In what cases should you indicate the UIN?

In 2021, the UIN must be indicated only in payment orders for payment of arrears, penalties or fines at the request of the Federal Tax Service, Pension Fund or Social Insurance Fund.

That is, to indicate the UIN, organization or individual entrepreneur in the payment:

- first they must receive from the Federal Tax Service, Pension Fund or Social Insurance Fund an official request for payment of arrears, penalties or fines;

- find the UIN code in this requirement;

- transfer it to your payment card in field 22 “Code”.

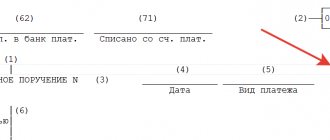

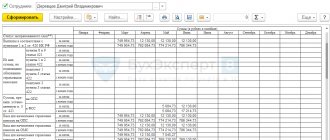

The UIN field can be found at the bottom of the payment order:

Accordingly, to the question “where can I get the UIN?” there is only one answer - in the request for payment received from the regulatory authorities. There is no single UIN for taxes or contributions. In each specific case the code is unique.

Traffic police fine according to UIN

Using the UIN, you can check or pay traffic fines. This is done either on the official website gibdd.ru, or on one of the Internet services intended for these purposes.

To use the online service for finding fines, you must enter a unique code in the required field. A combination of twenty numbers (or twenty-five) can be found in the resolution issued by the traffic police inspector. The resolution is issued in two cases:

- The inspector discovered a violation, issued a warning and applied a fine.

- If an administrative fine issued on the spot has not been repaid, a case of administrative offense is initiated.

On the above-mentioned resources you can pay the fine online, which is quite risky. There are several fraudulent services operating on the Internet, the goal of which is to “pump out” as much money as possible for services. If you still prefer to use one of the specialized sites, pay attention to the size of the commission. In most cases it does not exceed two percent.

You can pay a monetary penalty online not only using services on the Internet, but also in other ways:

- Using Internet banking (the commission will be about 50 rubles).

- On the official website gibdd.ru.

- Through the portal gosuslugi.ru.

- Using one of the electronic payment systems (WebMoney, Yandex Money).

On a note! When paying a fine from the traffic police, the UIN is indicated in the supporting document PD4, receipt and check.

A few important points about paying fines:

- If you do not live at your place of registration, check periodically for fines. Do not allow the amount of monetary penalties to reach ten thousand rubles. Otherwise, you may be prohibited from crossing the border or deprived of the right to drive a car for some time.

- If you pay the fine within twenty days after it was imposed, you can reduce the amount of the penalty by half.

- If you believe that the fine was issued undeservedly, you can appeal to the district court or the traffic police.

- It is possible to appeal a monetary penalty within seventy days from the date of execution of the decision.

- If you know for sure that a fine was issued, but did not find it when checking the system, wait a while. It is possible that State Traffic Inspectorate employees have not yet had time to enter the information. If enough time has passed and the amount of the administrative penalty does not appear, an error was probably made when entering the data. In this case, call the traffic police and find out this issue.

Periodically check for fines from the traffic police

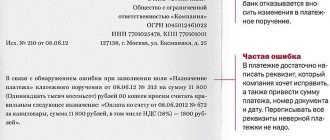

If you make a mistake in the UIN

Using the UIN number, taxes, insurance contributions and other payments to the budget are automatically recorded. Information about payments to the budget is transmitted to the GIS GMP. This is the State Information System about State and Municipal Payments. If you specify the wrong code, the system will not identify the payment. And the obligation to pay will be considered unfulfilled. And as a consequence of this:

- the company will incur debt to the budget and funds;

- continue to accrue penalties;

- you will need to clarify the payment and find out its “fate”;

- the money will arrive to the budget or funds with a delay.

The meaning of the identifier components

Each number included in the identifier has its own meaning:

- The first three numbers. Assigned by the Treasury.

- The fourth number. Indicates the department from which the request for funds transfer came.

- Fifth number. Represents the payment code.

- Sixth and seventh numbers. Date of payment.

- Numbers from 8th to 12th. Series and number.

- The twentieth. Needed to increase the uniqueness of the identifier. Assigned to a specific payment card.

The identifier is approved by the recipient of the funds. Its formation is an automatic process. The code must be unique for each payment document.

