Deductions

Author: Ivan Ivanov Overpayment of insurance premiums may occur in case of incorrect calculation or indication

The importance of the production calendar cannot be overestimated. The information contained in it is useful and necessary for both professionals,

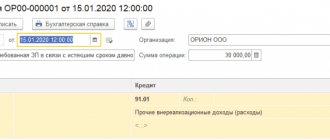

Determination of the financial result of the company’s activities is carried out not only before the reformation of the balance sheet, but also

Drawing up mandatory financial statements for sending to the tax authorities requires filling out an officially established form,

Account 76. AB If it is necessary to calculate and withhold alimony amounts collected from employees, also

Paragraph 2 of Article 257 of the Tax Code determines that the initial cost of fixed assets may change

To take part in obtaining profitable contracts and government orders and financially

Home — Articles According to Art. 53 of the Tax Code of the Russian Federation, the tax base is a cost, physical

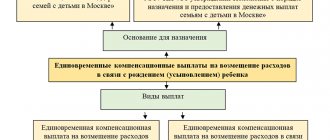

Home / Family law / Benefits and benefits Back Published: 07/29/2018 Reading time:

Changes in 2021 Drastic changes in reporting deadlines, tax payment and procedure