When to transfer personal income tax in 2018

General rule

As a general rule, personal income tax must be paid in 2021 no later than the day following the day the employee (individual) was paid income. So, let’s say the employer paid the salary for January 2021 on February 9, 2021. The date of receipt of income will be January 31, 2021, the tax withholding date will be February 9, 2021. The date no later than which personal income tax must be paid to the budget, in our example, February 12, 2021 (since the 10th and 11th are Saturday and Sunday).

Benefits and vacation pay

Personal income tax withheld from temporary disability benefits, benefits for caring for a sick child, as well as from vacation pay must be transferred no later than the last day of the month in which the income was paid. For example, an employee goes on vacation from March 6 to March 23, 2018. Vacation pay was paid to him on March 1. In this case, the date of receipt of income and the date of withholding personal income tax is March 1, and the last date when personal income tax must be transferred to the budget is March 30, 2021.

In general, pay the withheld personal income tax in 2021 to the details of the Federal Tax Service with which the organization is registered (paragraph 1, clause 7, article 226 of the Tax Code of the Russian Federation). Individual entrepreneurs, in turn, pay personal income tax to the inspectorate at their place of residence. However, individual entrepreneurs conducting business on UTII or the patent taxation system transfer tax to the inspectorate at the place of registration in connection with the conduct of such activities.

What interest must be paid on income?

In Russia, the standard rate of 13% is necessarily deducted from the income received by citizens (residents). For example, if, when hired, an employee signed an employment contract stipulating a salary of ten thousand rubles, then he will receive 8,700 rubles (minus 1,300 rubles as income tax). Most often, the candidate is offered the amount of labor income already taking into account tax deductions.

At the same time, for non-residents of the country, 30% has already been established, which will be deducted from the earned labor income. The personal income tax rate will be 13% only for the following categories of non-residents:

- visa-free migrants;

- residents of countries that are members of the Eurasian Economic Union;

- foreign specialists with a high level of qualifications;

- refugees.

Another type of income is profits received from equity participation in a company, or simply dividends. In our country, since 2015, they are taxed at 13% of the amount received (previously the tax figure was nine percent). For non-residents of Russia, this rate automatically increases to 15%.

We emphasize that a resident of Russia is considered a person who lives on its territory for at least 183 days over the next twelve months in a row. As an exception, the state allows short-term trips (not exceeding six months in a row) necessary for citizens to receive education or medical care, as well as work trips for the purpose of extracting hydrocarbon resources from fields in the seas. Absence from the country for more than a year without loss of resident status is permissible for three categories of payers:

- Military personnel in service.

- Employees of government or law enforcement agencies.

- Representatives of local government bodies.

Who is a tax resident of the Russian Federation? Our article will help you figure this out. In it we will look at what the tax status depends on, documents for confirmation, as well as the regulatory framework for residents and non-residents.

KBK in 2021: table

In 2021, there have been some changes in the KBK part. See “Changes to the BCC in 2021.” However, the BCC for personal income tax for employees in 2018 did not change and remained exactly the same. The BCC on personal income tax for individual entrepreneurs has not undergone any amendments. We present in the table the current main BCCs for 2021 for income tax.

Table with KBK for 2021 for personal income tax

| Type of personal income tax | KBK in 2021 |

| Personal income tax on employee income | 182 1 0100 110 |

| Penalties for personal income tax on employee income | 182 1 0100 110 |

| Personal income tax fines on employee income | 182 1 0100 110 |

| Tax paid by individual entrepreneurs on the general taxation system | 182 1 0100 110 |

| Penalties for personal income tax paid by individual entrepreneurs on the general system | 182 1 0100 110 |

| Penalties for personal income tax paid by individual entrepreneurs on the general system | 182 1 0100 110 |

Why is budget classification needed?

Main purposes of budget classification:

- Assisting the government in planning and managing financial flows;

- Tracking revenues and expenses, ensuring visibility of data on sources of income;

- Ability to compare data from different budgets;

- Grouping of funds according to their intended use;

- Detection of inappropriate expenses;

- Easier control over the finances of the organization as a whole.

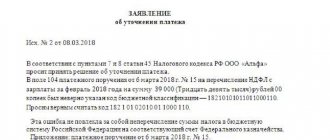

If the error

Despite the fact that entering the KBK of personal income tax into a payment slip is an elementary matter, mistakes are still possible. What to do? If you incorrectly write the KBK for personal income tax, you must immediately write a letter to the Federal Tax Service at your location to clarify the KBK. This follows from the letter of the Ministry of Finance dated January 19, 2017 No. 03-02-07/1/2145.

You do not need to pay personal income tax, penalties and fines again if you made a mistake in the instructions of the KBC. It is enough to simply write an application for clarification of the KBK personal income tax to the Federal Tax Service. And then the tax office itself will redirect the payment to the necessary details.