IMPORTANT! The payer cannot generate the code independently using arbitrary numbers. If the UIN code is simply invented, the funds will not reach their recipient.

ATTENTION! Sometimes, if a person does not know his or her ID, you can enter “0”. In some cases, the UIN code is supplemented with letter designations. These can be Russian or Latin letters.

What does the ID on the receipt mean?

The code serves to identify the payment. It contains this information:

- Who issues the payment?

- Payment addressee.

- What exactly are the funds paid for?

The bank employee can decipher the code, after which he sends the payment to its recipient. All accruals to the budget are recorded in the GTS GMP system. The presence of the code allows you to immediately record the payment.

UIN and current payments

When paying current taxes, fees, and insurance premiums calculated by payers independently, the UIN is not established. Accordingly, there is no need to indicate it in field 22. Received current payments are identified by tax authorities or funds by TIN, KPP, KBK, OKTMO (OKATO) and other payment details. A UIN is not needed for this.

Also, the UIN does not need to be indicated on the payment slip when paying arrears (penalties, fines), which you calculated yourself and did not receive any requirements from the Federal Tax Service, Pension Fund or Social Insurance Fund.

When paying all current payments, in field 22 “Code” it is enough to indicate the value “0” (FSS Letter No. 17-03-11/14-2337 dated 02/21/2014). There is no need to use quotation marks. Just enter - 0.

If, when transferring current payments in field 22, you indicate “0”, then banks are obliged to execute such orders and do not have the right to require filling out the “Code” field if the payer’s TIN is indicated (letter of the Federal Tax Service of Russia dated 04/08/2016 No. ZN-4-1/6133 ). At the same time, do not leave field 22 completely empty. The bank will not accept such a payment.

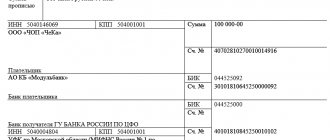

Organizations can indicate both the INN and the UIN on their payments at the same time. Or they can only indicate the TIN, since the UIN is not always known. But then there should be 0 in field 22.

What is a UIN code?

The UIN is a combination of twenty or twenty-five digits written without spaces. The purpose of the details is to indicate what type of payment it is and to process it correctly. The identifier makes it easier to account for funds and helps organize information about incoming payments. This code is needed not for the payer, but for state and municipal structures, bank employees and treasury employees.

On a note! There are no lists or tables that contain all the UINs of a particular organization. For each payment, its own unique combination of symbols is developed, which is never repeated.

Each payment has its own unique identifier

UIN for individual entrepreneurs

Individual entrepreneurs, notaries, lawyers, heads of peasant (farm) households and other individuals indicate either the Taxpayer Identification Number (TIN) or the UIN (UIN) in their payments. If both of these details are not filled in, the bank will not accept the payment order. That is, the principle is this (letter of the Federal Tax Service of Russia dated 04/08/2016 No. ZN-4-1/6133):

- if the individual entrepreneur indicated his INN in the payment, then in the “Code” field instead of the UIN, 0 is entered;

- if the UIN is specified, the TIN is not filled in.

Useful tips

Sometimes when transferring money, the system for some reason does not recognize the identification code. In this case, you should contact the organization for which the payment is intended. Most likely this is a common mistake.

Another common problem that many citizens face. A person receives a receipt from a budget organization. Then he decides to check the debt again using the Internet. And he sees that the UIN from the receipt does not match the code from the system. There is no mistake here. The fact is that the UIN is always unique. Therefore, when generating a receipt, one code was assigned, and when generated again on the Internet, the system issues a different code. In this situation, the correct decision would be to indicate the UIN from a receipt received from a state or municipal authority when paying.

Invoices issued by medical institutions also have the column “Document Index” or “UIN”. In most cases, when paying such bills, you do not need to provide a code, since the identifier is not used. When paying, just enter the number zero (“0”) on the receipt. If you still require a code, you can find out the number at the medical institution itself.

Conclusions for 2021 about UIN

In field 22 of the payment slip, indicate the UIN (unique accrual identifier), if you know it (for example, indicated in the inspection request for tax payment). It consists of 20 or 25 characters, and all of them cannot have the value “0” at the same time.

