To make a non-cash transfer from your bank account in favor of the budget or any other counterparty, the payer - an individual or legal entity - must generate an appropriate order and send it to the servicing financial institution.

The payment document is always drawn up according to a unified template and must contain all the necessary information.

One of the most important payment details is considered to be the budget classification code (abbreviated as KBK), used to properly designate budget income/expenditure items.

It is necessary to understand what KBK is, what information this code carries, and how it is reflected in the payment order.

In addition, it is necessary to clarify the procedure for recommended actions in the event of incorrect indication of the BCC in the payment.

The significance and role of the BCC in the system of budget regulation

The use of KBK budget classification codes is carried out on the basis of instructions approved by Order of the Ministry of Finance dated 06/08/2018 No. 132n.

The instructions establish the structure, principles of purpose, general requirements for the procedure for the formation and application of the CBC and are mandatory for everyone. The instructions contain a budget classification of income, expenses and sources of financing of various budgets of the Russian Federation, which is used for maintaining budget accounting, generating budget and other reporting and includes the classification:

- budget revenues;

- budget expenditures;

- sources of financing budget deficits.

The codes of operations of the general government sector are enshrined in Order of the Ministry of Finance No. 209n dated November 29, 2017.

Budget revenues are replenished, among other things, by taxes and similar payments. They are quite varied, but each is assigned its own separate budget classification code, with the first three digits of the code indicating the payment administrator. The most common administrator code is 182, code of the Federal Tax Service of the Russian Federation.

Administrator

The first three digits in the KBK, which form a grouping of numbers, are called administrator. They display which institution is the budget manager, that is, its administrator. These enterprises include the tax service and other government bodies, local governments, as well as other organizations that are entrusted with the powers of managers.

Let’s say the Federal Tax Service code in KBK will start like this - 182-000-000...0, and the Pension Fund code - 392-000-000...0.

KBK in payment in 2021

What is income for the budget, for taxpayers is payment to the state treasury of taxes and equivalent payments and insurance premiums (except for “injuries”). Therefore, each of them first goes to the accounts of the territorial body of the Federal Treasury and is classified there on the basis of the BCC.

For any taxpayer or tax agent, regardless of its organizational and legal form, it is very important to correctly fill out a payment order, since errors, for example, incorrectly filling out this field in a payment order, can lead to money being credited to the “wrong address.” The Federal Treasury may classify it as “unclarified.” This means that the payer has an unpaid obligation to the state, i.e., outstanding arrears, penalties, fines and other sanctions from the state, in this case to the payment administrator. This can be avoided if you indicate the budget classification code correctly.

Order No. 245n dated November 30, 2018, which amended the current guidelines for the application of the BCC, contains new budget classification codes:

- excise taxes New budget classification codes have been introduced for dark marine fuel, petroleum raw materials for refining, state duties for issuing excise stamps, etc.;

- a new BCC for a single tax for individuals on professional income, a fee introduced for self-employed citizens;

- codes for paying taxes on additional income from the production of hydrocarbons, calculated according to the norms of Art. 333.45 Tax Code of the Russian Federation.

Dependence of KBK with other indicators of the payment document

Legislative acts do not provide for a direct relationship between field 104 and other document cells. But separately published regulatory texts may oblige payers of tax and insurance payments to correlate the KBK code with other payment cells. For example, the Ministry of Finance of the Russian Federation in its Letter No. 02-08-10/800 indicates the dependence of the BCC with field 101, which reflects the status of the payer when it comes to reimbursement of land tax and income tax. The same regulatory document states that companies belonging to consolidated groups of tax payers are prohibited from marking a status other than 21 and 22 if the payment document is filled out with field 104. But organizations not belonging to the consolidated group of taxpayers, on the contrary, cannot set the payer status to 21 or 22 if the payment document is filled out with the KBK.

You should not think that BCC is not the main indicator of a payment order; accountants need to responsibly approach the issue of obtaining the correct BCC. If the details are incorrectly specified, unpleasant financial consequences may arise for the payer’s company.

How to correctly indicate BCC in settlement documents

The form of the payment order and the procedure for filling out the transfer of obligatory payments to the budget are approved by the Directive of the Central Bank of the Russian Federation dated 03.03.2003 No. 1256-U, and the rules for filling out are approved by the Ministry of Taxes of the Russian Federation dated 03.03.2003 No. BG-3-10/98. In 2021, the payment order forms established by the Regulation of the Central Bank of the Russian Federation No. 383-P and Order of the Ministry of Finance dated November 12, 2013 No. 107n are used.

Each field of the order has its own code, with the help of which the Central Bank and the Ministry of Finance establish the rules for filling out the details. For example, field 101 is for payer status.

IMPORTANT!

The KBK field in the payment order is field 104.

Simplified mode

Entrepreneurs strive to minimize the effort and time spent on calculating the endless variety of debts. The state met the wishes of businessmen and introduced a simplified tribute regime. The benefit is mutual: the treasury receives income and is not spent on publicans who are forced to count the labor penny of the entrepreneurial class; companies using the simplified tax system also sigh happily - the risk of not seeing another trap in the tax field is reduced.

