of unscrupulous payers.

Daily allowances for traveling workers: whether to charge personal income tax and contributions

If an employee’s work involves constant travel, then the amount of daily allowance issued to him is not subject to either contributions or personal income tax in full, and not just within the general limit.

For income tax purposes, the date of presentation of the “primary report” is the date of its preparation

Expenses for the acquisition of work (services) performed (rendered) by third parties are recognized for “profitable” purposes in the period in which the fact of performing these works (rendering services) is documented. The Ministry of Finance reminded what to consider as the date of such documentary evidence.

A new procedure for the work of tax officials with unclear payments has been approved

From December 1, 2017, the rules by which tax authorities will deal with unclear payments to the budget will change. A special place in the new rules is given to clarifying payment slips for the payment of insurance premiums.

If the payer does not have such a document and does not know the UIN, then “0” is entered when filling out this field. The bank will have to accept this payment. The main thing in this case is not to leave the field empty and unfilled. The state duty to the traffic police will be considered paid.

When paying state duty to the traffic police, you should not use the UIN indicated for paying another payment. If the same codes are entered, the payer runs the risk that the payment will be lost and the state duty will not be considered paid. UIN is always a unique code.

- Log in to Sberbank Online, in your personal account.

- After entering the category of transfers and payments, select paid services in the list under the name “Staff Police”.

- In the electronic form that appears, indicate the UIN from the previously received receipt, and then select the card to write off the money.

- At the final stage, all you have to do is click “continue”, make sure that all data is entered correctly, including the amount of the fine, and confirm the transfer.

Upon completion of the procedure, the transferred amount will be credited to the recipient’s account within 3 banking days, although it is usually credited instantly.

If you have any questions, please let us know Ask a Question

Just in case, let me remind you that UIN is required only on payments to government agencies. This is not required for other organizations. Yes, this is a painful question. But it’s easy to answer if you understand the logic of the procedure for generating a unique identifier.

The name itself suggests that this cipher is not repeated.

If it is not there, then in the field where you need to indicate the UIN in the payment order, put “0”. The same thing applies to receipts for payment of traffic police fines.

UIN for state duty is unknown

If the UIN for the state duty is unknown to the payer, the bank or terminal may not accept such a payment due to the lack of correctly entered data. There are several options for the development of events:

- the payment may be mistakenly transferred to another organization;

- will be rejected altogether.

Also see “Procedure for generating UIN for payment orders”.

UIN stands for unique accrual identifier. This field consists of 20-25 numeric characters and must be entered in the "Code" field. Bank and treasury employees need this code. The digital value of this identifier helps specialists determine the purpose of the credited payment and process the payment correctly. This is precisely why this accrual identifier is called unique, because it cannot be repeated and is intended specifically for a specific payment.

For a state duty payer, the UIN, as a rule, is nothing more than a combination of numbers that is simply unknown to most payers.

At the same time, this situation is not hopeless for the payer, and payment of the state duty can still be made. When filling out a payment document in a bank or through a terminal, in the “Code” field, the UIN value is entered by indicating the number “0”.

But if the UIN is not filled out in any way, that is, either a 20-digit code or the number “0” is not entered, then the payment will be refused and payment of the state duty will not be accepted.

It is sometimes possible that the terminal does not allow payment of the state duty even with the UIN value “0”, but the payer does not know the other UIN. Then you can try not filling out this field and leaving it empty, and then press the “enter” key.

Many payers are also often interested in the question “what to do if the UIN is unknown?” Most organizations that independently pay tax payments do not use the UIN when processing payment orders. For such organizations, the unique identifier is KBK. As for individual payers, the TIN number is used as the UIN. This applies to both individuals and individual entrepreneurs. Legal entities use checkpoint as this code.

If an entrepreneur planning to make a payment to the tax authority works according to the “simplified” system, when generating a payment order, he must indicate a zero UIN value. In this case, in field 104 you should indicate the code in accordance with the current KBK directory.

To summarize, it must be said that in the absence of a tax notice, the field that is intended to write a unique identifier always has a zero value. In this case, it is necessary to indicate a zero value or identifier in the field as required by the Federal Tax Service. Payments with an empty field for entering a unique identifier are considered invalid.

What to write if the UIN is not specified?

It is important to note that not all organizations create unique identifiers. For the most part, we are talking about government departments, which receive transfers in large quantities. What to do if there is no such code. The UIN simply does not exist at a certain office, but it is necessary to prepare a payment. Where can I get it? In fact, there is no problem, and there is no need to invent anything. Instead of a code combination, it is enough to indicate zero.

If the organization receiving the payment does not have a UIN, then its absence in the payment order cannot become an obstacle to the execution of the money transfer. It is strictly forbidden to enter a fictitious set of numbers, since this very action can become an obstacle to the transfer being rejected.

Is it possible to come up with a UIN yourself?

Speaking about the features of the unique accrual identifier, it is worth emphasizing once again that this parameter is unique. At the same time, the UIN code is formed only by budget authorities. Under no circumstances does the payer have the right or opportunity to independently come up with this code. By specifying an invented code, the payer risks that his payment may not reach its destination. Accordingly, it will be considered imperfect.

It is worth understanding that the code is generated automatically. If for any reason the payer does not know the exact unique accrual identifier, he must indicate a zero UIN. A similar code is usually entered if the payment order is intended to transfer funds to the account of a commercial organization.

In the event that the payment order is intended to make a money transfer to the traffic police, the UIN is formed using the number of the issued resolution and the date of its issuance. It should be said that the UIN can be formed not only by the traffic police, but also by banking or credit institutions through which payment is made. Payers have the opportunity to find out the traffic police ID thanks to special formulas that can be found on the Internet.

UIN code in the payment order

conclusions

UIN is a unique code that is filled in the field with code 22 in the payment order. Such a need arises only when making payments to the state upon receipt of a notification from the tax office about the presence of debts on taxes, contributions, and fees.

When paying current payments to the budget, 0 is indicated in field 22.

The field may not be filled in if the payment order is filled in to transfer funds to a recipient who is not related to government agencies.

For example, when paying for goods to the supplier, field 22 does not need to be filled in.

How to pay by UIN through Sberbank online?

Please note that the mandatory submission of a document confirming payment of the state duty is not provided for, since the Law of July 27, 2010 No. 210-FZ “On the organization of the provision of state and municipal services” allows it to be submitted exclusively at the initiative of the applicant (information about payment is promptly sent to the state information system).

In addition, it is allowed to issue a form for paying the state fee for registering property rights after the documents have been submitted to the registration authorities. However, this is not very convenient from the point of view of completeness of the set of documents, and will also delay the completion of registration actions. Therefore, the presence of a paid receipt is a guarantee of immediate acceptance of documents for processing, since the date of payment of the state fee is considered the day the application for registration is accepted.

Like other financial institutions, Sberbank makes payments using UIN only if this code is included in the payment document. Employees may only require this information in certain cases. By law, today we are required to indicate the identification number of individual entrepreneurs and heads of peasant farms, lawyers and notaries. From an individual, the maximum that an operator can require is to enter the number zero in the UIN field.