If the KBK is incorrectly indicated for personal income tax, it is possible that penalties will be charged in 2021, but there is no need to list them. If the company paid income tax on time, then after clarification by the BCC, penalties are canceled.

Read also

16.11.2017

Recipients of dividends and procedure for receiving them

Based on annual results, all shareholders of the company expect to receive additional profit. At the same time, both legal entities and individuals can be the owners of shares. Thus, profit tax is withheld from legal entities, and personal income tax is withheld from individuals.

Depending on how it is reflected in the company's charter, the division of profits between participants occurs in a specific order. The most common variant of “division” is from proportion to share. If it is decided differently, the company will inevitably face a dispute with the tax authorities. Community members who were accepted later than others, according to the share they purchased, receive payments.

How are payments made?

Dividend payments are deducted at the moment when the organization has already covered all necessary expenses. That is, participants receive unallocated money (for example, not needed to pay for something or to maintain the work in an efficient state). The very fact of receiving dividends indicates that the business is performing excellently and is being managed wisely. That is, shareholders must be interested in the company’s income generation and its stable activities.

Payments themselves cannot have a fixed schedule. Shareholders or management of the company decide together at what time (or at what interval) dividends will be transferred. For this purpose, general meetings of shareholders are held, at which the following are decided by a majority vote:

- What part of the profit will be sent as dividends?

- How the profit will be divided among the shareholders.

- When will payments be made?

When a decision is made, a protocol is drawn up confirming that such and such shareholders were present at the meeting, made such and such a decision and contains their personal signatures. You must understand that changing it often or just like that is undesirable, since it affects accounting and interaction with the tax office.

Video - Why pay dividends?

Concept of dividends

The profit received by the enterprise after taxation can be distributed among the participants of the company.

Dividends recognize not only income from the distribution of remaining profits received by the participant, but also other similar payments to the participants (letter of the Ministry of Finance of the Russian Federation dated May 14, 2015 No. 03-03-10/27550). Dividends are also recognized as receipts outside the Russian Federation, recognized as such by the legislation of other countries (Clause 1, Article 43 of the Tax Code of the Russian Federation). Read about the conditions under which dividends are distributed in an LLC in this article.

For information about the specifics of calculating dividends for organizations that use a special regime, read the article “Procedure for calculating dividends under the simplified tax system.”

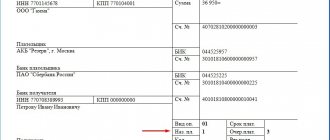

How to fill out a payment order

Let's look at how to correctly fill out a payment order for the transfer of income tax. Payment orders for the payment of fees and insurance premiums are drawn up in accordance with the rules approved by Appendix No. 2 to Order No. 107n of the Ministry of Finance of the Russian Federation dated November 12, 2013. In order for the payment to be generated correctly, you need to pay attention to the following aspects:

- in field 101 “Payer status”, enter the value 02 - tax agent;

- in field 104 - KBK (for personal income tax in 2021 - 182 1 0100 110);

- OKTMO is entered in cell 105 (the correct value for a specific institution is on the official website of the Federal Tax Service);

- field 107 indicates the tax period for which payment is made;

- the basis for the payment, which determines its purpose, is entered in field 106.

It is also mandatory to register the details of the parties - TIN, KPP of the payer (fields 60, 102) and TIN, KPP of the recipient (cells 61, 103).

You can find out more about the rules for filling out a payment order in this material.

You can fill out a payment order for the transfer of personal income tax in 2021 indicating the BCC below.

How to find out KBK tax

Option I: via online service. To facilitate filling out documents, the tax service has developed a specialized resource. It can be found by going to: service.nalog.ru Here you can not only find the necessary codes (IFTS, OKTMO, KBK), but also fill out tax receipts.

Without knowing the address of your Federal Tax Service, you can start entering the address, and the code will appear in the document on its own. Next, you determine what type of tax and payment you need; after entering this data, the KBK code will appear automatically.

Option II: through the tax website. Copy and enter in the browser into the search window: nalog.ru/rn01/taxation/kbk/fl/ndfl

The same page will open when you go to the “Personal Income Tax” section. Here you will find KBK codes and you can choose the one that interests you.

To tax or not

From any income of an individual, including dividends, a percentage of the amount issued must be transferred to the treasury.

The date of transfer of dividend income is the day of their payment, regardless of how they were received - through the organization's cash desk, from its current account, or the money was issued in cash. That is why tax on dividends must be withheld on the day they are transferred.

Some people are concerned about the question of whether dividends are subject to personal income tax if they are received in kind. So: if they are issued to an individual in any form, the tax rate is 13%. Therefore, the tax occurs regardless of how such income from participation in the business was received.