Since January of the centenary of the October Revolution, life has once again become simpler. Now, for organizations using the simplified tax system, there is no puzzle: apply the “income-expenditure” method of taxation or pay the minimum fee. The Ministry of Finance heeded the request of the Federal Tax Service to simplify the settlement of mutual claims under the simplified tax system.

Both types of calculated tax are awaited on the same basis for the simplified tax system, KBK, in subgroup 05 under article 01021.

If the company has chosen the simplified taxation system “income” with a payment of 6% of the amount of income received, then when making payments to the treasury they use article 01 subarticle 011 in subgroup 05 . The difference with the previous KBK is the number of the tenth category.

Insurance premiums

From 01/01/2017, all contributions for compulsory insurance of employees, except for contributions for injuries, must be transferred to the Federal Tax Service. For the convenience of payers, the Federal Tax Service website contains information on which BCC to indicate for payments to the budget. To pay insurance premiums for compulsory pension insurance (20%) for June we use 182 1 0210 160.

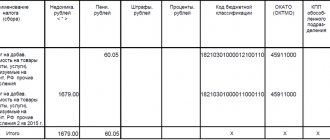

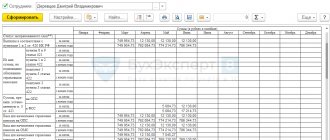

Payment order details for OPS (20%) for June 2021:

Where:

- field 104 - budget classification code, for example, insurance contribution for compulsory pension insurance;

- field 105 - OKTMO, territory code according to the all-Russian classifier of territories of municipalities at the place of registration of the taxpayer (tax agent);

- field 106 - for current payments, indicate the TP code (current year);

- field 107 - value of the tax period indicator; can take the corresponding value of the period: MC - monthly payments;

- field 108 — document number, in this case it is set to “0”;

- field 109 - date of the document, in this case it is set to “0”;

- field 110 - payment type, not filled in;

- field 24 - purpose, in this case the number of the policyholder in the Pension Fund of the Russian Federation is indicated.

Examples of filling out payment orders for contributions

How to fill out a payment order correctly in accordance with the new requirements? Let's look at the basic details of the document. Below is a sample payment slip for contributions with new BCCs that are relevant for this period.

The KBK for insurance premiums has the widest list of possible codes, since they are used by entrepreneurs for all tax payment regimes.

In the payer status, or in the 101st detail, it is necessary to enter code 01 if the payment is made to the tax service for insurance (medical, social, pension). If the company is an individual entrepreneur, then the status is indicated as 09. If the contribution is paid for injuries, code 08.

Next is field No. 16 or the recipient field. Here you need to write down the name of the Russian Treasury and indicate your tax office in brackets. Previously, the name of the fund was indicated here.

In the TIN and KPP field - these are the 61st and 103rd details, the recipient of the funds is registered, that is, the tax office.

At the base of the payment (106) the code “TP” is written, and not zero, as was previously the case.

Next, in the period field under number 107, enter the digital value of the month and year for which the contribution is transferred.

Document number and date (108, 109) - enter a zero here.

And finally, the 110th field - in accordance with the order of the Bank of Russia dated March 2021, there is no need to fill out this detail.

Corporate income tax

Sometimes it is necessary to distribute one tax at appropriate rates across different budget levels: federal and regional, for example, on profit.

Let's assume you need to pay tax in the amount of RUB 20,000.00 in 2021. (tax base amounted to RUB 100,000.00).

To do this, you need to generate two payment orders:

- to the federal budget the amount will be 3% - 3000.00 rubles;

- to the budget of a constituent entity of the Russian Federation - 17%, that is, 17,000.00 rubles. in the example.

Each budget level has its own budget classification code:

- to the federal budget - 182 1 0100 110;

- to the budget of a constituent entity of the Russian Federation - 182 1 0100 110.

Field code 104 of the order for the federal budget will contain the corresponding cipher.

For the regional one it will be different.

Current codes for corporate income tax on income received in the form of interest on bonds of Russian companies issued during the period 01.01.2017-31.12.2021.

KBK structure

Twenty KBK numbers are combined into eight groups:

- Includes three numbers. They denote the budget revenue administrator. For example, the tax office - 182, the social fund. insurance – 393.

- Includes one digit. Indicates a group of receipts.

- Includes two numbers. With their help, it reflects a certain type of budget revenue (for example, taxes, fees, duties, etc.).

- Includes two numbers.

- Includes three numbers. This and the previous group indicate the item and subitem of income.

- Includes two digits. They indicate the budget level to which the payment is transferred.

- Includes four numbers. They determine the status of the payment (the tax itself, penalties for late payment, collection).

- Includes three digits. They establish to which economic category the budget revenue belongs. The main categories are:

- 110 – tax revenues;

- 120 – profit from transactions with property objects;

- 130 – income received from the provision of paid services;

- 140 – forced withdrawal of funds;

- 160 – social contributions. needs.