In other cases, put “0” (zero) in field 22 (clause 12 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, Explanations of the Federal Tax Service of Russia), including:

- when paying current tax payments;

- when transferring arrears not at the request of the inspection;

- if the request does not indicate the UIN.

Read also

26.12.2016

How is the payment number generated?

A unique identifier is not a collection of random numbers. All twenty signs have meaning. The code is divided into four parts:

Table 1. Rules for generating an identifier

| Part of the number | What does it mean |

| Initial three characters | Number of the organization to which funds are transferred. |

| Fourth character | Always has the same value - zero. |

| Next fifteen characters | Transaction number or document index in the payment administrator database. |

| Last, twentieth digit | A symbol for control, which is calculated using a special algorithm. |

There are special services on the Internet that can be used to check the correctness of the identifier.

Where can I find it on my receipt?

The ID is located on the top line of the receipt above the barcode. Once again it is duplicated on the 2nd half of the payment slip above the taxpayer’s data.

If you can’t find it, you can pay automatically through Sberbank.Online

- When making a transfer using a receipt through Sberbank Online, you will need to enter the “Payment of taxes” section and find the “Pay by document index” tab, click on it.

- If the transfer needs to be made through a terminal or using the Sberbank-Online application on a smartphone, then it will be enough for the system to scan the barcode of the receipt, which also encrypts its index.

- At an ATM, you need to hold the document under the red light, and when paying via a smartphone, you will need to take a photo of the receipt while in Sberbank Online. The electronic document will then be filled in automatically.

Is it possible to use one UIN for different payments?

UIN is a unique code that can be used to make only one payment. Thanks to this, it is possible to significantly reduce the number of uncleared customs, tax and other monetary receipts. In addition, the uniqueness of this code allows us to simplify the system of cash payments to government bodies. Repeated use of one unique identifier can lead to confusion and loss of a money transfer due to the fact that government agencies failed to correctly identify it.

Payments indicating the UIN can be made not only by individuals, but also by legal entities. Such payments are also available to budget authorities and individual entrepreneurs. Individuals most often indicate their UIN when filling out declarations or receipts for making payments to the tax service. It is also possible to make payments to the traffic police.

Legal entities use this code to transfer taxes that are accrued for a certain period of time. In this case, the payer’s identifier is his TIN and KPP of the organization. Quite often, payment receipts are generated directly by the budget authority. In this case, it is automatically assigned a UIN and document index.

Russian Standard Bank"

Making payments through Russian Standard Bank is easy. The main stages are the following:

A digital code will be sent to the phone number; you need to enter it into the form on the website. In this way, the user will confirm the payer’s intentions to transfer funds to the tax system account.

Possible problems with ID

Most often, when paying tax amounts using ID via Internet banking, a problem may arise due to the lack of connection with the Federal Tax Service database. In such a situation, you will not be able to pay online; you will have to contact the bank, fill out all the required details and make the transfer. You must have your passport and Taxpayer Identification Number with you.

Another problem that may arise with ID is the independent generation of an electronic document on the official website of the Federal Tax Service. Here it is worth remembering that when generating a new payment document, it will be assigned a new ID, since it is assigned specifically to the document, and not to the amount payable. It will be pointless to compare it with the previous receipt.

Another problem may be the unsuccessful search by the banking system for the receipt ID, which indicates an error in its assignment. In this case, it is still possible to make a payment using the remaining details. But for your own peace of mind, it is better to contact the Federal Tax Service, since an error in the remaining details is possible.

We can conclude that ID significantly simplifies and speeds up the procedure for transferring state duties. The simplest payment method is payment through the Sberbank-Online system, since this service has a connection with the Federal Tax Service database.

How to pay a receipt using ID

Payment by receipt can be made at any bank office.

Payment via Qiwi

It is possible to pay state fees through Qiwi wallet. You must have your document ID or TIN with you.

- To pay, you will need to enter the ID from the receipt in the “Index” line, after which the check for the presence of the entered ID in the system will begin.

- Next, the payment document will be displayed on the screen. Then we advise you to check the amount payable against the receipt; if everything is correct, then you need to click the “Pay” section.

- If a receipt has not yet been generated by the Federal Tax Service, the screen will display the message “No accruals were found based on the entered UIN.”

Where can I pay?