New KBS from 01/01/2021

In connection with the introduction of an increased personal income tax rate from January 1, 2021, the Ministry of Finance, by order No. 236n dated October 12, 2020, made changes to the budget classification codes (BCC) for 2021. The new codes will come into force simultaneously with amendments to Chapter 23 of the Tax Code of the Russian Federation on the introduction of a progressive rate. To transfer taxes to the budget next year, you should, among other things, use the following codes:

- 182 1 0100 110 - for tax exceeding the amount of 650,000 rubles and relating to part of the base in excess of 5 million rubles;

- 182 1 0100 110 - for the tax of individuals on CFC profits received by taxpayers who switched to a special procedure for paying personal income tax based on filing a notification with the Federal Tax Service;

- 182 1 0100 110 - for tax on interest (coupon, discount) on circulating bonds of Russian organizations that are denominated in rubles and issued after 01/01/2017.

Additionally, new codes have been introduced for municipal districts.

ConsultantPlus experts have sorted out which codes to indicate in payments for taxes and fees. Use these instructions for free.

to read.

Income calculation

In order to calculate a resident’s personal income tax, you need to use the general tax rate that is relevant on the day the income is received. If this is 2021, then dividends in the 2-NDFL certificate are calculated at a rate of 13%.

There are cases when a shareholder/business participant was unable to receive his money as a result of errors in the details, so he has no dividend income in such a situation.

If the company received its dividends from a business in another organization, then the formula from clause 5 of Art. 275 Tax Code of the Russian Federation.

In this case, the share of dividends of an individual is first determined, for which the amount of payment to his account is divided by all accrued dividends. Next, you need to calculate the difference between the dividends that a person received last year, the current period and the sum of all distributed dividends. That is, the first indicator is multiplied by the second and by the percentage tax rate.

Fines and mandatory payments

| Payment | KBK |

| Income from the provision of paid services | |

| Fee for providing information contained in the Unified State Register of Taxpayers | 182 1 1300 130 |

| Fee for providing information contained in the Unified State Register of Taxpayers (when applying through multifunctional centers) | 182 1 1300 130 |

| Fee for providing information and documents contained in the Unified State Register of Legal Entities and in the Unified State Register of Individual Entrepreneurs | 182 1 1300 130 |

| Fee for providing information and documents contained in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs (when applying through multifunctional centers) | 182 1 1300 130 |

| Fee for providing information from the register of disqualified persons | 182 1 1300 130 |

| Fee for providing information from the register of disqualified persons (when applying through multifunctional centers) | 182 1 1300 130 |

| Government duty | |

| State duty on cases considered in arbitration courts | 182 1 0800 110 |

| State duty for state registration of a legal entity, individuals as individual entrepreneurs (if the service is provided by tax authorities), changes made to the constituent documents of a legal entity, for state registration of liquidation of a legal entity and other legally significant actions | 182 1 0800 110 |

| State duty for state registration of a legal entity, individuals as individual entrepreneurs (if the service is provided by a multifunctional center) | 182 1 0800 110 |

| State duty for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities | 182 1 0800 110 |

| Payments for the use of natural resources | |

| Payment for emissions of pollutants into the atmospheric air by stationary facilities | 048 1 1200 120 or 048 1 1200 120 (if the payment administrator is a federal government agency) |

| Payment for emissions of pollutants into the atmospheric air by mobile objects | 048 1 1200 120 or 048 1 1200 120 (if the payment administrator is a federal government agency) |

| Payment for emissions of pollutants into water bodies | 048 1 1200 120 or 048 1 1200 120 (if the payment administrator is a federal government agency) |

| Fines and sanctions | |

| Monetary penalties (fines) for violation of laws on taxes and fees | 182 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on the use of cash register equipment when making cash payments and (or) payments using payment cards | 182 1 1600 140 |

| Monetary penalties (fines) for administrative offenses in the field of taxes and fees provided for by the Code of the Russian Federation on Administrative Offenses | 182 1 1600 140 |

| Monetary penalties (fines) for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions | 182 1 1600 140 |

Read also

13.11.2016

CBC for personal income tax refund for treatment

Tax refunds for treatment expenses, etc. relate to deductions - property, social, standard or special. Refunds in such cases may vary:

- full refund of tax paid for the past calendar year (one and the last 3 years; data for one year is filled out in one declaration);

- receiving a deduction at your place of work - submitting a request to your employer to stop collecting income taxes on your salary; there is no refund here, but it does stop you from being taxed for the time being.

Most often, the first option is used for treatment. In this case, the BCC in 3-NDFL when registering a deduction will be the same as when paying, but instead of the number 3, the number 1 is used in the code:

Where to indicate KBK

Let's take a closer look at where the BCC indication is necessary.

| Money orders | Tax returns |

| There should be only one code indicated. For cases when you need to make a payment using more than one code, two or more payment documents are filled out. You can transfer funds to pay: – tax, – collection, - fine, – fine. In the approved payment order form, field 104 is allocated for BCC. | Declarations: – profit tax; – VAT; – transport tax; - fear. deductions. The KBK here is intended to help the tax authorities see the debts for payment of the above fees and pay them off immediately after the money arrives in the budget. |