Payment of tax by an individual

Any citizen (payer) is forced to understand the CBC. This will be required to pay taxes such as land tax and personal property tax.

The basis for payment is a tax notice sent by the tax authority (clause 4 of Article 397 of the Tax Code of the Russian Federation). However, each payer must check whether the details are correct, including the budget classification code.

Why are budget classification codes changing?

Most entrepreneurs are indignant about why the KBK codes change so often and why the state does not establish uniform codes once and for all.

On the contrary, the Ministry of Finance changes the BCC codes in one way or another every year. Due to the fact that entrepreneurs and accountants do not always have the opportunity to track changes in codes, they are forced to pay penalties to KBC. In order not to be confused about where to get the current KBK code during the reporting period, you need to constantly monitor changes.

The main versions of why the KBK codes change:

- It is beneficial to have “suspended” funds in the budget. The more receipts passed through incorrect codes, the more free money there will be. While it is being figured out where to redirect them, you can use these funds (on a national scale these are large sums of money).

- Replenishing the budget through the accrual of fines and penalties. Entrepreneurs send payments through no longer operational cash registers and receive fines.

- Inconsistency between two organizations: the Ministry of Finance, which assigns codes, and the Ministry of Justice, which approves them.

- Changes within government structures. Considering that BCCs are directly related to the public sector, any changes in this system lead to changes in codes.

It would be easier for payers to make payments if payment coding were handled by treasury employees. But today the situation is such that this work is entrusted to payers, and they cannot refuse coding, otherwise they will pay fines.

The KBK is incorrectly indicated on the payment slip: what to do?

Let us turn to clause 7 of Art. 45 of the Tax Code of the Russian Federation. If an error is discovered in the execution of a document for the transfer of a tax or other obligatory payment to the budget system, but no debt has been incurred for this tax, the taxpayer has the right to submit a free-form statement to the tax authority at the place of his registration that an error has been made. The application must be accompanied by documents confirming payment of the tax (i.e., transfer to the accounts of the Federal Treasury), with a request to clarify the details of the specified payment: its basis, type and affiliation, tax period or payer status. We wrote about this in detail in an article on how to offset or return overpayments on taxes.

Since the KBK belongs to the group of details that allow one to determine the identity of the payment, if an erroneously specified KBK is detected in the order for the transfer of tax, the payer has the right to contact the tax authority with an application to clarify the identity of the payment. This position has been repeatedly expressed by the Ministry of Finance (for example, Letter dated January 19, 2017 No. 03-02-07/1/2145), the Federal Tax Service (for example, Letter dated October 10, 2016 No. SA-4-7 / [email protected] ), as well as the Arbitration by the court in the Resolution of the Administrative Court of the North Caucasus District dated December 4, 2014 No. A53-7943/2013.

EKD - income classification

And the final, fourth part of the code - the economic classification of income, occupies the last three digits of the BCC. In this part, the encoding is indicated in accordance with Decree of the Government of Russia dated May 22, 2004 No. 249, in Appendix No. 2 regarding income. For example, 110 is tax revenue, 150 is gratuitous revenue, and 180 is other income.

This is what the structure of the BCC looks like, which is used for budget revenues. If the BCC is indicated incorrectly in the payment, it is often the 14th character, which turns out to be registered as zero. Such documents are sent to the federal treasury as “unclassified” payments.

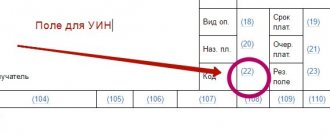

UIN and KBC - differences

According to clause 7 of Appendix No. 4 of Order No. 107n in gr. 22 “Code” indicates the UIN (unique accrual identifier). Regulation No. 383-P determines that this indicator must be filled out only if it is assigned to a taxpayer; in other cases, this column is entered “0”. Unlike the KBK, when transferring taxes (fees), there is no need to create an identifier for individual entrepreneurs and legal entities (Explanations of the Federal Tax Service of the Russian Federation “On the procedure for indicating the UIN when filling out orders for the transfer of funds to pay taxes).

Note! Leaving the field blank is prohibited; this may lead to the bank refusing to process the payment.

Focus abbreviation

Taxes are assigned to KBK. This is the account number for crediting the entrepreneur's payments. Place the account value in field 104 of the payment form.

The code is built from 20 Arabic numerals.

Positions 1, 2, 3 indicate the government agency receiving the payment.

You might be interested: 10 rubles “Chechen Republic”. Where to buy and how to run into a fake

Channel PROGRAMMER'S DIARY

The life of a programmer and interesting reviews of everything. Subscribe so you don't miss new videos.

Cell 4 – income group.

Places 5, 6 are given to the income subgroup.

Numbers 7, 8 contain the income item.

Positions 9, 10, 11 specify the income sub-item.

Cells 12, 13 show the budget level.

Places 14-17 indicate the contents of the payment - tax, fine, fee, etc.

Positions 18, 19, 20 indicate the type of income.

The information provided makes it easier to understand what KBK is in the details.

"class="page-contents-link">