Tax payments can be made without leaving home through the Internet banking system. Using it, you can pay not only for your own payments and fees, but also for your relatives and friends; you only need to have the UIN of their payment document. After all, the coincidence of the name of the payer with the name of the person making the payment is not a necessary condition.

Today, the Federal Tax Service databases are linked to many banks that have this system. These banks include:

- Sberbank;

- Alfa Bank;

- Russian Standard Bank;

- Promsvyazbank.

How to pay in any online banking

To transfer, you will need to go to the “ Payments ” subsection and click on the item with the word “ Taxes ”. Enter the ID from the receipt in the appropriate line and the system will issue an automatically completed electronic form. The payment method is determined by each bank independently, since the design of the personal account is different for all banks. If you have problems making payments, you can look for advice on using your account online or call bank employees.

In a situation where it is not possible to transfer tax fees through your personal account using an ID, you need to check with representatives of this bank whether they have a link to the Federal Tax Service databases.

Payment via Sberbank.Online

As an example, let’s study payment for a receipt from the Federal Tax Service through the Sberbank-Online portal, since it is the most popular among the country’s population.

- To make a payment through this system, you will need to log into your account, on the main menu page, click on the “ Transfers and Payments ”

- On the page that appears, find the item “Staff Police, taxes, duties, budget payments”, and under it click the line “Federal Tax Service”.

- Next, a page with a search line will be displayed on the screen, under which there is a button “Search and pay taxes to the Federal Tax Service”, you need to click on it and the form for transferring money will load.

- In its top line “Select a service” you need to find the item “ Payment of tax by document index ”, then you need to indicate the plastic for debiting funds.

- In the bottom line you will need to enter the UIN from the tax receipt, carefully double-check the entered parameters and click “ Continue ”.

- The completed payment document will be displayed. At the moment, you will only need to verify the amount payable, since the details may not match the receipt. If the amount is indicated correctly, then you need to click on the “ Continue ” item, after which the page will refresh and the details required for the transfer will be displayed on the screen.

For peace of mind, you can check them with the receipt, then complete the transfer process using the received SMS code. A page with an electronic receipt will be displayed on the screen, it will have the “Completed” stamp on it, the payment has been made.

Attention! When making payments to the budget, no commission fees should be charged. They are not present in the Sberbank-Online system and they should not be in other Internet banking systems.

When is the UIN not used when paying taxes?

Numbers are not indicated if the entrepreneur or head of the organization assumes responsibility for calculating and making payments to the state budget based on tax return data. Such a document requires the use of a completely different identification system. In this case, you need to refer to field 104 of the payment order. The budget classification code will determine the direction of the contribution.

Starting from 2021, payment of property tax for individuals does not require indicating the UIN. The basis for refusing this detail is a tax notice, which is issued by the fiscal authority. In this case, the responsibility for creating the notification and the payment document attached to it rests with government employees. The payment index acts as an identifier of the direction of the contribution.

Many taxpayers have a question about how to fill out the code field if they receive a tax notice. In this case, the value “0” is entered into the line, which is separated from other characters in the section.

Does the bank have the right to demand a UIN?

Anyone who has to fill out payment orders should know that an id is only needed when it comes to interacting with government agencies.

Bank employees should not require payers to non-state services to indicate an identifier. It is enough to fill out the TIN column and put “0” in section 22. If you do the opposite, which happens in some cases when bank employees fill out forms, the identification of the taxpayer is violated.

What happens if the UIP is specified incorrectly?

If the UIN or UIP is present but entered incorrectly, the financial institution is obliged to process the payment. The exceptions are:

- Cases when transfer accounts are opened specifically for identification purposes.

- If the sending account and the receiving account are located in the same financial institution.

Differentiated payment and annuity: what is the difference?

The bank does not process the payment if the above 2 factors are present.

The sender should be aware that if the identifier is incorrectly specified, the payment may not be credited and, as a result, payment obligations will remain unfulfilled, which will entail a number of troubles.

For whom is UIP necessary?

Legal entities and private entrepreneurs cannot independently determine the id to fill out the payment form. Unique codes are created by government agencies that need to organize the huge volumes of information received daily by services.

State UIN is required. authorities for the following:

- reduce the risk of payments that cannot be determined: from whom, the purpose of the transfer;

- reduce the number of uncertain payments entering the state treasury.